Published on June 27, 2023 by Sanchit Tuli

Fast fashion’s rapid production and consumption cycle has a detrimental impact on the environment. The fast-fashion industry, valued at c.USD35bn as of March 2023, represents only 1.4% of the USD2.5tn fashion industry but is responsible for aggravating a number of environmental issues such as pollution and greenhouse gas (GHG) emissions and depleting natural resources while exploiting labour.

The fashion industry’s negative impact on the environment, society and governance is extensive and unsustainable:

-

Environmental impact

-

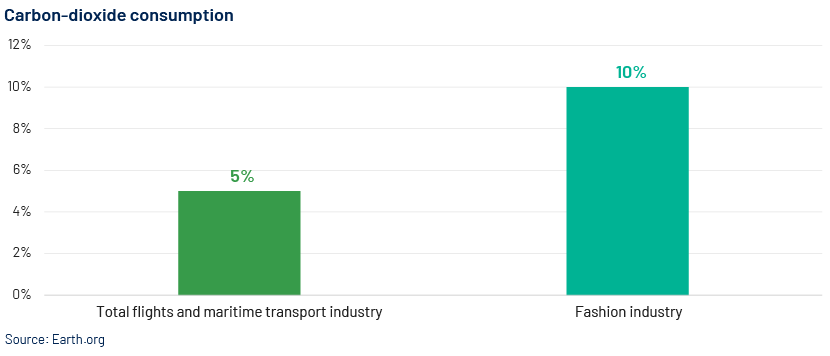

Carbon emissions – The fashion industry produces an estimated 1.2bn tons of carbon-dioxide a year, more than that produced by international flights and maritime shipping combined.

-

-

Water consumption – Around 2,700 litres of water are required to produce a single cotton T-shirt, resulting in water scarcity in a number of regions.

-

Deforestation – The fashion industry contributes to deforestation through the production of materials such as viscose and rayon. Around 150m trees are cut down annually to produce viscose for products such as clothing, textiles and accessories, according to non-profit organisation Canopy.

-

Chemical pollution – Approximately 20% of global water pollution is attributed to the fashion industry, primarily due to chemical pollution from textile manufacturing processes. Around 8,000 synthetic chemicals are used in the textile dyeing and finishing processes.

-

Waste generation – The Ellen MacArthur Foundation estimates that the equivalent of one garbage truck of textile is landfilled or incinerated every second.

-

Social impact

-

Exploitative labour practices – Approximately 93m textile industry workers live in poverty, according to the Clean Clothes Campaign.

-

Worker safety – A number of factory accidents are reported in the fashion industry, such as the 2021 factory fire in Bangladesh’s Gazipur district that claimed at least eight lives and injured many more as it spread rapidly owing to flammable materials stored in the factory. Bangladesh is one of the world’s largest garment producers and has witnessed several such incidents, including the Rana Plaza collapse in 2013 that claimed the lives of 1,100 workers.

-

Child labour – Approximately 170m children work, according to the International Labor Organization, with a significant number in the fashion industry.

-

Gender inequality – The global average gender pay gap in the arts, entertainment and recreation sector (which includes fashion) was estimated at 31.7%, according to the Global Gender Gap Report by the World Economic Forum, indicating a significant disparity in earnings. Women hold only 14% of executive committee positions in the global fashion industry, according to McKinsey & Co. This lack of representation at the top hampers gender diversity and limits opportunities for female professionals to shape decision-making processes. Furthermore, the industry is yet to make progress on gender and inclusion; only 40.6% of models cast in runway shows were non-white in 2021, of whom 29.8% were aged 18-25.

-

-

Governance impact

-

Lack of regulation – The fashion industry operates in a global supply chain where regulations and oversight are often inadequate, allowing for exploitative practices.

-

Weak labour laws – Many countries lack strong labour laws and fail to enforce existing regulations, leaving workers vulnerable to exploitation and abuse.

-

Limited accountability – Brands and manufacturers often lack transparency, making it difficult to hold them accountable for their social and environmental practices.

-

Trade policies – Trade agreements may prioritise economic growth over social and environmental considerations, potentially undermining efforts to address sustainability in the fashion industry.

-

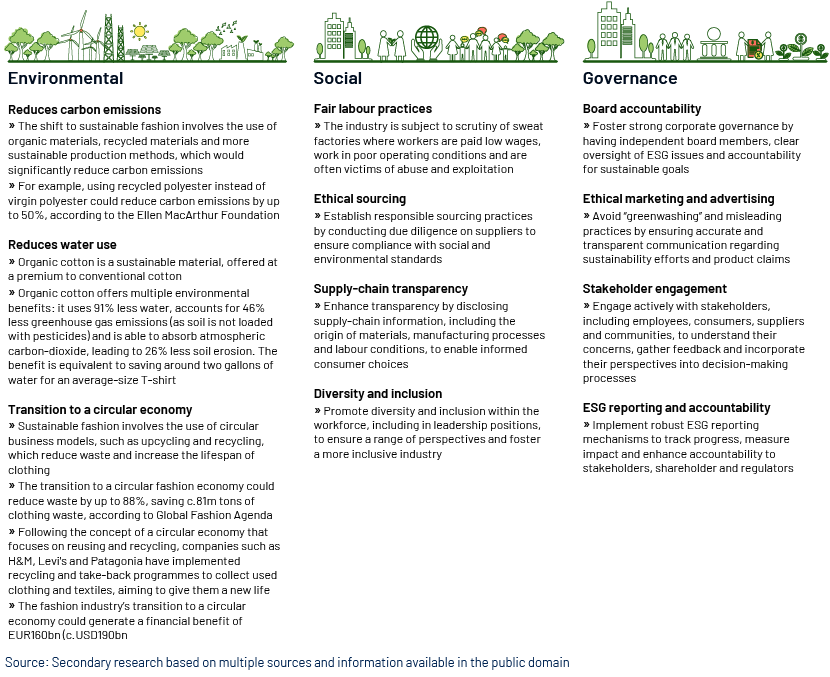

On the positive side, the fast-fashion industry is gradually transitioning to a slow-fashion industry, implementing sustainable environmental, social and governance (ESG) practices such as the following:

-

Using eco-friendly materials (such as organic cotton, recycled polyester, hemp, Tencel and bamboo)

-

Reducing resource consumption

-

Adopting circular economy models

-

Increasing supply-chain transparency

-

Improving worker welfare

Sustainable fashion sales are growing, reflecting optimistic consumer demand. Customers are also inclined to buy from second-hand sellers such as ThredUp Inc. and Poshmark (both based in California, USA) to reduce their consumption of fast fashion. The “shared economy” concept is also being adopted by the fashion industry, with an increase in cloth rental solutions provided by companies such as US-based Rent the Runway and Gwynnie Bee, UK-based Girl Meets Dress and Dutch firm Mud Jeans promoting the culture of “keeping, returning and swapping” clothes to increase their lifespan.

Incorporating ESG considerations, fashion brands can minimise their environmental impact, improve social conditions and benefit from the business opportunities that ethical production presents. Collaboration between brands, industry stakeholders and conscious consumers is key to ensuring a sustainable and ethical industry.

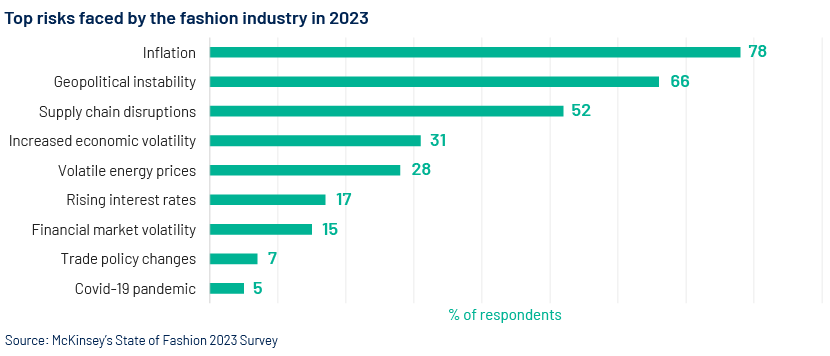

The fashion industry has faced multiple challenges in recent years and 2023 is expected to test its resilience yet again. The main risks it faces are inflation, geopolitical instability and supply-chain disruptions, according to the McKinsey State of Fashion 2023 Survey.

