Published on January 12, 2024 by Gaurav Sharma , Akshay Gupta and Surbhi Joshi

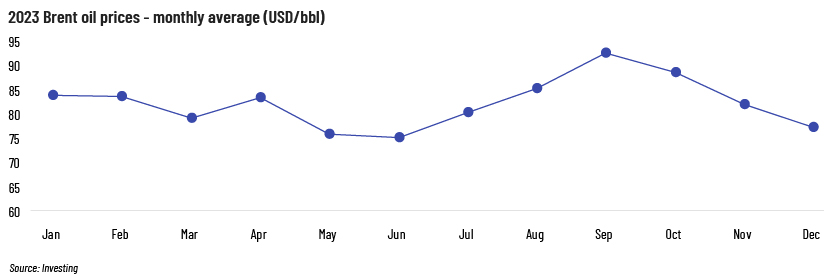

Average Brent oil prices continued to fall for a third consecutive month in December 2023. They fell by 5.6% (on average) on a m/m basis, declining by 16.5% since September 2023.

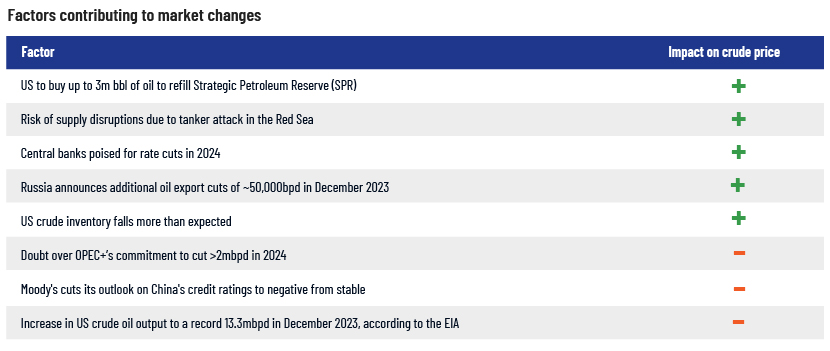

The bears had the upper hand as record-high US production, uncertainty surrounding the delivery of production cuts announced by OPEC+ and China’s gloomy economic growth outlook overshadowed the maritime disruption due to frequent attacks in the Red Sea, demand to refill the US Strategic Petroleum Reserve (SPR), a decline in US inventory levels and potential interest rate cuts in 2024.

Monthly oil market snapshot – December 2023

Industry analysis for the month

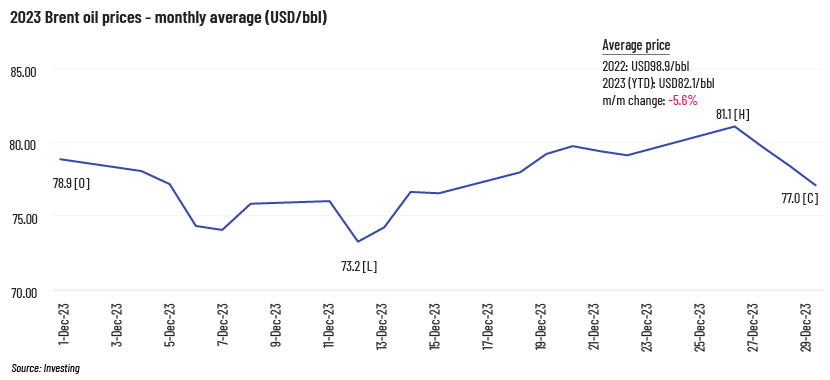

The Brent oil price remained under pressure during the first two weeks of December 2023 amid the US’s requirement to refill the SPR, possible interest rate cuts in 2024 and a weak economic outlook for China. However, the price rallied after 13 December 2023 due to attacks in the Red Sea, forcing major companies such as Shell to halt transit via the Suez Canal.

The price declined towards the end of the month because of high US oil production and an easing of supply concerns due to resumption of trade via the Red Sea.

OPEC+’s announcement in November 2023 of voluntary cuts in 2024 still had no impact on the oil market, as traders remained doubtful about the commitment.

Industry updates (key M&A/investments/deals in the month)

-

Qatar signs first-ever five-year crude oil supply deal (for 18m bbl per year) with Shell

-

Harbour Energy reaches an agreement with BASF and LetterOne to buy all Wintershall Dea's upstream assets for more than $11bn

-

Gulf of Mexico lease sale raises $382m in high bids, making it the largest lease sale in the past eight years

-

Berkshire Hathaway raises Occidental Petroleum stake to 27.7%

-

Saudi Aramco acquires a 40% stake in Pakistan’s Gas & Oil Pakistan Ltd, entering the country’s downstream market

-

Occidental plans to buy CrownRock for $12bn to expand Permian operations

-

India plans to boost oil refining capacity by 1mbpd/year until 2028

-

Shell sees $6bn worth of oil and gas investment opportunities in Nigeria

-

Woodside Energy and Santos in merger talks to create a $52bn energy giant

-

Equinor and SOCAR sign an agreement where Equinor will divest all its remaining assets in Azerbaijan to SOCAR

Acuity Knowledge Partners’ view

We expect oil demand to continue to increase in 2024 but at a slower rate than witnessed soon after the pandemic. China, a key importer of crude oil that saw a record increase in oil demand in 2023, may witness reduced growth amid its troubled economic growth. We expect Japan, too, to see a decline in consumption, mainly due to demographic changes and a stagnant economy. India is likely to remain a bright spot, consuming nearly two-fifths of global supply.

On the supply side, we expect the increase in supply to be hampered by OPEC+’s continued efforts to keep supply tight. However, increased production by non-OPEC countries will likely continue to reduce the impact.

Geopolitical uncertainties, macroeconomic factors such as changes in interest rates and any boost to the global economy, especially China’s, could impact the global supply-demand balance.

How Acuity Knowledge Partners can help

Our large pool of oil and gas experts are experienced in providing strategic support across the value chain. We have partnered with leading energy companies over the years, working closely with their strategy, business development, market intelligence and M&A teams to provide them with the information and analysis necessary to achieve their business objectives.

We also offer our expertise in power, renewables, metals and mining, ESG and sustainability. (https://www.acuitykp.com/solutions/energy-and-utilities/)

Sources:

Investing, CME Group, ICE, Reuters, Reuters, FT, BBC, AFR, , Trading View, CNN, OP, OP, OP, Market Screener, Yahoo Finance, OP, CNCCTV, OP, Market Screener, Reuters, World Oil, EIA, EIAWhat's your view?

About the Authors

Gaurav has close to 14 years of experience working across oil and gas value chain. He has varied experience working on various strategic research projects involving market intelligence, competitive intelligence, market sizing models, industry benchmarking and market entry strategy. At Acuity Knowledge Partners, Gaurav is leading a team to support a major LNG player in various strategic research projects. He holds a MBA degree in Oil and Gas Management from University of Petroleum and Energy Studies and a BE degree in Mechanical.

Akshay Gupta is an energy analyst with over 6 years of work experience in oil and gas domain. At Acuity Knowledge Partners, he has been a consistent member for leading and liasoning various LNG and gas projects. His current interest includes energy market studies and exploring avenues for energy transitioning. He is a post-graduate in Business Management from TERI University.

Surbhi has close to 4 years of experience in oil and gas sector, with a major focus on LNG and upstream. At Acuity Knowledge Partners, she supports a leading LNG player in various strategic research projects involving market intelligence and competitive intelligence. Surbhi holds a MBA degree from University of Petroleum and Energy Studies and also B-tech degree in Chemical engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox