Published on August 13, 2021 by Anup Dhanuka

The Egyptian Stock Exchange tumbled further in early July after Ethiopia announced starting a second filling of the Grand Ethiopian Renaissance Dam’s (GERD’s) reservoir on the Nile River, according to Reuters. The EGX 30 has been one of the worst-performing indices YTD. The underperformance could partially, if not entirely, be attributed to the GERD issue. The firm stance of key countries Egypt, Sudan and Ethiopia has led to a stalemate, with the issue now being discussed at the UN Security Council, much to the dislike of Ethiopia, which does not want any foreign interference except that of the African Union. Egypt has made Ethiopia’s filling of the reservoir an existential crisis for itself, and its leaders have been quite vocal about it. We need to understand how severe the impact of filling the reservoir would be on Egypt and whether the stock markets really need to account for it. Before we do that, however, let’s take a brief look at the history.

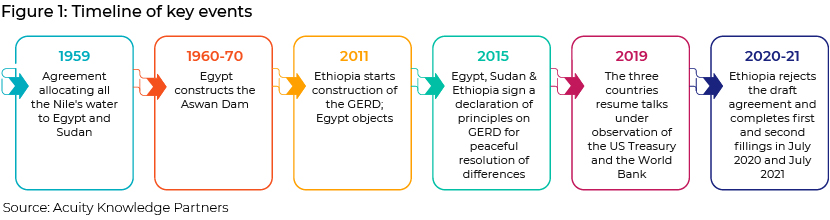

The latest Nile water-sharing agreement goes back to 1959; the agreement allocated all of the Nile River’s waters to Egypt and Sudan, and around 10 billion cubic meters (bcm) was left for seepage and evaporation. The agreement did not allocate any water to Ethiopia or other countries upstream. There were no large dams on the Nile to control the flow of water until 1959, when Egypt started constructing the Aswan Dam; this took 10 years to complete amid much controversy. Egypt benefitted significantly from the construction of the dam in terms of consistent water flow and electricity generation, while Ethiopia, where the Blue Nile originates, did not benefit much from the river, as it had no dam.

Ethiopia started constructing the GERD in 2011; it spent a total of USD4.8bn – quite a large sum from the country’s perspective, but managed with the support of its citizens. Egypt opposed the construction due to the size of the dam, fearing that filling this reservoir would affect its own at the Aswan Dam. A number of negotiations and studies to understand the impact of the GERD followed, but a new agreement has yet to be reached; both Egypt and Ethiopia maintain their stance, and Sudan changes its stance frequently. Ethiopia has completed two rounds of filling – in July 2020 and July 2021 – without an official agreement with Egypt and Sudan.

Egypt has strong support on the GERD and was able to internationalise the issue, with the UN Security Council taking up the matter for discussion in July 2021. However, this was not favourable for Egypt. The five permanent members of the Security Council stressed the need to resolve the issue peacefully through negotiations, with the African Union continuing as mediator. This would prove to be a setback for Egypt, and it would have to soften its stance.

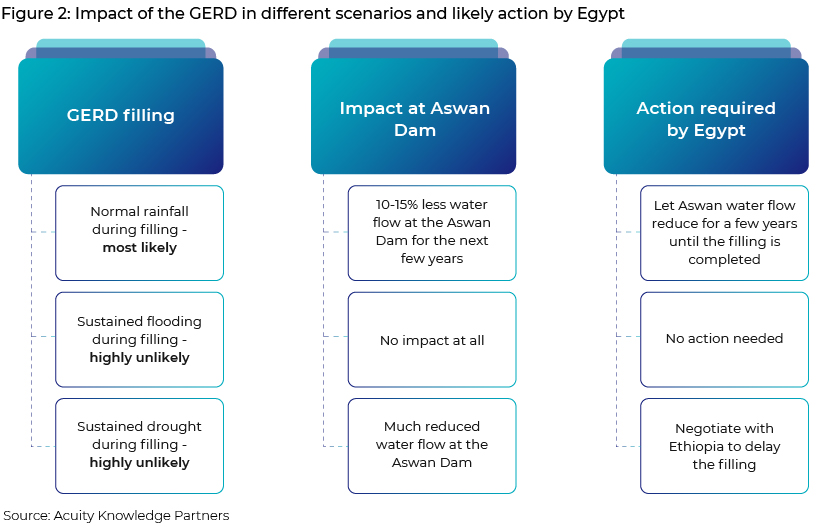

Would it result in an existential crisis for Egypt, as its leaders claim? Perhaps not. We expect the second filling to have a limited impact on Egypt's economy, as highlighted by Egypt's Minister of Water Resources and Irrigation Dr Mohamed Abdel-Aty in a televised statement on 19 May: “There are three different scenarios as far as the second filling is concerned. If the flooding is high, there would be an overflow of the strategic reserve in Lake Nasser, and Egypt’s water share would not be affected. If the flooding is at a medium level, the remaining water from the reserved quantities behind the dam would be shared with Sudan, and the impact may be of low risk to Egypt. The third scenario, which is the most difficult, unfolds when the second filling coincides with a natural drought, as this would result in a more severe drought.”

The Aswan Dam – the saviour

Built from 1960 to 1970, the dam has proved to be Egypt’s lifeline. It creates Lake Nassar, a reservoir with a capacity of 169bcm. It controls the flow of the Nile’s water in Egypt and annual flooding. It releases around 55bcm of water annually for Egypt’s needs and around 18bcm annually for Sudan’s, and has a 10-15bcm provision for evaporation. Hence, the reservoir holds enough water to serve Egypt’s needs for three years, assuming no flow at all from upstream (an extreme scenario). Ethiopia’s plan to fill its own reservoir (capacity: 74bcm) over the next five to six years implies the annual filling will reduce water flow by 12-15bcm, a 15% reduction of average annual flow of around 85bcm at Aswan. Although a concern, this is not an extreme situation that cannot be dealt with unless the Nile Basin experiences prolonged periods of drought, reducing average flow at the Aswan Dam. Most of the contribution from rainfall is from Ethiopia, as Egypt receives minimum rainfall. Average rainfall in the Nile Basin is estimated at around 650mm/year; there has been no notable drop in the past 10 years, meaning that a prolonged period of drought would be a rare scenario and filling the reservoir should not have a significant impact on Egypt’s water needs, as the country can deplete the reservoir during the filling before the flow normalises.

Egypt has also been working on a number of long-term alternatives, many of which are costly, to deal with the third scenario (prolonged periods of drought). The key policy relating to this is the National Water Resources Plan 2017-37, a four-pillar approach requiring an investment of EGP900bn on several projects over 20 years. The projects involve increasing the capacity for wastewater treatment, desalination and improving farm technology.

Egypt has awarded the contract to build the world’s largest wastewater treatment plant to Orascom Construction and Hassan Allam Construction. The plant will be able to handle 6 million cubic metres (mcm) of water per day, with irrigation capability of up to 500,000 feddan (around 518,921 acres). The Egyptian government has also been accelerating the pace of construction of desalination plants. At least 14 desalination plants will come online by 2023, bringing the total to 90, with a production capacity of 1.3mcm. The government plans to increase the production capacity to 6.3mcm by 2050.

Egypt has also been trying to efficiently manage water consumption for agricultural use, which accounts for 85% of the country’s consumption. It has stopped sowing water-consuming crops such as wheat and rice, and started importing them. It has also focused on introducing new technology to optimise the use of water for agriculture. The government has launched a pilot project using sensors to understand how much water a particular type of soil needs. Farmers get the results on a mobile app. Initial results have been encouraging, saving up to 15-20% of water consumption. Mass adoption will likely be a challenge because of the technology involved, but we believe the project is a step in the right direction. There has also been increased focus on implementing drip irrigation.

In conclusion, we believe the impact of the filling will be limited until there is a prolonged period of drought. In such an event, the amount Ethiopia fills would be limited, and the initiatives Egypt is taking should also reduce dependence on the Nile in the long run. Hence, we expect the GERD issue to only be sentiment-negative for the market, while the impact on the real economy should be limited.

How Acuity Knowledge Partners can help

We support global investors to internalise more of their investment research process by building dedicated teams of research analysts at our delivery centres in South Asia, Beijing and Costa Rica. Our analysts (MBAs, chartered accountants, CFAs) work as an extension of client teams and support them on different types of client-specified research assignments, including financial modeling and valuation, conducting background research, gathering primary and secondary data, preparing for company visits, providing earnings season support and a whole host of value-added research. Each research output we produce is customised for the client and reflects the client’s proprietary and differentiated research process. This gives our clients a unique, sustainable edge.

Sources:

https://www.reuters.com/article/us-egypt-water-climate-farming-feature-t-idUSKBN2AA0NO

https://www.crisisgroup.org/africa/horn-africa/ethiopia/grand-ethiopian-renaissance-dam-timeline

What's your view?

About the Author

Anup Dhanuka has eight years of experience in equity research, supporting both buy-side and sell-side clients. He has been with Acuity Knowledge Partners for five years and has worked with buy-side fund managers in the consumer, real estate and healthcare sectors. In his current role, he supports a buy-side fund manager with coverage of real estate and healthcare stocks in the MENA region. He holds a Post Graduate Diploma in Management from T.A.Pai Management Institute in Manipal, India.

Like the way we think?

Next time we post something new, we'll send it to your inbox