To mitigate such risks, industry players must

-

Diversify sourcing – to reduce overreliance on a single country or region, to reduce vulnerability to geopolitical instability.

-

Strengthen relationships with suppliers – regular communication, collaboration and transparency help foster trust and ensure better coordination in times of disruption.

-

Invest in sustainability and circularity – deploy sustainable practices and circular economy models. By reducing waste, promoting recycling and using organic materials, companies can contribute to long-term sustainability.

-

Embrace digitalisation and technology – use digital tools and technology to enhance supply-chain visibility and transparency. Implementing advanced analytics, automation and blockchain technology can provide real-time data on inventory, production and logistics, supporting better decision making and mitigating supply-chain risks.

New regulations amid heightened consumer awareness of the fashion industry’s contribution to the climate crisis prompt brands to be hyper-vigilant about sustainability-related initiatives and achievements and ensure they are not “greenwashing” their products, which would lead to reputational damage and/or costly fines.

The fast-fashion industry has an environmental impact at the different stages of the production cycle – from raw material extraction and procurement to garment production, transport and disposal. The following is an in-depth analysis of the environmental, social and governance impact of the global fast-fashion industry:

The transition to sustainable fashion

The abovementioned negative impacts highlight the need for the industry to transition to sustainable fashion for long-term sustainability and the wellbeing of human capital and the environment. Benefits of shifting to sustainable fashion are as follows:

Given the benefits of transition, industry players are now shifting their focus from maximising profits to minimising their environmental impact and improving social responsibility by adopting sustainable materials such as organic cotton, recycled polyester or Tencel. They are also looking to reduce waste by recycling fabrics, cutting down on production and minimising packaging. They could improve supply-chain transparency by tracing the origin of procured materials and ensuring safe working conditions for their workers.

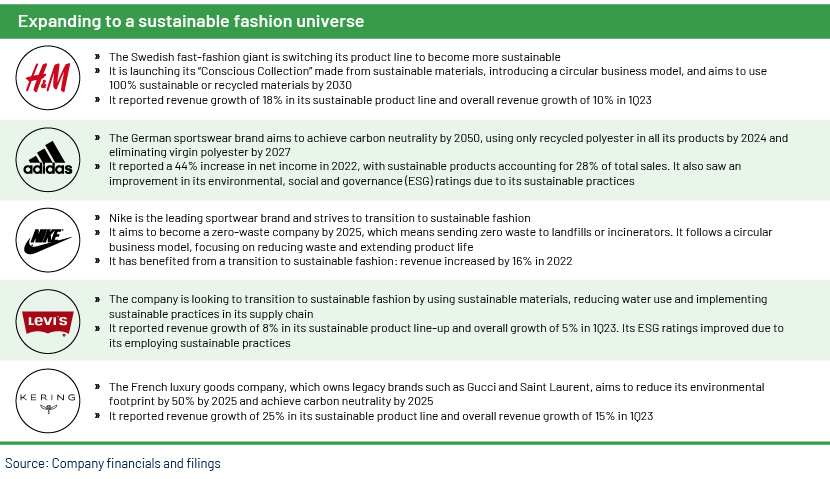

Examples of companies moving to the sustainable fashion universe

Several public players in the fashion industry have now entered the sustainable fashion segment, capitalising on demand for eco-friendly products and the need to address environmental and social issues. The following table lists some of these companies’ transition and its impact on their earnings:

