Published on December 15, 2023 by Gaurav Sharma , Akshay Gupta and Surbhi Joshi

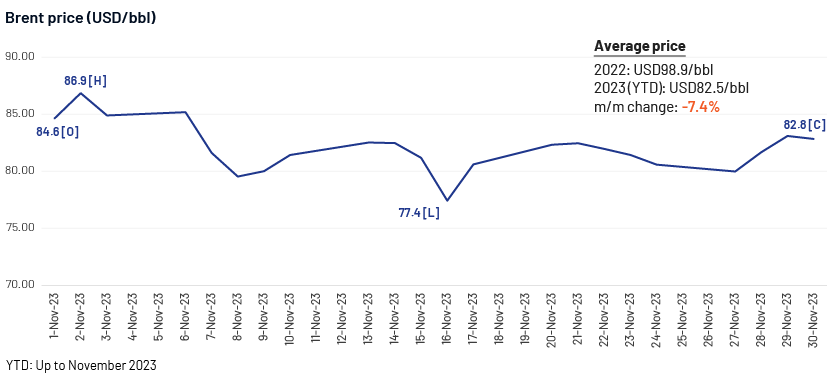

The Brent oil price showed a wide range of swing in November 2023 and declined by 7.4% from October 2023. The downward momentum was mainly macro-based due to higher interest rates globally, resulting in increasing inventories in the US and low refinery runs in China. The highs were attributed to factors such as a positive demand outlook, sanctions on violators of the Russian price cap and the market’s hope of deeper supply cuts from OPEC+ to counter the surplus expected in early 2024.

Monthly oil market snapshot – November 2023

Industry analysis for the month

The Brent price remained extremely volatile during the month, with highs recorded at USD86.9/bbl and lows at USD77.4/bbl, before closing at USD82.03/bbl, a decline of 7.4% m/m. This volatility was driven by downside factors such as the Israel-Hamas war premium fading, high interest rates, rising inventories in the US and China's weak refinery runs; upside factors were a positive demand outlook and fresh sanctions on violators of the Russian price cap.

The market remained unaffected and reacted negatively to OPEC+’s latest >2mbpd voluntary output cuts, as traders were expecting deeper cuts and doubt the commitment of these voluntary cuts, as the cartel refrained from releasing a joint output policy for 2024.

Industry updates (key M&A/investments/deals in the month)

-

Saudi Arabia and Italy discuss investments in the oil and gas and mining sectors

-

Petrobras to spend USD102bn in 2024-28 to boost oil and gas exploration

-

Russia’s Lukoil to double oil output at Iraqi West Qurna 2 to 800,000bpd

-

The UAE’s plan to use COP28 climate talks to make oil deals

-

ONGC charges premium over Brent in oil deals with BPCL, HPCL

-

Permian Resources wraps up USD4.5bn acquisition of Earthstone Energy

-

Energy Transfer completes USD7.1bn acquisition of Crestwood

-

Occidental Petroleum in talks to buy shale driller CrownRock for over USD10bn

-

Crescent Point expands Canadian shale presence with USD1.5bn Hammerhead acquisition

-

Mach Natural Resources acquires Oklahoma oil, gas assets for USD815m

-

BW Energy completes USD73m acquisition of FPSO Cidade de Vitoria

Acuity Knowledge Partners’ view

We believe that high volatility and price swings will make traders adopt a cautious approach, keeping price projections weaker in the near term. The market remains wary of individual OPEC+ members’ strategy to deliver >2mbpd voluntary cuts, due to the disagreements regarding output cuts ahead of the meeting. In addition, rising non-OPEC supply, increasing inventories, high interest rates and China’s demand likely to slow would keep the market balanced.

How Acuity Knowledge Partners can help

Our large pool of oil and gas experts are experienced in providing strategic support across the value chain. We have partnered with leading energy companies over the years, working closely with their strategy, business development, market intelligence and M&A teams to provide them with the information and analysis necessary to achieve their business objectives.

We also offer our expertise in power, renewables, metals and mining, ESG and sustainability. (https://www.acuitykp.com/solutions/energy-and-utilities/)

Sources:

Investing, CME Group, ICE, Reuters, Reuters, Reuters, India Today, Hellenic Shipping News, Reuters, Business Standard, Bloomberg, EIA, EIA1, OP, OP, SP, Oil Price, Brazil, OP, BBC, Economic Times, OT, lP Gas Magazine, World Oil, WO#1, WO#2, Mrchub

What's your view?

About the Authors

Gaurav has close to 14 years of experience working across oil and gas value chain. He has varied experience working on various strategic research projects involving market intelligence, competitive intelligence, market sizing models, industry benchmarking and market entry strategy. At Acuity Knowledge Partners, Gaurav is leading a team to support a major LNG player in various strategic research projects. He holds a MBA degree in Oil and Gas Management from University of Petroleum and Energy Studies and a BE degree in Mechanical.

Akshay Gupta is an energy analyst with over 6 years of work experience in oil and gas domain. At Acuity Knowledge Partners, he has been a consistent member for leading and liasoning various LNG and gas projects. His current interest includes energy market studies and exploring avenues for energy transitioning. He is a post-graduate in Business Management from TERI University.

Surbhi has close to 4 years of experience in oil and gas sector, with a major focus on LNG and upstream. At Acuity Knowledge Partners, she supports a leading LNG player in various strategic research projects involving market intelligence and competitive intelligence. Surbhi holds a MBA degree from University of Petroleum and Energy Studies and also B-tech degree in Chemical engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox