Green and Blue Bonds – Re-defining financial institutions’ portfolios and services

Social Bonds : A significant financing opportunity amid the pandemic

Introduction

Bonds have taken many forms and have evolved over the years to align with stakeholders’ needs. Green and blue bonds have been trending recently with increased awareness of sustainability and ESG considerations, with many individual investors, companies and even governments stepping up their preference for such bonds.

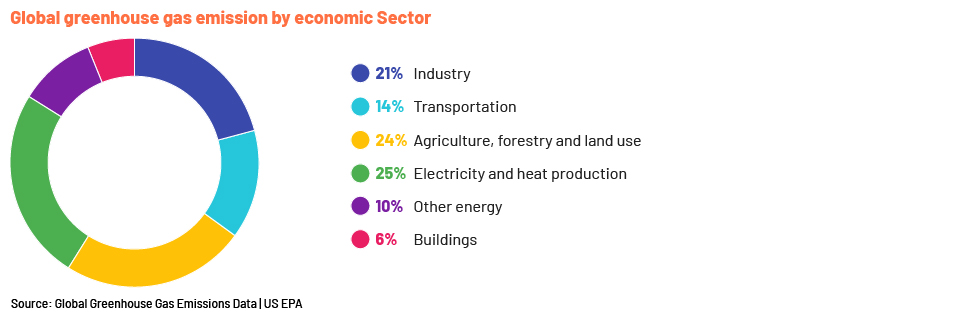

Stakeholders are increasingly concerned about the environmental impact of business operations. Carbon emissions are the main cause of climate change and global warming that affect the agri-business sector and the health of humans and animals. Governments, renewable-energy companies and environmental activists are keen to allocate investment, time and knowledge towards promoting a greener and sustainable economy.

The United Nations Framework Convention on Climate Change (UNFCCC): 196 nations were party to the 12 December 2015 Paris Agreement, which aims to reduce greenhouse gas emissions to levels consistent with holding the increase in global average temperature to well below 2° Celsius above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5° Celsius above pre-industrial levels. Meeting these targets would require an unprecedented allocation of capital, measured in trillions of dollars a year. [Source: Research: Rating Action: Moody's assigns Aa3 rating to green bonds to be issued by Bank of China (Hong Kong) Limited – Moody's (moodys.com)]

