Published on August 31, 2020 by Deepak Garg

Evolution of sustainable investing

The term “sustainable investing” has evolved through a series of definitions, starting from “ethical investing” in the early 1900s to “socially responsible investing (SRI)” in the late 1900s to the current “environmental, social and governance (ESG) investing”. However, the message has been the same – investing money in ways that make the world a better place. The only thing that has changed is that the importance of maintaining a good ESG record has shifted from being “good to have” to “must have” for corporates to attract investment.

Where once sustainability reporting was conducted by a handful of green or community-oriented companies, we now see this process employed as a best practice by companies worldwide. The big corporates are marketing their low to negative carbon footprints and spending millions to become “zero waste” companies.

The goal of “maximising shareholder wealth”, irrespective of social and environmental impacts, is now considered to be an outdated approach to running a business and attracting investors.

Flows to ESG-focused funds increasing

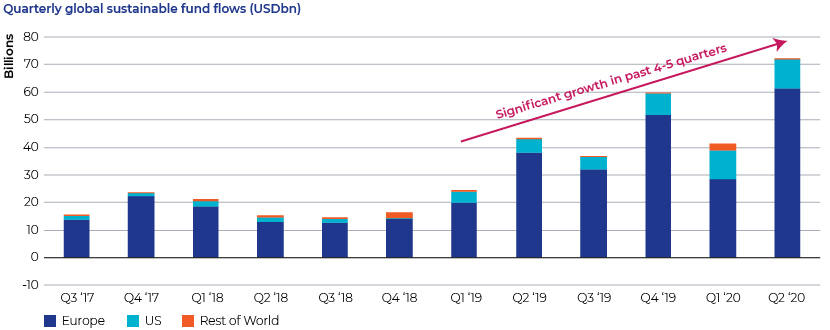

The shift in investor interest from “just” maximising their wealth to “responsibly” maximising their wealth is clearly visible from the latest ESG data reported by Morningstar. Global inflows to sustainable funds were up 72% to USD71.1bn in 2Q 2020, supported primarily by growing investor interest in ESG issues.

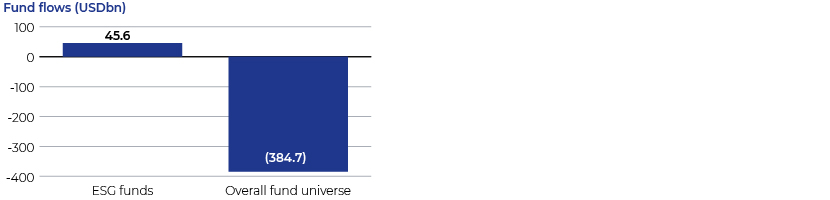

“Even in the first three months of 2020, which saw a peak in the pandemic in developed regions such as the US and Europe, global ESG funds saw inflow of USD45.6bn versus outflow of USD384.7bn for the fund universe as a whole.”

The steady increase in asset flow to sustainable funds, as the following chart shows, indicates that the shift in investor interest is not a one-off event but an emerging trend, fuelled by the latest crisis, the COVID-19 pandemic.

Source: Morningstar

Source: Morningstar

Global inflows to sustainable funds increased to USD71.1bn in 2Q 2020 from c.USD15bn in 3Q 2017, indicating average q/q growth of c.15% over the period. This growth was supported significantly by the increasing popularity of the ESG theme and an increase in the number of new ESG funds launched every year.

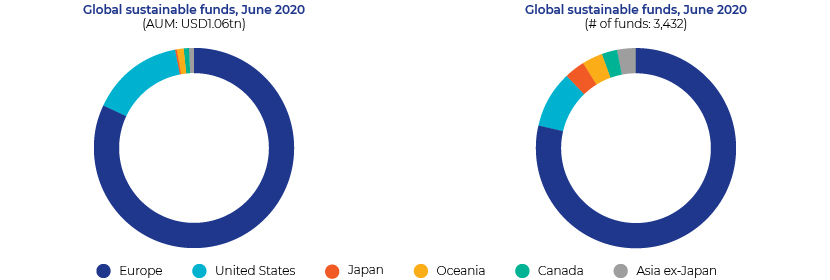

While the developed regions are setting an example in terms of ESG investing, Europe seems to be far ahead with regard to assets under management (AuM) in sustainable funds as well as the number of ESG funds

Source: Morningstar

Renewable energy driving sustainable investments

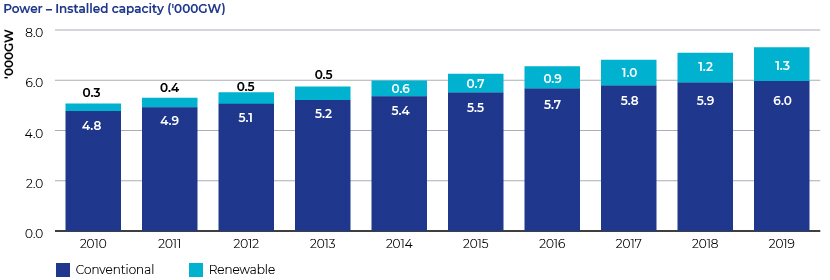

We believe this growing interest in ESG funds has been largely supported by the increasing role of renewable energy sources in the past three to four years. Renewable energy has contributed 61% to growth in global power capacity since 2016; the contribution was 39% for the period 2010-16 (after the black-swan event of the sub-prime crisis).

Source: EIA, IRENA

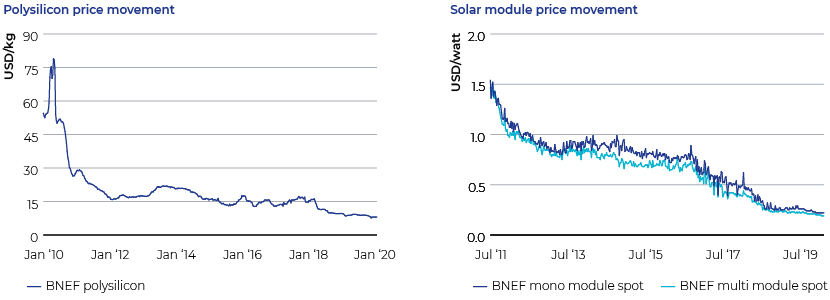

A number of factors have triggered this inflection point in the growth of the renewable energy industry in the past three to four years. For example, the continued decline in prices of input material (such as polysilicon and solar modules) leading to a lower levelised cost of energy (LCOE), favourable regulatory policies executed by state governments, and increasing focus on climate change and the need to move towards a sustainable source of energy (due to the depletion of fossil fuels).

Prices of polysilicon and solar modules had dropped by more than 85% in the past decade, putting prices of renewable energy on par with those of conventional energy.

Source: Bloomberg

Attractive returns from renewable energy investments

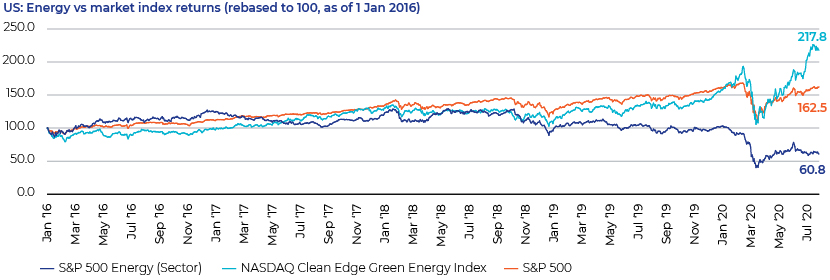

It has been an accepted fact over the past two decades that all the short-term setbacks aside, the world is moving towards a green environment with clean sources of energy. Only this time, investors are also making money, while investing responsibly. This is evident from a comparison of returns of “clean energy” indices against returns of market indices and conventional energy indices in developed markets such as the US and Europe.

