Published on July 22, 2020 by Jeetendra Prakash, CFA

-

We believe the COVID-19 pandemic will act as a catalyst for oil demand plateauing before 2030, with governments having provided incentives for electric-vehicle (EV) adoption as part of fiscal stimulus. This comes against the backdrop of lower oil demand due to the global working-from-home and lockdown measures.

-

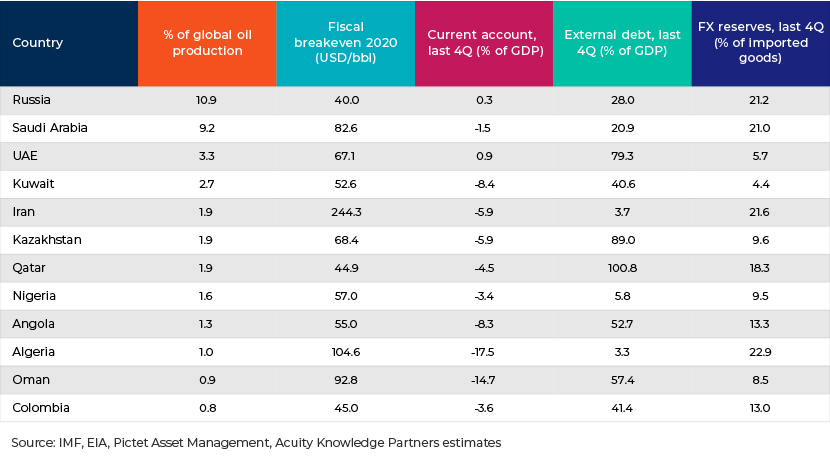

On the supply side, the Organization of Petroleum Exporting Countries and its allies (OPEC+) are treading cautiously by keeping oil prices low enough to keep US shale out of the market but fighting for market share among themselves. Consequently, marginal shale producers and countries with high fiscal breakeven oil prices remain at risk of financial distress.

-

Weak demand and reluctance to scale back production for prolonged periods of time would keep oil prices below USD50/barrel until end-2021 at least.

In the first quarter of 2020, crude oil prices were showing signs of weakness against a backdrop of slowing global growth, the consistent threat of EVs capturing market share and increasing fear of a trade war between the US and China. However, the COVID-19 pandemic and the spat between Saudi Arabia and Russia were the death knell for oil prices: WTI futures contracts started trading in negative territory. While this is a one-off case, we take a closer look at the prevailing demand-supply (im)-balance in the oil market to understand the implications for asset managers.

Demand curve – All downhill after a strong December 2019

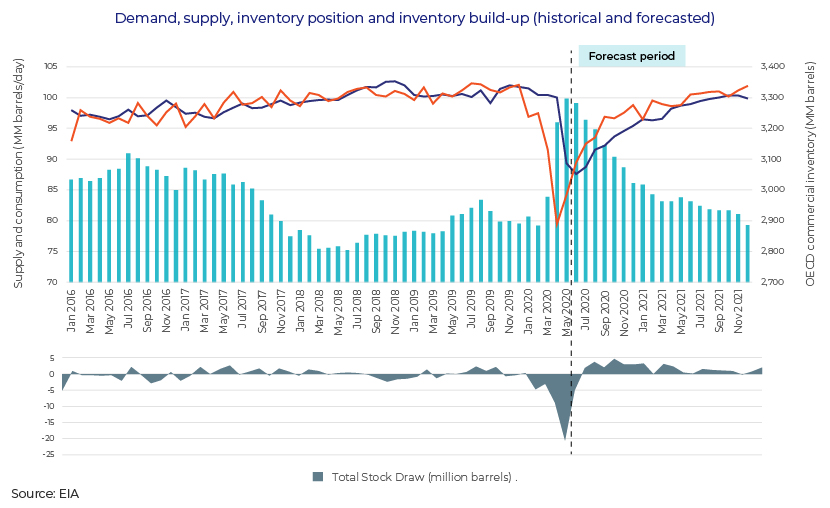

December 2019 was one of the stronger months before the pandemic started to reduce demand, first in China and then in the rest of the world. Transportation fuel was the biggest drag, and by April 2020, demand had fallen more than 20% compared to December 2019 levels. In a scenario that assumes no second wave of infections, the US Energy Information Administration (EIA) estimates that 2020 demand will be 8% lower y/y and that demand will reach pre-COVID-19 levels only by December 2021. The lack of demand for transportation fuels is the biggest drag on crude oil prices.

