Published on April 23, 2024 by Sreeja Roy Chowdhury , Debarati Dutta , Mahesh Agrawal , Jenil Mehta , Archana Anumula and Somya Dixit

Price performance in March 2024

Global market overview

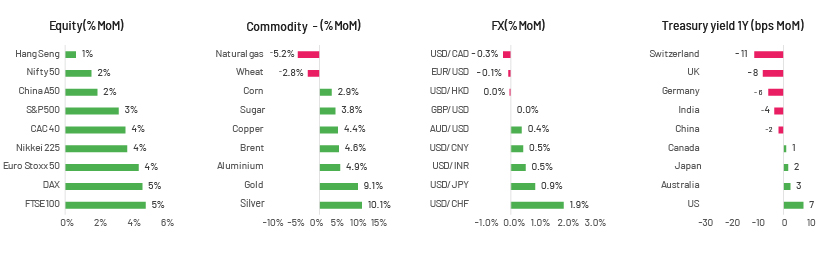

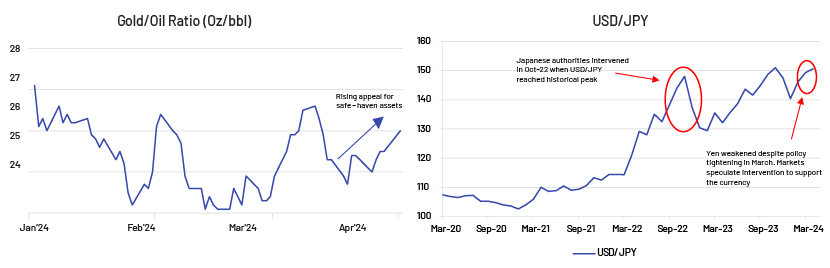

The equity market continued to have positive momentum in March, with the European market outperforming other regions, as a slowdown in inflation rates helped buoy sentiment. Over the coming weeks, the focus is likely to shift to the earnings season. The commodity market also performed better, with precious metals leading the rally. The rush to safety assets continued in March on the backdrop of geopolitical risks. Stronger economic data and overall optimistic sentiment could keep supporting commodity prices over the coming weeks.

The US dollar traded strongly against major currencies in March, on the back of more robust economic activity in the US during the month. Looking ahead, the focus will be on the US Federal Reserve (Fed) and European Central Bank (ECB), with some speculations building up that the ECB can make a move on policy rates sooner than the Fed. Japan tightened its policy rates to support the Japanese yen; however, the measure has not been effective until now, with USD/JPY rising again to 150 levels.

Charts of the month

Source: Investing.com

Source: Investing.com

Equity market

-

Review: Most of the major indices traded positively in March 2024, driven by healthy economic data and positive sentiment. The KOSPI delivered a 5.7% return, one of the highest among global peers. This remarkable performance can be attributed to the Corporate Value -up programme, the implementation of a short-sell ban and Korea’s National Pension Service’s interest in investing in value-up programmes, all of which significantly boosted the market. Additionally, the Euro Stoxx and DAX also experienced a broad-based rally in all sectors, supported by positive economic surprises and accommodative central bank policies, further contributing to the overall positive sentiment in the market.

-

Outlook: Looking ahead, the likelihood of a pullback this month has increased, considering the strong market rally witnessed in the past quarter. The Bank of Japan (BoJ) officially halted fresh purchases of ETFs last month, as the stock market made new highs and valuation concerns emerged. There are some speculations about selling existing ETF holdings by the BoJ, although the bank has not confirmed anything yet. Any future guidance by BoJ on ETF holdings can have potential market implications. Moreover, with the beginning of the earnings season over the next few weeks, further insights will be provided into corporate performance, potentially driving market sentiment.

Commodity market

-

Review: The commodity complex performed relatively well in March (compared with the previous month), as lingering geopolitical concerns sent precious metals and energy prices higher, whilst base metals moved up on tightening supply concerns. Gold extended the upward rally and reached fresh record highs, as cooling inflation numbers in the US raised the bets for three potential rate cuts this year. Meanwhile, crude oil prices rallied last month, with ICE Brent reaching year-to-date highs, as OPEC+ members extended supply cuts until 2Q24, whilst the International Energy Agency estimated an oil supply deficit for the year. Along with that, continued tensions between Russia and Ukraine added to the risk premium for oil.

