Introduction

Executive summary

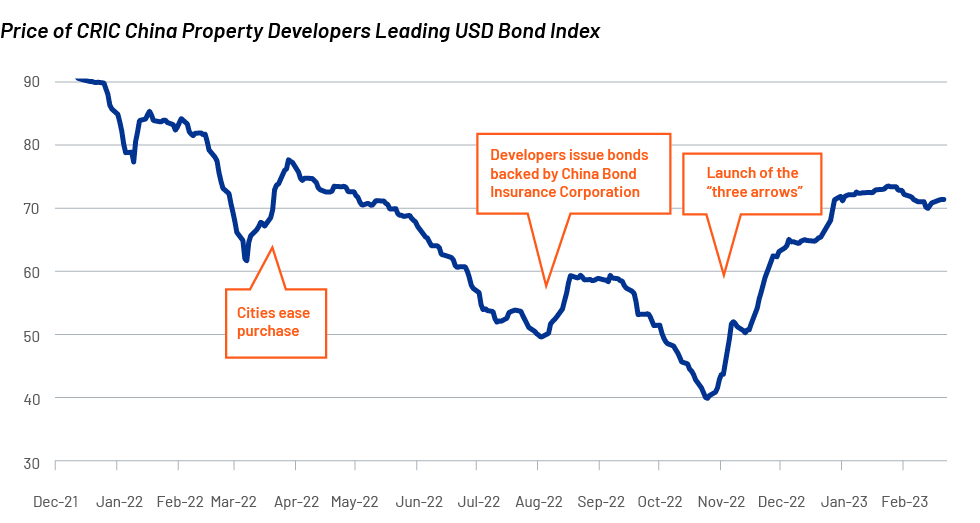

The Chinese authorities have rolled out a set of financing policies known as the “three arrows”, aiming to ease liquidity pressure on the country’s troubled property sector amid surging defaults in debt instruments. This paper discusses market performance after the launch of the supportive scheme and the property market’s possible path to recovery.

Introduction

The “three arrows” framework was launched in November 2022 to unblock financing channels for China’s domestic property development sector that experienced a sharp increase in defaults as a result of a decline in sales, highly regulated presales proceeds and stifled external financing under the government’s tightened policies. The scheme lent a hand to developers by facilitating their access to bank credit, and bond and equity markets.

Market performance after the “three arrows”

Following the policy moves, China property USD bond prices soared from a deeply depressed level, indicating a positive turn in sentiment towards the property sector. Onshore issuance volume was shored up by end-2022, narrowing the financing gap to its smallest in the year. However, the housing market has reacted slowly to the government’s moves, with individual home buyers still wary. Housing prices in major cities have just stopped declining, but not enough to regain home buyers’ interest.

Contracted sales slowed their y/y pace of decline but are not strong enough yet to buoy the land market. The easing financing conditions offer little incentive for developers to show up in the land market, as homebuilders still face debt repayment pressure.

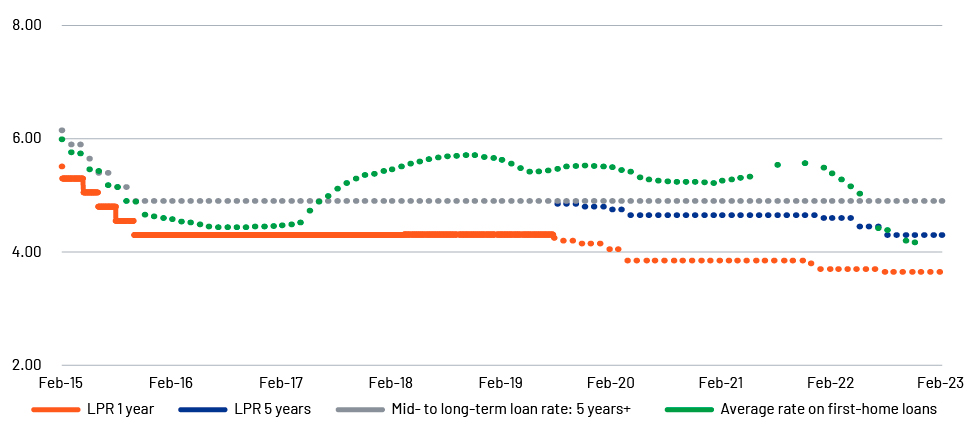

Demand-side policy in place to drive up home purchases

We believe stabilising home sales by bolstering market demand is a key measure for helping developers generate liquidity on their own and repair balance sheets. The authorities have loosened controlling measures in home buying and financing. More than 80 cities have reportedly reduced the down-payment ratio to 20% since the beginning of 2023. Such supportive measures are expected to appeal to homebuyers and boost sales for developers.

Acuity’s value proposition

Global organisations and research houses leverage our industry- and country-specific expertise to make sound strategic decisions. We set up dedicated teams of analysts and macro-level associates to support our clients in areas such as macroeconomic research, industry profiling, financial analysis, econometric modelling, thematic research, building databases and providing regular sector coverage. Each output is customised, based on the client’s requirement, and made available for their exclusive use. This ensures our clients a unique, sustainable edge.