Published on November 21, 2024 by Sreeja Roy Chowdhury , Debarati Dutta , Mahesh Agrawal , Jenil Mehta , Archana Anumula and Somya Dixit

Global market overview

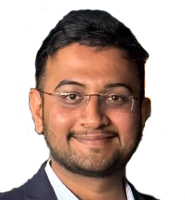

The global equity market retreated last month as geopolitical tensions relating to the Israel-Iran conflict, uncertainty surrounding the US elections, policy disappointment from China and concerns about an economic slowdown weighed on sentiment. The conclusion of the US elections and the return of a Trump presidency could provide much-needed support to the US equity market, especially the manufacturing sector, in the immediate term. The optimism could also spill over to those markets where a Trump 2.0 administration is viewed as being more favourable. Gold has remained one of the preferred investment choices in recent months, and we do not see this changing for the rest of the year. Silver could see some sell-off as industrial demand from the renewable sector may slow due to policy shifts in the US. Energy prices are likely to remain volatile for the rest of the year due to the uncertainty in the Middle East.

The USD traded strongly against major currencies in September and continued the trend in October. The Japanese yen (JPY) lost around 7% against the USD as the Bank of Japan (BoJ) kept rates steady while the GBP and the EUR also lost around 3% against the USD. The European Central Bank (ECB) lowered key short-term interest rates by another 25bps in October to support the economy; the US Fed is likely to follow suit on 7 November. However, longer-term bond yields in the US, UK and EU increased in October, and the trend could continue in the immediate term. The Trump administration is seen as being more inflationary in the medium term, which could push the Fed to curtail the easing cycle early.

Equity market

-

Review: Global equities experienced broad-based declines, with most indices in negative territory, as China’s latest stimulus package took centre stage. The stimulus was not in line with investor expectations of the NPC meeting; this partly disappointed investors and sparked mixed reactions. Nonetheless, it is still generating interest for investors to move China's equity from Underweight to Neutral at least. In the US, big tech underperformed, with 2025 profit growth estimates falling short of sparking investor enthusiasm. India faced record-high outflows from foreign institutional investors (USD10.9bn) in October, surpassing even pandemic-era levels due to high valuations, a lacklustre earnings season and investor interest shifting towards China. Geopolitical tensions further intensified India’s market challenges.

-

Outlook: Investors are gearing up for heightened volatility due to the US elections, especially as the "Trump 2.0" administration could reinvigorate certain market themes. US equities may benefit from Trump’s potential tax cuts and a protectionist focus on bolstering local manufacturing. Key sectors likely to attract attention include fossil fuels, defence, industrial metals and crypto that may benefit under a Trump administration. However, this stance could also negatively impact China/China-exposed stocks, as a renewed hardline approach towards China could create headwinds for companies with significant exposure to the region. Meanwhile, China’s National People’s Congress (NPC) meeting will be closely watched, as Beijing’s policies could shift in response to US political dynamics, adding another layer to investor sentiment. Geopolitical developments, especially the Middle East conflict, add further uncertainty, with potential ripple effects across global markets. The intersection of these events – a Trump administration, China’s policy responses, Fed decisions and geopolitical volatility – creates a complex, high-stakes environment where investor strategies will likely pivot on both economic policy signals and global stability factors.

