Published on April 4, 2022 by Mahesh Agrawal

“I view diversification not only as a survival strategy but as an aggressive strategy, because the next windfall might come from a surprising place” – Peter Bernstein, economist and author

In hindsight, however, it is easy to concentrate only on returns from the US equity markets in recent years and ignore the unnecessary diversification through gold that generated moderate returns at best and provides no cash flow. Nevertheless, in the longer term, gold not only offers competitive returns, but also brings stability to a portfolio, making gold an ideal diversification candidate. For example, gold offered significantly higher returns than US equity over the first decade of this century, although it could not keep up with equities over the next decade. For investors in Europe or Japan, gold has consistently generated superior returns compared to equities or debt over the past two decades, and a diversified portfolio performed better than a concentrated portfolio on risk-adjusted return parameters. We believe the possibility of the US equity markets consolidating again around the current levels or even falling cannot be ignored completely, and a holistic approach to portfolio optimisation could be the best strategy going forward.

In this article, we analyse portfolio returns and a risk matrix of different portfolios with the three main asset classes – equity, debt and gold. Equity provides growth, debt provides safety and gold offers a mix of growth and safety given ever-increasing demand for it amid limited supply, its high correlation with inflation and its low cost of storage.

Data and methodology

For our analysis, we mainly considered three asset classes – equity, debt and gold – considering their liquidity. We also considered three different geographies (the US, Europe and Japan), in order to reach a broader conclusion, as one asset class may have performed exceptionally well for investors in one region but may fail to generate equally good returns in other geographies. For equity and debt, we considered the total return index to account for dividends and interest; for gold, we used spot gold prices. The data starts from 2000 and ends in 2021, considering the availability of data and keeping the analysis in line with current trends. For different portfolios, we considered that equity and debt could constitute up to 100% of the portfolio; however, gold allocation is capped at 25% given the size of the market. The portfolio is rebalanced at the start of every year to maintain the weight of each asset class at a constant level. To calculate the Sharpe ratio, we used the two-year government yield as the risk-free interest rate for the respective countries.

Diversification – returns correlation

“Diversification is a safety factor that is essential because we should be humble enough to admit we can be wrong” – John Templeton, founder of the Templeton Growth Fund

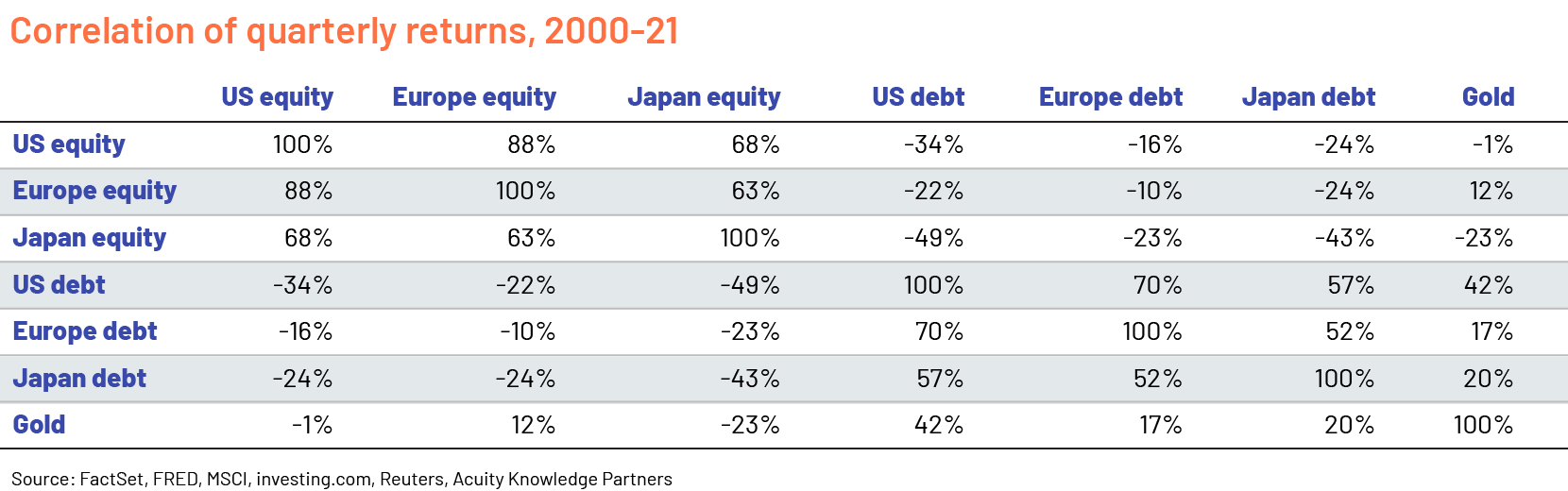

The primary objective of using different asset classes in a portfolio is to diversify the portfolio and protect it against unwarranted shocks in one sector. The correlation matrix shows that returns from all three equity indices share a high correlation while equities’ correlation with gold is relatively low, indicating that diversification will likely reduce volatility of the overall portfolio if gold is included. Debt shows a negative correlation with equities and a positive relationship with gold (although not a very strong one), as high interest rates affect economic growth and push more investments towards safe assets. Hence, we believe a mix of the three asset classes in a portfolio stabilises returns during good or bad times.

