Published on January 11, 2024 by Anurag Sikder

Asset managers are on the cusp of an environmental transformation. With each passing day, new regulatory requirements and the rapid pace of technological advancement necessitate changes in their responsibilities. With the recent developments in communication and reporting technology, investors expect companies to provide them with seamless, timely and personalised experiences, and that on a range of devices. Therefore, the relationship between clients and brands continues to change.

In this environment, portfolio managers (PMs) are under pressure not just to achieve higher returns, but also to seek the right kind of support to stay on top of their target audiences’ rapidly changing demands.

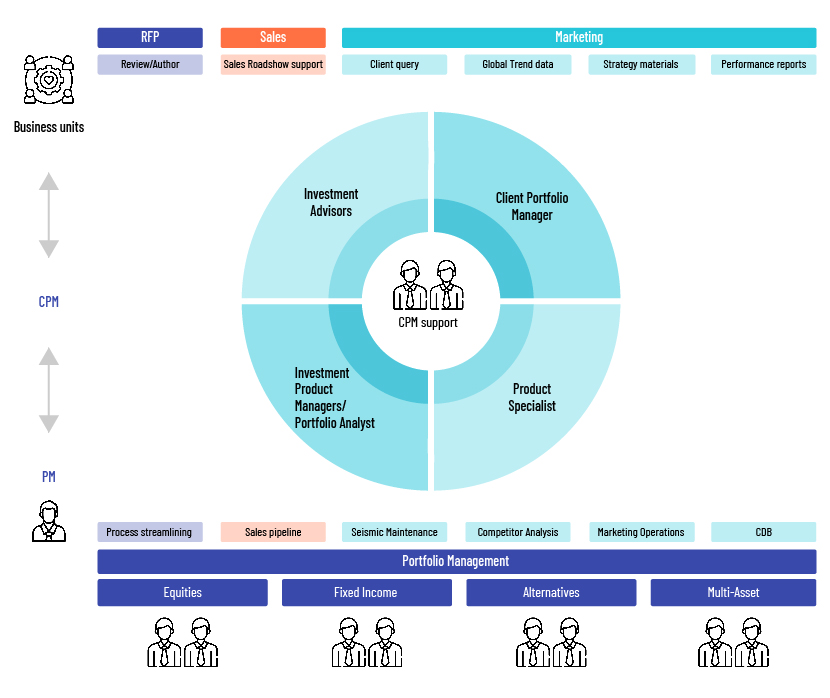

Amid these new changes, a new ecosystem has emerged, with PMs delegating most post-investment trade activities to a trusted team, better known as a client portfolio manager (CPM) that echoes the investment ideas of the PM. This approach is a key aspect of client portfolio management, as it ensures seamless coordination and alignment with the portfolio’s objectives. As such, this is not a relationship that can be built in a short period of time.

The CPM – the arms and legs of the PM

The CPM is capable personnel, handpicked by the PM to align with the PM’s ideology when offering suggestions, ideas and solutions to enable better decision making. The underlying premise is that the CPM performs the duties necessary to retain clients and keep their money locked into the portfolio. A dedicated CPM is, therefore, expected to handle substantial demand for data requests from clients/prospective clients and provide insights for the PM, while preparing all the performance and marketing material needed to satisfy investors and for the purposes of the organisation’s teams that depend on the CPM for inputs.

However, in today’s business environment, this is not as simple as using the tried and tested methods of a decade ago, in some cases, not those of even a year ago. In such a competitive space, highlighting one’s unique identity could make the difference in retaining clients.

This would, however, depend on the knowledge base and the experience of the person/team in question. By making an informed selection, outsourcing could result in unprecedented gains and operational fluidity, as exemplified below.

Case study: CPM support to a multi-billion-dollar asset manager

In 2022, one of our biggest clients’ PMs were facing difficult, demanding circumstances due to a change in ownership. This presented an opportunity for us to use our expertise to stabilise matters. Until this change, our role was restricted to investment writing and marketing support.

The client was acquired during a somewhat volatile time, and the PM’s requirements for different reports (such as on risk, return, market analysis and market forecasts) grew significantly. For the incumbent CPM, the amount of work grew exponentially in a matter of weeks. Although the organisation had dedicated teams able to compile such reports, the PM needed much more timely and precise reports to help with informed investing and rebalancing decisions.

While the asset manager’s relationship with our company had been quite strong until that time, they still had to be more confident that we could handle some of the roles and responsibilities of the CPM. They started training us on some of their proprietary report generation and data visualisation tools. Seeing the improvement and seamless support, the client increased our responsibilities, based on the transparency and frequency of communication on developments, our desire to learn more and our ability to offer new solutions to issues. These were all essential to building a relationship of trust and responsibility that would lay the foundation for a more diverse role. Hence, each report needed to be handled with care, while staying open to the possibility of having to rework a report completely.

Using a weekly, three-phase communication process, the client brought Acuity into close contact with other members of the PM’s team so that everyone could be on the same page. This communication process meant setting expectations at the start of the week, training and knowledge transfer during mid-week and a feedback delivery day at the end of the week. This helped build confidence over time through domain and academic knowledge sharing with key stakeholders.

Soon, the investment commentary process also benefited from this knowledge transfer, as the market reviews were much more detailed, containing the nuances of each individual fund offering. The PM received reports that were far more relevant to their funds, and after six months, the support teams were so sure of our ability and experience that they provided us the flexibility of choosing the reports most relevant to the PM’s requirements. We added discernible value during a volatile period by building a relationship based on results and trust. This led to the client confidently increasing the service areas under our purview.

How Acuity Knowledge Partners can help

We have a large number of offerings that are aligned with the responsibilities of a CPM across geographies and asset classes, including marketing, reporting and investment communication. We support prominent fund managers in compiling RFPs/DDQs and marketing collateral and help with consultant databases and investment commentaries. We also offer a broad range of marketing material support as part of our financial marketing services, combined with our rich experience in working with professional software. Our customised and integrated technology solutions offer more flexibility than off-the-shelf software for fund factsheets. We also leverage a portfolio analytics platform that allows our clients to gain deeper insights into their investment portfolios, providing the data and tools necessary to create more relevant reports, drive better decision-making, and optimise portfolio performance. We also offer Seismic slide library management support, support with migration and regular maintenance, and overall insight to ensure clients' financial marketing material and fund brochures are up to date

-

https://www.assetmark.com/blog/how-outsourced-investment-management-can-improve-your-practice

-

https://www.riaintel.com/article/b1fzqft4j9gn6m/the-case-for-outsourcing-portfolio-management

-

https://www.commonwealth.com/insights/reluctant-to-outsource-investment-management-you-shouldnt-be

What's your view?

About the Author

Anurag Sikder has over 13 years of experience in producing content for a wide range of industries. At Acuity, Anurag leads a range of different teams providing qualitative insight for numerous sectors in the form of market reports, white papers, thought leadership pieces, and commentaries.

Like the way we think?

Next time we post something new, we'll send it to your inbox