Published on December 19, 2023 by Siddhartha Chabria, CFA®

Introduction

Market participants, especially investors concerned about climate change and social justice, have been focused on environmental, social and governance (ESG) agendas and policies in the past two decades.

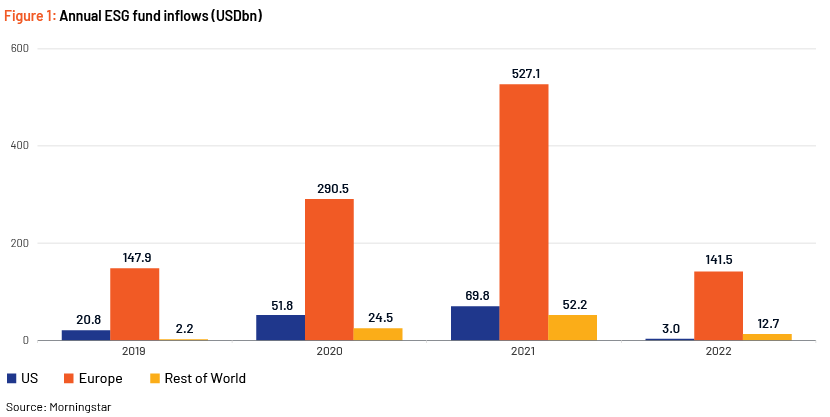

In recent years, ESG-oriented investors have pushed companies and regulators to make changes by way of investing substantially in funds focused on ESG issues. A record USD649bn in inflow to ESG-focused funds was recorded globally in 2021, up from USD542bn in 2020 and USD285bn in 2019. ESG funds now account for 10% of global fund assets. This shift in capital allocation has gained the attention of financial markets (Figure 1).

However, fund flows dipped globally in 2022 amid market turbulence as central banks raised interest rates to reduce inflation. Additionally, the US market faced anti-ESG sentiment as several states passed laws that prohibited state and local municipalities from dealing with financial services firms that specifically avoid oil and gas producers or other companies.

Banks have been early adopters of a wide variety of ESG policies, with most large banks in the US committing to at least some policies. Banks’ ESG policies are of utmost significance for capital allocation, as banks are the essential intermediary in disbursing credit to households, businesses and governments.

A brief background

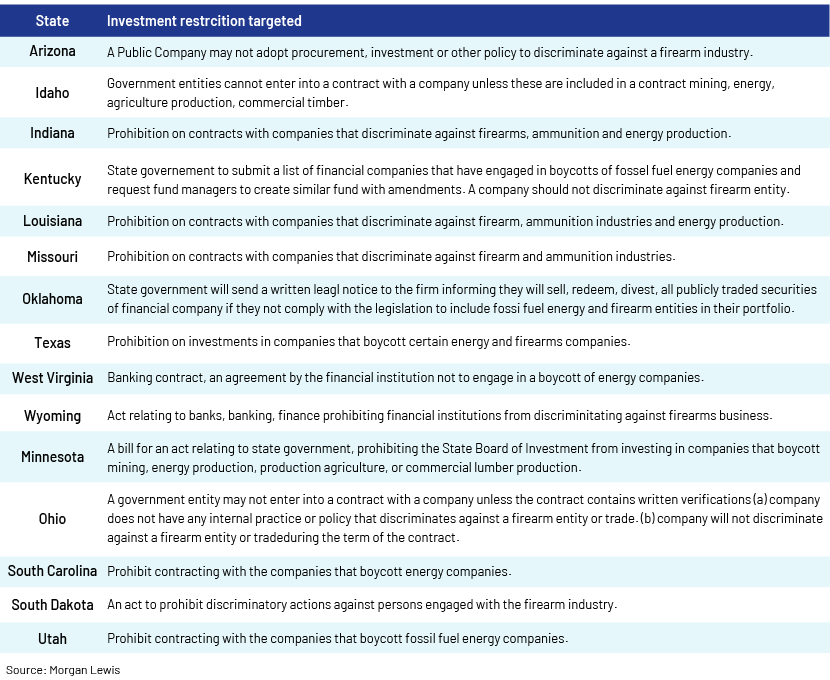

Many states in the US have recently proposed or passed legislation that limits financial institutions with certain ESG policies from participating in public finance markets or that simply bans firms with such policies from servicing public or municipal clients.