Commodities market

-

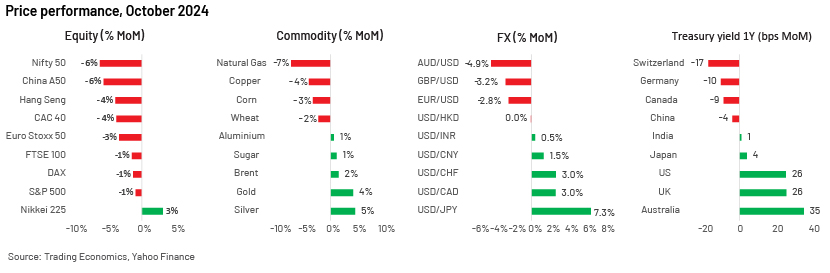

Review: Gold hit another record high, with prices climbing to USD2,790/oz in October, following the uncertainty relating to the US elections and expectations of another rate cut by the Fed at its policy meeting in November. Gold has been one of the best-performing commodities this year, surging by more than 30%. It is supported by central-bank buying and safe-haven demand amid conflicts in the Middle East and Ukraine. Among other precious metals, silver prices rallied, tracking gains in the yellow metal, while palladium also rose on reports that the US has asked G7 members to consider placing sanctions on Russian palladium in October. Turning to energy, US natural gas prices fell over 7% MoM in October as mild weather continues to limit heating demand for the fuel, while the weekly storage report showed that stocks rose by more than the five-year average. EIA weekly data shows that US gas storage increased by 78Bcf in the last week of October, well above the five-year average increase for a week of 67Bcf. Total gas stocks totalled 3,863Bcf as of October, up almost 3% from the same period last year and 4.8% above the five-year average. In contrast, crude oil prices managed to end the month in the green, following the uncertain geopolitical situation in the Middle East. Lastly, in agri commodities, the performance of grains remained weak last month, with corn and wheat falling over 3.3% MoM and 2.3% MoM, respectively. The price declines were primarily due to higher supplies and ample availability of inventories at major producing nations as China (a major importer) limits its overseas purchases to support its domestic market.

-

Outlook: Precious metals (especially gold) are expected to remain under pressure this month, after rallying to yet another record high last month. Donald Trump’s victory in the 2024 US presidential elections leaves market participants anticipating more dramatic policy and an economic change as the new administration takes charge. On the day of Trump’s political comeback, Treasury yields and the USD surged to their highest since 2022, weighing heavily on the commodity complex. Major changes expected include steep tariffs on imported products, worsening trade tensions with China and rising pressure on Europe to ramp up defence spending. Industrial metals are expected to react strongly to the heightened uncertainty, given their sensitivity to trade dynamics and industrial demand. In contrast, energy markets may receive short-term support due to the possibility of stricter enforcement of sanctions against Iran. The decision by OPEC+ members to delay their gradual increase in supply by one month would also support prices, along with the likely supply disruptions in the US Gulf of Mexico due to Tropical Storm Rafael. However, in the medium to longer term, a Trump victory could be more bearish for oil due to higher domestic production, trade and foreign policy.

FX market

-

Review: October had important region-specific events that drove currencies. In the UK, the pound sterling (GBP) plunged after Chancellor Reeves’s Autumn Budget received a very negative initial market reaction. As a result, the GBP/USD fell in October (by over 3%) to its lowest since September 2023. In the US, strong retail sales data and signs of an improving economy (release of the Beige Book and a strong labour market) prompted markets to expect a slower pace of interest rate cuts by the Fed in the coming months. This, along with expectations of a Trump majority ahead of the elections, incited a rally in the USD during the month. The USD rallied, in contrast to its trend in August and September, and the DXY index rose to a three-week high in October. In Japan, results of key events were largely in line with market expectations: (a) the BoJ kept policy rates on hold and (b) Shigeru Ishiba took over as prime minister. Together with a strong USD, these outcomes put downward pressure on the currency – the JPY weakened, with the USD/JPY breaching the 150 mark, surging by over 7% since September. The markets were impacted by the BoJ governor’s remarks, in tandem with the new prime minister’s, on being in no rush to further tighten policy rates in the coming months. The ECB reduced policy rates, as expected, adding further pressure on the EUR/USD, which plunged by over 2% in October. Asian currencies saw a slump in October, driven by a bullish USD. The Chinese yuan (CNY) remained stable, underpinned by China’s monetary and fiscal measures to reinforce economic growth.