Portfolio scenario analysis

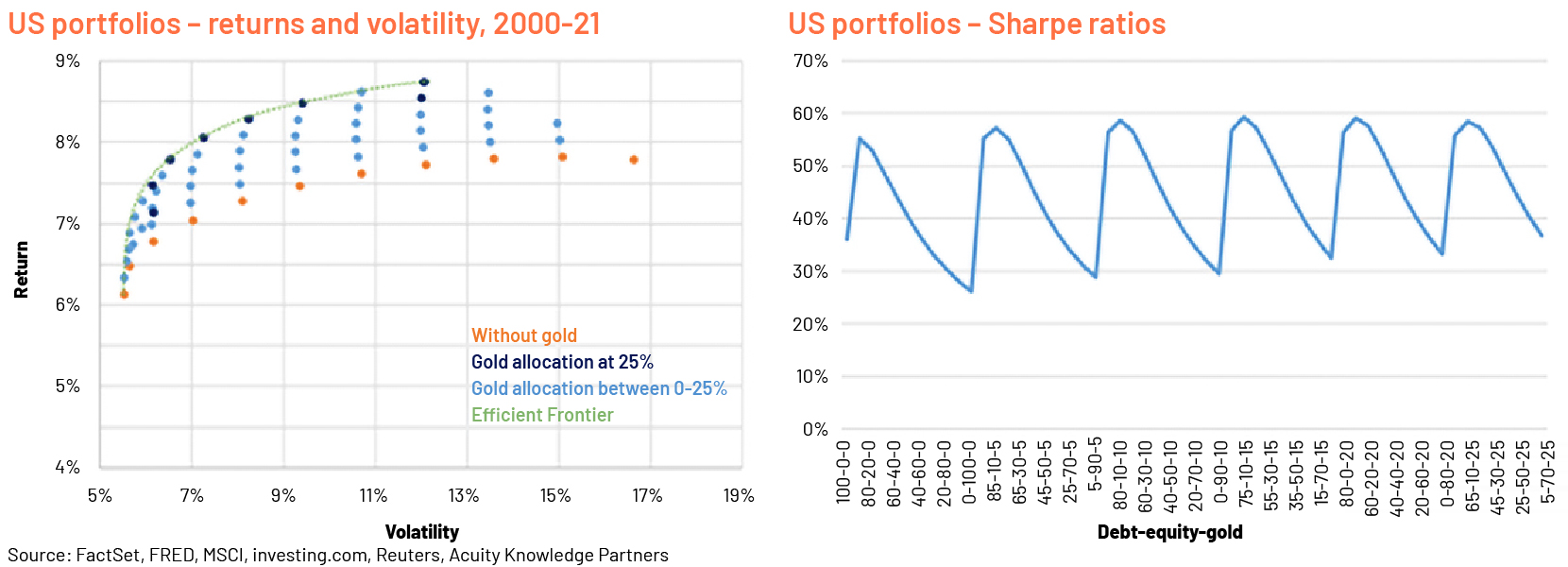

US: For our analysis, we considered a number of portfolios with different combinations of the three asset classes; the results on some parameters are presented in the charts below. In the first chart, each dot represents a different portfolio with a mix of the three asset classes. Orange dots show portfolios with no gold allocation, and the dark blue dots show portfolios with the highest gold allocation at 25%. As the charts show, portfolios with gold have outperformed equity-concentrated portfolios while keeping overall volatility low. Debt-heavy portfolios have low volatility but their returns are moderate at best. On the risk-adjusted parameters, portfolios with 5-10% in gold, 20-30% in equity and the rest in debt appear to generate higher Sharpe ratios.

