Published on February 9, 2024 by Sanchit Tuli

The incremental capital output ratio (ICOR) emerged as a result of the Harrod-Domar growth theory in 1939. It stands out as a powerful tool, surpassing absolute measures such as gross domestic product (GDP). Analysing a nation’s productivity involves insight on the efficiency with which investments are converted into tangible output.

The ICOR plays a pivotal role in measuring the productivity of capital investments. It shows the amount of incremental capital required to produce one additional unit of output, offering insight on the efficiency and effectiveness of economic activities. Unlike GDP, which measures a country’s overall absolute output, the ICOR specifically focuses on the relationship between incremental capital and output.

ICOR vs GDP

GDP provides a broad overview of a nation’s economic performance but often fails to capture the intricacies of resource utilisation and efficiency, whereas the ICOR provides a more focused analysis.

For example, if 5% more capital is required to increase overall output by 1%, the ICOR is 5. Thus, the lower the ICOR, the better. A lower ICOR indicates that a country is producing more output with less incremental capital, signifying higher economic efficiency. This helps economists and strategic decision-makers make informed decisions about resource allocation and economic planning. In other words, a decreasing ICOR suggests that the country is becoming more efficient in using its incremental capital for production. This efficiency, in turn, contributes to sustained economic growth. By tracking the ICOR over time, analysts can identify trends and potential challenges, enabling proactive measures to enhance productivity.

However, this metric is limited for manufacturing economies. For economies driven primarily by intangible assets – such as design, branding, research and development, and software, which are difficult to measure or record – this metric does not portray the correct picture, because with low investments, these assets can contribute exponentially to GDP. As it may not display a real view of productivity, a sector-based ICOR must be considered for such cases.

Application of the ICOR

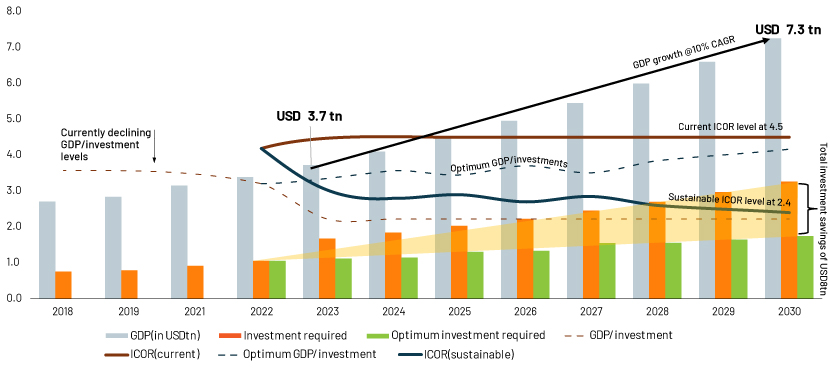

India case study – India’s GDP is expected to rise to USD7.3tn by 2030 from USD3.5tn in 2022, according to an S&P report dated 8 December 2023.

Analysing how much capital is required to fund GDP of USD7.3tn by 2030

With the help of the ICOR, we can determine how much additional investment is required to fund GDP of USD7.3tn by 2030.

To reach this target, from USD3.5bn as of 2022, India must grow at a CAGR of c.10%.

At the current investment rate of c.31.2% and GDP growth rate of c.7%, India’s current ICOR stands at c.4.5.

At the given level of an ICOR of 4.5, if India expects GDP to grow by 10%, the rate of investment stands at 45% of GDP. Thus, to reach GDP of USD7.3tn by 2030, India needs USD20.3tn of investment by 2030. Given the current scenario, investment is not being leveraged, but the country is increasing GDP.

However, if the nation is to ensure sustainable and quality productivity and earnings, it must optimise ICOR levels. In the given case, if India targets an ICOR of 2.7 at an average investment rate of 27% at the same growth rate, it would have investment savings of USD8tn (equivalent to investment required for six years).

