Published on July 29, 2021 by Jeetendra Prakash, CFA and Mohit Choudhary

-

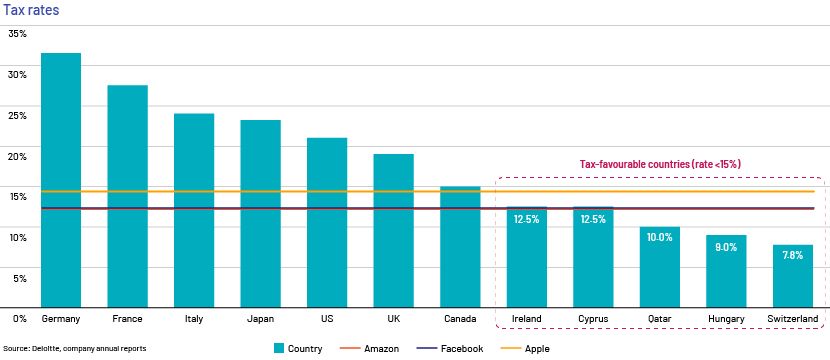

Big tech companies (combined cash balance: >USD580bn1 ) have paid lower taxes by incorporating in tax havens where corporate tax rates range from 0% to 17% as opposed to tax rates of more than 20% in the countries in which they were initially founded.

-

Apple, Facebook, Twitter and Microsoft have their international headquarters registered in Dublin, Ireland, where the tax rate is 12.5%. Effective tax rates for Amazon, Facebook and Apple were only 11.8%, 12.2% and 14.4%, respectively2 , in FY 2020 – much lower than the 21% corporate tax rate in the US.

-

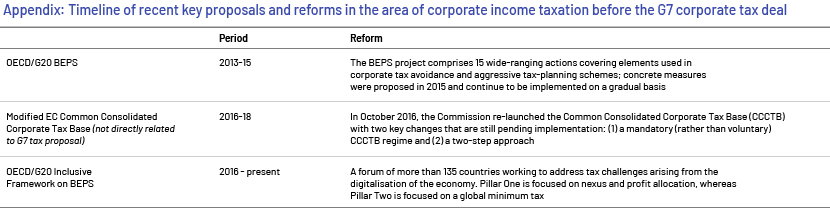

G20 countries asked Organization for Economic Co-operation and Development (OECD) nations to address this disparity in 2013-15. Base Erosion and Profit Shifting (BEPS) strategies were subsequently introduced to ensure uniformity and certainty in the international tax system.

-

In June 2021, the G7 countries agreed to tax the top 100 companies globally, irrespective of the place of incorporation, and are looking at setting up a framework to check tax arbitrage.

Need to change archaic tax laws

Taxing traditional business models is relatively simple, as an entity’s taxability could be linked to its physical presence in a country. However, in a highly digitalised era, the taxability of tech companies is blurred significantly, as revenue generation and value-add do not necessitate a physical presence in the country of operation.

A study by the IMF estimates that tax havens cost governments USD500-600bn per annum, mostly in corporate tax revenue. To put this in perspective, 55 corporations in the US paid no federal taxes in 2020, according to the Institute on Taxation and Economic Policy.

To prevent tax erosion, the UK, India, Italy, Spain, France and other European countries have unilaterally started levying a Digital Service Tax (DST) on non-resident digital service providers by taxing 2-3% of the revenue earned from domestic users.

The G7 corporate tax deal – the background and details

The Biden administration seems to be working its way back to the global centre stage, as evidenced by a softened stance on global minimum taxes to push the G7 tax deal. The (domestic) corporate tax cuts introduced by the previous administration cannot be reversed in isolation; hence, the US is focused on developing a multilateral agreement to resolve the digital and other international tax issues with other countries.

On 5 June 2021, the G7 countries (the US, the UK, Germany, Canada, France, Italy and Japan) agreed to create tax reforms aimed at multinational companies that bypass taxes through tax haves and remove the DST. Removing the DST would make the tax structure uniform internationally.

The deal is based on two pillars:

1) To enable countries to tax the top 100 most profitable multinationals in the country of operation (subject to a minimum 10% profit margin in that country) rather than where their international headquarters are located (often in tax havens).

2) To apply a global minimum corporate tax rate of 15% to counter the “tax haven” status enjoyed by many countries. Note that the US and France initially proposed a 21% tax rate but later conceded to the current 15% tax rate.

Implications

-

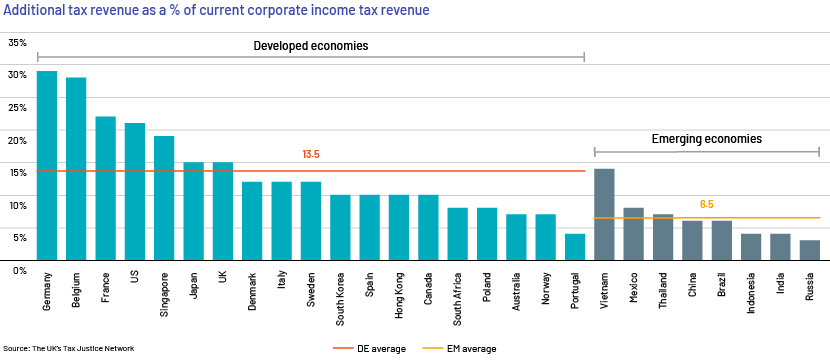

An additional USD275bn3 of tax revenue could be earned under the proposed minimum corporate tax rate – 61% of this would accrue to the G7 nations; the US would earn 50% of this.

-

With limited tax arbitrage, capital could flow back to (or accumulate in) the countries where the multinationals have a strong business presence.

-

In the long term, measures such as infrastructure, favourable regulation and rule of law, and quality of workforce would be the key factors attracting foreign direct investment (FDI).

Conclusion and key takeaways

-

Timing and the way forward: The backing of the G7 nations has provided a definitive step towards reforming the international tax structure. The tax proposal will be discussed next at the G20 meeting in October 2021.

-

We expect several changes before the final law is passed, as there are a number of aspects that need to be addressed such as (a) the basis for choosing the top 100 most profitable companies, (b) differences between the accounting methods of the companies and the accounting methods of the countries in arriving at the profit figures, (c) the possibility of revising the profitability threshold limit and the likelihood of a potential revenue loss if the current DST is eliminated and (d) the treatment of losses and how they will be offset against profits in a different jurisdiction. Apart from this, G7 members would have to get this proposal passed in their respective parliaments. The US, for instance, is likely to face a challenge, as passage requires a two-thirds majority. The deal is at a nascent stage, and it could take years until actual implementation.

-

-

Tech companies: In the current form, the impact on tech companies is not significant. For instance, the top 15 companies in the US are subject to an effective tax rate of c.14%4 . Under the new tax reform, we estimate that the effective tax rate will increase by 300-400bps5 , as some of the tax increase will be offset by the withdrawal of the DST. The minimum tax rate of 15% is only marginally higher than Ireland’s current tax rate of 12.5%.

How Acuity Knowledge Partners can help

We have developed expertise in different sectors to help fixed income-focused asset managers with the investment process. Our sector experts closely track global developments that have a material credit impact on corporates and sovereigns. Our team of investment research analysts bake these developments into our detailed financial model forecasts to isolate the impact on issuers’ cash flow and creditworthiness.

Appendix

Sources:

1 For the most recent full year – includes Apple Inc., Facebook, Microsoft, Amazon, Alphabet, Oracle and CISCO

2 Based on company annual reports

3 The UK’s Tax Justice Network

4 FactSet

5 Assuming domestic revenue accounts for 40-50% of total revenue

What's your view?

About the Authors

Jeetendra Prakash has close to 15 years of work experience in investment research, with a focus on oil and gas and real estate. He currently supports a large US-based hedge fund. The process involves credit research of high-yield and investment grade credits for different strategies. In addition, he is also actively involved in training and quality control of deliverables. He holds an MBA and is also a CFA charter holder.

Mohit Choudhary has over 7 years of experience in investment research with a focus on real estate, cable and media sectors. He has cleared CFA level 3 exam and is a bachelor of commerce.

Like the way we think?

Next time we post something new, we'll send it to your inbox