Published on December 20, 2021 by Shweta Gupta

The COVID-19 pandemic is considered to be the most crucial global health calamity of the century and the greatest challenge humankind has faced since the Second World War. A new class of coronavirus, known as severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), was found to be responsible for this disease.

This blog focuses on both approved and novel drug treatment therapies used for the treatment of COVID-19.

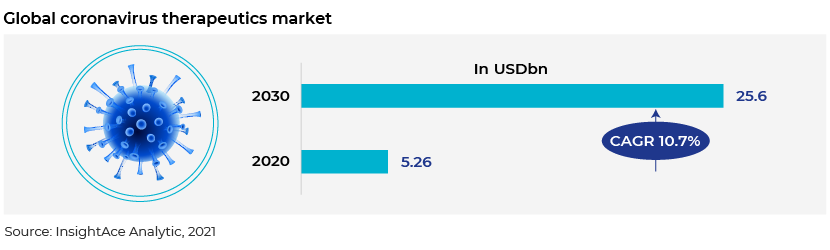

Market size analysis

The spike in infections led to a steep increase in the number of clinical trials conducted to treat COVID-19, with most leading pharmaceutical, biotechnology and healthcare companies working towards producing drugs and vaccines. A market intelligence report by InsightAce Analytic estimates that the global COVID-19 therapeutics market will reach USD25.6bn in 2030 owing to the increase in the number of drug approvals and rising cases of COVID-19 and patient awareness.

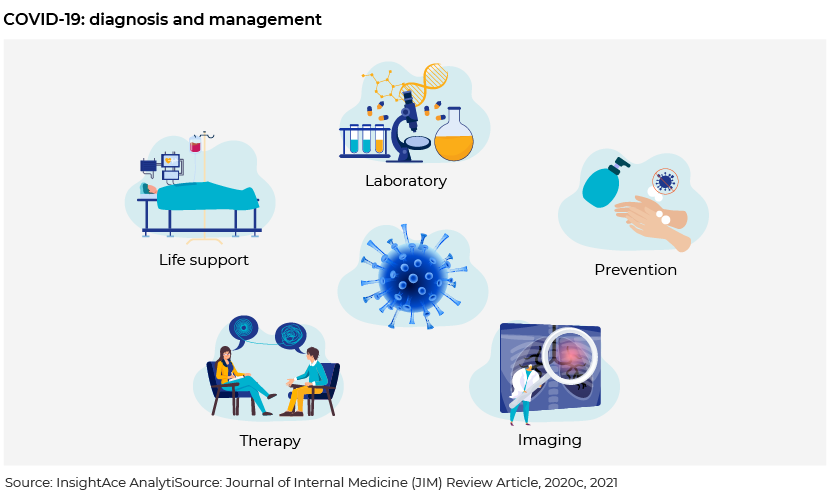

Diagnosis and management

The global health and economic consequences of the SARS-CoV-2 pandemic are severe. Although many therapies capable of treating COVID-19 or preventing SARS-CoV-2 infection have been suggested, the only interventions currently viable and proven to reduce the rate of contagion seem to be strict quarantine measures and vaccination.

Specifically designed randomised clinical trials are ongoing to determine the most appropriate evidence-based treatment modality to reduce the spread of this disease and prevent a future outbreak.

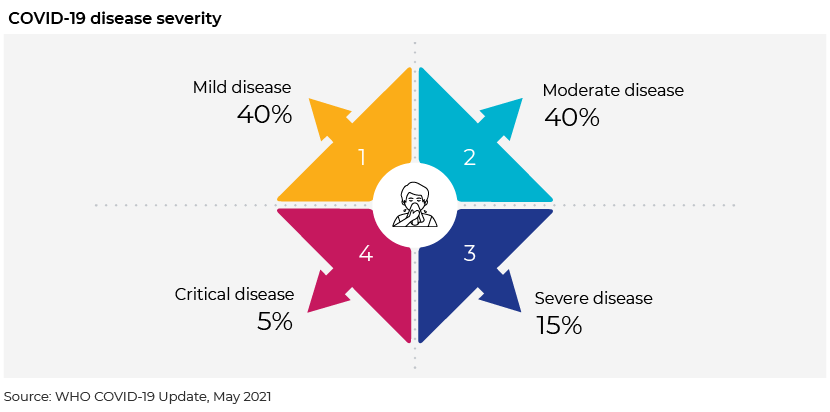

The COVID-19 disease is classified based on severity as non-severe, severe and critical.

-

Non-severe: characterised by the absence of signs of severe or critical disease

-

Severe: when saturated oxygen SpO2 <90% on room air, the respiratory rate >30 in adults, the respiratory rate in children is raised and there are signs of severe respiratory distress

-

Critical: requires life-sustaining treatment, acute respiratory distress syndrome, sepsis and septic shock

Most COVID-19 patients have mild to moderate disease, with severity ranging from asymptomatic to severe illness and death. WHO recommendations for therapeutics differ based on the level of severity of the disease, classified as mild, moderate, critical or severe. Systemic corticosteroids are recommended by WHO for the treatment of severe or critical COVID-19, while antibiotic therapy is not recommended for patients with mild or moderate COVID-19, and hydroxychloroquine, lopinavir, ivermection, ritonavir and remdesivir are not recommended for patients with any level of severity.

Treatment includes different classes of drug therapies, as mentioned below:

Class 1: Anti-viral therapies

Anti-viral drug therapies treat COVID-19 through blocking virus replication inside the human body. Key drugs include lopinavir, ritonavir, remdesivir, molnupiravir and Paxlovid.

Human immunodeficiency virus protease inhibitors lopinavir and ritonavir work via inhibition of 3-chymotrypsin-like protease. Remdesivir is an intravenous nucleotide prodrug of an adenosine analogue that binds to the viral RNA-dependent RNA polymerase and inhibits viral replication through premature termination of RNA transcription. It has demonstrated in vitro activity against SARS-CoV-2. Favipiravir, marketed as Avigan, is a Japanese drug manufactured by Fujifilm Toyama Chemical to treat influenza; in September 2021, the company released Phase III trial results of its use to treat COVID-19. Fluvoxamine is also found to reduce the risk of hospitalisation and death of COVID-19 patients by 32%. Molnupiravir (MK-4482, EIDD-2801), an investigational oral antiviral medicine produced by Merck, became the first oral medicine for the treatment of COVID-19. In November 2019, the UK Medicines and Healthcare products Regulatory Agency (MHRA) granted approval for molnupiravir to be branded as Lagevrio in the UK. Merck plans to seek Emergency Use Authorization (EUA) in the US, and the application is under review by other regulatory authorities including the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA).

Leading pharmaceutical companies are developing new therapies and repurposing existing drugs; these are playing a key role alongside booster vaccines. AT-527, developed by US-based Atea Pharmaceuticals and Switzerland-based Roche, is in Phase II clinical trials to test efficacy in patients with mild cases. Trials in non-hospital settings will begin next year.

Class 2: Monoclonal antibodies

The SARS-CoV-2 genome encodes four major structural proteins: spike (S), envelope (E), membrane (M) and nucleocapsid (N) as well as non-structural and accessory proteins. The spike protein is further divided into two subunits, S1 and S2, which mediate host cell attachment and invasion. Anti-SARS-CoV-2 monoclonal antibodies (mAbs) that target the spike protein have been shown to have a clinical benefit in treating SARS-CoV-2 infection. Currently, three anti-SARS-CoV-2 mAb products have received EUA from the FDA for the treatment of mild to moderate COVID-19 in non-hospitalised patients with laboratory-confirmed SARS-CoV-2 infection at high risk of progressing to severe disease and/or hospitalisation. Issuance of an EUA does not constitute FDA approval. Bamlanivimab + etesevimab are neutralising mAbs that bind to different, but overlapping, epitopes in the spike protein of SARS-CoV-2. Casirivimab + imdevimab are recombinant human mAbs that bind to non-overlapping epitopes of the spike protein of SARS-CoV-2. Sotrovimab targets an epitope in the binding domain of the spike protein that is conserved between SARS-CoV and SARS-CoV-2. AZD7442, a drug developed by AstraZeneca, is in Phase III clinical trials; this utilises COVID-19 antibodies isolated in Wuhan, China. In October, the clinical trials demonstrated a 77% higher effect in preventing symptomatic COVID-19 in high-risk individuals; the company has applied for approval in the US.

Class 3: Cell-based therapies

Mesenchymal stem cells are investigational products that have been studied extensively for broad clinical applications in regenerative medicine and for their immunomodulatory properties. It is hypothesised that mesenchymal stem cells could reduce acute lung injury and inhibit the cell-mediated inflammatory response induced by SARS-CoV-2.

Mesoblast, developed in Australia, is a stem cell treatment that targets acute respiratory distress syndrome in COVID-19 patients. It is currently being registered for Phase III trials in the US.

American company Athersys began Phase II and III trials of its stem cell treatment to test its effectiveness against acute respiratory distress syndrome in COVID-19 patients.