Source: World Bank

Strategies for India to lower its ICOR

-

Economic and technical innovation – Given India’s development, its ICOR even at current levels is considered to be low. This is primarily because India is one of the world’s fastest-growing economies, driven by digital transformation that was accelerated by the pandemic. Its population with internet access stands at 627m, double the entire population of the US. India’s digital economy is forecast at USD1tn in just two years’ time.

-

Increase ease of doing business – The country must implement reforms to improve the ease of doing business there, reduce bureaucratic hurdles and promote a business-friendly environment. Streamlined processes attract more investment and contribute to lowering the ICOR. India ranked 63rd in the World Bank’s Doing Business 2020 Report. In terms of construction permits, India’s ranking improved to 27 in 2019 from 184 in 2014, primarily due to a decrease in the number of procedures and the time taken for obtaining construction permits. Its ranking in terms of access to electricity improved to 22 in 2019 from 137 in 2014, as it now takes 53 days and four steps to obtain a connection.

-

Decentralise manufacturing setups – The growing trend of decentralised and distributed manufacturing using 3D printing and other technologies reduces the need for centralised factories and heavy capital expenditure on large-scale production facilities. This would result in significant cost optimisation across the manufacturing sector.

-

Integrate artificial intelligence (AI) and machine learning (ML) – AI and ML play a crucial role in reducing India’s ICOR by enhancing efficiency and productivity across sectors. For example, in healthcare, AI-driven diagnostics reduce reliance on costly equipment, lowering the sector’s ICOR. In manufacturing, ML-based predictive maintenance reduces downtime and extends machinery life, trimming the need for frequent capital replacements. In agriculture, AI-enabled precision farming boosts resource utilisation, resulting in higher crop yields with decreased capital expenditure.

Conclusion

Overall, the nation’s ICOR is vital for fostering sustainable economic growth and improving overall efficiency in resource utilisation at the macro level. The strategies mentioned above – from infrastructure development to technology adoption and policy reforms – would collectively contribute to creating an environment conducive to lowering the ICOR. By investing in education, innovation and a skilled workforce, coupled with streamlined and transparent policies, India could attract investment and promote entrepreneurship, increasing productivity with lower capital requirements.

A focus on environmental sustainability and balanced regional development ensure the long-term viability of economic growth. As India continues to evolve and address these aspects, a concerted effort across sectors and consistent policy implementation would be essential for achieving a lower ICOR and maintaining economic development.

How Acuity Knowledge Partners can help

We are a leading provider of high-value research, analytics and business intelligence. We help corporate clients from diverse sectors understand strategy; we understand the operational concerns and challenges they face and assist them with decision making.

We offer customised solutions including market and competitive intelligence, benchmarking and analysis, strategy research, due diligence and industry analysis. We provide venture capital and private equity firms with comprehensive solutions across the investment cycle and help them stay abreast of industry dynamics and trends in consumer behaviour, economics and demographics in both current and new markets. We also offer horizontal support across middle-office and back-office operations to private equity firms on the investment side; our services range from portfolio management and advisory to deal finding and target selection.

Sources:

-

https://www.5paisa.com/blog/measuring-economic-efficiency-with-icor

-

https://databank.worldbank.org/source/world-development-indicators/Series/

-

https://www.weforum.org/agenda/2023/05/india-technology-opportunity/

-

https://indianembassynetherlands.gov.in/page/ease-of-doing-business-in-india/

Tags:

What's your view?

About the Author

Sanchit Tuli joined Acuity Knowledge Partners’ (Acuity’s) Investment Banking team with over three years of experience. He specialises in the healthcare and consumer sectors. He currently supports the US division of a leading European bank, having demonstrated proficiency in financial statement analysis and preparing credit reports and pitch decks. Sanchit holds a Bachelor’s degree in Business Administration from Christ University, Bengaluru.

Like the way we think?

Next time we post something new, we'll send it to your inbox