Published on February 2, 2024 by Ranjith Poojary and Sandeep Khandelwal

What is investment compliance?

Investment compliance (IC), including investment guideline monitoring, is an important aspect of portfolio management. Portfolio managers (PMs) must ensure that their portfolios comply with the regulatory requirements and policies of particular committees and clients in accordance with investment agreements.

Why asset management firms need to monitor investment compliance

Proactive monitoring is crucial to ensure managers keep abreast of the evolving regulatory guidelines in order to mitigate risk and avoid penalties and reputational loss. Organisations often update their policies, and managers should be diligent about staying on top of these changes and their impact on accounting practices. When a violation is identified, it should be rectified within the stipulated timeframe; this would reduce the financial and legal consequences for both investment managers and clients.

Recent data shows that the number of investment advisors has grown by about 50% over the past 10 years. Investment managers from international asset management companies work with investors from a number of countries. Investments in these countries are governed by different regulatory bodies and local laws. To be compliant with these regulations and laws, investment managers should have sufficient knowledge of regional regulation.

Despite their best efforts, asset management companies face significant pressure. Recent developments in the investment sector and regulators’ efforts to enforce policies have made the compliance environment more challenging, and monitoring compliance is key to navigating this.

The need for investment compliance

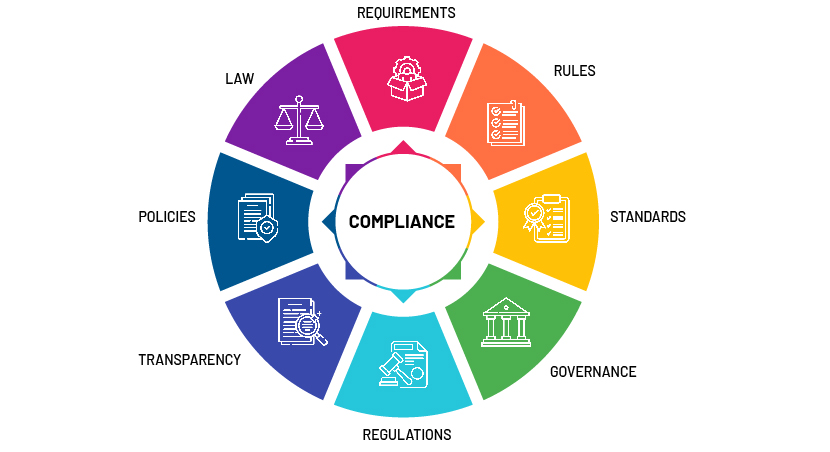

The following illustrates what compliance involves.

The 2008 financial crisis led to an increase in regulatory scrutiny. The role of the compliance department shifted from providing advice to active risk management and monitoring. Compliance departments are now expected to provide practical perspectives on translating regulations into operational requirements.

The role of investment compliance is not only to ensure that a business is compliant with external regulations and client mandates, but also to maintain internal controls and standards. In the financial services sector, compliance departments ensure that regulatory objectives are met to protect investors and that markets are fair, efficient and transparent.

Investment compliance mainly relates to pre-trade, post-trade and end-of-day batch monitoring, along with account management functions. The investment compliance function not only provides advisory solutions for compliance breaches, but also notifies PMs of issues that require immediate attention.

Major trends in investment complianceAmid the rapid growth of the compliance support sector and constant change in regulations, new technologies and tools are being developed to streamline the process.

We list some compliance-related trends in the financial sector below:

1. Sanctions

A number of countries have imposed sanctions on Russia and Belarus since the start of the Russia-Ukraine war. There are also sanctions on countries such as Iran and Sudan and Chinese military companies, directly prohibiting investing in their securities. Organisations should be vigilant enough to ensure that their clients are protected from exposure to such sanctions.

2. ESG

Environmental, social and governance (ESG)-related investments are increasing, leading to companies becoming more conscious about their impact on the environment and society and starting to offer ESG-focused products.

3. Due diligence

Enhanced due diligence plays an important role in identifying money laundering and fraud and in reviewing the policies and procedures of an organisation. The higher risk associated with sanctioned entities necessitates additional checks, including advanced searches, transaction monitoring and fund verification and generating intelligence reports on the customer or business owner.

4. Technological advancements

Seventy-six percent of the compliance managers surveyed say they manually scan regulatory websites to track changes and assess the impact on their organisations, according to the MetricStream State of Compliance Survey Report 2021. Technological advancements and the adoption of machine learning have led to an increase in the development of in-house compliance tools to automate the different investment compliance functions.

5. Fines and penalties

The US Securities and Exchange Commission (SEC) imposed a record-breaking USD6.4bn in penalties and disgorgement in 2022. Organisations could lose millions in revenue due to a single non-compliance event. Organisations spend USD5.47m on compliance compared to an average of USD14.82m for non-compliance (source: GlobalScape).

Best practices for investment compliance

Organisations face challenges in day-to-day operations while monitoring investment compliance. Adhering to best practices would reduce operational inefficiency and risk of non-compliance, and enhance the effectiveness of the overall compliance structure.

-

Address every alert that is non-compliant and conduct a root-cause analysis before approving the alert. Save all related documents and correspondence for future reference.

-

Notify the PM of a red flag as a potential violation, so the necessary action could be taken to ensure that the fund remains compliant with the prescribed guidelines.

-

Reduce the number of false alerts by identifying rule-optimisation items or conducting a standard review of the restriction while coding in the system.

- Make use of automated tools and formulated sheets where required to increase efficiency and reduce human error in monitoring, especially in complex processes like investment guideline monitoring. Focus on developing in-house tools to automate the account management process.

-

When launching a new account, interpret guidelines from the investment policy statement/prospectus properly and create grids and onboarding checklists. A secondary standard review would check for omissions and mistakes.

How Acuity Knowledge Partners can help

We are pioneers in investment services offerings. We create tailor-made dynamic functions with a robust, responsive and proficient control framework and process delivery. Our highly experienced tool-agnostic team provides support in investment compliance, trade surveillance, venture capital portfolio monitoring, corporate compliance services, corporate, forensic and crime compliance. These services are supported by our proprietary suite of Business Excellence and Automation Tools (BEAT), which offer domain-specific contextual technology.

Our teams of experts have a unique combination of skillsets. They have extensive experience in order management/compliance systems such as Bloomberg AIM, Ion’s Latent Zero Sentinel, Charles River Database (CRIMS), LDC, ThinkFolio and BlackRock’s Aladdin, BTCA and SMARTS.

Sources:

Tags:

What's your view?

About the Authors

Ranjith Poojary has over 9 years total work experience, and is currently working as an investment compliance specialist in pre-trade, post-trade monitoring and rule coding. He has worked for firms including Oracle & State Street Syntel. His expertise spans across the Portfolio risk analytics and investment compliance sector. At Acuity Knowledge Partners he is working as a Delivery Lead supporting both post & pre-trade compliance services. Ranjith has done his MBA from Acharya Institute of Technology, Bangalore.

Sandeep has overall 15 years of experience and is currently working as Investment compliance specialist in pre trade & post trade monitoring. He has worked with various firms including BNY Mellon Pershing, Standard Chartered Bank & HDFC Bank. His expertise spans across Retail Banking operations, Capital Market Operations & Compliance monitoring. At Acuity Knowledge Partners, he is working as a Delivery Manager supporting both post & pre-trade compliance services. He is a MBA graduate in Finance from GRD College of Management, Coimbatore.

Like the way we think?

Next time we post something new, we'll send it to your inbox