Published on July 31, 2025 by Alankar Ranade, CFA and Nishant Mishra

Key takeaways

-

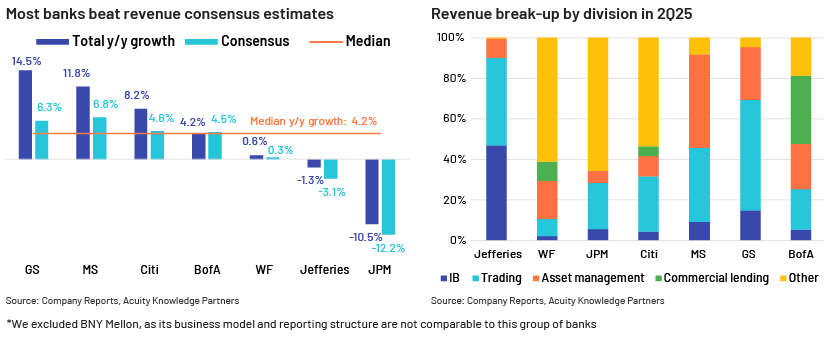

US banks performed better than expected in 2Q25, with six out of the top seven banks outperforming on revenues and management teams have a positive outlook for 2H25 and the full year

-

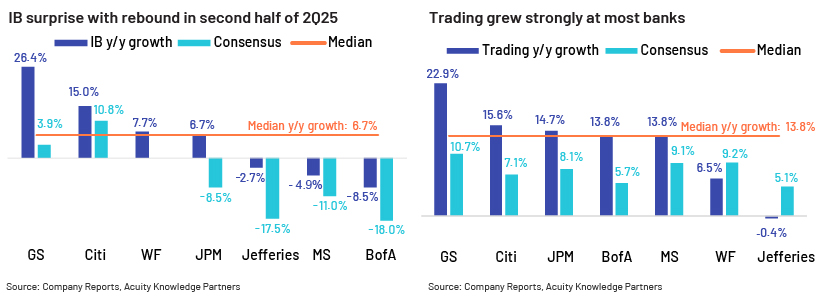

Investment banking (IB) surprised on the upside as impact of tariffs faded as the quarter progressed, while trading was a standout performer

-

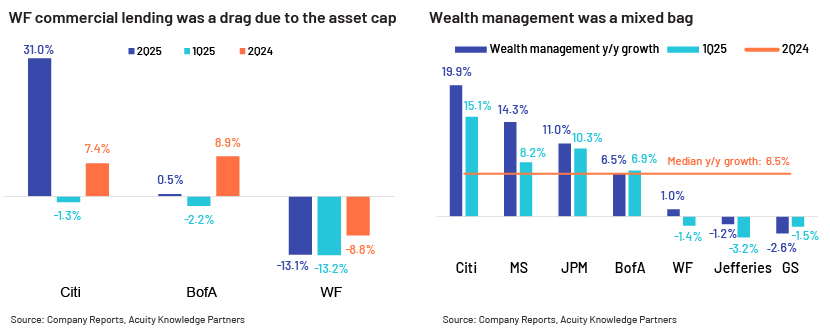

Commercial lending and wealth management had mixed results across the industry, but wealth management divisions generally outperformed expectations

-

Banks are leaning heavily into artificial intelligence (AI) investments: AI agents are now getting more and more integrated into the workforce

US banks performed better than expected in 2Q25, with six out of the top seven banks outperforming consensus revenue forecasts. This demonstrates the sector’s resilience to the heightened economic and geopolitical uncertainty in 1H25 and that banks have largely moved on from US President Donald Trump's trade war.

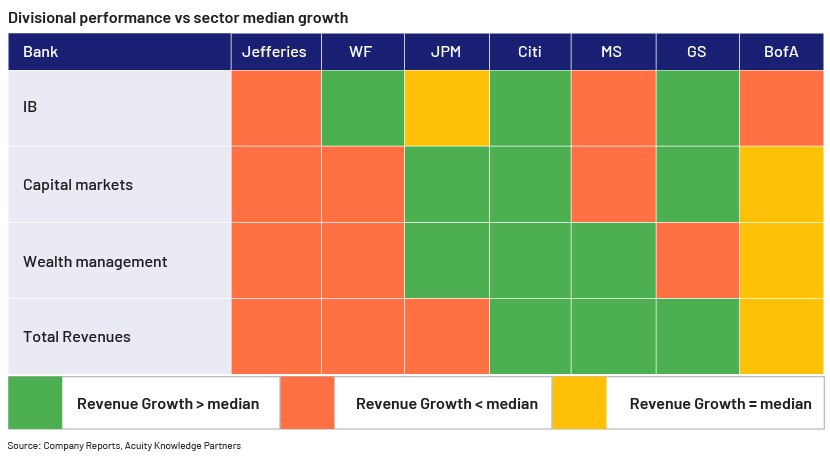

Citi outperforms, Jefferies misses the June rebound

Comparatively, Citi performed the best, with all major divisions and total revenue beating the respective division’s median y/y growth. On the other hand, Jefferies was the laggard. Notably, Jefferies has a slightly different reporting period, with 2Q25 ending in May, so its 2Q25 results did not include the benefits of the June market normalisation that other banks reported.

IB defies forecasts; Trading desks thrive amid chaos

Going into the quarter, analysts had forecast IB to perform poorly – dealmaking was expected to stall in the volatile business environment – and face a delay in recovery till 2H25. However, actual results were considerably better, as IB activity picked up in the second half of 2Q25. All banks beat their respective consensus estimates by wide margins, despite revenues declining y/y at three banks.

