Published on February 3, 2022 by Ankit Agrawal

-

India’s budget for April 2022 to March 2023 (FY23) is broadly positive, with a focus on Capital expenditure -led growth (Capital expenditure accounts for 19% of total spending vs 16% a year ago) and a slow path towards fiscal consolidation

-

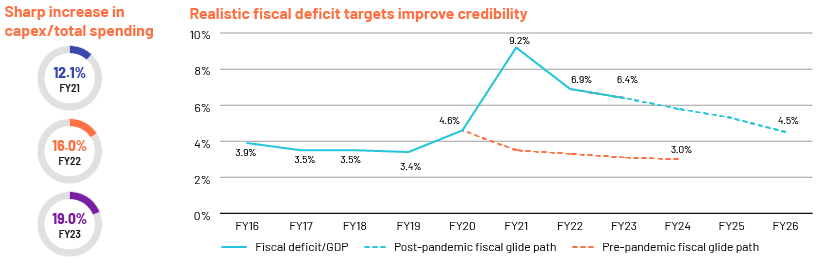

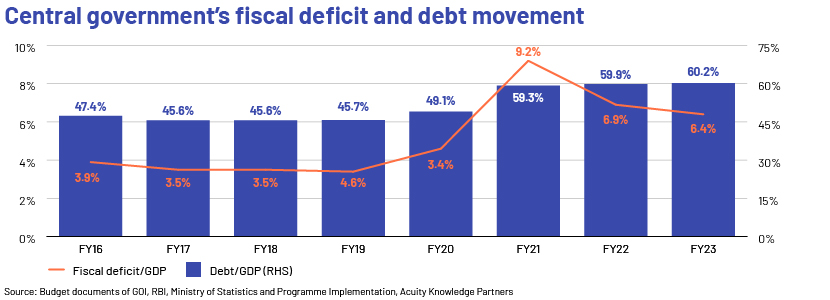

The fiscal deficit is estimated at 6.4% of GDP in FY23 (vs 6.9% in FY22), and the government maintains its fiscal consolidation target at less than 4.5% of GDP by FY26

-

Government bonds are unlikely to be included in global indices in FY23 given that no steps have been taken to eliminate capital gains tax – a key requirement for listing the government bonds on the Euroclear platform

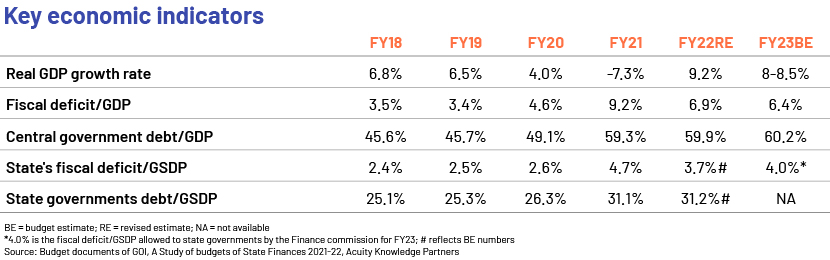

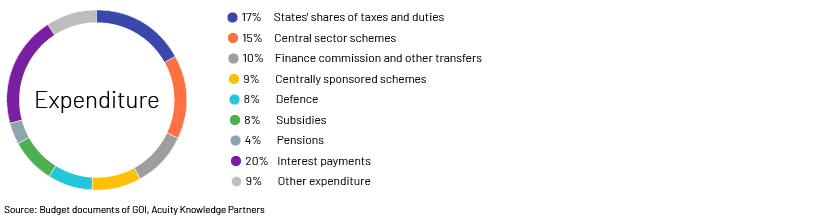

The FY23 budget continues to provide support to India’s slow economic recovery from the pandemic. The government estimates that GDP will grow 8.0-8.5% in FY23 vs 9.2% in FY22. The government projects a moderate increase in expenditure of 4.6% over the FY22 revised estimates. The quality of spending is improving, with Capital expenditure accounting for 19% of total spending in FY23 vs 12% in FY21, while spending on subsidies declines to 8% in FY23 vs 20% in FY21. The government has now pegged a fiscal deficit of 6.4% GDP vs 6.9% in FY22.

Other key announcements:

-

Extension of the Emergency Credit Line Guarantee Scheme (ECLGS) by one more year (to March 2023)

-

Launch of central bank digital currency in FY23

-

30% tax on gains from digital assets – a positive step towards recognition and part legalisation of digital assets

Capital investment remains the focus area

The budget for FY23 maintains the Capital expenditure push, with a focus on public-sector Capital expenditure (infrastructure – road, rail and defence) and manufacturing. For FY23, the government has budgeted INR7.5tn (ca USD100bn) of Capital expenditure investment (+24.5% y/y), following a 41.4% increase in investment in FY22. This would be boosted by the INR1tn (ca USD14bn) in interest-free loans offered to states (for a duration of 50 years) to drive capital spending vs INR150bn (ca USD2bn) in FY22. This expenditure will be over and above the allowed fiscal deficit/GSDP target of 4%.

The fiscal calculation seems to be conservative

The fiscal deficit is expected at 6.9% of GDP in FY22 and to consolidate further to 6.4% by FY23. For FY23, the government projects conservative gross tax revenue growth of 9.6% vs nominal GDP growth of 11.1%. The forecast for non-tax revenue of INR2.7tn (ca USD36bn) is below the INR3.1tn (ca USD42bn) for FY22, due to a reduction in estimated dividend revenue from the Reserve Bank of India (RBI) and public-sector enterprises (PSEs). Disinvestment proceeds are expected at INR650bn (ca USD9bn), down 17% y/y. Nevertheless, an upward revision of divestment proceeds is likely if the government completes the sale of Bharat Petroleum Corporation Ltd (BPCL) and IDBI Bank, among others, in FY23.

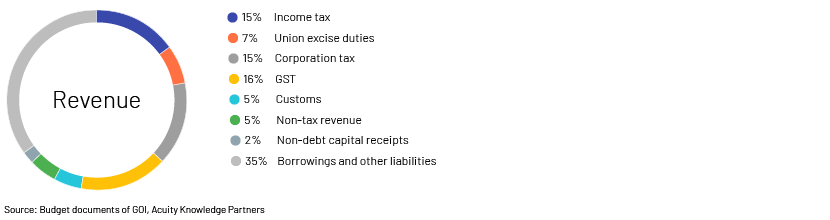

Revenue

Central government revenue estimates are on the conservative side and, as such, the government’s ability to meet its fiscal deficit target remains high. Revenue receipt estimates (+6% y/y) are supported by goods and services tax revenue (+16% y/y), personal income tax (+14% y/y) and corporate income tax (+13% y/y), partly offset by lower disinvestment receipts (-17% y/y) and non-tax revenue (-14% y/y).

Expenditure

The budget remains focused on Capital expenditure, especially on infrastructure spending (transportation and logistics, and urban infrastructure), a INR1tn (ca USD14bn) boost to education and INR799bn (ca USD11bn) towards IT and communication (+1.8x y/y to increase digitalisation). Spending remains skewed towards revenue expenditure, which accounts for ca 84.1% of total expenditure. However, we view the increase in Capital expenditure as a share of total spending to 16% from 12% in FY21 as positive.

Deficit funding

For FY23, the government projects a fiscal deficit of 6.4% of GDP, less than the 6.9% for FY22. The deficit is expected to be funded by a net debt assumption of INR16.6tn (ca USD222bn), translating into debt/GDP of 60.2% (vs 59.9% in FY22 and 49% in FY20). The government estimates gross market borrowings of INR14.95tn (ca USD200bn) in FY23, up 23.6% y/y.

A long road ahead for including Indian bonds in global bond indices

The lack of progress made on listing Indian government bonds on the Euroclear platform and the resulting delay in their inclusion in global bond indices will likely increase the government’s funding costs. Large market borrowings are expected for FY23, along with reviving the credit growth cycle, and the RBI stopping deficit financing will likely result in higher interest rates for domestic funding.

Bond spreads widen while the equity market ends in green

The bond and currency markets reacted negatively to news of higher-than-expected market borrowing of INR14.95tn (ca USD200bn) in FY23 vs INR12.1tn (ca USD160bn) in FY22. The 10-year bond yield was up ca 20bps, while the 5-year bond yield, which anchors corporate borrowing costs, rose ca 12bps. Upside risk to the sovereign bond yield remains, as the RBI is likely to continue offloading government bonds in FY23 to absorb excess liquidity, credit growth is likely to be revived and policy rates are likely to be normalised in the near to medium term.

However, the equity market, although volatile, closed on a positive note, with the benchmark SENSEX and NSE indices closing 1.45% and 1.37% higher, respectively. Key beneficiaries could emerge in sectors such as cement, building materials, affordable housing and clean energy and manufacturing – on the back of production-linked incentive schemes.

Sources:

-

Union Budget document

-

Economic Survey of India

-

Ministry of Statistics and Programme Implementation

-

Controller General of Accounts

-

Reserve Bank of India

What's your view?

About the Author

Ankit has close to 12 years of experience in fixed income credit research, focusing on bank, sovereign and corporate credit reviews. He has worked with three of the largest buy-side asset managers, based in Europe and the US, assisting with investment decisions. He is actively involved in discussing themes and issuer updates and is adept at writing detailed credit reviews and building in-depth financial models to present his investment case. Ankit holds a Master of Business Administration (Finance) from Symbiosis International University.

Like the way we think?

Next time we post something new, we'll send it to your inbox