Published on March 27, 2023 by Shweta Mitra

Asset management (AM) companies need to monitor the pulse of the market and position their funds against competition in this constantly changing environment. Gaining actionable insights from the data mines each company has at its disposal is key to positioning funds against peers’ and meeting investor needs.

Understanding and interpreting how funds react to market dynamics and fare in the competitive landscape help distribution and marketing teams sell funds effectively and promote the best-performing funds to clients, whether as new or replacement funds.

The market research team assists the distribution team in providing data and insights, helping prioritise and promote the fund’s position and performance. Factoring the purpose, market pulse and other dynamics, the market research team shortlists competitor funds and prepares a comparison report. The report showcases standardised metrics and data points for an efficient comparison and understanding of the investment capabilities of the funds in question.

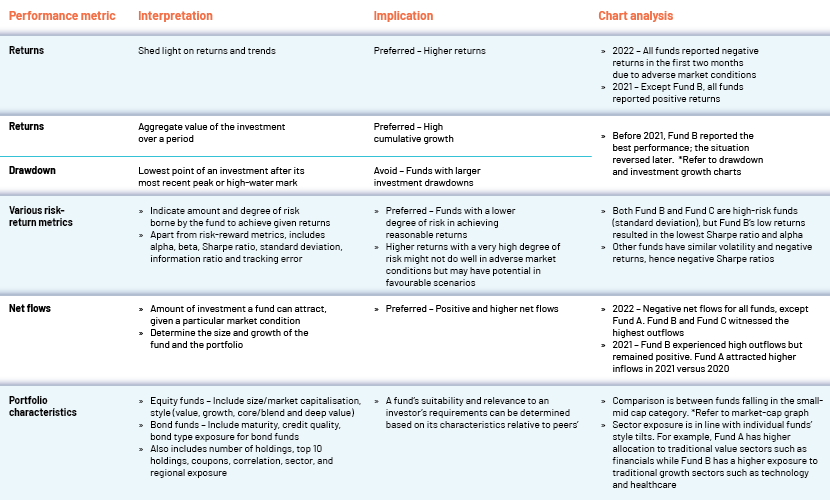

The following are key metrics and their interpretations used in competitor analysis, with insights shared from our evaluation of select funds, to help decide on the prospects for a fund.

