Published on June 25, 2021 by Nachiketa Trivedi

A narrative of increasing demand and limited resources

Growth of due diligence:

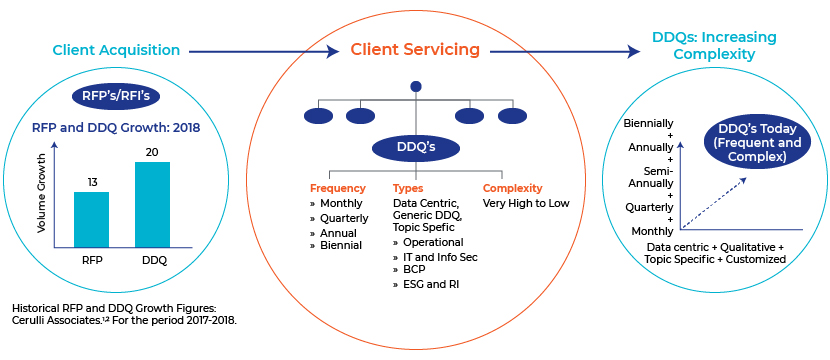

“Clients are conducting more operational due diligence before they invest” said respondents to a Cerulli Associates survey1 of asset managers based in Europe (including UK). The survey also found that from 2017 to 2018, the number of Due Diligence Questionnaires (DDQs) grew by 20% while in the same period the growth in Requests for Proposal (RFPs) lagged that of DDQ’s and stood at 13%.2 Due diligence generally follows the initial RFP rounds and is conducted before clients fund a mandate, it is also conducted on an annual or more frequent basis thereafter. Respondents to the survey also believed this trend of increasing due diligence will continue2. Indeed, DDQ asset management equests now account for a significant proportion of the queries handled by an asset manager’s RFP team. In addition to the volume of DDQs their complexity is also increasing. They are becoming more topic-specific, focused on areas such as Operations, IT and Information Security, Business Continuity, ESG and Diversity and Inclusion. With this increase in complexity asset managers are increasingly driven to provide more detailed and tailored responses to DDQ’s which till now was more typical for a RFP rather than for a DDQ. What we are seeing now is a paradigm shift towards more technically demanding due diligence in asset management, driven by regulatory pressure and investor scrutiny.

Increasing demand – “Clients are conducting more operational due diligence before they invest” – Cerulli Associates survey

Does due diligence matter?

What is driving this increase in volume and complexity? To first understand the utility of due diligence better, let us consider the series of credit events that rocked India’s asset management industry from 2018 to 2020. The industry was buffeted by wave after wave of adverse credit and liquidity events, not of the same cataclysmic scale as that of the global financial crisis of 2007-08, but enough to cause premier Indian fund houses and Indian arms of prestigious foreign fund houses to delay or suspend redemption for some of their schemes. Technically, the schemes had the mandate to take risks and the legal possibility of such events transpiring could not have been be ruled out, but the suspended redemptions and losses severely dented investor confidence and raised serious questions about the policies and procedures of asset management firms related to areas such as collateral monitoring, mark-to-market pricing, loans to promoters and reliance on credit ratings. The question is, can channel partners such as banks and other intermediaries take steps to identify signals of an impending crisis like the one that shook Indian asset management companies (AMCs).

We believe they can, and the way out is thorough and effective due diligence in asset management, which helps uncover operational risks before they escalate. Due diligence helps investors, distributors and other intermediaries scrutinise investment management and operational processes and practices of AMCs to reveal gaps and deficiencies. It allows for the setting up of a feedback and dialogue mechanism that benefits all stakeholders and serves as an early warning system with the potential to contain and mitigate risk. Due diligence also helps an investor or intermediary gauge an asset managers response to new investing trends, like ESG/Responsible Investing, and changes in industry operating models like the planned phasing out of LIBOR.

The due-diligence process:

Due diligence almost compulsorily consists of a questionnaire for a AMCs to respond to, but, based on the perceived level of risk and criticality of services offered, may also involve onsite visits. Regardless of the format, the quality of response to a DDQ is key, as they most frequently form the basis of onsite meetings and further scrutiny. It is no surprise then that today handling the complexity and the number of due diligence requests has become as specialised and, in some cases, more daunting a task than handling RFPs for new business.