Major emitters

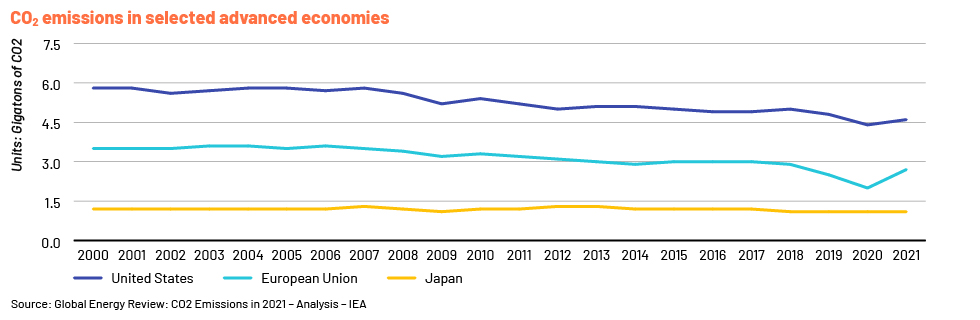

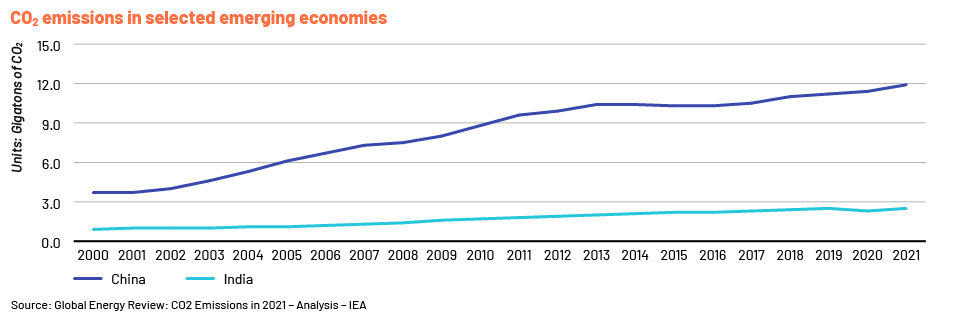

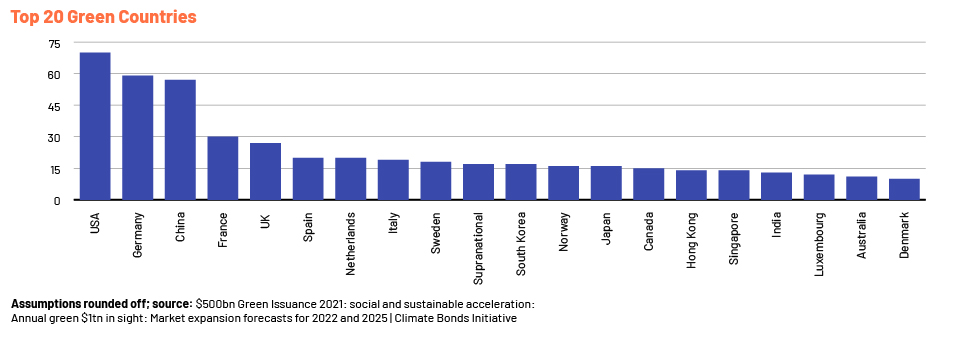

China and the US are the major CO2 emitters, accounting for more than 40% of the world’s CO2 emissions in 2021. China is known for its power and industrial plants, which generate about 58% of total energy from coal alone. Moreover, China is one of the largest importers of oil, contributing to higher carbon emissions via motor vehicles. The US is known to be the second-largest emitter due to its major reliance on the transportation sector and as a major producer of crude oil.

India, Japan and the European Union are next in line. As India moves towards urbanisation, use of oil, gas and electricity increase, contributing to carbon emissions. Japan is also highly reliant on burning natural gas for household and industry use, especially after the closure of nuclear reactors in Fukushima.

Sectors that emit greenhouse gases

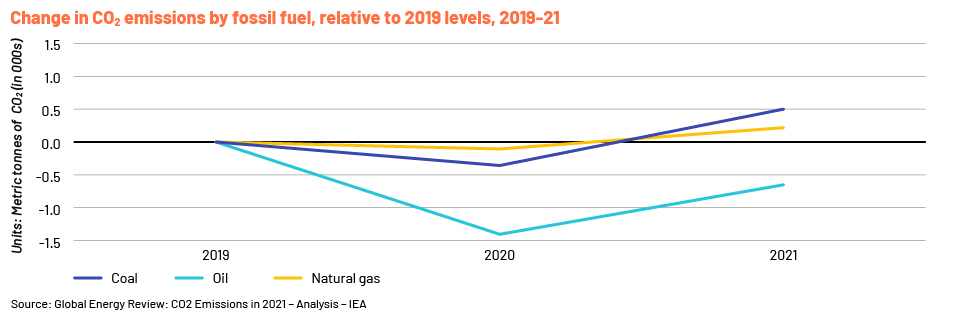

Carbon emissions from coal – Coal alone accounted for 40% of the increase in carbon emissions from the energy and transportation sectors in 2021. Coal-related emissions almost surpassed 200 metric tonnes (MT) of CO2, while carbon emissions from natural gas also increased significantly.

Carbon emissions from oil – Use of oil in the transport sector in 2021 was at least 6m barrels less than in 2019 due to the pandemic-related lockdowns and the transition to working from home, resulting in 600MT less emissions. A complete return to pre-pandemic levels could result in a 7.8% increase in carbon emissions, estimated to be the fastest rate of growth since the 1950s.

The bottleneck to promoting a greener economy is finance

Financial institutions have recognised the growing need for building a greener and sustainable economy and are preparing to cater to this need via sustainable finance. Green and blue financing is part of sustainable finance, which is increasing its share in banks’ portfolios.

Transitioning towards sustainable finance

Green and blue financing

What are green and blue bonds?