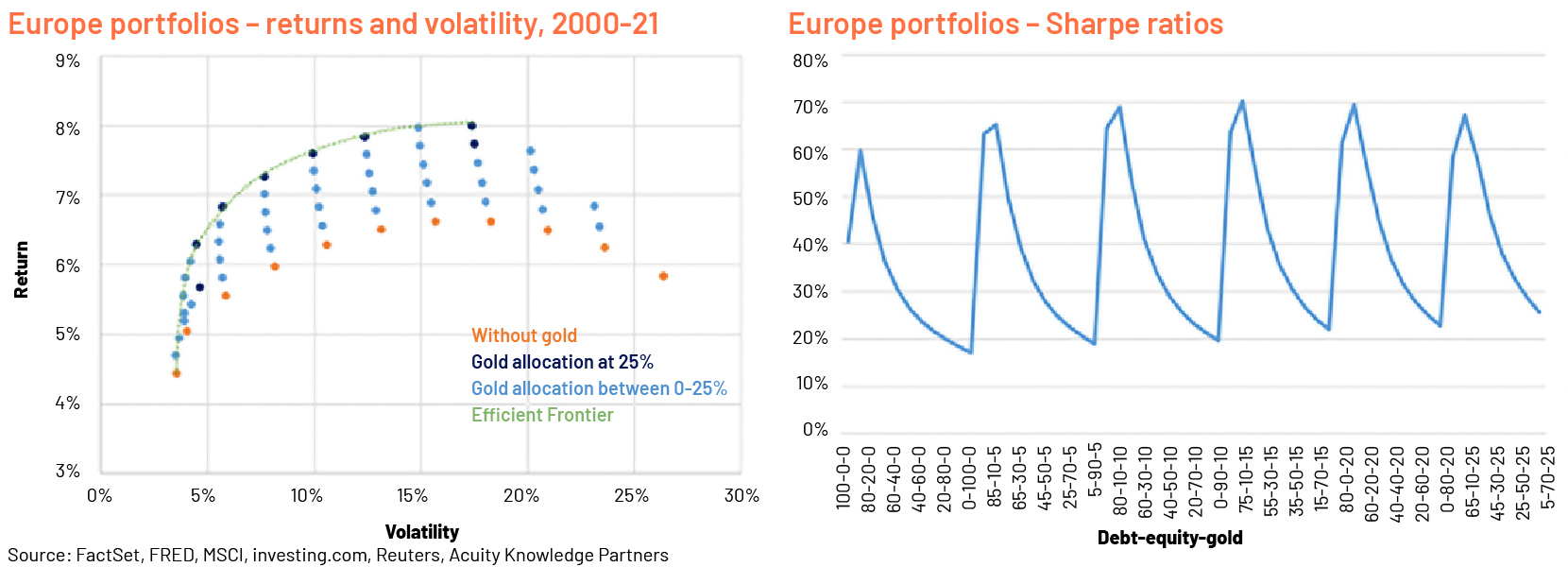

Europe: Portfolios with gold at the maximum cap have outperformed other portfolios with higher returns and lower volatility. On risk-adjusted parameters, Sharpe ratios appear to be high for portfolios with 10-20% in gold, 10-20% in equity and the rest in debt. The efficient frontier includes portfolios with up to 25% in gold as the optimum asset allocation.

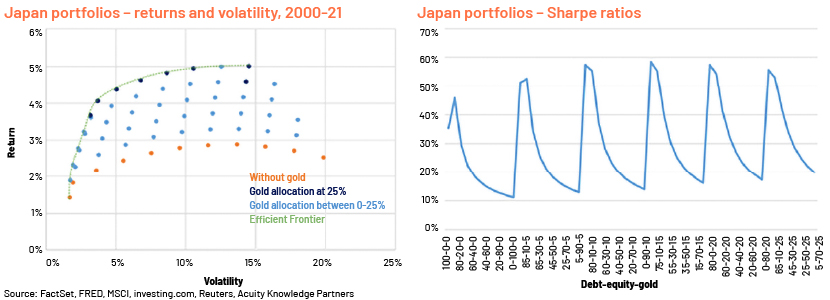

Japan: Portfolios with gold allocation at a maximum of 25% have generated higher returns than have equity- or debt-concentrated portfolios with relatively competitive volatility. On risk-adjusted parameters, the Sharpe ratios suggest optimal asset allocation at around 10-25% in gold, 0-20% in equity and the rest in debt.