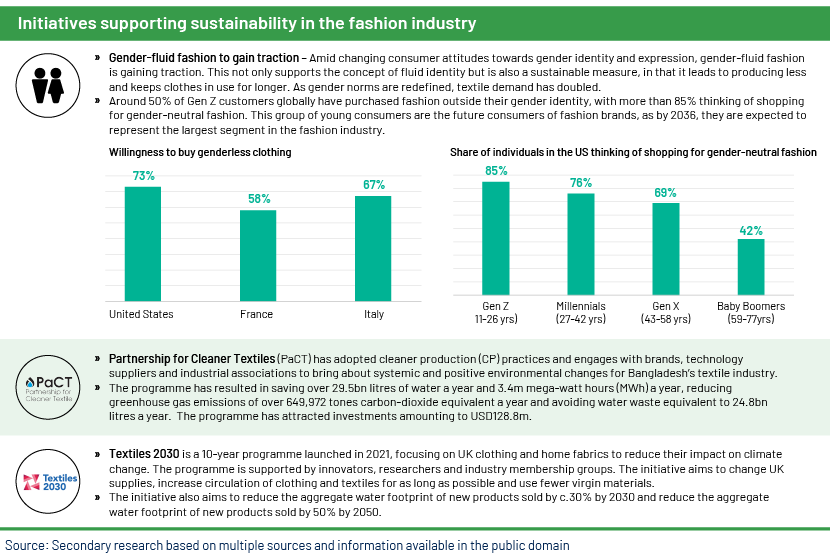

Initiatives supporting sustainability

The sustainable fashion industry has launched a number of initiatives to promote the use of sustainable materials.

We list more solutions and initiatives implemented by companies, governments and international organisations below:

-

Company initiatives

-

Sustainable sourcing – Many fashion companies are adopting sustainable sourcing practices by using organic or recycled materials, supporting fair trade and reducing the use of harmful chemicals. For example, Patagonia is a renowned outdoor clothing brand that prioritises sustainability in its supply chain. It actively seeks out sustainable raw materials such as organic cotton, recycled polyester and responsibly sourced down feathers.

-

Circular economy models – Some companies are implementing circular economy principles, such as designing for durability, offering repair services and promoting clothing rental or resale programmes. For example, Eileen Fisher operates a programme called “Renew” where customers can bring back their gently worn Eileen Fisher garments in exchange for store credit. These returned articles are then cleaned, mended and resold as part of its ‘renewed’ collection, extending the lifespan of the garments. General trends and examples of how fashion companies are adopting circular economic principles are as follows:

-

Clothing rental and subscription models – The global clothing rental market is projected to reach USD2.1bn by 2025, growing at a CAGR of 10.4% from 2019. Companies such as Rent the Runway, Nuuly and HURR Collective provide rental and subscription services, allowing consumers to access a variety of garments without the need for ownership, promoting reuse and reducing waste.

-

Material innovation and recycling – The global textile recycling market is projected to grow at a CAGR of 14.2 % from 2020 to 2027. Companies such as The North Face and Adidas are incorporating recycled materials into their products, such as by using recycled polyester from plastic bottles or regenerated nylon made from discarded fishing nets, reducing demand for virgin resources.

-

Repair and maintenance services – The repair and maintenance segment of the fashion industry is gaining traction. The second-hand market, including repairs and alterations, is projected to reach USD64bn by 2024, according to a report by ThredUp. Brands such as Patagonia and Levi’s offer repair services for their products, encouraging customers to extend the lifespan of their garments through mending and maintenance.

-

Design for durability and modularity – The durability of clothing is a key aspect of circular fashion. Extending the average life of clothing by just three months of active user per item could lead to a 5-10% reduction in carbon, water and waste footprints. Companies such as Nudie Jeans and Mud Jeans focus on creating durable products that can be easily repaired and offer modular designs that allow customisation and adaptability to changing trends, reducing the need for frequent replacement.

-

Extended producer responsibility (EPR) and take-back programmes –More than 60 leading fashion brands have committed to implementing or expanding garment collection programmes, according to the Ellen MacArthur Foundation. Companies such as Eileen Fisher and Patagonia have established take-back programmes where customers can send used garments for recycling, upcycling or resale, reducing landfill waste and promoting a closed-loop system.

-

-

Transparency and traceability – Companies are enhancing supply-chain transparency, providing information about the environmental and social impact of their products, and using certifications to verify sustainable practices. Eileen Fisher is also committed to transparency and traceability across its supply chain. It provides information on the origin of its materials and its commitment to fair labour practices.

-

-

Government and international initiatives

-

Regulation and policy – Governments could implement regulations related to environmental protection, labour rights and product labelling. Examples include restrictions on hazardous substances, regulations on waste management and requirements for reporting sustainability practices.