These bonds are fixed-income securities that could be taxable or tax-exempt and used to finance or re-finance environmental and sustainable projects. These bonds may include debt obligations with or without recourse to issuers and projects tied to collateral. Compared to traditional bonds, green/blue bonds trade at lower yields or higher prices.

The proceeds from green financing should be used only for environmentally friendly projects. From a banking perspective, issuance of green bonds plays a significant role in promoting a greener economy.

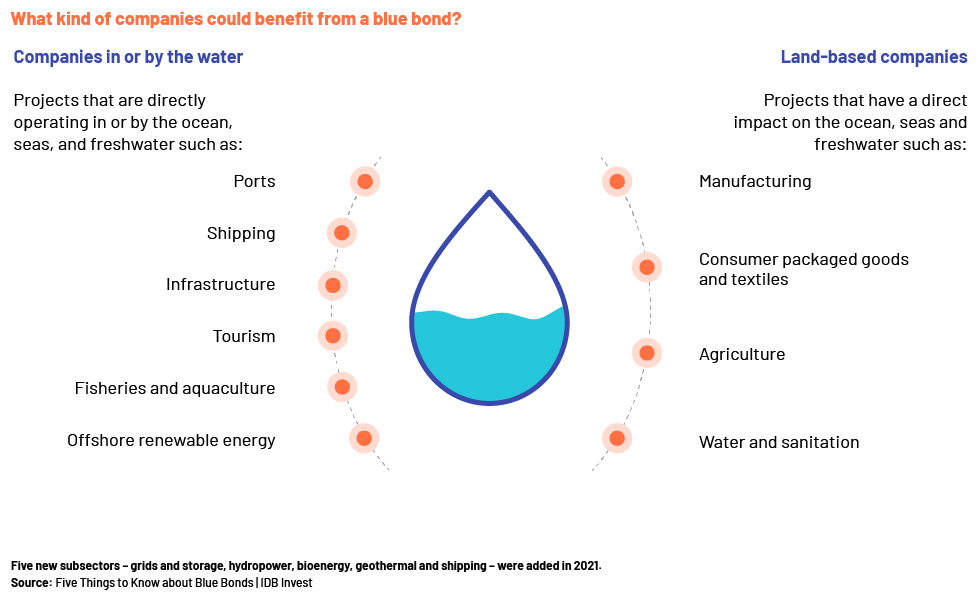

Blue financing is where bond proceeds are used for ocean- and water-related initiatives such as protecting coral reefs and ocean biodiversity. These pave the way to funding ocean- and water-related solutions, creating sustainable business opportunities. Blue bonds are a subset of green, social and sustainable bonds, and should adhere to globally recognised principles.

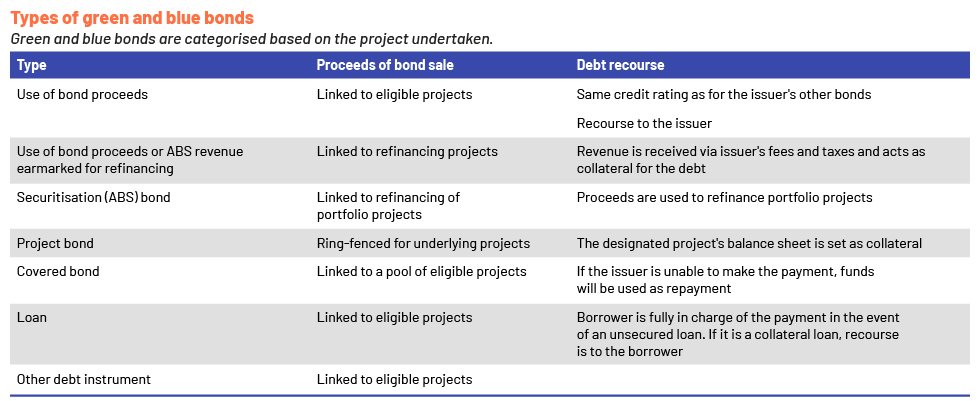

Types of green and blue bonds

Green and blue bonds are categorised based on the project undertaken.

Benefits and risks of green and blue bonds

Benefits

These bonds benefit environmental investors who lack adequate funding – they provide such investors with easy access to finance, assisting rapid execution of sustainability projects. Moreover, interest rates on these bonds are lower than interest rates on loans offered by commercial banks, prompting companies and investors to consider sustainable projects. Furthermore, increasing fuel shortages and fuel price hikes are increasing the importance of such bonds, which could fund better alternatives at a lower cost. This could help governments reduce fuel imports, narrowing deficits and resulting in stronger economies and a greener environment. The two main objectives of government could, thus, be achieved in one go.

By issuing green bonds/blue bonds, banks are likely to have more diversified portfolios, spreading risk and enhancing the development of financial markets.

This results in enhancing goodwill for investors, lenders and other stakeholders.

Risks

Since these bonds are linked to long-term environmental projects, there is a risk that sufficient liquidity will not be generated for repayment. Moreover, there are very few rating guidelines governing these bonds, making it difficult to assess them. Proceeds from such bonds may not be used for environmental projects as specified, and there may not be sufficient transparency.

Growth of green and blue bonds

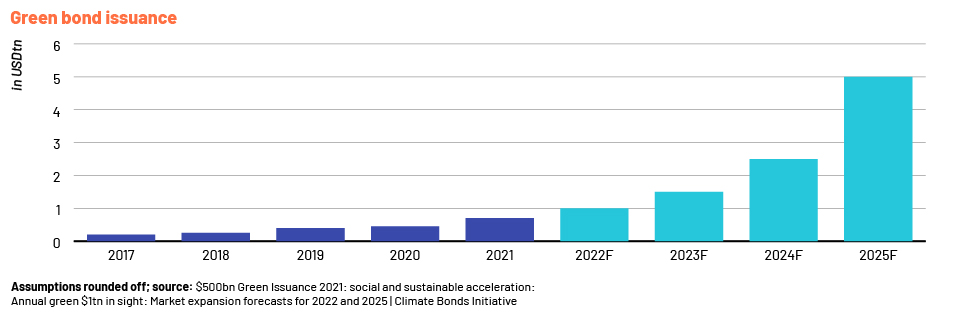

The green bond market has grown 50% in the past five years. Cumulative green debt reached USD104bn in 2019 and more than USD1.5tn in December 2020. In 2021 alone, the market grew more than 60% from 2020, exceeding forecasts.

Issuance of sustainability bonds plummeted to an estimated USD26.1bn in 4Q 2021 from USD95.3bn in 1Q 2021 due to the slow recovery from the pandemic, according to Sandinaviska Enskilda Banken AB’s (SEB’s) The Green Bond Report 2022. This trend is likely to continue in 2022 amid uncertainty surrounding monetary policy and rising inflation rates. However, green bond issuance is estimated to grow by 51% to more than USD900bn in 2022.

Growth in green bonds is driven by various factors:

New policies were announced ahead of the UN Climate Change Conference (COP26) on 14 December 2021. Of the 24 major industrialised countries and regions that submitted updated Nationally Determined Contributions (NDCs) to the Paris Agreement, 22 countries, including the EU, China, the US, Japan, Korea and Saudi Arabia, seem to have stronger targets for emission reduction. Moreover, 1,500 companies applied to join the Science-Based Targets initiative (SBTi) in 2021 and committed to setting emission reduction targets in line with the Paris Agreement.

The carbon price has increased by 50% due to the spike in the gas price and supply shortages; this could increase the carbon price to EUR100, making corporates switch to sustainable resources to save costs.

As more sectors adopt renewable energy, demand for green bonds would grow. This, coupled with easing monetary policy and the longer durations offered by these bonds, would help drive the green bond rally.