For instance, in 2022, West Virginia and Arkansas stopped using BlackRock Inc. for certain services because of its stance on climate change, according to West Virginia’s Republican Treasurer Riley Moore and Arkansas media reports. In Texas, JPMorgan Chase & Co, Bank of America and Goldman Sachs have been sidelined from the municipal bond market.

Texas is at the forefront of advocating anti-ESG sentiment in the US. We use this as a case study to understand the impact of anti-ESG sentiment on the municipal bond market.

Case study: Texas bond market

The state of Texas regulates the business practices of banks that engage in public finance within the state.

In terms of ESG, banks have been facing increasing demand from both the general public and stakeholders to promote investments that uphold ESG policies and agendas. In response, many banks have started to divest from energy companies. The dilemma, however, is that Texas is one of the largest producers of oil and gas in the US, and some Texas lawmakers saw this as a direct boycott of their state. The lawmakers retaliated by introducing legislation in late 2021 that would ban banks that limit credit to the oil and gas sector from participating in public finance markets in the state. Additionally, they prohibited state and local governments in Texas from contracting with financial services firm that limit business with the firearms sector. These actions led to the abrupt exit of most financial entities from the state’s public finance market.

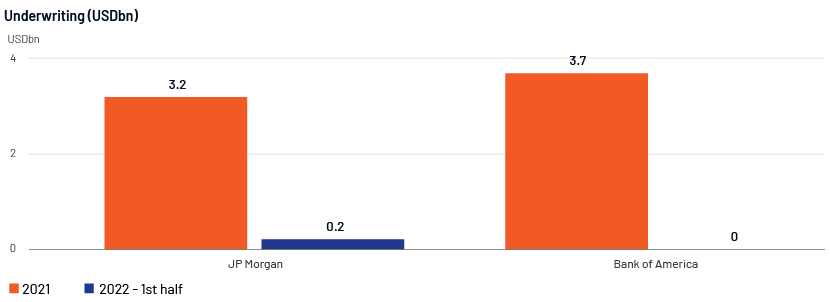

The municipal bond underwriters that were blacklisted as a result of these regulations were Citigroup, JP Morgan, Goldman Sachs, Bank of America, UBS and Fidelity. These banks underwrite many of the largest municipal bond issues within and outside of Texas. The following table shows the positions of some of these targeted banks, namely Bank of America, JP Morgan, Citigroup and Goldman Sachs.

The following graph shows the immediate impact of the regulation on the underwriting activities of the two targeted underwriters for municipal bonds in Texas – JP Morgan and Bank of America. For JP Morgan, underwriting activity fell to USD0.21bn in the first half of 2022 from USD3.2bn in 2021 while for Bank of America, it fell to nil from USD3.7bn.

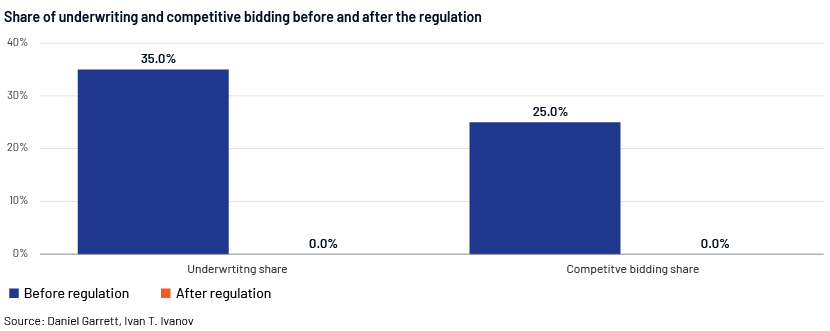

The regulation also affected the underwriting and competitive bidding by the targeted underwriters, namely Bank of America, JP Morgan, Citigroup and Goldman Sachs. Before the regulation, underwriting and competitive bidding accounted for 35% and 25% of the activity of the prominent underwriters, respectively, but subsequently, they accounted for 0%.

Moreover, the regulation prohibits state and local agencies from investing in or doing business with financial firms that refuse to invest in fossil fuel producers. This led to a number of state funds divesting holdings in certain asset managers, including in prominent names such as BlackRock, HSBC and Invesco.

This restriction would make it more difficult for financial firms to engage in a range of state business – from bond underwriting to managing state funds and depository accounts.

Reliance of municipal bond issuers on underwriters

Financial underwriters act as the principal monitors in the municipal bond market, as they specialise in valuing bonds and earn commissions by way of refinancing bonds.