Supply curve – Russia calls the shots as OPEC’s role in price cartelisation diminishes

Global crude oil production remained consistent at over 100m barrels/day for about two years until April 2020, driven by strong supply from Russia, the US, Saudi Arabia and other countries.

Despite demand remaining reasonably strong through 2019, a lack of consensus between OPEC+ (mainly between Russia and Saudi Arabia) ensured the market stayed oversupplied. It was only in May 2020 that Saudi Arabia and Russia scaled back production. Months of oversupply had pushed inventory to levels never seen before. Nations that are part of the Organisation for Economic Co-operation and Development (OECD) have 129 days of forward inventory in stock, ca. 35% higher than the five-year average, as per the June 2020 OPEC report. With the May 2020 production cut, however, the market has moved back to a deficit, and inventory levels should return to pre-COVID-19 levels only sometime in 2022 the earliest.

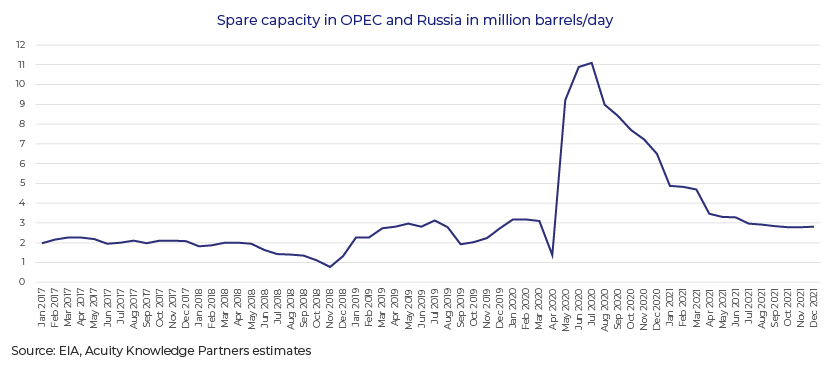

Spare capacity: It must be noted that despite the COVID-19 impact on demand being clear since January 2020, Saudi Arabia and Russia continued to flood the market. It was only after the (in) famous negative crude oil prices that these countries scaled back on output. Most oil-producing nations will, therefore, likely be engaged in a balancing act over the next few years. For instance, they (especially Saudi Arabia and Russia) would ensure supply is restricted to levels where oil prices do not become lucrative for shale producers (above USD50/barrel). Given the prevailing crude oil prices, the North American oil and gas (O&G) sector posted 23 bankruptcies (c.15% of total bankruptcies) in 1H 2020, and the sector remains one of the most vulnerable; the number of bankruptcies is likely to increase further by the end of the year.

On the other hand, OPEC+ would also ensure they maintain market share and capitalise on any short-term spike in oil prices since most countries are operating well short of their fiscal breakeven prices. While there is considerable disparity in the forex reserves held by oil producers, some of the larger producers have deeper pockets that can help them withstand low prices for longer

How Acuity Knowledge Partners can help

Over the years, we have built a pool of sector experts to support clients in preparing sector outlooks and sector primers. We also conduct industry research in conjunction with sovereign analysis to measure the impact of market developments on sovereign health.

Sources

EIA website

OPEC website

IMF

What's your view?

About the Author

Jeetendra Prakash has close to 15 years of work experience in investment research, with a focus on oil and gas and real estate. He currently supports a large US-based hedge fund. The process involves credit research of high-yield and investment grade credits for different strategies. In addition, he is also actively involved in training and quality control of deliverables. He holds an MBA and is also a CFA charter holder.

Like the way we think?

Next time we post something new, we'll send it to your inbox