A typical due-diligence questionnaire:

Almost all standard asset management due diligence questionnaires have sections dedicated to research and investment processes and practices at AMCs. Legacy of research, robustness of investment processes, reliance on external research and credit ratings, changes to investment process in response to key events, propriety tools and application of technology in management of assets are all areas that are closely scrutinised. Another area of focus is the structure and functioning of the investment management department. The line of questioning here includes areas such as the number of investment professionals, investment personnel turnover, compensation structure including clawback provisions, personal investments in products/investment strategies and time devoted to research. In addition to queries related to research and investments, clients are also keen on understanding AMCs’ support and operational infrastructure.

Topic-specific due diligence:

Thorough due diligence of support and operational functions has become such a key aspect of due diligence that, in many cases it entails completing separate questionnaires on operational processes such as securities and derivatives pricing and support, mark-to-market pricing mechanisms, trade support and settlement, administration and reconciliation functions, calculation of NAV, the extent of straight-through processing and automation, and the resilience of the IT framework supporting these functions, along with information security measures in place. Adding to this paperwork is the rising trend of separate ESG/ Responsible Investing and Diversity and Inclusion questionnaires. Albeit not as significant as ESG, we are also observing an increasing number of event specific due diligence questionnaires for example questionnaires focused on the COVID -19 pandemic and LIBOR transition.

While clients look closely at all these areas, what is not lost on them is the paramount importance of internal governance and control structures that act as checks and balances, specifically on front-office functions. Compliance, audit and risk management units – the critical aspects of any AMC’s governance structure – are rigorously assessed for their independence to act and take corrective action, the effectiveness and relevance of their control processes and their reporting lines to board committees and the board itself. An AMC’s ability to interpret and act on new regulations while maintaining adherence to existing regulations is also looked at closely.

Limited RFP/DDQ resources – “Almost all the managers that Cerulli spoke to said budget constraints had meant headcount had been stable”3 – Cerulli Associates survey

Acuity Knowledge Partners’ (Acuity’s) Advantage: Rich Experience, Human Capital and a Culture Built on Knowledge Sharing:

It takes a proposal specialist with deep knowledge of all the key functions of an AMC to effectively handle a detailed due diligence request that can withstand the most rigorous of client reviews. We at Acuity Knowledge Partners have been handling complex and thorough DDQ’s for over two decades and have specialists who understand and respond to these not only in the letter but also in the spirit. Our interpretation of client queries stems from a deep understanding of the core investment and ancillary functions of an AMC that has been built over the years through training, discussions and knowledge sharing among teams working for different clients across geographies. We critically analyse scenarios such as the liquidity crisis in the aftermath of the COVID-19 pandemic, debt-market events in India and the global financial crisis of 2008. We clinically dissect these events; evaluate their impact on front, middle and back-office functions; look at how client concerns shift in the face of these events; and brainstorm on the most appropriate and optimal response structures to best position our clients. We then record and disseminate these as best practices across our various teams.

Leveraging technology: With RFP team expansions remaining constrained, asset managers are looking to employ smart technological solutions to enhance efficiency. At Acuity, we train our staff on the latest tools, including those employing artificial intelligence.

Consultative client engagement: Over the years, this culture of active pursuit of knowledge and being on top of technological change driving our business has helped us engage with our clients not only collaboratively but also consultatively to adopt time-tested best practices in investment communication. We help our clients position themselves the best, while we, in turn, learn from them and grow.

Sources

1https://portfolio-adviser.com/esg-adds-to-paperwork-already-swamping-due-diligence-teams/

3https://portfolio-adviser.com/esg-adds-to-paperwork-already-swamping-due-diligence-teams/

What's your view?

About the Author

Nachiketa Trivedi is a senior RFP writer at Acuity Knowledge Partners with over six years of experience in asset management and information technology. Nachiketa, who joined Acuity Knowledge Partners in June 2017, has worked across various asset classes. Prior to joining Acuity Knowledge Partners, he was with Invesco Asset Management where coordinated and completed RFIs/RFPs/DDQs for institutional and retail clients based in Asia (ex-Japan, ex-Australia). Prior to that, Nachiketa worked for Infosys in its banking platform Finacle as an Associate Consultant responsible for presales and business development activities. Nachiketa holds a Masters in Business Administration and a Bachelors in Technology (Civil Engineering).

Like the way we think?

Next time we post something new, we'll send it to your inbox