Published on February 1, 2023 by Malla Reddy Myla

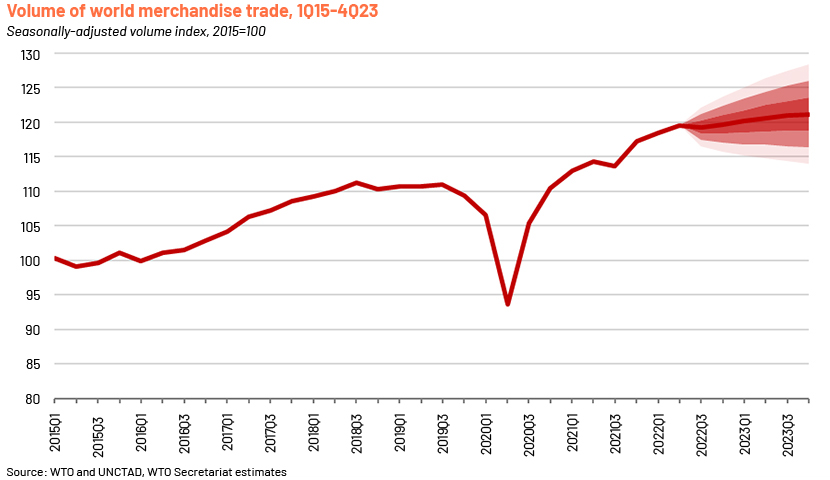

Following the steep decline in 2020, when global trade was hit by the COVID-19 pandemic, it recovered sharply to a record USD28.5tn in 2021. The growth momentum continued through 1H22 before it turned negative in 2H, due to growing uncertainties around geopolitical issues and worsening economic conditions. Nonetheless, global trade is estimated at USD32tn in 2022, aided by the robust growth in 1H22.

The UNCTD (United Nations Conference on Trade and Development) stated, ‘Economic growth forecasts for 2023 are being revised downwards due to high energy prices, rising interest rates, sustained inflation in many economies, and negative global economy spillovers from the war in Ukraine’.

The World Trade Organization expects a continued downtrend in global trade in the intermediate term and a subdued 2023 as major economies battle headwinds from the current geopolitical and global economic challenges.

While recent statistics and data hint at a year-on-year (y/y) contraction in 2023 and uncertain short-term outlook on international trade, growth in trade will likely accelerate over the coming years on advancements in trade logistics, development of new trade agreements, digital adoption and supply-chain diversification.

Evolution of trade finance: trade facilitation to digitalisation

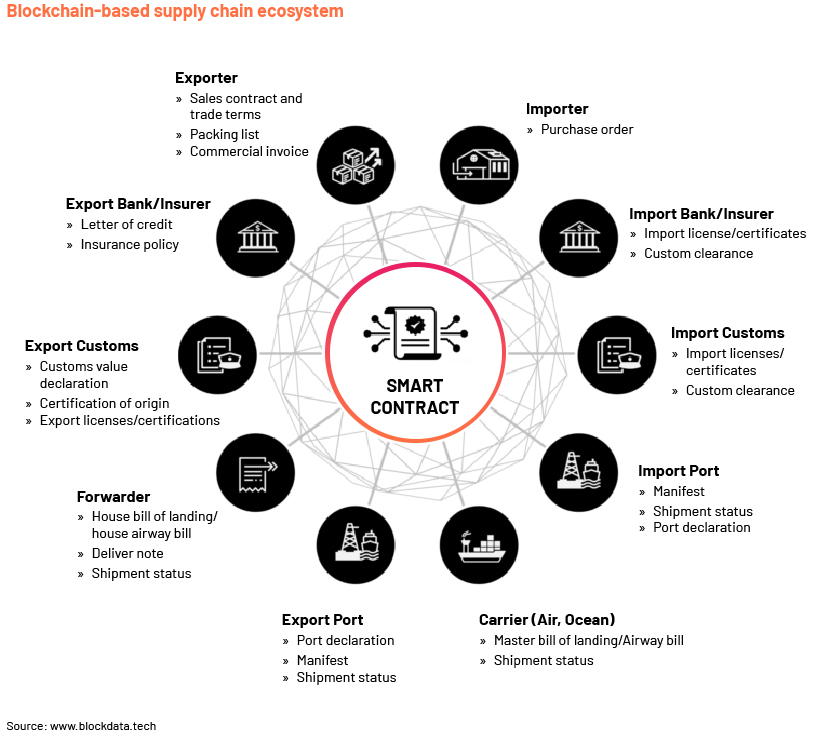

The trade finance business has grown from strength to strength – from merely facilitating trade through products and services to becoming the source of financing for buyers and sellers and other parties involved in the trade, playing a significant role in most economies. However, the sector has been undergoing a unique phase of transformation over the past couple of years owing to new-age technologies, whose development was accelerated by the pandemic but slowed by geopolitical issues and economic challenges. Trade finance practitioners, providers and governments have, however, been working relentlessly to ensure a smooth transformation by resolving the challenges in a sector heavily dependent on physical documents and manual processes.

Demand-supply dynamics in trade finance

Trade finance offers diverse financial instruments to importers and exporters to mitigate the risks tied to the underlying trade transaction and fulfil working capital requirements to effectively manage cash flow.

About 85% of global trade hinges on trade finance. Without trade finance, global trade will not grow.

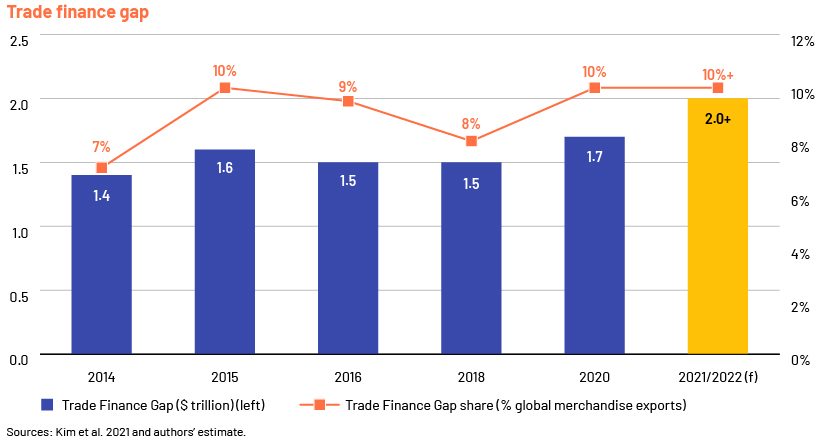

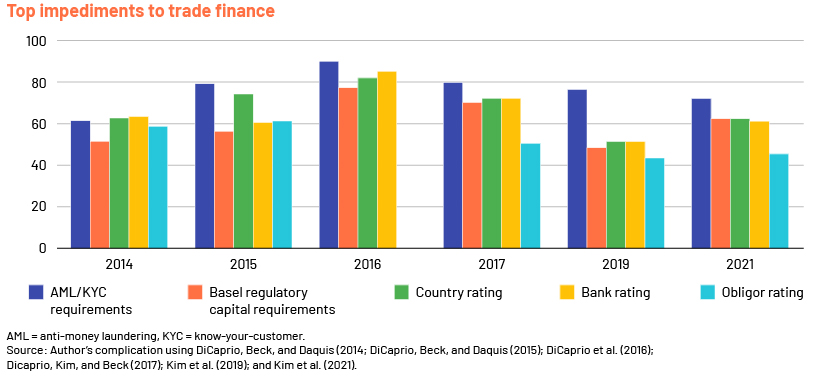

The trade finance gap has been a long-standing challenge. The rejection of trade finance funding applications by trade finance providers is mainly attributable to the lack of collateral and inadequate information on funding sources, as required by regulatory mandates. The rejection rate is high in the small- and medium-sized-enterprise segment, due to the lack of effective risk management tools, awareness and capabilities in trade finance products. During the COVID-19 pandemic, the gap widened, as trade finance providers’ risk appetite was spoiled by the heightened risk of funding.

The trade finance gap is expected to widen to USD2tn in 2022 from a record USD1.7tn in 2020. On the positive side, the gap signals a number of opportunities exist in trade finance for those adopting new means of conducting business, embracing innovative technologies and training and educating clients on the effective use of trade finance products, which have been historically considered low-risk, highly effective finance tools.

Rejig in trade finance partners

The other challenge is that trade finance providers limit their trade finance offerings for various reasons, which often leads clients to deal with multiple service providers to fulfil their business needs and/or get tailor-made products. It has also become a necessity for clients to constantly review the trade portfolio with existing partners and roaster them when a gap is identified in the products or services offerings.

A survey conducted by Accenture revealed that clients regularly rotated trade finance partners. According to the survey, 67% were planning to change their roster of partners in the next 12 months, 76% would change the number of partners on their current roster within 12 months and 62% already had five or more trading partners.

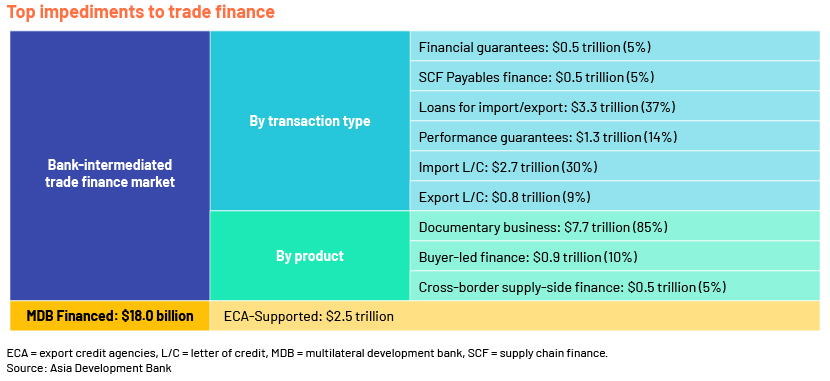

The value of trade finance transactions supported by top banks in the world was estimated at about USD9tn in 2020. Documentary credits, demand guarantee and trade finance loans account for 90% of trade finance transactions.

Structure of trade finance by transaction type and value

Trade finance services involve significant manual work, with complex layers, time-consuming processes and use of outdated software and systems, making the entire set-up highly vulnerable.

The COVID-19 pandemic forced the finance sector to adopt new ways of working, making it even more difficult for organisations highly reliant on physical documents.

Such organisations are not only struggling to survive with these outdated approaches but also failing to meet customer demand in terms of service delivery, adversely impacting their business, according to a 4Q22 survey conducted by Surecomp – a trade finance solution provider to banks and corporates.

Traditionally, trade finance offerings have largely relied on documentary evidence and information within these documents. One of the challenges for trade finance providers is to capture and validate data from paper documents before delivering trade finance services. Rapid developments in technology over the years could transform the burdensome and time-consuming tasks into more simplified and effective processes.

Governments’ push for regularisation of digital documents

2022 marked a roller-coaster journey for digitisation in global trade. One of the most important developments in digitisation is that governments worldwide are adopting new regulations and/or modifying existing ones to legalise the digital form of key documents used in international trade.

UK electronic trade documentation bill

As part of its legislative agenda for the 2022-2023 parliamentary session, the UK government announced an ‘electronic trade documentation bill’ on 10 May 2022. On the request of the UK government, the UK Law Commission developed and published a report, which contained proposed reforms to English law to legalise electronic trade documents, in consultation with other stakeholders in the legal, trade, finance and shipping industries. This is one of the significant developments in English law, which regulates most of the global trade, and is expected to effective by 2H23.

Key documents covered by the electronic trade document bill are:

-

Bills of lading

-

Cargo insurance certificates

-

Drafts (bills of exchange)

-

Marine insurance policies

-

Promissory notes

-

Ships’ delivery order

-

Warehouse receipts

US amendments to Uniform Commercial Code

Another significant development in 2022 was amendments to Uniform Commercial Code (UCC) in the US to permit financial instruments, including promissory notes and bills of exchange, in electronic form. The UCC already allows electronic document of titles. The 2022 amendments to UCC are expected to be placed in state legislatures in 2023 for adoption.

Blip in trade finance digitisation

One of the biggest setbacks in trade digitisation, particularly in blockchain-enabled solutions, was the announcement to withdraw TradeLens – a blockchain-powered open and industry-neutral platform introduced by IBM and Maersk in 2018 as a shipping solution to promote global trade through transparency, collaboration and efficiency in global supply chains.

On 29 November 2022, IBM and AP Moller-Maersk announced they would discontinue and withdraw TradeLens and close the platform completely towards the end of 1Q23.

According to AP Moller-Maersk’s Head of Business Platforms Rotem Hershko, ‘TradeLens was founded on the bold vision to make a leap in global supply chain digitization as an open and neutral industry platform. Unfortunately, while we successfully developed a viable platform, the need for full global industry collaboration has not been achieved. As a result, TradeLens has not reached the level of commercial viability necessary to continue work and meet the financial expectations as an independent business’.

Although there could be short-term challenges to trade digitisation similar to TradeLens, which the stakeholders consider as part of the learning, they continue to work towards ‘the future is digital’ theme.

Challenges in keeping abreast of business shifts and embracing innovation

The global trade finance business has no option but to adopt new-age technologies and platforms if it has to offer innovative and competitive trade solutions. However, the challenges faced in keeping abreast of business shifts would only delay the process of transformation and force organisations to continue with their legacy systems.

Banks’ major areas of concern in technology

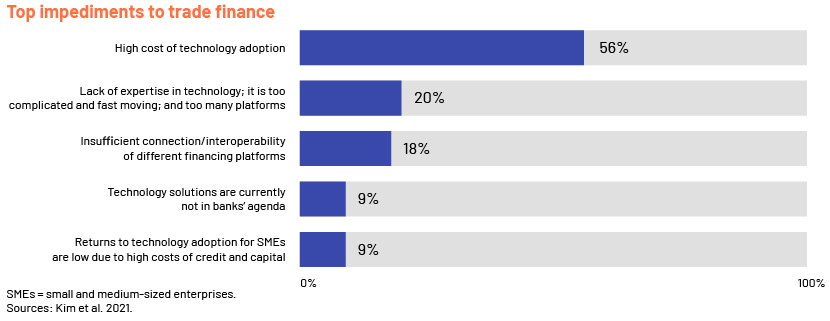

Recent trends indicate that the legal and regulatory barriers in digitising trade are easing. However, internal challenges remain a material roadblock to banks’ efforts to fast track digital adoption. The major impediments are costs linked to the adoption of technology, lack of expertise in technology and outdated legacy systems, which are not compatible to the latest technologies. Consequently, most banks may adopt the ‘wait and watch’ approach rather than taking the lead in digitisation.

Banks’ major areas of concern regarding technology, 2021

How Acuity Knowledge Partners can help

How Acuity Knowledge Partners can help

We provide secure systems, have designated workplaces to mitigate risk and handle work with the outmost confidentiality.

Our employees are equipped with end-to-end product knowledge and are experienced in examining and screening digital documents. We ensure minimal handling of physical documents, reducing the potential for data breaches and document-handling costs. Furthermore, our subject-matter experts help standardise and streamline legacy processes and bridge process and knowledge gaps.

We provide all types of data services, including data analysis and reports across the trade finance spectrum.

Our support enables clients to spend more time in front- and middle-office services, the development of business strategies for expansion and technological adoption without disrupting their day-to-day business.

Sources

Tags:

What's your view?

About the Author

A seasoned professional with over 13 years of experience in the field of trade finance, worked with reputable financial institutions, gained valuable experience in various aspects of trade finance and have successfully managed a diverse range of trade transactions, including letters of credit, demand guarantees, documentary collections, supply chain finance with a deep understanding of trade finance operations, has successfully led and executed multiple trade finance project migrations.

Like the way we think?

Next time we post something new, we'll send it to your inbox