The Nasdaq Clean Edge Green Energy Index has increased by 118% since 1 January 2016 against negative growth of 39% for the S&P 500 Energy Index and 63% growth for the S&P 500 Index. In terms of a post-COVID-19 recovery, the Clean Edge Green Energy Index has recovered by 102% versus 50% for the S&P 500 Energy Index and 46% for the S&P 500 Index.

Source: Nasdaq, S&P Global, Capital IQ

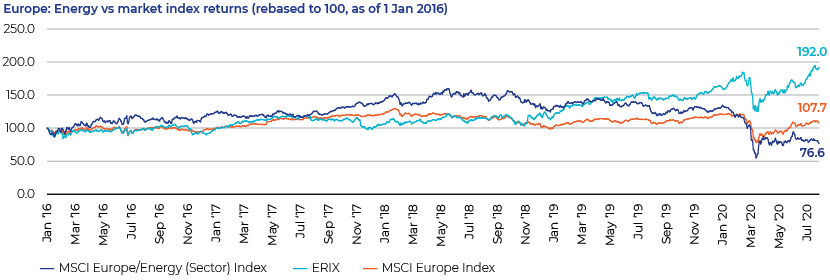

Similarly, the European Renewable Energy Index (ERIX) increased by 92% against negative growth of 23% for the MSCI Europe Energy Index and only 8% growth for the Europe MSCI Index. In terms of a post-COVID-19 recovery, the ERIX has recovered by as much as 53% versus 24% for the MSCI Europe Energy Index and 38% for the Europe MSCI Index.

Source: MSCI, Yahoo Finance, Capital IQ

Outlook

The increase in ESG fund flows and clean energy investor returns supports the theme of “profitable” sustainable investing.

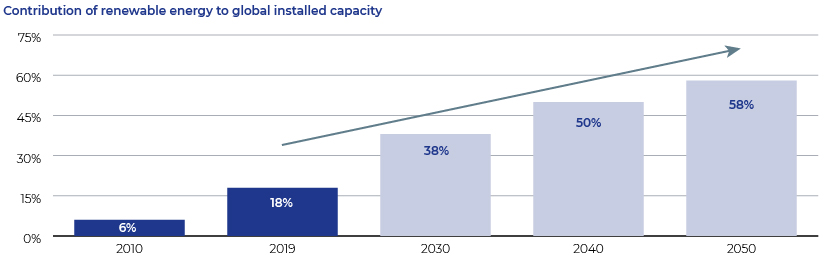

The contribution of renewable energy to global installed power capacity is expected to increase by 40% over 2019-50, according to the International Renewable Energy Agency (IRENA). Half of this growth is expected to come in the next 10 years and the remainder in another 20 years.

Economics have also started to favour renewable energy now, and we expect this emerging trend to shift investors from their conventional strategies of investing to the one helping to make the world a better place.

Source: IEA, IRENA

At Acuity Knowledge Partners, we enable investment banks and advisory firms to establish and grow their practice by providing a wide range of customised analysis and support in the field of sustainable finance. Our support areas cover the entire spectrum of financing products in the sustainable financial investment lifecycle. We are the preferred partner for sustainable finance solutions, backed by our comprehensive thought leadership and specialised research solutions.

With a pool of cleantech experts and a wide range of experience, we are able to conduct extensive research on growth potential and sector trends, and the macroeconomic environment, regulatory structure and competitive landscape.

Sources

https://www.nasdaq.com/market-activity/index/cels/historical

https://www.spglobal.com/spdji/en/indices/equity/sp-500-energy-sector/#overview

https://www.nasdaq.com/market-activity/index/spx/historical

What's your view?

About the Author

Deepak Garg is part of the Investment Banking division at Acuity Knowledge Partners, attached to the Power, Utilities & Infrastructure sector. He joined Acuity Knowledge Partners in Jan’17 and currently leads a team catering to a leading global investment bank. Previously, he has worked with HSBC-IB for more than 2 years and was actively involved in the origination and execution of M&A & ECM deals. Deepak holds an MBA in Finance from IMT Ghaziabad and a Bachelor of Technology degree in Mechanical Engineering from NIT Kurukshetra.

Like the way we think?

Next time we post something new, we'll send it to your inbox