Gold vs the broader commodity complex

Over the years, gold has generated far superior returns than has the broader commodity index and remained a preferred investment destination. Although the broader commodity index has appreciated significantly over the years, with the IMF primary commodity index rising from 58.5 at the start of 2000 to 186.8 at the end of 2021[1]. However, owning the broader commodity index has a number of associated costs that weigh on the return on investment, making it relatively unattractive. We list below some of the advantages gold offers over the broader commodity index in terms of portfolio diversification:

-

Low cost of physical storage – gold is a high-value investment; therefore, its storage costs are much lower than those of other commodities that need large spaces to store very large investments. At USD2,000/oz, a USD1bn investment would buy only around 15.6 tonnes of gold but around 100,000 tonnes of copper at USD10,000/t; far more would be required to store other metals or agri commodities. One possible solution is to invest in commodities using futures (such as on the Reuters CRB Index or the Bloomberg Commodities Index), where commodities need not be physically stored; however, the rolling cost (premium + transaction cost) at the expiry of contracts is usually very high and drags down overall returns significantly.

-

Diversification – industrial commodities, including metals, energy and agri, share a direct relationship with economic growth and usually move in line with equities. Investors looking to diversify their assets may find portfolios less diversified even after including the broader commodity index. On the other hand, gold has a negative correlation with equities due to its safe-haven appeal and helps investors in the optimal diversification of portfolios.

Long-term fundamentals remain supportive of gold

Gold has performed well in diversifying portfolios since the start of the century, and we believe it will continue doing so for the foreseeable future. Some key factors we believe will support gold prices over the next decade are as follows:

-

Hedge against inflation – with key interest rates at ultra-low levels, inflation has been spiking, likely to drive higher investments in gold that acts as a hedge against inflation, especially during periods of high inflation. As the value of fiat currencies falls sharply, investors turn to safe-haven assets such as gold to protect the purchasing power of investments.

-

Geopolitical risks – a number of countries, especially Russia and Ukraine, the Middle East and the countries involved in the South China Sea dispute, face growing geopolitical risks. Governments, central banks and investors tend to prefer gold during uncertain times. Any short-term escalation in geopolitical risks, such as that in recent weeks relating to Russia and Ukraine, could push demand for gold significantly higher and generate a good return for investors in the metal.

-

Limited supplies – gold mining production increased at a moderate CAGR of around 2.2% per year over the past decade to around 3,561 tonnes in 2021[2]. Gold mining is a profitable business but not very lucrative, limiting its appeal to attract substantial investments in the immediate term. Additionally, labour issues in gold mining and depleting reserves make it difficult to increase production significantly in the long term.

-

Availability of investment vehicles – investment in gold has historically been via purchasing jewellery, especially in Asian countries such as China and India, largely on account of the ease of transaction; however, this has added to the cost of gold procurement (fabrication charges and adulteration) and reduced the realised rate of return for investors in the short to medium term. However, with new investment vehicles (such as ETFs or gold bonds) increasingly available to retail investors, investment in gold is likely to remain strong over the next decade.

Conclusion

Managing risks and generating high returns are the two basic principles of Portfolio analytics and reporting. While equity is generally considered to be a growth asset, having generated significant returns for US investors in recent years, the story is not the same for all geographies. Furthermore, amid uncertainty, such as during the global financial crisis of 2007/08, the pandemic and Russia-Ukraine tensions, equity has made portfolios highly volatile and risky. On the other hand, debt keeps portfolios steady but offers very moderate returns at best, likely not more than the rate of inflation. Gold can be a worthwhile addition, bringing growth and stabilising returns. Portfolios with allocation to gold performed better on risk-adjusted parameters in all three geographies in our study, highlighting the importance of Portfolio Analytics and Reporting in identifying optimal asset allocations. We believe gold will remain an ideal way to diversify portfolios over the longer term.

How Acuity Knowledge Partners can help

We provide market research on industries, economies and commodities. We have a firm grasp of macroeconomic and market concepts, and expertise in technical and quantitative analysis to provide in-depth market insight on relevant topics. We help clients manage increasing demand on their teams by providing customised managed-services solutions, based on specialised skills and technology, and by delivering operational efficiency, resilience and significant cost savings.Portfolio analytics and reporting.

Sources:

https://www.imf.org/en/Research/commodity-prices

https://www.investopedia.com/terms/s/sharperatio.asp

https://www.investopedia.com/articles/basics/09/simplified-measuring-interpreting-volatility.asp

https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/efficient-frontier/

Tags:

What's your view?

About the Author

Mahesh has over 14 years of experience in commodity and macroeconomic research and has been associated with Acuity Knowledge Partners (Acuity) since September 2012. At Acuity, he supports a leading European investment bank’s commodity research desk in analysing commodity markets, preparing research notes and creating presentations for conferences and client interactions. Mahesh holds a master’s degree in Science (Energy Trading) from the University of Petroleum and Energy Studies, Gurugram, and a Bachelor of Science from Bikaner University, Bikaner.

Like the way we think?

Next time we post something new, we'll send it to your inbox