-

Outlook: The USD is expected to be volatile in early November, with a close call in the presidential election results. A Trump win would propel the USD, going long against other currencies, in November. JPY weakness has been a concern among Japanese authorities, which have time and again issued warnings on speculative trading of the currency. If the JPY continues to fall further against the USD, it may prompt market intervention by the authorities, which last intervened in July this year, to support the currency. Markets are likely to expect rate cuts at all meetings of the ECB (given the sluggish economic scenario and easing inflation), triggering a dent in the currency. In the UK, the markets will look forward to (a) the Bank of England’s (BoE’s) policy stance at its meeting in November, when it is expected to cut rates, and (b) Chancellor Reeves’s first Mansion House address on 14 November, outlining the government’s support plan for the financial services sector. The CNY will likely be impacted by China’s National People’s Congress Standing Committee meeting in November, as markets expect an announcement of a bigger fiscal stimulus package in support of the economy. This may also depend on the outcome of the US elections, as the impact on trade policy will be a key factor to be taken into consideration.

Debt market

-

Review US bond markets were characterised by increased volatility in October, as the 10-year yield jumped over 50bps from end-September. Robust economic data, expectations of a rate cut at the November FOMC meeting, election-related uncertainty and mounting budget deficits made bond investors jittery. The ICE BofA MOVE Index, which tracks US Treasury market volatility, increased up to 40% in October, fuelled primarily by the close election race. In the UK, Gilts sold off after the budget announcement, highlighting the higher-than-expected borrowing requirement. 10-year gilt yields rose to their highest level in more than a year. In Europe, Bunds sold off as well in reaction to higher-than-expected inflation. In Japan, following the BoJ’s decision to leave policy unchanged, the yield on Japan’s 10-year government bonds (JGBs) fell.

-

Outlook All eyes will be on the US presidential election in November. A Republican victory may lead to higher 10-year yields, as investors will be concerned about the imposition of tariffs, tighter immigration policy and tax cuts. On the other hand, a Democratic victory may lead to significantly lower 10-year yields owing to minimal changes to tariffs and immigration laws. In addition, the upcoming FOMC meeting should provide clarity on the guidance for future meetings. In Europe, the US elections will be a key driver of EUR yields. Additionally, higher-than-expected 3Q GDP and October inflation data may not encourage the ECB to go for larger rate cuts at the next meeting. In the UK, gilt yields will remain volatile as investors watch the BoE November meeting, when the MPC is expected to cut rates, and watch economic and political outcomes in the US. In Japan, the JGB market will focus on the 10-year JGB auction on 7 November and the US election results.

Key data releases:

| Major macro indicators | Country | Release date | Consensus (actual) | Previous |

| CPI (% y/y, October, final) | US | 13-Nov-24 | - | 2.5% |

| Eurozone | 19-Nov-24 | 2.0% | 1.7% | |

| UK | 20-Nov-24 | - | 1.7% | |

| China | 9-Nov-24 | 0.3% | 0.4% | |

| Japan | 22-Nov-24 | - | 2.5% | |

| Manufacturing PMI (Index, November, flash) | US | 22-Nov-24 | - | 48.5 |

| Eurozone | 22-Nov-24 | - | 46.0 | |

| UK | 22-Nov-24 | - | 49.9 | |

| China | 30-Nov-24 | - | 50.1 | |

| Japan | 22-Nov-24 | - | 49.2 | |

| Retail sales (% m/m, October) | US | 15-Nov-24 | - | 0.4% |

| Eurozone* | 7-Nov-24 | 0.5% | 0.2% | |

| UK | 18-Nov-24 | - | 0.3% | |

| China^ | 15-Nov-24 | - | 3.2% | |

| Japan | 30-Nov-24 | - | -2.3% | |

| GDP (% q/q, 3Q, flash/2nd estimate) | US | 27-Nov-24 | - | 0.7% |

| Eurozone | 14-Nov-24 | - | 0.4% | |

| UK | 14-Nov-24 | - | 0.5% | |

| Japan | 15-Nov-24 | - | 0.8% | |

| Policy rate decisions (%, November) | US | 8-Nov-24 | 4.750% | 4.875% |

| UK | 7-Nov-24 | 4.75% | 5.00% | |

| China** | 20-Nov-24 | - | 3.10% | |

| Major events due in November | ||||

| NPC Standing Committee meeting | China | 4-8 Nov | ||

| Presidential election | US | 5-Nov-24 | ||

| BoJ meeting minutes for October | Japan | 6-Nov-24 | ||

| Finance minister’s speech at Mansion House | UK | 14-Nov-24 | ||

| G20 Summit | Brazil | 18-19 Nov | ||

| FOMC meeting minutes for November | US | 27-Nov-24 | ||

Notes: *September release; ^% y/y; #final release; **1y LPR. Dates are reported in IST (UTC+05:30)

Source: National Statistical Offices, central banks, Trading Economics

How Acuity Knowledge Partners can help

Our large pool of macro experts is experienced in providing research and strategic support across the value chain. We have partnered with macro research firms, global investment banks, asset management firms and hedge funds over the years, working closely with their research, strategy and investment teams to provide them with the information and analysis required in the investment decision-making process.

We also provide tech-enabled data-management solutions and modelling and analytics services covering macroeconomics, FX and commodities forecasts [Macro Economic Research, FX and Commodities Analysis | Acuity Knowledge Partners (acuitykp.com)].

What's your view?

About the Authors

Sreeja has over 5 years of experience in economics and equity research. She has been with Acuity Knowledge Partners (Acuity) since 2018, providing sell-side research support to a global investment bank. At Acuity, she is part of the Cross-Asset Research Support team, specializing in macroeconomics research, high-frequency data tracking and financial modelling. Prior to joining Acuity, she worked as an equity research analyst with Zacks Research. Sreeja holds a Master of Science (Economics) from the University of Calcutta, India.

A postgraduate in Economics with over 7 years of experience in economic research. Currently at Acuity Knowledge Partners, is Delivery Manager, supporting a leading investment bank specializing in macroeconomics research. Responsibilities broadly involve analyzing country-specific macroeconomic data, tracking macro indicator releases and their evolution. Debarati holds a Master of Arts (Economics) from Madras Christian College (Autonomous), India and Bachelor of Science (Economics) from the University of Calcutta, India.

Mahesh has over 14 years of experience in commodity and macroeconomic research and has been associated with Acuity Knowledge Partners (Acuity) since September 2012. At Acuity, he supports a leading European investment bank’s commodity research desk in analysing commodity markets, preparing research notes and creating presentations for conferences and client interactions. Mahesh holds a master’s degree in Science (Energy Trading) from the University of Petroleum and Energy Studies, Gurugram, and a Bachelor of Science from Bikaner University, Bikaner.

Jenil Mehta is part of the Specialized Solution team at Acuity Knowledge Partner. He is part of a team of Asian equity derivatives strategists at one of the leading Japanese investment banks. He contributes to highlighting and publishing trade ideas, bespoke reports, and idea back testing based on fundamental and quantitative analysis. Before working here, he was a fixed-income derivatives trader and research analyst for North American and Brazilian markets. Jenil holds a bachelor’s degree in computer engineering and has passed all three CFA Levels.

Archana has over 16 years of experience in economics research, with proficiency in areas such as writing country-specific economic reports, real-time macroeconomic indicator release coverage and building and maintenance of large datasets. She has been with Acuity Knowledge Partners since 2011 and currently manages the Macroeconomics Research teams for two top-tier global firms. She is responsible for hiring, client engagement and account management. She is also in charge of business development for the Macroeconomics Research sub-vertical under Quantitative Services. Archana holds a Master of Arts (Economics) from St Joseph‘s College (Autonomous), India and a Bachelor of Commerce from Bangalore University, India.

A management postgraduate with over 12 years of experience in the Commodities Market. Well conversant with the fundamental aspects, inter-market relationships and Geo-political issues impacting the market. Currently at Acuity Knowledge Partners as Delivery Manager responsible for providing market analysis and assisting the client in preparing research analysis for the commodities (Energy, Metals & Agri). Well-acquainted with the use of data sources such as Thomson Reuters and Bloomberg. Somya holds a postgraduate degree in finance and a bachelor's degree in electronics engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox