Published on January 18, 2023 by Dr. Harshika Jain

One of the favourite strategies of private equity (PE) investors for exiting the market is an initial public offering (IPO). IPOs enable private investors to realise their invested money. Privately held companies often need to inject funds, which they could obtain by taking a company public. Sometimes, investors wish to exit such companies and park their funds in other companies with better opportunities. In such instances, IPOs help companies make an exit.

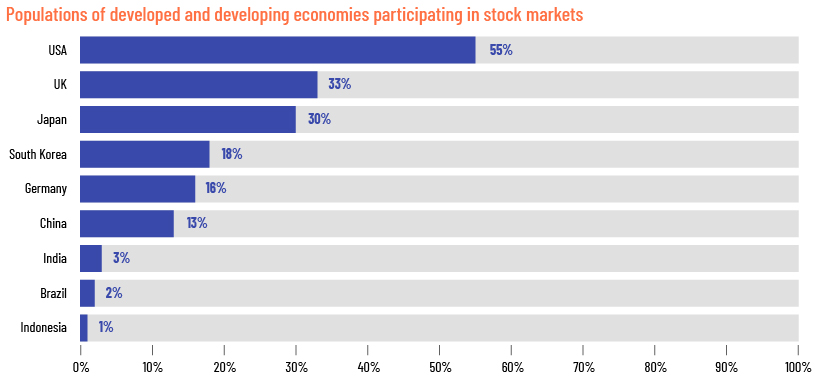

However, IPO subscription can be a challenge, especially for companies launching IPOs in developing markets. The global IPO market has slowed due to a reduction in deals and poor valuation and subscription. It is essential that investor participation be increased to enhance IPO subscription. Investor participation in the stock market is low, primarily in developing countries, leading to plummeting IPO subscription. Figure 1 highlights that investor participation is as high as 50% of the population in developed countries such as the US, whereas in India and other developing countries, very small portions of the population invest in stock markets.

Investor participation is growing very slowly, almost static

Despitexbroker companies coming up with zero broker fees, and the advancement in technology, de-mat accounts can be opened from the convenience of one’s home. The number of de-mat accounts open has increased in the past five years, driven by increased awareness of financial stability, progress in social security and better decision making. Higher equity returns have fuelled investor interest, prompting a shift away from savings account deposits to equity markets, but growth in the number of investors remains small.

Factors impacting participation

-

Financial knowledge: An understanding of simple components such as interest rates, compounding, and returns. Most do not have an in-depth understanding of company fundamentals and are, therefore, not able to assess a company’s true financial position; this leads to scepticism and often demotivates them from investing in the stock market.

-

Attitude: This is also related to the experience – pleasant or stressful – when an individual is investing. This could depend on the broker, or the investment platform used.

-

Hassle: Most find it difficult because of the app interface and a lack of guidance. Moreover, in developing economies, information asymmetry is high, leading to investors being unable to participate in the stock market.

-

Financial self-efficacy: This refers to believing in one’s ability to manage finances on one’s own and that the decisions made are correct.

-

Parental influence: A strong feature in Asian and Italian markets is strong family ties, with parental influence significantly impacting decisions such as investing in stock markets. Those whose parents have been investing in stock markets are likely to invest in securities themselves and get the assistance of their parents’ brokers or investment advisors.

-

Risk: Investors are often averse to risk, and stock market investments are often associated with high risks and losses. However, expert investment advisory could generate profits.

For PE firms to take their portfolio public, it is crucial that they understand their targeted secondary markets and understand the investment awareness and proficiencies of investing public. After assessing the suave nature of investors, retail and institutional both, a firm can garner more confidence to navigate the pitfalls of going public. This shall also help to devise plans and strategies to increase awareness for their IPO, inspire right promotional approaches, and disperse information as to minimise information gap between potential investors and the IPO issuing company. These considerations, along with other factors like macro conditions and regulatory compliances, are likely helpful in creating right conditions for a successful IPO with higher subscription.

How Acuity Knowledge Partners can help

Acuity’s PE practice offers a range of strategy support services to PE firms and assist them in their entire investment life cycle including exits. We have been assisting PE firms worldwide for past two decades, with a strong pool of experienced skilled professionals.

Sources:

-

Bhatia, S., Singh, N., & Jain, H. (2021). What Explains Millennials’ Intention to Invest in the Stock Market? An Extension to the Theory of Planned Behavior. The Journal of Wealth Management, 24(2), 25-47.

-

Akhtar, F., and N. Das. 2019. “Predictors of Investment Intention in Indian Stock Markets: Extending the Theory of Planned Behaviour.” International Journal of Bank Marketing 37 (1): 97–119.

-

https://finshots.in/infographic/what-percent-of-a-nations-population-invests-in-stocks/

-

https://www.livemint.com/Money/l7NotJMIZm3Re70Lc80FxL/The-real-cost-of-opening-a-demat-account.html

-

https://www.worldatlas.com/articles/countries-trading-the-most-stocks.html

What's your view?

About the Author

Harshika is a PhD in finance with 7 years of financial research and advisory experience. She has conducted comprehensive equity research across multiple sectors, with detailed financial analysis to support investment decisions. She analyses financial statements assessing performance, identifying risks, and uncovering trends.

She has also performed quality of earnings reviews to evaluate the reliability and sustainability of reported earnings, and sustainable finance principles have been applied to align investment strategies with long-term environmental and social objectives.

Like the way we think?

Next time we post something new, we'll send it to your inbox