Published on April 26, 2023 by Chenran Tian

Executive summary

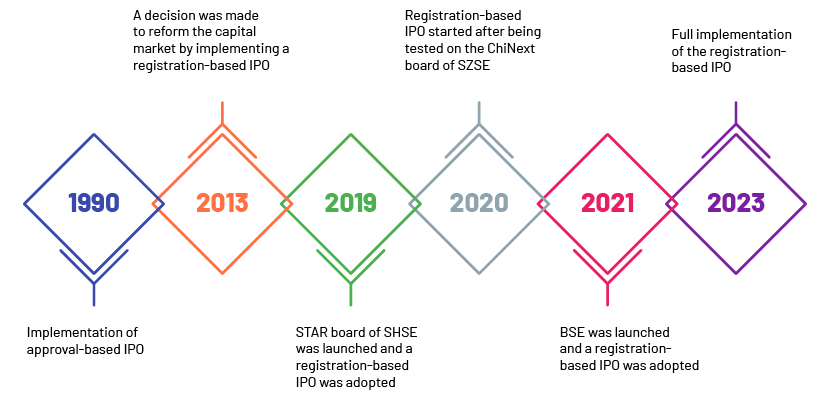

The health of a capital market depends heavily on an IPO process that is efficient and has proper risk-control measures. China has long focused on protecting investors, with an approval-based IPO process in place. After being tested at the STAR board of the Shanghai Stock Exchange (SHSE), the ChiNext market of the Shenzhen Stock Exchange (SZSE) and the Beijing Stock Exchange (BSE), the registration-based IPO process was launched in all Chinese stock exchanges in February 2023, marking a leap in reforming China’s capital market.

Registration-based IPO differs from approval-based IPO in a number of ways

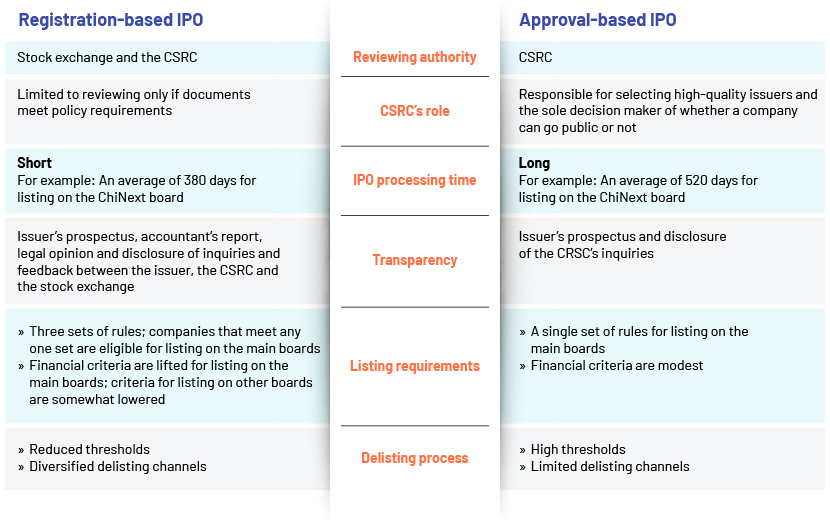

In general, registration-based IPO is a market-oriented approach that focuses on disclosure, while approval-based IPO is an administration-oriented approach that focuses on a company’s performance.

The registration-based IPO process works as follows: the equity issuer and sponsor submit the required documents such as prospectus and audited report to the review centre of the targeted stock exchange. The independent advisory committee advises reviewers after understanding the nature of the business. The reviewers may ask for more documents or even on-site inspection. They would then report to the listing committee for deliberation and hearing. If the stock exchange deems the issuer qualified, it would submit the application to the China Securities Regulatory Commission (CSRC) for registration. The CSRC would review the documents, and if the documents meet the disclosure requirements, the application would be approved.

The financial requirements for listing are revised regularly. They are now more flexible and comprehensive, having changed from one set of rules to three sets of rules, making companies that satisfy any one of the three sets of rules eligible for listing on the main boards. The financial requirements have also been adjusted to differentiate the focus of the number of boards involved and accommodate companies at different phases of development. For main boards, which are the listing venue for large-cap and industry-leading companies, listing thresholds are increased. For example, previously, net profit required for listing on the main board was a cumulative CNY30m for the last three years; under the new scheme, this has increased to CNY150m. For other boards, structured to provide financing channels for fast-developing companies at earlier stages of development, some requirements are relaxed. For example, they have to report positive net profit in the most recent operating year. The registration-based IPO process also optimises delisting procedures by reducing delisting thresholds and allowing for more exit channels such as forced delisting, mergers and acquisitions, and bankruptcy reorganisation.

The approval-based IPO process was different. Companies pursuing an IPO would submit documents directly to the CSRC. The CSRC would not only determine the sufficiency and accuracy of the documents, but also assess companies’ profitability. Only high-quality companies with a good operational history would be allowed to raise funds through the capital market. The delisting process was equally difficult. It had high delisting thresholds and complex delisting procedures, resulting in a small number of delisted issuers each year.

Additionally, registration-based IPO comes with stricter penalties for financial fraud. Previously, the maximum fine for fraudulent issuers was 5% of total capital raised. This ratio has been increased to 100%. The maximum fine for breach of information disclosure requirement has increased to RMB10m from RMB600,000. China’s Securities Law also specifies the joint liability of the issuer’s controlling shareholder and actual controller in the event of illegal activity.