Class 4: Immunomodulators

Drugs that target the immune system are classified as immunomodulators. These are the most popular class of drugs, as they prevent overreaction of the immune system, which causes acute respiratory distress syndrome and may require COVID-19 patients to be put on a ventilator. The broad categories of drugs in this class include corticosteroids: prednisone, methylprednisolone and hydrocortisone, and WHO recommends the use of systemic corticosteroids for severe COVID-19. Interferon alpha and beta, and Interleukin-1 and Interleukin-6 inhibitors including sarilumab, tocilizumab and siltuximab have been evaluated in patients with COVID-19 and systemic inflammation.

Class 5: Supplemental therapies

This class includes antimalarial drugs, antithrombotic therapies, concomitant medications and vitamin supplements. Drugs include apilimod, which can safely treat autoimmune diseases and follicular lymphoma. A COVID-19 trial was initiated in July 2021, and the drug has shown efficacy in preventing the coronavirus from entering cells; the FDA has granted it fast-track status to ramp up development. Noviricid Phase II and III clinical trials in COVID-19 patients were initiated in October 2021. Chloroquine and hydroxychloroquine are antimalarial drugs used to treat COVID-19 and fall into two categories: those that target the viral replication cycle and those that aim to control the symptoms of the disease. Amino quinolones chloroquine and hydroxychloroquine are polymerase inhibitors classically used as anti-malarial medications. Ivermectin is a lipophilic macrolide used as a broad-spectrum anti-parasitic drug, which when directed against COVID-19, works by binding and destabilising cell-transport proteins used to enter the nucleus.

Conclusion

As the COVID-19 pandemic rages on, all healthcare workers, pharma companies and clinical research organisations are likely to continue to assess pertinent factors of the drugs and the clinical trial landscape in an effort to inform national and global COVID-19 response efforts. At the same time, scientists must continue to identify opportunities for readying the clinical development environment for greater patient impact in the context of public health emergencies.

We need to adapt to a range of demand scenarios, and governments, distributors, manufacturers, regulators and other stakeholders should build contingency plans to react and adapt successfully while ensuring that manufacturing is flexible. We believe they should also take a long-term view of each drug candidate in the pipeline and consider how decisions taken today could shape their relevance in the post-pandemic world, especially given that a likely scenario is COVID-19 becoming endemic to some countries.

How Acuity Knowledge Partners can help

Leveraging nearly two decades of experience in analysing historical information and projecting trends, we help clients, including life sciences and healthcare consulting firms, build and strengthen their strategies and business.

We also provide bespoke research support on therapy area assessment, indication prioritisation, market research and forecasting, M&A and due diligence and competitive intelligence.

For more information on our capabilities, please visit our Life sciences solutions page.

Sources:

Global COVID-19 Therapeutics Market Size Now Expected To Exceed $25 Billion In 2030 (prnewswire.com)

COVID-19 Treatment Market Trends Analysis Report, 2020-2027 (grandviewresearch.com)

Lopinavir/Ritonavir and Other HIV Protease Inhibitors | COVID-19 Treatment Guidelines (nih.gov)

New antiviral drugs mark a big turning point in the covid-19 pandemic | The Economist

15 drugs being tested to treat COVID-19 and how they would work (nature.com)

Coronavirus Treatment Drugs Market by 2020 Trends Progresses for Huge Profits at US$ 49,204 Million by Global Demand to 2027 | Coherent Market Insights | Medgadget

Coronavirus disease (COVID-19) (who.int)

Coronavirus Disease 2019 (COVID-19) | CDC

A living WHO guideline on drugs to prevent covid-19 | The BMJ

COVID‐19 diagnosis and management: a comprehensive review – Pascarella – 2020 – Journal of Internal Medicine – Wiley Online Library

Coronavirus’ business impact: Evolving perspective | McKinsey

FDA Combating COVID-19 With Therapeutics

Tags:

What's your view?

About the Author

Shweta Gupta has ~16 years of experience in research, consulting and advisory services. She is currently part of Acuity’s strategy research and consulting team, with experience in secondary research, business, and corporate strategy, thought leadership and competitive intelligence and benchmarking.

Prior to joining Acuity Knowledge Partners, Shweta Gupta worked with companies in the consulting, telecom and research analytics domains, where she was largely responsible for strategic research, corporate strategy, landscape study, market sizing, market entry and growth strategy, operating models, business models, opportunity analysis, company and product profiling and supplier identification.

Like the way we think?

Next time we post something new, we'll send it to your inbox