The relationship between issuer and underwriter can change for reasons such as pairing with a new underwriter that commits to the issuer’s sale or re-optimising with a new issuer/underwriter. The average issuer would use the same lead underwriter for 87% of its bonds. Such “stickiness” existed prior to the regulatory change.

Adapting to the impact of anti-ESG laws

Municipal bond issuers may need to adapt to the impact of the anti-ESG laws by switching the bond-underwriting method they select to bring bonds to market.

There are two bond-underwriting methods of bringing bonds to market:

-

Competitive bid underwriting – where different underwriters bid on the bond offering, with the lowest yield-to-maturity bid winning the auction.

-

Negotiated underwriting – where bond underwriting is negotiated directly with an underwriter.

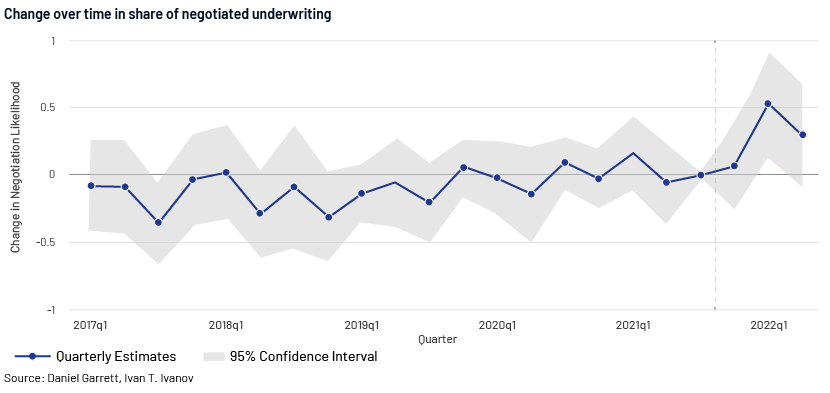

Issuers dependent on targeted underwriters are more likely to opt for the negotiated underwriting method and not for competitive bid underwriting. The following figure shows the shift in the method of bond underwriting in Texas over time as anti-ESG laws came into play.

The time series shows a sudden and large positive change in the likelihood of initiating negotiated underwriting – this moves towards positive territory (>0) soon after the legislation is passed (dashed line).

Negotiated sales enable underwriters to better place an issuance with investors when market or issuance uncertainty is high, but it is also associated with higher issuance costs than for competitive underwriting. As a result, issuers face higher borrowing costs.

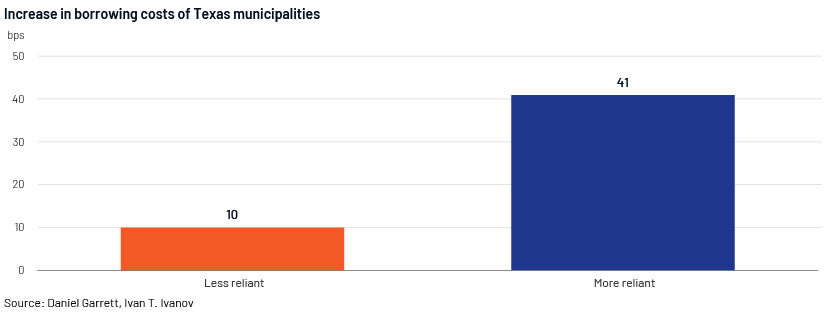

The higher borrowing costs differ based on whether the issuer was less or more reliant on the targeted underwriters that exited the space, as illustrated by the following graph.

The borrowing costs of issuers more reliant on the underwriters increased more (by 41bps) than the costs of those that were less reliant (10bps).