Performance metrics and analysis

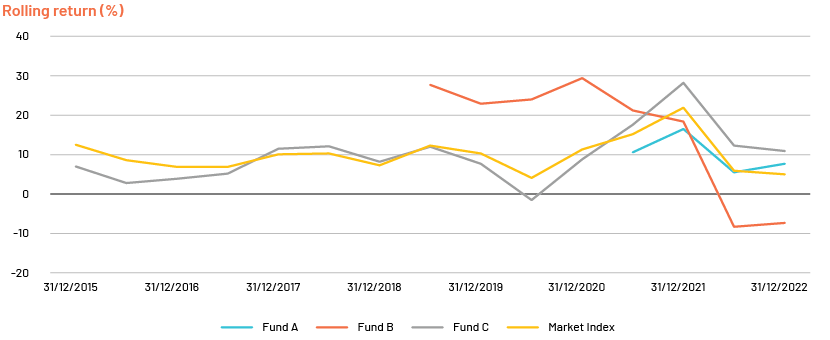

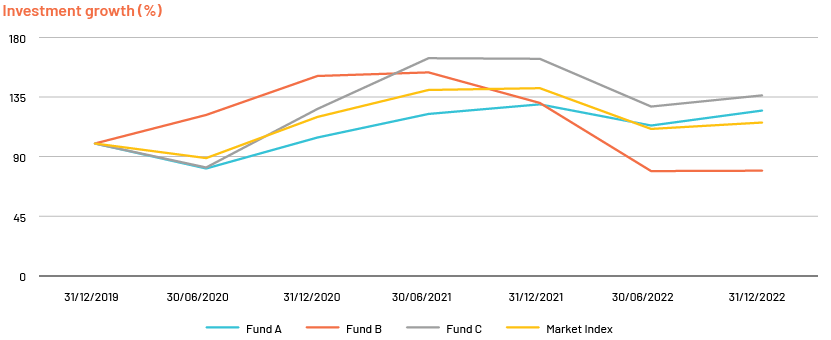

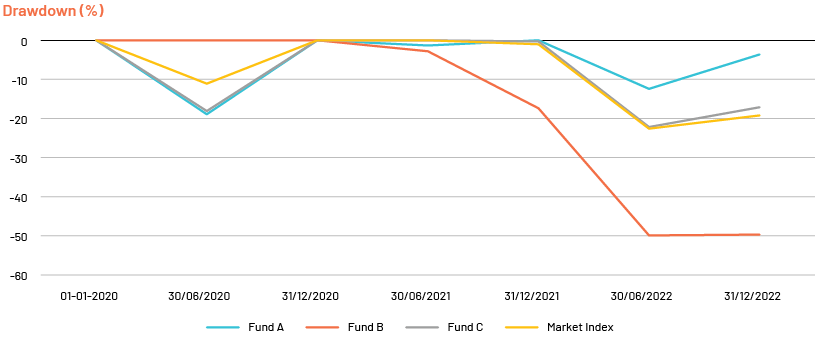

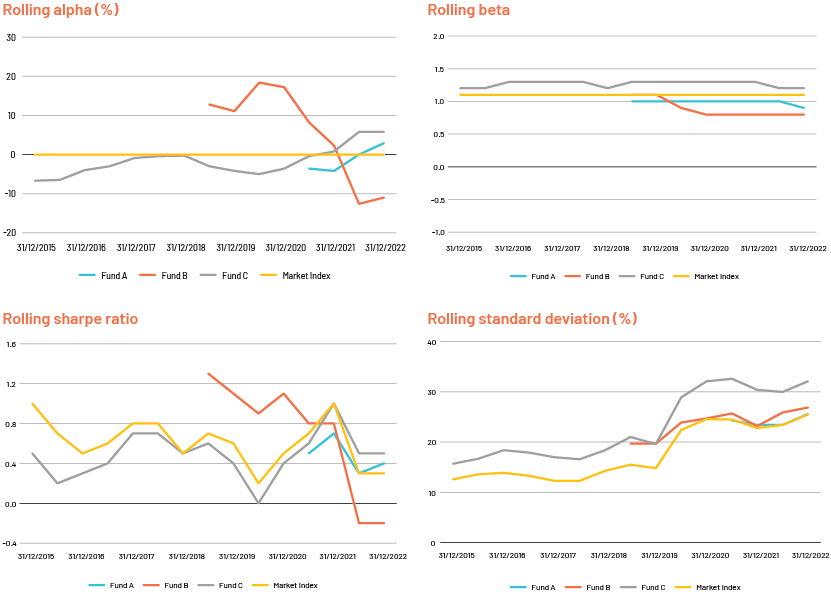

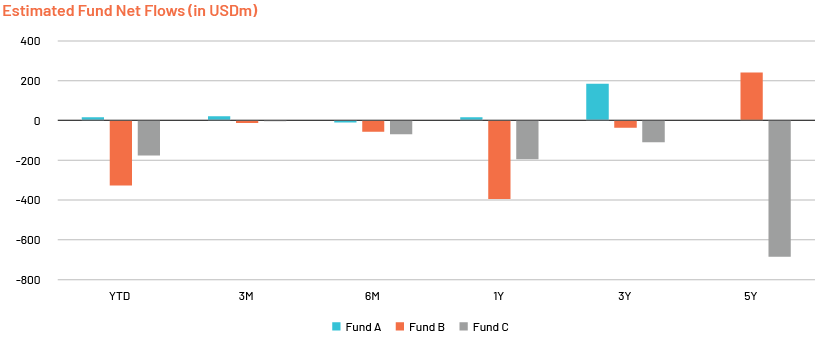

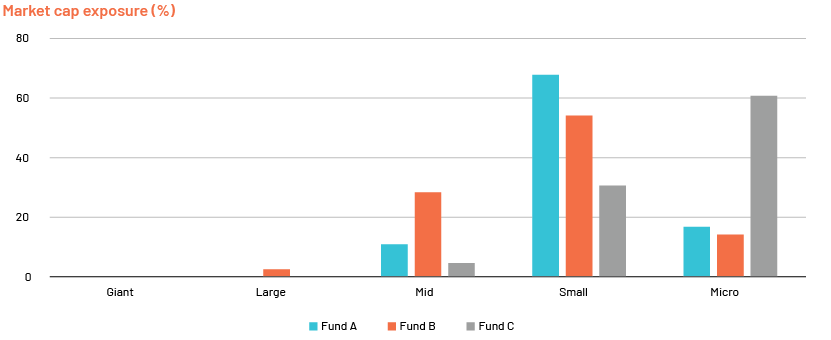

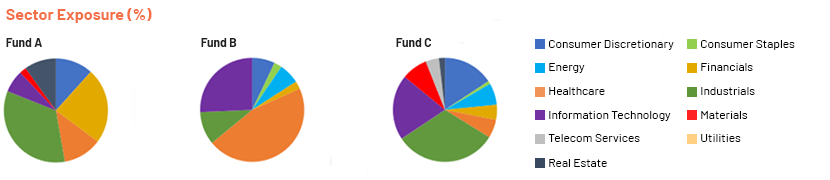

We explore highlights from a sample comparison of selected US small and mid-cap equity funds. The funds and data are for representative purposes only. The stated market index is relevant to the US small and mid-cap strategy and is used as a calculation benchmark for the comparison.

The stock market experienced unexpected volatility in the last two quarters of 2021, with value stocks outperforming growth stocks. This drove funds with a value tilt, such as Fund A, to perform well. However, funds with a heavy tilt towards growth stock holdings, such as Fund B, did not respond well to the changing market scenario, ending up with lower returns and higher drawdowns. The following is a detailed analysis interpreting key performance metrics and providing competitive insights for the funds.

Keeping tabs on how these important metrics move over time helps AMs align with investor requirements, handle their fund positioning and stay on top of their game. When performance responds favourably to changing market dynamics, it helps build overall confidence in their funds, drives insights and supports client pitches, bringing us back to the game of marketing and distribution.

How Acuity Knowledge Partners can help