-

International collaboration – Organisations such as the United Nations Alliance for Sustainable Fashion and Sustainable Apparel Coalition promote global collaboration and set industry standards for sustainable fashion.

-

Zero Discharge of Hazardous Chemicals (ZDHC) programme – This promotes the elimination of hazardous substances in the textile and footwear supply chain.

-

-

Future of sustainable fashion

-

Transition to a circular economy – The fashion industry is moving towards a circular economy, where products are designed for durability, repairability and recyclability, reducing waste and reliance on new resources.

-

Sustainable materials – Innovations in materials science and technology are leading to the development of eco-friendly materials such as bio-based fabrics, recycled fibre and innovative alternatives to leather and synthetic materials.

-

Technology and digital solutions – Digital platforms and technologies are enabling increased transparency, supply-chain traceability and consumer engagement in sustainable fashion.

-

-

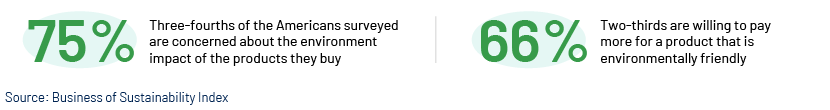

Consumer transition to sustainable fashion

-

Conscious consumerism – Consumers are becoming more aware of the environmental and social impacts of fashion and are actively seeking out sustainable and ethical brands.

-

Education and awareness – Increased education and awareness campaigns are helping consumers understand the benefits of sustainable fashion and make informed purchasing decisions.

-

Second-hand and rental market – Consumers are embracing second-hand shopping, clothing rental services and peer-to-peer resale platforms as alternatives to buying new.

-

Gender-neutral clothing – Embracing the circular economy in the fashion industry involves reducing waste, extending the lifespan of garments and promoting clothing reuse or recycling, Gender-neutral clothing can contribute to reducing fashion waste by providing versatile and inclusive options that can be worn by people of different genders, reducing waste in several ways, as follows:

-

Reduced production – Gender-neutral clothing eliminates the need for separate production lines and inventories for men’s and women's clothing. By designing garments that can be worn by individuals of any gender, fashion brands can streamline their production processes and reduce overall waste generated during manufacturing.

-

Extended lifespan – Gender-neutral clothing tends to be more versatile and can be worn by individuals of various genders and body types. Such versatility potentially increases the lifespan of garments, as they can be passed on or shared among different individuals, reducing the frequency of clothing disposal.

-

Reduced overconsumption – Gender-neutral clothing promotes a shift towards more conscious and intentional consumption. By moving away from gender-specific trends and styles, consumers may be less inclined to follow fast-fashion trends, resulting in reduced clothing consumption overall and subsequent waste generation.

-

-

Outlook

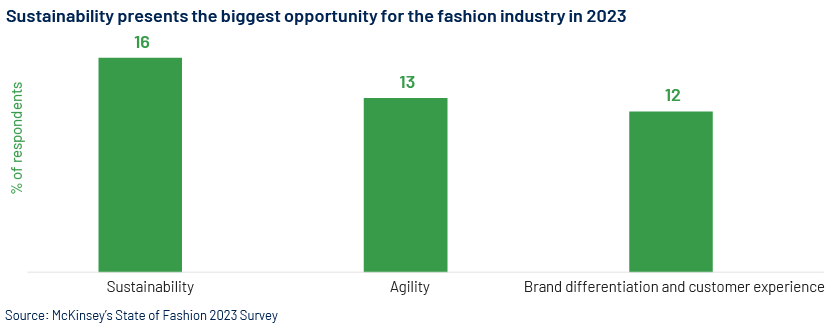

The outlook for the sustainable fashion industry is promising, as it presents opportunities to reduce environmental impact and increase profitability. Sustainable fashion practices could lead to cost saving by optimising resource use, reducing waste, and achieving operational efficiencies through lower production costs. For example, using recycled material can be more effective than sourcing new materials. Consumers are also inclined to adopt sustainable purchasing habits now, but brands still have a long way to go to capitalise on the opportunity.