-

Outlook: The commodity complex is expected to perform mixed, with oil and base metals mostly remaining on the positive side this month. For gold, the market could remain volatile on mixed market expectations for the Fed to start cutting rates in June. Meanwhile, crude oil prices are expected to perform better over the coming weeks, owing to continued escalations in tensions in the Middle East. Lastly, base metal prices are expected to extend their upward trend, especially copper, following the latest decision by Chinese copper smelters to opt for supply cuts.

FX market

-

Review: March was eventful, with several central bank policy meetings held. The US dollar lost ground after the Fed meeting; Fed Chair Powell displayed a softer rhetoric, reassuring rate cuts in 2H. However, data releases later in March painted a decent picture of the economy, resulting in the US dollar strengthening back to its lost spot by end-March. Much of the US dollar appreciation is also buoyed by lows seen in other major currencies. The BoJ tightened its monetary policy, lifting policy rates out of negative territory. Despite this, the yen continued to slide, taking the USD/JPY to the 150 mark again. The British pound tumbled post the policy outcome by the Bank of England (BoE). While a pause was widely expected, the vote split (eight members voted for a pause and one voted for a cut), signalling a rather dovish stance, in contrast to the previous meeting, when two members voted in favour of a hike. On the other hand, following a brief strengthening in EUR/USD on a weak dollar (post Fed meeting), the currency pair weakened by end-March. The fall in the euro has been largely due to a stabilising US dollar and softer Germany manufacturing data. The People’s Bank of China (PBoC) surprised markets by depreciating the yuan and fixing USD/CNY at the highest rate seen since November 2023.

-

Outlook: As USD/JPY strengthened, breaching the 150 mark, markets are speculating a currency intervention by Japan’s financial authorities to support the yen if such a depreciating trend persists. The US dollar’s rally, going forward, will depend on economic data outcomes in the US, with some resistance due to the Fed’s rate cuts in 2H. If US economic data remains buoyant, a stronger US dollar will be bearish for EUR/USD. The currency pair may also be hit by markets speculating an early policy move by the ECB, relative to the Fed. The PBoC is expected to tolerate a relatively depreciating currency in the coming months, likely pressuring other Asian currencies.

Debt market

-

Review: US 10-year Treasury yields remained elevated in March, amid a dovish outcome from a Fed meeting. Eurozone government 10-year bond yields ended higher, after falling mid-March, as investors became more confident of a rate cut by June. Moreover, UK 10-year gilt yields were down from February, as two more policymakers turned dovish. In Japan, bond yields ended higher in March compared with February, as the BoJ exited from its negative interest rate policy. Notably, the BoJ also terminated its yield curve control policy in March.

-

Outlook: As the US economy remains resilient, yields are expected to rise. UK gilt yields are expected to fall, with the BoE indicating a sooner-than-anticipated rate cut. Germany’s Bund yield, the euro area’s benchmark, is also expected to drop, with the ECB likely to cut policy rates in 2Q. JGB yields are expected to remain under upward pressure, owing to the BoJ’s rate hike path and the pace of quantitative tightening.

Key data releases:

| Indicator | Country | Release date | Consensus (actual) | Previous | |||||

| CPI (% y/y, March, final) | US | 10-Apr-24 | - | 3.2% | |||||

| EZ | 17-Apr-24 | 2.4% | 2.6% | ||||||

| UK | 17-Apr-24 | - | 3.4% | ||||||

| China | 11-Apr-24 | - | 0.7% | ||||||

| Japan | 20-Apr-24 | - | 2.8% | ||||||

| Manufacturing PMI (Index, March, final) | US | 01-Apr-24 | 50.3 (A) | 47.8 | |||||

