Published on November 30, 2021 by Vipul Gupta

The White House needs a turnaround in the political environment in the next 12 months, ahead of the midterm elections. Historically, an incumbent president's party has often struggled at midterm elections, although this time round, many of the economic issues can be attributed to the pandemic. Some workers have not returned to work or are slow to do so. The spike in infections due to the delta variant slowed the momentum of recovery after the earlier waves.

The following is a brief overview of issues affecting the US political and business environment.

Fiscal stimulus may have been excessive

The US saw an unprecedented fiscal stimulus in the last two calendar years, far in excess of the size of the problem. In an effort to stabilise the economy amid pandemic-induced disruptions, both the Trump and Biden administrations signed trillions of dollars of virus relief spending into law, including the USD2.2tn Coronavirus Aid, Relief, and Economic Security (CARES) Act in March 2020 and USD900bn of additional relief in December 2020. The government’s bid to stabilise the economy has continued into 2021, with the USD1.9tn American Rescue Plan, passed in March 2021, aimed at providing critical aid to workers and businesses still dealing with the effects of the pandemic. It is feared that macroeconomic stimulus on such a large scale has led to inflationary pressures, overheating the economy.

Pandemic-induced supply chain disruptions and the post-pandemic surge in demand have increased prices of various products. Inflation is being further fuelled by high gasoline prices due to multiple factors such as high demand, a reduction in the industry’s capacity amid the pandemic and the reluctance of oil-producing nations to increase crude production. The Producer Price Index, which measures prices of goods and services, increased 8.6% y/y in October 2021.

To ease some of the pressure, the Fed announced on 4 November that it will start scaling back its USD120bn monthly bond-buying programme.

The Build Back Better plan and fear of tax increases

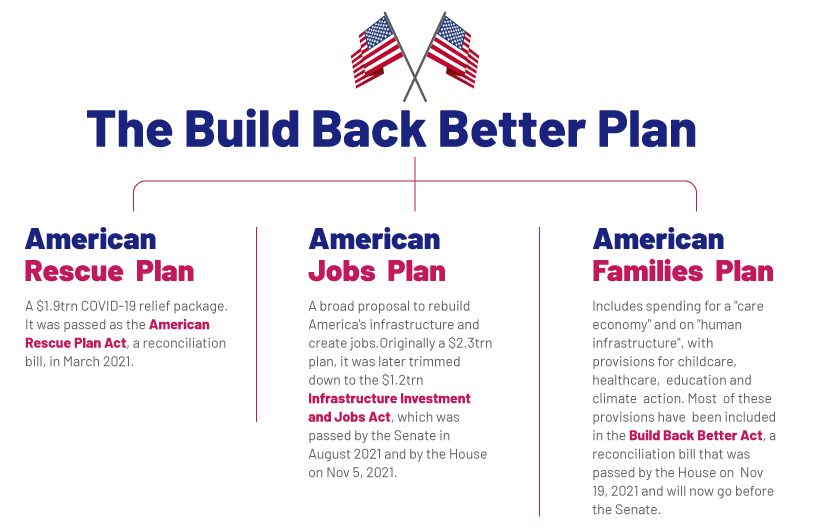

The Build Back Better plan was proposed by President Joe Biden to fund pandemic relief, boost economic recovery and invest in new infrastructure.

After the American Rescue Plan was passed in March 2021, the House passed the USD1.2tn infrastructure bill on 5 November to rebuild roads and bridges, modernise public works systems and boost broadband internet, among other major improvements to the nation’s infrastructure after months of delay. US manufacturers feel the new infrastructure bill will support a year’s worth of public works projects and they will also benefit from refurbished and expanded ports, airports and roads, easing some long-running bottlenecks. The final bill – the American Families Plan, a USD1.75tn investment in social benefits and the climate – is still being processed.

The Build Back Better bill is widely expected to be largely self-funded. It includes a minimum 15% corporate tax on big companies, a new tax on firms engaged in stock buybacks and a new “surcharge” tax on Americans with income above USD10m a year. These initiatives, along with stricter enforcement, should come close to covering the costs. However, according to the Tax Foundation, there is a view that the Build Back Better agenda may lead to a hike in the average top tax rate on personal income to c.57.4% (from the current 42.9%). We believe it is too early to comment either way.

Debt default and reappointment of Powell

In October, to avoid a debt default, Congress voted to extend the debt limit through early December. A default is unlikely and has never happened in US history but if it does, it would have catastrophic implications for the US and the global economy. A default may also trigger a spike in interest rates and ruin America's creditworthiness, causing stock market turmoil and threatening the health of the global economy.

Fed Chair Jerome H Powell’s term expires in February 2022. Presidents typically announce nominations for this post by early November so markets have time to adjust to the news and the Senate has time to confirm nominees. This time round, market observers are increasingly concerned about the lack of clarity on the Fed’s leadership. Powell has done a good job in guiding monetary policy through the COVID-19-related downturn, and he has rebalanced the central bank’s focus, deemphasising inflation control in favour of maximising employment, all the while triggering remarkably little controversy. The president is likely to re-nominate Powell and underscore the Fed’s political independence.

In summary, if the government can keep a grip on the pandemic, inflation is brought under control, the labour market is healthier and supply chain issues are sorted, voters may be in a brighter mood by November 2022.

How Acuity Knowledge Partners can help

Banks have a significant role to play in getting customers and the economy back on track. Helping businesses, particularly those in heavily impacted sectors, return to growth would require more innovative assistance. We have partnered with leading global banks, providing innovative solutions, efficiently setting up flexible teams, managing portfolios and providing support on stimulus programmes such as the Paycheck Protection Program (PPP). Our proprietary suite of Business Excellence and Automation Tools (BEAT) provides intelligent automation capabilities using artificial intelligence and machine learning. We have the deep domain expertise required to build customised tools for the banking industry. Our team of experts have a good understanding of the US banking industry, lending trends and the regulatory framework.

Sources:

https://www.bbc.com/news/world-us-canada-58820071

https://www.forbes.com/sites/sergeiklebnikov/2021/10/19/bidens-latest

https://indianexpress.com/article/explained/joe-biden-infrastructure-bill-explained-7609766/

The views expressed in this blog are the independent opinions of the blogger and do not necessarily reflect the views of Acuity Knowledge Partners, its affiliates or employees.

Tags:

What's your view?

About the Author

Vipul Gupta has over 14 years of experience in working with leading global organizations in the banking and commercial lending domains. His expertise spans a broad range of credit analysis, financial modelling, portfolio management, leveraged lending, industry coverage and onshore client-facing roles. At Acuity Knowledge Partners, he leads a large portfolio management team for a mid-size US bank. He has previously led specialized leveraged lending credit analysis team covering diverse industries. Vipul holds a MBA finance and a Bachelor in Mechanical Engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox