Published on April 8, 2024 by Gaurav Sharma , Akshay Gupta and Surbhi Joshi

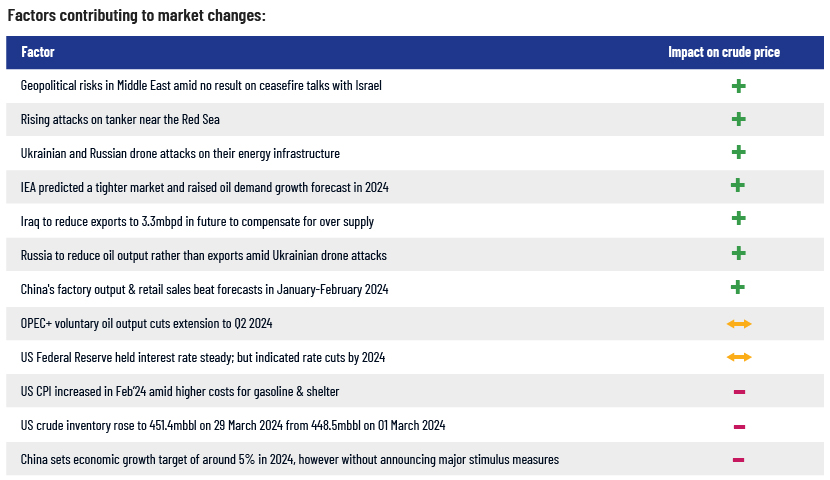

Oil prices rose 4.0% m/m in March 2024, a third consecutive quarterly rise, maintaining the bullish nature of the oil market amid prevailing geopolitical risks. Houthi attacks in the Red Sea and Ukrainian and Russian attacks on each other’s energy infrastructures were the major concerns in March 2024. Demand from China and the US was vague, due to the lack of major stimulus packages from the Chinese government to reach its 5% y/y 2024 GDP growth target and sticky inflation in the US, which delayed rate cuts.

Monthly oil market snapshot – March 2024

Industry analysis for March

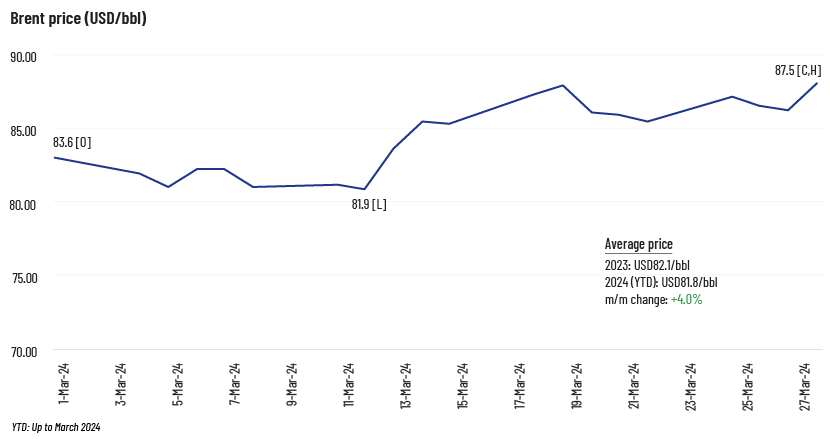

Brent price in March 2024 recorded a 4.0% m/m gain. Brent opened at USD83.6/bbl, reached an intra-month low of USD81.9/bbl and closed at a five-month high of USD87.5/bbl.

The surge in price was due mainly to tight global supply as a result of escalating conflicts in the Middle East (Israel-Hamas war and Red Sea crisis) and the Russia-Ukraine war. Besides, the IEA’s projection of a tight market in 2024, as well as commitments from Iraq and Russia to cut exports also lifted prices. On the other hand, the extension of OPEC+’s cuts to Q2 2024 had a neutral impact, as it was already priced in by the market. Additionally, China’s demand growth concerns and sticky inflation in the US neutralized the impact.

Industry updates (key M&A/investments/deals in March)

-

Chevron’s USD53bn Hess deal in jeopardy as Exxon and CNOOC merged arbitration claims

-

Ithaca Energy in talks to buy Eni’s UK upstream assets

-

OPEC says the oil industry needs USD11.1tn in upstream investment by 2045

-

BlackRock dismayed by Texas Fund’s decision to divest USD8.5bn in assets

-

Iran signed USD13bn new contracts for the development of oil fields to add 350,000 bpd to daily production

-

Petrobras to invest USD7.5bn in five years in oil and gas exploration offshore Brazil

-

CNOOC, a Mozambique partner, to increase oil and gas investment through offshore exploration deals

Acuity Knowledge Partners’ view

As the risk to global supply surges amid prolonged geopolitical crisis in the Middle East and Eastern Europe, we expect price spike risk to remain in oil market in near-term. The future demand side direction will be driven by any major announcements from China to revive its economy and reduction in Fed interest rates which will tighten the market further amid OPEC+ extended production cuts.

How Acuity Knowledge Partners can help

Our large pool of oil and gas experts is experienced in providing strategic support across the value chain. We have partnered with leading energy companies over the years, working closely with their strategy, business development, market intelligence and M&A teams to provide them the information and analysis necessary to achieve their business objectives.

We also offer our expertise in power, renewables, metals and mining, and ESG and sustainability (https://www.acuitykp.com/solutions/energy-and-utilities/).

Sources:

-

Investing, CME Group, ICE, OP, Offshore Energy, OP#1, OP#2, OP#3, PRN, Live Mint, ET Times, OP#4. Euractiv, Dawn, , Reuters, Reuters, Reuters, ET, EIA, World Oil

What's your view?

About the Authors

Gaurav has close to 14 years of experience working across oil and gas value chain. He has varied experience working on various strategic research projects involving market intelligence, competitive intelligence, market sizing models, industry benchmarking and market entry strategy. At Acuity Knowledge Partners, Gaurav is leading a team to support a major LNG player in various strategic research projects. He holds a MBA degree in Oil and Gas Management from University of Petroleum and Energy Studies and a BE degree in Mechanical.

Akshay Gupta is an energy analyst with over 6 years of work experience in oil and gas domain. At Acuity Knowledge Partners, he has been a consistent member for leading and liasoning various LNG and gas projects. His current interest includes energy market studies and exploring avenues for energy transitioning. He is a post-graduate in Business Management from TERI University.

Surbhi has close to 4 years of experience in oil and gas sector, with a major focus on LNG and upstream. At Acuity Knowledge Partners, she supports a leading LNG player in various strategic research projects involving market intelligence and competitive intelligence. Surbhi holds a MBA degree from University of Petroleum and Energy Studies and also B-tech degree in Chemical engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox