Published on April 13, 2023 by Chenran Tian

Executive summary

China’s once rapidly developing real estate sector was an important engine driving the nation’s unprecedented economic growth. However, the sector has been declining since 2021. After several efforts by the government to stabilise the market, we have seen a few positive signs so far this year. The future of the real estate market depends on several factors, and an in-depth understanding of the drivers of China’s housing market is required to navigate these challenging times.

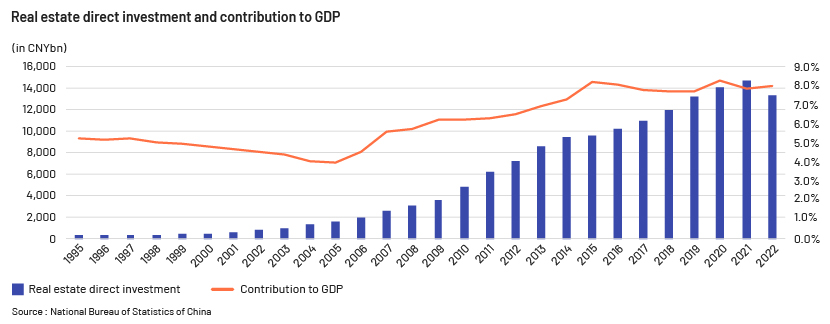

China’s real estate sector has evolved into an important pillar of the economy

China’s real estate sector is younger than global peers, but it quickly became a pillar of China’s economy, accounting for c.7% of China’s GDP for the past 20 years and leading to the prosperity of other sectors that relied on the property market flourishing. China’s real estate market can be traced back to the late 1970s, when the government started to theoretically explore commercialising the housing market; the sector has so far experienced five distinct development phases:

-

The kick-off phase (1978-91): 1978 marked the official start of China’s real estate sector, when the government allowed the commercialisation of the housing market and recognised land property rights, and more than 10,000 real estate companies were established across the country. The government had invested a total of CNY102.7bn by 1990, positioning the real estate market for significant growth.

-

The fast-developing phase (1992-97): To encourage the development of the real estate market, the Chinese government held the second working conference of national housing system reform and implemented housing reform in 24 provinces in 1991. Consequently, the sector started growing exponentially. The total invested in real estate development increased to CNY317.8bn in 1997 from around CNY73.1bn in 1992 (CAGR: 34%). Such expansion inevitably led to a housing bubble.

-

The adjusting phase (1998-2015): Impacted by the macroeconomic changes, the government had to balance controlling the overheated housing market with trying to boost it, with the markets facing significant volatility. The government’s actions eventually reduced speculation in the housing market, stabilising housing prices.

-

The regulated phase (2016-20): The regulatory environment changed in 2016. The government issued “restrictions on purchases and loans” and “restrictions on sales and prices” and reiterated that “houses are for living, not for flipping”. 2017 saw the strictest policies, and housing prices in tier 1 and 2 cities started to drop.

-

The overall stabilising phase (2021 to present): In 2022, property sales dropped by more than 26%, and investment in the sector decreased by 9.8%, compared with 2021. This decline has spread to tier 3 and 4 cities. In late 2022, the government intended to set the floor for the real estate market through various measures.

Each round of the property sector’s ups and downs closely matched the performance of China’s domestic economy, with its vast spectrum of upstream and downstream sectors. Homebuilders acquire land from local governments that control the national land bank, accounting for a significant portion of a local government’s fiscal income. Under China’s current fiscal income-expenditure allocation mechanism, local government relies on such land sales to fulfil its duty related to infrastructure development and other capital outlay. Primary land development, together with other infrastructure investments undertaken by local government or local government financing vehicles (LGFVs), paved the way for secondary property development. The substantial investment in infrastructure and homebuilding created large demand and jobs in sectors such as construction, steel, building materials and home appliances. For example, employment in the construction sector exceeded 50m in 2021. The infrastructure and real estate sectors thus started to drive China’s economic growth. The real estate market also has strong links to the financial system. Property companies take large loans from banks. In 2022, over CNY15tn in loans was granted to the real estate sector, accounting for 27.1% of all loans outstanding, not counting the more than CNY30tn in mortgage loans to households. As a result, the finance sector had considerable exposure to real estate.

Government plays a critical role in directing the real estate sector

The adjusting phase (1998-2015) illustrates the critical role the government plays in adjusting the housing market.

- 1998 to 2001: By end-1997, the housing-market bubble had burst due to the Asian financial crisis. To restore the sector, the government issued the housing allocation policy in 1998, aiming to provide financial subsidies to households that could not afford basic housing, as opposed to giving them a house outright. As a result, the inventory of houses was quickly digested. This trend continued as demand remained strong.

- 2002 to 2007: With the development and globalisation of the Chinese economy, investor confidence was boosted. Consequently, the housing market showed signs of overheating. The government started taking measures to control the market, such as by raising the required down-payment rate for purchasing a second house and increasing the mortgage interest rate. As a result, housing prices and trading volumes were negatively impacted, but to a small extent.

- 2008 to 2009: The 2008 global financial crisis further tamped down the market, as well as the Chinese economy. To rescue the market, the government revised down the mortgage interest rate and the down-payment requirement. More importantly, it provided fiscal stimulus of CNY4tn. The gloomy real estate market rebounded, marking the second destocking.

- 2010 to 2013: The overall tighter regulations for the housing market were published in 2010. The government limited purchases in major cities such as Beijing and Shanghai, raised the required down-payment rate to 50% for purchasing a second property, raised the interest rate by 11bps and stopped mortgage approval for purchasing a third property. Housing prices dropped across the market.

- 2014 to 2015: Due to slow economic growth, the government decided to boost the real estate market again. By adjusting the down-payment requirement and interest rate, it gradually rejuvenated the housing market; housing prices in tier 1 and 2 cities surged, while prices in other cities stabilised.

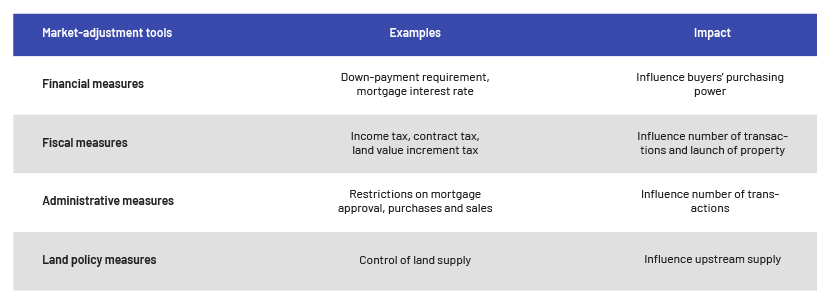

Each phase followed a policy change, indicating the Chinese government is a key stakeholder in this market. In the early stage, the government tended to control the demand side, and its impact was large and short-term. In the later stages, it started to explore long-term mechanisms and tried to stabilise the market. However, in 2021 and 2022, it curbed leverage of real estate companies while restraining demand. Consequently, the sector underwent a painful trough.

The ways in which the government has directed the market can be broadly categorised as follows:

Given the importance of the real estate sector, it is easy to understand the government’s determination to stabilise the market and bolster investor confidence. On 28 November 2022, the China Securities Regulatory Commission (CSRC) announced it would further optimise five measures in equity financing to support real estate companies, allowing for mergers and acquisitions, and restructuring. This action formed the last part of the “three arrows” plan to boost the housing market, aiming to support the real estate market through three financing channels: credit, bond and equity. The equity-related measures directly addressed the current problems of real estate companies, enabling the companies to reduce their reliance on the debt market. This is precious progress because these companies have already been trapped into a high leverage ratio that weakens the companies’ credibility and undermines investor confidence. Compared with previous measures of rescuing the market, for example, by directly providing monetary subsides to home buyers in 1998, it is clear that the government’s intention has shifted from “saving real estate companies” to “cultivating a healthy and stable market”. The government means to set the floor and bolster investor confidence in the sector. Such a fundamental approach may not have an immediate positive effect on the market, but will most likely benefit the sector in the long term.

Urbanisation is still the main engine driving the real estate market’s prosperity in the long term

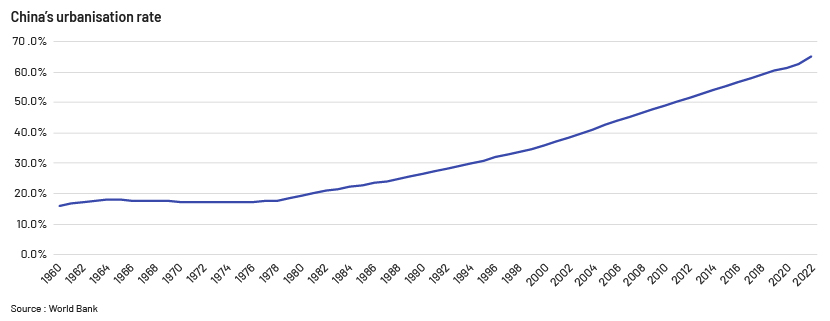

Urbanisation is another important driver of the real estate market. The real estate market boom coincided with China’s economic take-off. Enticed by the job opportunities, millions flooded into the cities from rural areas, driving up demand for housing. The impact was compounded by the cultural notion that owning a house means stability. Quantitative analysis suggests that urbanisation accounted for c.80% of China’s house price increase, according to a study by Garriga et al (2017) from the National Bureau of Economic Research.