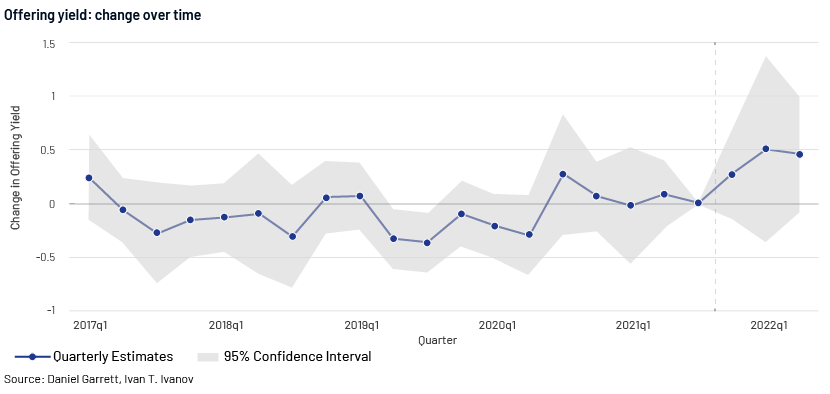

On the other hand, if the issuer wants to bring bonds to market using the competitive bid underwriting method, it needs to offer a higher yield. This is because the competition between banks declines as the number of underwriting bidders reduces sharply; the discrepancy among the remaining bids increases, resulting in the winning bid being higher in terms of yield to maturity. The following figure shows the change in the offering yield over time as anti-ESG laws came into play.

The time series shows a large increase in the likelihood of an elevated offering yield – it moves towards positive territory (>0) soon after the legislation is passed (dashed line).

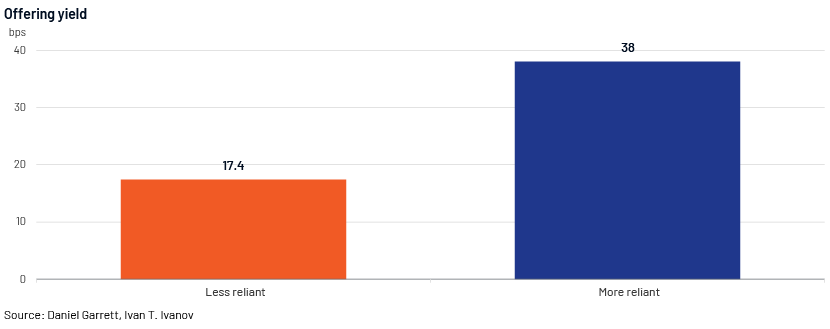

The offering yield differs based on whether the issuer was less or more reliant on the targeted underwriters that exited, as illustrated by the following graph.

The offering yield of issuers that were more reliant on these underwriters increased by around 17bps, while the yield of those that were less reliant increased by 38bps.

Conclusions drawn from the Texas case study:

-

The exit of the targeted underwriters from the Texas market due to anti-ESG laws had an adverse impact on underwriter competition, with the remaining banks enjoying an increased market share. Smaller firms such as Ramirez & Co. Inc. and Loop Capital Markets have jumped more than 10 places so far this year in the Texas muni bond market bookrunner rankings, based on deal values.

-

Issuers in Texas leaned more towards negotiated underwriting to bring bonds to market; this resulted in higher borrowing costs.

-

Banks valued their ESG policies and chose to leave the Texas public finance market instead of abandoning these policies.

How Acuity Knowledge Partners can help

We help investment banking teams scale up their public finance underwriting practices and drive value for their clients. Leveraging dedicated teams of experienced analysts in our offshore delivery centres, they benefit from operational efficiency and cost optimisation. Our team of public finance experts are well versed in covering the municipal financing and public sectors and are vested with state-of-the-art modelling capabilities. Clients working with our specialised public finance investment banking teams have benefited from our integrated suite of services along the investment banking advisory value chain. Public finance advisory outsourcing

References:

-

https://www.reuters.com/article/wallstreet-esg-insight-idTRNIKBN2OH0O1

-

https://www.reuters.com/markets/us/how-2021-became-year-esg-investing-2021-12-23/

-

https://www.investopedia.com/texas-deepens-fight-against-esg-investors-with-citigroup-drop-7108704

-

https://www.investopedia.com/esg-fund-inflows-plunge-2022-7106493

-

https://www.brookings.edu/articles/gas-guns-and-governments/

-

https://www.brookings.edu/wp-content/uploads/2023/03/WP85-Ivanov-Garrett_formatted.pdf

-

https://miranda-partners.com/addressing-the-anti-esg-sentiment-in-the-us/

What's your view?

About the Author

Siddhartha is an Investing Banking Senior Associate at Acuity Knowledge Partners, having around 2.5 years of experience working with one of the leading credit-rating agencies in India and around 7 years of capital market experience. He is skilled in investment research, financial modelling, report writing, investment recommendations. His areas of interest are equity, fixed income, derivatives, portfolio-management along with keeping a track of the global-macro scenario. He has also made notable submissions in CFA Asia Pacific Research Exchange. He is currently a CFA Charter holder and has completed his Masters from the University of Calcutta, he is also certified by NSE as a Capital Market Professional.

Like the way we think?

Next time we post something new, we'll send it to your inbox