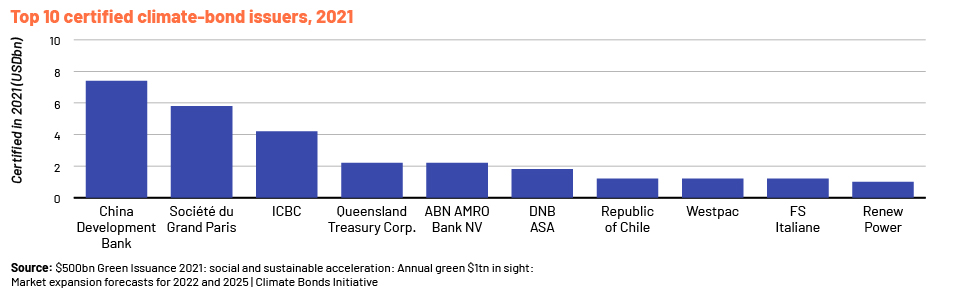

Top 10 certified climate-bond issuers, 2021

History of green and blue bonds

Amid the increase in natural disasters, a group of Swedish pension funds wanted to invest in sustainable projects in 2007 to protect the climate. They were unable to find or finance such projects, so they reached out to SEB. SEB acted as an intermediary between the investors and the World Bank to raise funds for the project.

However, there had to be certainty that these bonds would be used for sustainable projects, with a tracking process in place. The Centre for International Climate and Environmental Research (ICERO), an interdisciplinary research centre for climate research in Oslo, came forward to provide a view on these projects.

Following many discussions, the Swedish pension funds, SEB, the ICERO and the World Bank defined criteria for the issuance of green bonds, with the ICERO being the second opinion provider. The first green bond was launched in November 2008. The World Bank has since issued 200 bonds in 25 currencies, raising more than USD17bn for institutional and retail investors across the world.

The Republic of Seychelles was the first to issue a sovereign blue bond (USD15m) with the assistance of the World Bank along with three international investors – Calvert Impact Capital, Nuveen and US-headquartered Prudential Financial, Inc. – on 28 October 2018.

On 13 April 2022, Asian Development Bank launched the world’s first blue bond incubator to support ocean-related projects in Asia and the Pacific. This is likely to provide technical assistance of at least USD5bn by 2024. Blue bonds are where green bonds were 10 years ago, but are continuing to grow.

Major sectors involved in issuing green and blue bonds

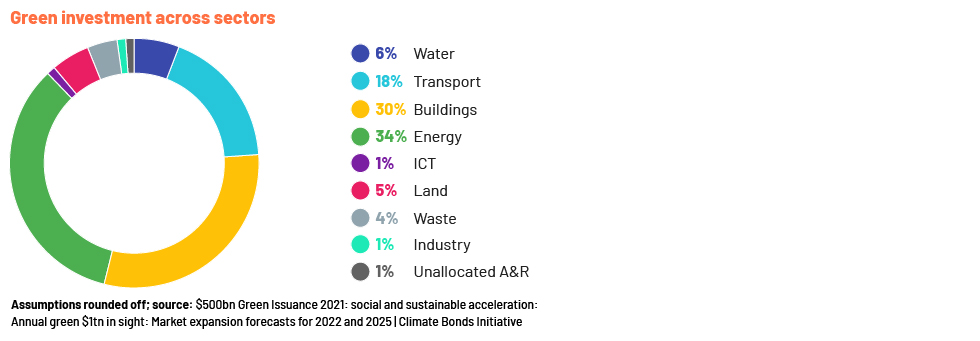

Green bonds are popular among the energy, transport and building sectors, and are gaining in popularity in sectors such as ICT and real estate. Blue bonds are gaining in popularity among the water, land and waste sectors. Projects that have a direct impact on the ocean, seas and freshwater can benefit from blue bonds.

Role of regulators and financial institutions

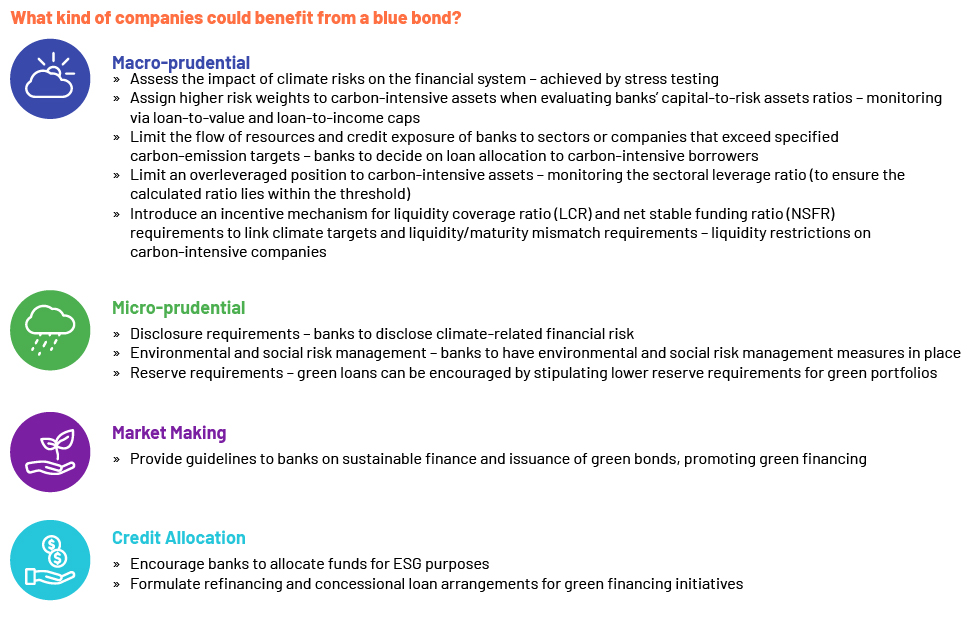

Regulators

Regulators play a major role in financial markets and economic growth. They ensure financial services markets function effectively and efficiently by setting guidelines, promoting financial products, allowing an efficient level of capital and ensuring the highest level of disclosures and scrutiny. This boosts stakeholder confidence, resulting in more capital injections and better returns.

Regulators are taking the lead in green banking, providing assurance for both lenders and borrowers to go ahead with investments.

They have set the following green banking policy in place:

Financial institutions Financial institutions have different types of green and blue bonds to suit the different projects undertaken. They also have an underwriting framework and a rating mechanism designed specifically for these bonds.

Green and blue bond frameworks These frameworks guide businesses on how to launch and maintain sustainability projects, and how to track bond proceeds.

Green bond framework It is recommended that issuers explain how the green bond programme is aligned with the bond framework. This would help lenders and other stakeholders make qualitative decisions.

Use of proceeds and project evaluation process

To qualify as a green bond and receive the proceeds thereof, the legal document should specify how the proceeds will be used on green projects. These green projects should provide clear environmental benefits, which the issuer will assess and, where feasible, quantify.

In the event the bonds are used for refinancing purposes, the issuer would need to specify the percentage of funds that would be used, along with the applicable projects and lookback periods.

The following are examples of eligible projects:

Renewable energy

Energy efficiency

Pollution prevention and control

Environmentally sustainable management of living natural resources and land use

- Management of proceeds

Bond proceeds should be credited to a sub-account of the portfolio or tracked in an appropriate manner and attested to by the issuer in a formal internal process linked to the issuer’s lending and green/blue investment operations.

The tracked net proceeds from the outstanding bonds should be periodically adjusted to match allocations to the projects undertaken during the period. The issuer should also let investors know of other projects that would make use of the unallocated net proceeds.

A high level of transparency needs to be maintained on the use of net proceeds, with verification of the internal tracking method by an auditor or third party.

- Reporting

Issuers should maintain records of the use of proceeds and annually review development. The annual report should specify the amounts allocated to green/blue projects and include descriptions of the projects. A generic description could be provided in the event the project needs to remain confidential.

It is also recommended that qualitative and quantitate performance indicators be maintained and the underlying assumptions used to derive the quantitative indicators be mentioned.

Blue bond framework

Ocean health and productivity

Assessing and incorporating both the short- and long-term impact of ocean-related activities on ocean health in strategy and policies

Considering sustainable business activities that could help protect the health and productivity of ocean dependencies

Taking measures to reduce greenhouse gas emissions to prevent ocean warming and acidification

Planning the use of marine-related resources and ensuring long-term sustainability with precautionary measures in place

Governance and engagement

Continuing to engage with ocean-related regulatory or enforcement bodies

Following, supporting and adhering to the procedures developed, contributing to a healthy and productive ocean, and secure livelihoods

Respecting all stakeholders involved in the company’s ocean-related activities, ensuring due diligence is conducted before project initiation and continuing to communicate with stakeholders in a timely manner while the project is in the work-in-progress stage. This would ensure an immediate response to issues and the development of preventive measures.