We provide clients with a competitive edge through our experience in research-based marketing, reporting and digital marketing solutions. We have best-in-class expertise in analysing comparisons and generating insights, setting the stage for sales meetings with prospective clients (institutional/intermediary) of the particular asset management firms. These comparisons and analysis form the base of the sales pitch made by the distribution team and help the meeting reach a conclusion or turnaround. Valuable insights from competitor analysis also help us bridge teams in asset management firms. We are also experienced in navigating databases and using tools for extracting data and analysing funds.

We offer comprehensive solutions across a wide range of services such as RFP/DDQ and content support, consultant database uploads, marketing material, seismic support, client portfolio management, investment commentary, client reporting and end-to-end digital marketing support.

Sources:

-

Bloomberg

-

Reuters

-

Morningstar

Tags:

What's your view?

About the Author

Shweta is a Delivery Manager with Acuity and comes with almost ten years of work experience. She has exposure to a variety of roles, such as financial analysis and research, and has worked on multiple client and business development projects over her 2.5 years in the Financial Marketing Services Team at Acuity. Currently, she is an SME in market research and fund analysis, carrying expertise in numerous databases. Shweta has completed her graduation in Commerce from Delhi University, MBA from IMT Ghaziabad, and has cleared level 2 of the CFA program.

Like the way we think?

Next time we post something new, we'll send it to your inbox