Therefore, to gain perspective on future trends in China’s real estate market, it is necessary to understand the urbanisation process in the country. There are concerns that as China’s economic growth slows, the urbanisation process will end. It is true that urbanisation always accompanies economic growth, but the experience of many countries suggests that people are attracted by the better quality of life in the cities; urbanisation, therefore, will likely continue amid economic slowdown. In developed countries with populations larger than 30m, the rate of urbanisation exceeds 80%. Due to the small per capita land space in urban areas, many researchers believe China’s urbanisation rate may not reach the high 80% seen in developed countries, but the current urbanisation rate of 65.2% indicates large potential for increase. The strong urbanisation trend is, therefore, expected to continue supporting growth of China’s real estate market in the near term. Additionally, the current stage of urbanisation no longer focuses merely on bringing people to the cities, but emphasises the importance of the quality of urban life, and development is tilted towards green and low-carbon measures. Future development of the real estate sector would also have to incorporate the new features of urbanisation.

Prospects for the real estate market remain positive

China’s real estate market gave off positive signals at the start of 2023. For example, China’s high-yield dollar bond index, comprising major real estate developers, has recovered almost 50% from its low in November 2022. Existing house transactions rebounded y/y to different levels in several major cities in February, usually auguring a property market recovery. To gain insight on trends in the real estate market, it is critical to examine government actions and the market’s leading indicators (we provide a more detailed discussion of indicators in the next articles in this series).

The Chinese government has published several polices trying to stimulate the housing market since December 2022. For example, in January 2023, the Beijing local government drafted a 21-point plan to help developers facing debt issues. The plan dedicates CNY450bn in financing and debt extension to developers, indicating the government’s strong willingness to rescue the market. On the economic side, although China’s pace of economic development has slowed, the growth rate is still positive, and the relaxation of COVID-19-related restrictions in late 2022 will likely unleash significant potential for economic growth in 2023. The recovered high-yield dollar bond index shows an increase in investor confidence in the financial market.

China’s real estate market is only 45 years old, but it has completed a full cycle: from a slow start to rapid growth, then contraction, and the recent initial recovery. As an important player in the sector, the Chinese government has gained valuable experience in terms of how to regulate and adjust the market. Overall, the policymakers aim to strike a balance between ensuring housing affordability and spurring growth, and the goal is to establish a healthy and stable real estate market, which would contribute to steady long-term economic growth. Rapid growth may not recur, as overheated development is not sustainable and may not have a positive effect on the economy. However, it is welcome news to the government, citizens and investors that China’s real estate market has entered a stable growth period.

How Acuity Knowledge Partners can help

We have been engaged in investment research in China and closely monitoring changes in the economy, including the real estate market, for more than a decade. We are experienced in assisting global investors with their research requests, both equity and credit. Our expertise has helped investors gain a more comprehensive and clearer picture of the China story.

Sources:

-

https://www.ft.com/content/b331944c-642c-41d7-885b-7e3b047c9f9c

-

https://www.hlb.global/the-real-estate-industry-in-china-an-overview/

-

https://www.china-briefing.com/news/explainer-whats-going-on-in-chinas-property-market/

-

https://www.atlantis-press.com/proceedings/icssed-22/125973832

-

https://china-cee.eu/2022/11/02/chinas-urbanization-level-will-exceed-the-75-ceiling/

-

https://data.worldbank.org/indicator/SP.URB.TOTL.IN.ZS?locations=CN

-

https://www.ft.com/content/b9f17616-3654-4a04-a778-e7fa66d8a898

-

https://www.lwxsd.com/pcen/info_view.php?tab=mynews&VID=31290

-

http://news.iqilu.com/shandong/shandonggedi/20230228/5362778.shtml

-

https://www.cqcb.com/gongsifengxiangbiao/2023-02-27/5185197_pc.html

Tags:

What's your view?

About the Author

Chenran Tian works as an equity research analyst in Acuity Beijing. She is currently supporting a global asset management firm. She has a master’s degree of Financial Risk Management in University of Toronto. She previously worked as a banking advisor and client advisor in Royal Bank of Canada.

Like the way we think?

Next time we post something new, we'll send it to your inbox