Registration-based IPO rectifies several issues with approval-based IPO

The approval-based IPO process centralises the CSRC’s authority by granting the CSRC the right to make the ultimate decision on whether a company can go public or not. The purpose of approval-based IPO is to prevent low-quality equity issuers from entering the capital market and reduce risk to investors. However, the approval-based IPO process faces much criticism.

-

First that it is not efficient – the process takes one to three years – as it takes too long for companies in urgent need of financing.

-

Second, an important criterion is the issuer’s profitability. This mechanism may not be suitable for every company. For example, some fast-developing internet companies may not have positive operational income at the beginning. They have significant potential for growth but would be unable to access the capital market at the start-up phase, when they need financing the most.

-

Third, the CSRC makes all the decisions, but is it able to make the best decisions? As a government regulatory body, it is inclined to approve IPOs of companies politically aligned with the government, such as crown corporations. However, their businesses may not be performing well, resulting in unsatisfying post-IPO performance.

With registration-based IPO, the CSRC’s responsibility is limited to approving the listing. In other words, applications for IPO would be approved automatically if the documents meet disclosure requirements. Therefore, the processing time is shortened and efficiency increases. Furthermore, the different profitability requirements enable more companies to access the capital market and raise capital to meet growth potential. Lastly, registration-based IPO gives investors the right to choice and is, therefore, considered to be a better way to allocate capital resources.

Recognising the higher risks inherent in registration-based IPO, Chinese policymakers have established an enhanced investor protection regime under China’s Securities Law 2020. Investors are categorised as ordinary investors and institutional investors, based on factors such as investment amount and professional expertise. Ordinary investors enjoy a higher level of protection. For example, when in conflict with equity issuers, the issuers bear the burden of proof and need to demonstrate that their actions are in line with regulations and the law. Furthermore, to protect minority shareholders, any shareholder who holds 1% or more voting shares of a company may publicly request other shareholders to trust them to attend the general meeting of shareholders and exercise by proxy those shareholders’ rights, such as making proposals and voting on their behalf.

Implementation of registration-based IPO creates a new landscape

Although it is widely accepted that the registration-based IPO process will lead to a more evolved capital market, its specific impact on stakeholders requires close examination.

Investors

Being protected by the government under the approval-based IPO process, Chinese investors tend to rush into new listings without conducting a thorough analysis; this is an issue. The sudden withdrawal of protection may lead to some investors being unable to face the resulting uncertainties. Approval-based IPO had an unofficial valuation cap, a price-to-earnings ratio of 23x. With registration-based IPO, equity issuers are free to set their own IPO prices and may raise more capital than they need. However, unreasonably high prices are not sustainable, and prices would eventually return to normal levels, resulting in a loss for some investors. As the market becomes more complex, we recommend that investors conduct more research and due diligence before making investment decisions.

Equity issuers

Registration-based IPO making it easier for equity issuers to access the capital market is certainly a positive change. The IPO process becomes more standardised, transparent and predictable. However, this convenience comes at a cost. As more companies enter the capital market, they may face more fierce competition for investors’ funds. Therefore, “easy capital market access” would not necessarily mean an “easy financing opportunity”. Additionally, with the tightened regulations, companies would face higher compliance risks, and they would need to be prepared to face the continued monitoring after being listed. It is important that they have stronger internal control and accounting procedures; moreover, penalties for violation have now increased. In addition, although the delisting process has been made easier, equity issuers would face increased pressure from the need to continue meeting the conditions for staying in the market.

Securities firms

With China’s IPO process becoming more efficient, more domestic companies will likely choose to list onshore, creating more business for investment banks. Under the registration system, investment banks have more decision-making power in terms of evaluating issuers’ quality. However, they are also exposed to higher market risks as they need to seek high-quality companies.

How Acuity Knowledge Partners can help

The full implementation of registration-based IPO further aligns China’s capital market with developed countries’ financial markets, resulting in attracting more global investors. The new IPO scheme also requires a higher level of research and due diligence on the part of investors. We are experienced in working with international investors, and our large pool of bilingual staff are competent in conducting the required research.

Sources:

-

https://www.china-briefing.com/news/chinas-ipo-reforms-registration-based-mechanism/

-

China starts to implement registration-based IPO system - Global Times

-

https://www.fitchratings.com/research/non-bank-financial-institutions/top-chinese-securities-

-

(PDF) PRC Securities Law 2020: Promoting More Efficient and Transparent Capital Markets in

-

Sustainability | Free Full-Text | The Short-Term Impacts of the Registration-Based IPO Reform in

-

https://www.kwm.com/cn/en/insights/latest-thinking/full-implementation-of-registration

-

http://english.scio.gov.cn/m/chinavoices/2023-02/08/content_85094668.htm

Tags:

What's your view?

About the Author

Chenran Tian works as an equity research analyst in Acuity Beijing. She is currently supporting a global asset management firm. She has a master’s degree of Financial Risk Management in University of Toronto. She previously worked as a banking advisor and client advisor in Royal Bank of Canada.

Like the way we think?

Next time we post something new, we'll send it to your inbox