Governments and regulatory bodies are also increasingly implementing policies and regulations to encourage sustainable practices in the fashion industry; these include the Global Organic Textile Standard (GOTS) and Fairtrade certification that help brands commit to sustainability, gain recognition, improve ESG and credit metrics and gain consumer trust. Ultimately, this transition allows brands to increase profitability while reducing their environmental impact, creating a win-win situation for both business and the planet.

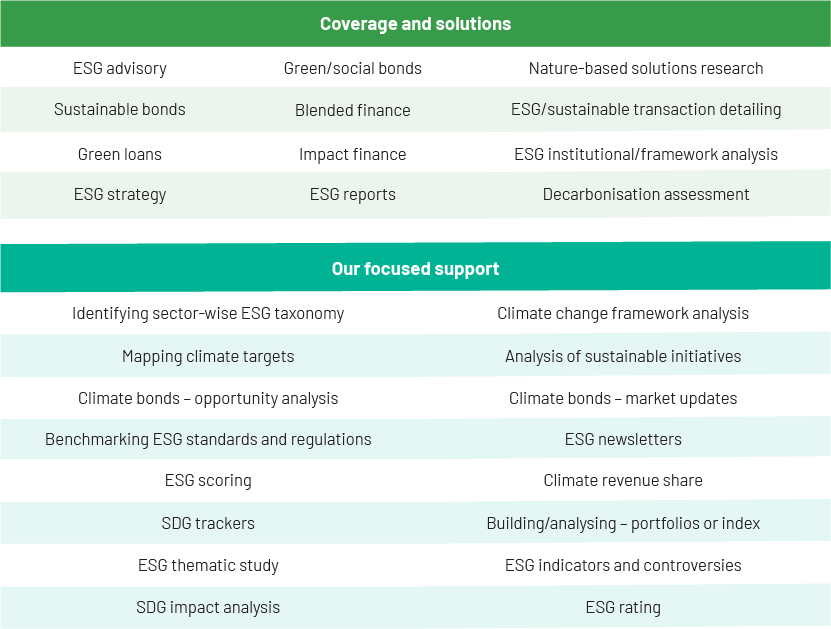

How Acuity Knowledge Partners can help

We are a leading provider of high-value research, analytics and business intelligence. We help corporate clients from diverse sectors understand strategy; we understand the operational concerns and challenges they face and assist them with decision making.

We offer customised solutions, including market and competitive intelligence, benchmarking and analysis, strategy research, due diligence, and industry analysis. We provide venture capital and private equity firms with comprehensive solutions across the investment cycle and help them stay abreast of industry dynamics and trends in consumer behaviour, economics and demographics in both current and new markets. We also offer horizontal support across middle-office and back-office operations to private equity firms on the investment side; our services range from portfolio management and advisory to deal finding and target selection.

Sources

-

https://www.bloomberg.com/graphics/2022-fashion-industry-environmental-impact/#xj4y7vzkg

-

https://www.defimode.org/wp-content/uploads/2022/11/The_State_of_Fashion_2023.pdf

-

https://www.worldbank.org/en/news/feature/2019/09/23/costo-moda-medio-ambiente

-

https://www.mckinsey.com/industries/retail/our-insights/fashion-on-climate

-

https://unfccc.int/news/un-helps-fashion-industry-shift-to-low-carbon

-

https://ellenmacarthurfoundation.org/topics/fashion/overview

-

https://hmgroup.com/investors/annual-and-sustainability-report/

-

https://report.adidas-group.com/2021/en/at-a-glance/2021-stories/our-sustainability-initiatives.html

-

https://investors.nike.com/investors/news-events-and-reports/?toggle=filings

-

https://wrap.org.uk/taking-action/textiles/initiatives/textiles-2030

-

https://earth.org/fast-fashions-detrimental-effect-on-the-environment/

Tags:

What's your view?

About the Author

Sanchit Tuli joined Acuity Knowledge Partners’ (Acuity’s) Investment Banking team with over three years of experience. He specialises in the healthcare and consumer sectors. He currently supports the US division of a leading European bank, having demonstrated proficiency in financial statement analysis and preparing credit reports and pitch decks. Sanchit holds a Bachelor’s degree in Business Administration from Christ University, Bengaluru.

Like the way we think?

Next time we post something new, we'll send it to your inbox