| EZ | 02-Apr-24 | 46.1 (A) | 46.5 | ||||||

| UK | 02-Apr-24 | 50.3 (A) | 47.5 | ||||||

| China | 01-Apr-24 | 51.1 (A) | 50.9 | ||||||

| Japan | 01-Apr-24 | 48.2 (A) | 47.2 | ||||||

| Retail sales (% m/m, March) | US | 15-Apr-24 | - | 0.6% | |||||

| EZ* | 05-Apr-24 | -0.4% | 0.1% | ||||||

| UK | 17-Apr-24 | - | 0.8% | ||||||

| China^ | 16-Apr-24 | - | 5.5% | ||||||

| Japan | 27-Apr-24 | - | -1.4% | ||||||

| GDP (% q/q, 1Q, preliminary) | US | 25-Apr-24 | - | 0.8% | |||||

| EZ | 30-Apr-24 | - | 0.0% | ||||||

| China | 16-Apr-24 | - | 1.0% | ||||||

| Policy rate decisions (%, April) | EZ | 11-Apr-24 | - | 4.50% | |||||

| China** | 22-Apr-24 | - | 3.45% | ||||||

| Japan | 26-Apr-24 | - | 0.00% | ||||||

| Major events due in April | |||||||||

| ECB minutes for March | EZ | 04-Apr-24 | |||||||

| FOMC minutes for March | US | 10-Apr-24 | |||||||

| WB-IMF annual meetings | Global | 15 to 21 April | |||||||

| General elections (Phase 1 & 2) | India | 19, 26 April | |||||||

| BoJ quarterly outlook report | Japan | 26-Apr-24 | |||||||

Note: * Feb release; ^ % y/y; ** 1-year LPR. Dates are reported in local time zones

Source: National Statistical Offices, https://tradingeconomics.com/calendar

How Acuity Knowledge Partners can help

Our large pool of macro experts is experienced in providing research and strategic support across the value chain. We have partnered with macro research firms, global investment banks, asset management firms and hedge funds over the years, working closely with their research, strategy and investment teams to provide them with the information and analysis required in the investment decision-making process.

We also provide tech-enabled data management solutions, and modelling and analytics services covering macroeconomics, FX and commodities forecasts. (Macro Economic Research, FX, and Commodities Analysis | Acuity Knowledge Partners [acuitykp.com])

What's your view?

About the Authors

Sreeja has over 5 years of experience in economics and equity research. She has been with Acuity Knowledge Partners (Acuity) since 2018, providing sell-side research support to a global investment bank. At Acuity, she is part of the Cross-Asset Research Support team, specializing in macroeconomics research, high-frequency data tracking and financial modelling. Prior to joining Acuity, she worked as an equity research analyst with Zacks Research. Sreeja holds a Master of Science (Economics) from the University of Calcutta, India.

A postgraduate in Economics with over 7 years of experience in economic research. Currently at Acuity Knowledge Partners, is Delivery Manager, supporting a leading investment bank specializing in macroeconomics research. Responsibilities broadly involve analyzing country-specific macroeconomic data, tracking macro indicator releases and their evolution. Debarati holds a Master of Arts (Economics) from Madras Christian College (Autonomous), India and Bachelor of Science (Economics) from the University of Calcutta, India.

Mahesh has over 14 years of experience in commodity and macroeconomic research and has been associated with Acuity Knowledge Partners (Acuity) since September 2012. At Acuity, he supports a leading European investment bank’s commodity research desk in analysing commodity markets, preparing research notes and creating presentations for conferences and client interactions. Mahesh holds a master’s degree in Science (Energy Trading) from the University of Petroleum and Energy Studies, Gurugram, and a Bachelor of Science from Bikaner University, Bikaner.

Jenil Mehta is part of the Specialized Solution team at Acuity Knowledge Partner. He is part of a team of Asian equity derivatives strategists at one of the leading Japanese investment banks. He contributes to highlighting and publishing trade ideas, bespoke reports, and idea back testing based on fundamental and quantitative analysis. Before working here, he was a fixed-income derivatives trader and research analyst for North American and Brazilian markets. Jenil holds a bachelor’s degree in computer engineering and has passed all three CFA Levels.

Archana has over 16 years of experience in economics research, with proficiency in areas such as writing country-specific economic reports, real-time macroeconomic indicator release coverage and building and maintenance of large datasets. She has been with Acuity Knowledge Partners since 2011 and currently manages the Macroeconomics Research teams for two top-tier global firms. She is responsible for hiring, client engagement and account management. She is also in charge of business development for the Macroeconomics Research sub-vertical under Quantitative Services. Archana holds a Master of Arts (Economics) from St Joseph‘s College (Autonomous), India and a Bachelor of Commerce from Bangalore University, India.

A management postgraduate with over 12 years of experience in the Commodities Market. Well conversant with the fundamental aspects, inter-market relationships and Geo-political issues impacting the market. Currently at Acuity Knowledge Partners as Delivery Manager responsible for providing market analysis and assisting the client in preparing research analysis for the commodities (Energy, Metals & Agri). Well-acquainted with the use of data sources such as Thomson Reuters and Bloomberg. Somya holds a postgraduate degree in finance and a bachelor's degree in electronics engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox