Published on March 9, 2022 by Jeetendra Prakash, CFA and Mohit Choudhary

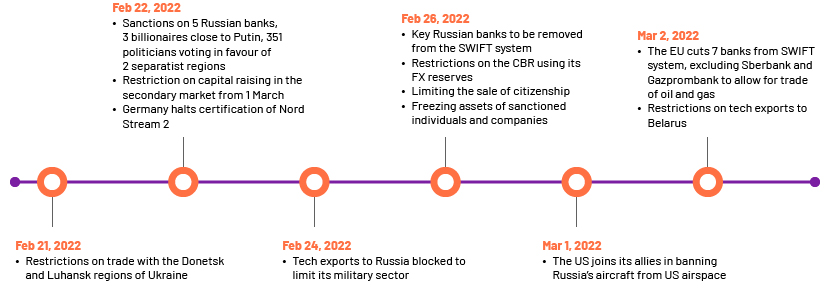

On 21 February 2022, Russian President Vladimir Putin recognised Donetsk and Luhansk, the two breakaway regions of Ukraine, as independent states and ordered a military attack on Ukraine. The West subsequently imposed a number of wide-ranging sanctions.

Events are unfolding rapidly, and the US, Europe, the UK and allies (including Australia, South Korea and Japan) are increasing the severity of sanctions daily, targeting the Russian economy:

These sanctions affect global markets:

-

-

US equity/bond market:

US investors flee to money-market funds from equity funds. In the week to 23 February 2022, money-market funds accumulated capital worth a net USD5.98bn in their first weekly inflows since 26 January 2022. In contrast, equity-market investors sold US equity funds worth USD1.92bn, marking the first weekly outflow in three weeks. US bond funds lost USD3.66bn in a seventh consecutive week of net selling, but net selling was 92% lower than in the previous week1 .

-

Fed rate hike:

With the growing uncertainty, expectations for a rate hike have come down from 50 bps to 25 bps at the Fed meeting in March

-

Monetary policy in the EU:

The war has forced the EU market to face the risk of stagflation amid higher energy and food prices. If the situation worsens, the EU could be forced to engage in more quantitative easing while opening up the possibility of hiking rates. Germany’s 10-year nominal rates slumped to their lowest since 2011 as expectations of rate hikes evaporate.

-

Steep rate hike in Russia:

The Central Bank of the Russian Federation (CBR) is to assist exporters and importers with forex requirements. It also more than doubled the benchmark rate to 20% to check inflation and devaluation risks.

-

Commodity prices:

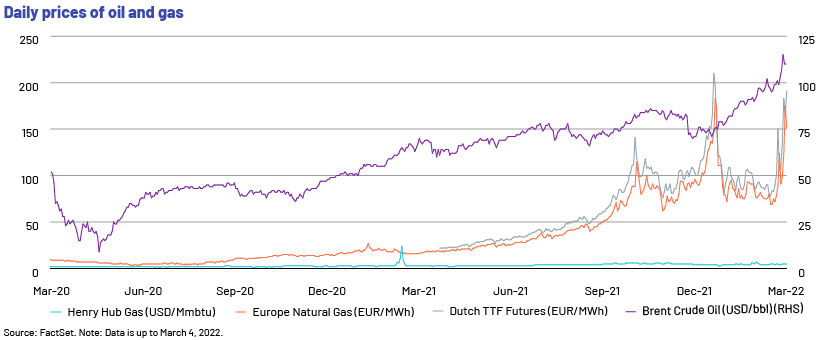

The Brent crude price has increased c.20% since the attacks on fears of Russian supplies being restricted. On 2 March 2022, OPEC+ announced there would be no additional supplies from the coalition in an effort to balance the market; the attacks triggered an increase of USD8-10/barrel.

-

Russia has significant market shares in other commodities as well. It accounted for 40% of global palladium production in 2021, and its gold production accounted for 10% of global volume. The price of palladium hit a seven-month high recently.

Russia is the largest producer of wheat (17% market share), and Ukraine (12% market share) is among the top four exporters of the commodity. Due to fears of global supply disruption, wheat futures traded “limit up” (at the most the price of a commodity is allowed to increase in a single day) for a second consecutive day on 2 March 2022. It settled at USD10.59/bushel – the highest in 14 years.

The sanctions – a closer look

-

-

SWIFT-related sanctions – a double-edged sword for the EU:

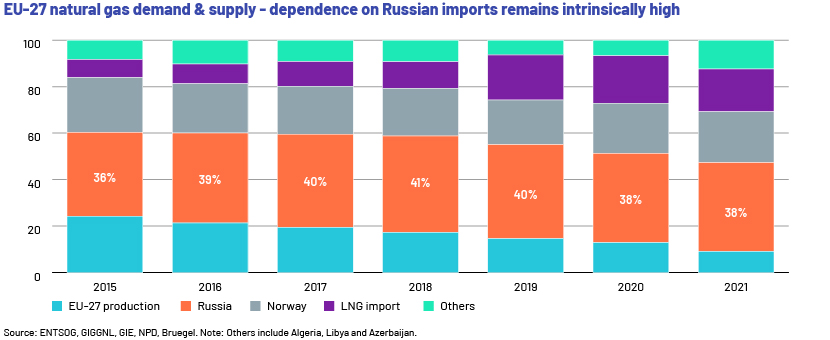

While SWIFT- and energy-related sanctions would have a far-reaching impact in isolating Russia, the EU would also bear the burden of these sanctions. The two economies are closely connected, as shown below:

-

The EU and Russia engage in EUR80bn worth of trade with each other; these sanctions would mean the EU cannot trade with 50% of the Russian banking system.

-

Russia exported 5m barrels of oil per day in 2020; 48% of it was to European countries2 .

-

While crude oil requirements could be met through other suppliers, there is no substitute for Russian gas supplies in the short term. Russia’s reliable gas production and pipeline network have provided ready access and clean energy to Europe over the years as it looks to reduce its carbon footprint and nuclear-based power generation. Imports of Russia’s natural gas account for 38% of the EU’s total natural gas imports. Major economies such as Germany and Italy import 65% and 43% of their gas requirements from Russia, respectively3 . In late 2021, Russia reduced its gas supply to Europe due to the deepening crisis with Ukraine; spot deliveries were restricted, although it delivered on its long-term contracts. This pushed Dutch TTF gas futures from EUR65/megawatt hour (MWh) in October 2021 to EUR180/MWh in December 20214 . This came against the backdrop of high inflation in the EU and UK that ate into personal consumption. Inflation remains well above the respective central banks’ tolerance levels.

-

Germany was scheduled to phase out all its nuclear plants in 2022 and was in the process of getting direct gas supplies from Russia through the Nord Stream 2 pipeline. This USD15bn pipeline owned by Gazprom (the state-owned gas supplier) as operator5 would meet more than half of Germany’s annual consumption. The German regulator has put the final certification on hold.

-

-

-

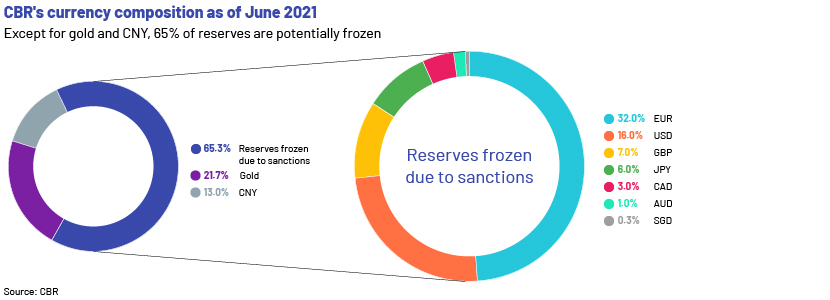

Restrictions on the CBR:

After the Crimea-related sanctions, Russia’s access to forex funding was restricted. Since then, the country has built up its forex reserves, which stand at USD630bn against USD386bn in 2014. The Western allies have wiped out 65% of these reserves through an asset freeze. Overall, the West has collectively targeted 10 of Russia’s largest financial institutions, which account for nearly 80% of the Russian banking sector. Sanctions target Russia’s financial institutions and the ability of state-owned and private entities to raise capital, be it equity or debt. Furthermore, Russian financial institutions conduct c.USD46bn worth of foreign-exchange transactions globally on a daily basis; 80% of these are in US dollars. These transactions will now be disrupted.

-

Russia’s options and countermeasures:

To partially bypass the SWIFT-related restrictions, Russia has been developing its own payment messaging system (SPFS), which can be used with countries such as China if they agree to adopt it. The SPFS currently accounts for c.25% of domestic payments6.

It remains to be seen how eliminating certain Russian banks from the SWIFT network would disrupt energy revenue. The oil and gas markets will likely witness a significant upheaval and rerouting of supplies if payments are disrupted.

Russia has also recently looked at diversifying its customer base by entering into deals with China for energy supplies. In February, Russia signed oil and gas deals (worth USD117.5bn) with China amid souring relationships with the West. The two countries entered into a new deal where Russia will supply 10bn cubic meters/annum of gas for 25 years and renewed an existing one to supply 100m tonnes (mt) of oil over 10 years. Despite these developments, China accounts for only 5% of Russia’s total natural gas exports, and scaling up would require significant investments in pipeline infrastructure over the longer term.

The way forward:

The US’s stance of not sending large forces to Ukraine and gradually tightening sanctions indicates that most nations want to deal with the current situation more diplomatically on both the political and the economic front and less through direct confrontation. The forex buffer held by the CBR provided effective insurance against sanctions of any sort. However, the recent sanctions on the CBR, freezing of forex reserves and keeping Russia out of the SWIFT messaging system are clearly the strongest and most coordinated efforts to isolate the country. Direct sanctions on Russian oligarchs and the president have strong symbolism. The immediate impact of the sanctions includes a free fall of the Russian ruble (which has declined 35% since 21 February), while Russian oligarchs have so far seen a USD126bn erosion in their wealth7 . The CBR’s rate hike to 20% would affect domestic businesses as the country tries to contain inflation.

Although Europe remains strong on intent, the sustainability of these sanctions remains to be seen given the high dependence on Russian oil and gas for which there are no substitutes in the near term.

Sources

1 Reuters, U.S. investors flee to money-market funds amid Ukraine crisis | Reuters

2 EIA, Country Analysis Executive Summary: Russia (eia.gov)

3Eurostat, figures pertain to 2020 Statistics | Eurostat (europa.eu)

4 Dutch TTF Futures, Dutch TTF Natural Gas Futures Price – Investing.com

5CNN, Nord Stream 2: Germany halts certification of Russian pipeline – CNN

6According to daily newspaper Kommersant

7 Forbes, Here’s How Russia Sanctions Could Impact Private Jets (forbes.com)

“Reference data and commentary of the above blog is as of March 2, 2022”.

Tags:

What's your view?

About the Authors

Jeetendra Prakash has close to 15 years of work experience in investment research, with a focus on oil and gas and real estate. He currently supports a large US-based hedge fund. The process involves credit research of high-yield and investment grade credits for different strategies. In addition, he is also actively involved in training and quality control of deliverables. He holds an MBA and is also a CFA charter holder.

Mohit Choudhary has over 7 years of experience in investment research with a focus on real estate, cable and media sectors. He has cleared CFA level 3 exam and is a bachelor of commerce.

Like the way we think?

Next time we post something new, we'll send it to your inbox