Data and transparency

Sharing relevant scientific data to support ocean-related research

Being transparent on the ocean-related activates undertaken and their impact and dependencies, in line with the relevant reporting framework

Rating blue and green bonds

Moody’s

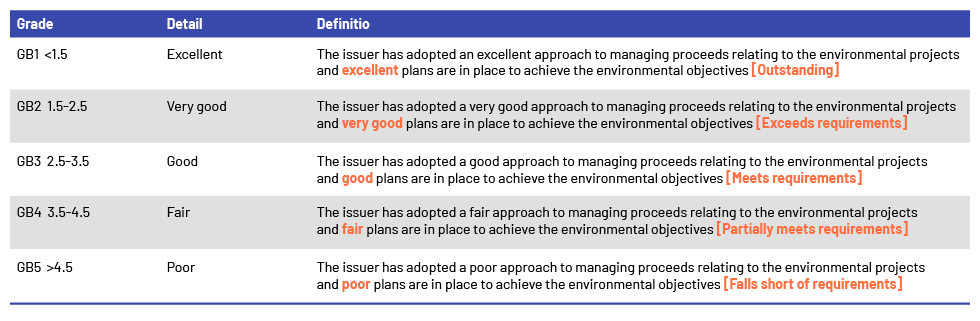

Similar to a credit rating, Moody’s provides a scorecard that indicates the strength of a bond. Weights will be assigned to the following factors, in keeping with the abovementioned bond framework.

- Organisation – 15%

Organisations must have skilled and dedicated personnel to evaluate, approve and monitor environmental projects, along with external expertise, if required. An organisation’s mission statement and goals are evaluated and a framework established for deploying bond proceeds and project approval.

The criteria will determine project eligibility, the monitoring process, performance indicators and impact reporting.

- Use of proceeds – 40%

Mentioned under the section “Green and blue bond frameworks”.

- Disclosure on the use of proceeds – 10%

Mentioned under the section “Green and blue bond frameworks”.

- Management of proceeds – 15%

Mentioned under the section “Green and blue bond frameworks”.

- Reporting disclosure – 20%

Mentioned under the section “Green and blue bond frameworks”.

These factors will be measured on a scale of 1-5, with 1 being the best. For a score of 1, all criteria should be satisfied. This numerical score is then multiplied by the assigned weights to produce a composite weighted-factor score, which will be mapped to the overall score presented below.

Fitch

Fitch has rolled out three linked ratings for sustainable bonds. These ratings are on a scale of 1-5.

- ESG Entity Ratings (ER1, etc.) – for companies and banks engaged in ESG activities

- ESG Framework Ratings (FR1, etc.) – for sustainability bonds such as green and social bonds linked to performance indicators

- ESG Instrument Ratings – for bonds, derived from Entity Ratings and Framework Ratings

As the world transitions rapidly to a sustainable economy due to increasing carbon emissions and price hikes, coupled with shortages of fuel supply, issuance of these sustainable bonds would evolve, changing the way financial markets and financial institutions work.

How can Acuity Knowledge Partners help?

We keep our clients apprised of evolving ESG and sustainable trends. Our Commercial Lending vertical helps lenders with loan monitoring, covenant monitoring and customised risk rating, and notifies them of early warning signals. Our detailed sector and company research adds value to credit reviews, helping lenders decide on loan extension or termination and changing loan covenants.

Sources

Transition towards green banking: role of financial regulators and financial institutions

Green-bonds--an-overview--may-2019.pdf (bakermckenzie.com)

Explaining green bonds | Climate Bonds Initiative

What are Green Bonds? Meaning, Types & Benefits (scripbox.com)

Green-Bond-Principles-June-2021-140621.pdf (icmagroup.org)

https://www.worldbank.org/en/news/immersive-story/2019/03/18/10-years-of-green

https://www.adb.org/news/adb-launches-first-blue-bond-incubator-boost-ocean-investment

https://www.worldbank.org/en/news/press-release/2018/10/29/seychelles-launches-worlds

Publications/Sustainable+Ocean+Principles.pdf (d306pr3pise04h.cloudfront.net)

Transition towards green banking: role of financial regulators and financial institutions