Trading revenues grew strongly y/y at all banks apart from Jefferies, which stayed flay y/y. Market volatility was elevated in the quarter, especially in April and May, due to fast-changing US tariff policies, pushing up trading volumes significantly. Volatility around trade policy drove massive activity as investors repositioned their holdings, creating a bonanza for banks’ trading operations. Fixed-income, currencies and commodities revenues grew strongly at most banks, led by higher trading in macro products such as foreign exchange and rates. Equity revenues of Wells Fargo, JPMorgan and Citigroup had one-off gains in 2Q24 related to Visa shares but still did well, helped by derivates trading.

Wells Fargo looks beyond the Fed asset cap, wealth management may see some M&A headlines

Results of commercial lending businesses varied significantly, as Citi widely outperformed expectations with 31% y/y growth, while Wells Fargo reported a 13% y/y decline (in line with expectations), partly due to a USD1.95trn asset cap constraint of the US Federal Reserve (Fed) that was only lifted last month. Loan growth was positive across all banks, but net interest margin (NIM) trends diverged. Despite significant volatility from US tariffs and the uncertainty of Fed rate cuts, all banks are optimistic about net interest income growth for the rest of the year. After the removal of the asset cap, Wells Fargo will be able to pursue wholesale lending growth, though the benefits may take time to flow through.

Performance at the wealth management divisions was a mixed bag. Assets under management increased for all banks from net inflows and higher valuations, though investment performance varied. Wealth management is a key focus area for US banks and a business in which a few banks such as Goldman Sachs and Morgan Stanley are looking to grow inorganically. In June, BNY Mellon explored a merger with Northern Trust but did not make a formal offer, as Northern Trust remained committed to being independent. Goldman Sachs had reportedly approached Northern Trust earlier this year about a merger but could not agree on a price.

2025 Outlook – Optimism with a dash of wariness

All banks affirmed or raised their FY25 outlooks, and bank management teams are cautiously optimistic about the economy, though they acknowledge the continued risk of a changing tariff scenario. While tariffs remain a key topic, companies have signalled that they are beginning to adjust to the shifting policy environment and expect volatility to settle down. Most banks have reported strong deal pipelines and expect robust dealmaking in 2H25.

Banks are betting big on AI to stay cutting edge

US banks are enthusiastically adopting AI tools to drive operational efficiencies and improve customer service. AI and large language model (LLM) technologies have triggered a new arms race between banks as each tries to outdo others in the speed and range of technology implementation. BNY Mellon has commenced the phased transition into its Platforms Operating Model to leverage AI efficiencies, with over 50% of employees having transitioned into the model by end-1H25 and the bank expecting more than 80% to have it by end-2025. Goldman Sachs is currently investing in several AI use cases across the firm, citing AI as "a big opportunity to automate processes, create efficiency and productivity". Last month, Goldman Sachs rolled out its natural language GS AI assistant to the entire firm, the first generative AI-powered tool to reach the scale allowing for safe, secure and responsible access to firm-approved external LLMs. Goldman Sachs recently hired Devin, agentic AI: a new AI-powered autonomous software engineer created by AI startup Cognition Labs to accelerate software development.

Bank of America spends USD13bn annually on technology, of which c.USD4bn will be directed to new technology initiatives in 2025. Citi remains focused on simplifying its operations, investing in technology and AI and exiting non-core consumer markets. In 1H25, the bank retired 211 legacy applications, expanded its generative AI capabilities and deployed a global strategic loan platform. Wells Fargo is also investing in technology to improve operational efficiencies, which pushed up non-interest expenses for the quarter.

Banks signal openness to M&A, but only for the right fit

Several bank management teams spoke about their openness to merger and acquisition (M&A) activity within the industry and expect a simpler path to consolidation under the current administration. On the post-results analyst call, Goldman Sachs CEO David Solomon elaborated on the bank’s stance on M&As, saying “we are always looking for ways we can accelerate our franchise, and we've been particularly focused on thinking about ways we can accelerate our asset wealth management franchise. But the bar to do anything significant will be very, very high.” Morgan Stanley is actively looking to deploy its capital and remains open to inorganic growth through tuck-in acquisitions, but stated the “bar is super-high”. The bank would be more likely to buy smaller businesses that add to its existing operations, such as wealth or investment management, where there are many opportunities due to high fragmentation. BNY Mellon reaffirmed a "very high bar" for M&A, with a focus on organic growth and disciplined, capability-led acquisitions only if they closely align with strategic priorities. BNY Mellon and Goldman Sachs eyed mergers with Northern Trust earlier in the year, but these did not materialise.

How Acuity Knowledge Partners can help

The recent quarter US bank results show that the industry can stay resilient even amid the most volatile scenarios. While there will be no shortage of challenges and opportunities for banks, the adoption of AI over the medium term could be a dominant theme that revolutionises the industry completely. Acuity’s unmatched domain expertise of over two decades across the financial services sector and growing capabilities in AI technology through our Agentic AI platform – Agent Fleet – put us in an ideal position to help industry participants navigate these tumultuous times.

References:

-

US banking giants reap gains from dealmaking rebound, trading bump

-

Goldman Sachs, Morgan Stanley Notch Record Quarter, Fueled by Market Volatility

-

US bank profits to rise on stronger trading, investment banking

What's your view?

About the Authors

Alankar has 16 years of experience in investment research and has been supporting high-yield analysts (buy side and sell side) and credit rating analysts. He currently supports sell-side analysts of a major trade desk, covering high-yield issuers in EMEA. Alankar holds an MBA in Finance and a bachelor’s degree in engineering.

Nishant Mishra has over 21 years of work experience in investment research, including 18 years at Acuity. With expertise in both equity and fixed income domains, he currently leads teams that provide research support to sell-side credit research clients. He acts as a single point of contact for clients and ensures the team delivers high-quality output in line.

Like the way we think?

Next time we post something new, we'll send it to your inbox