Published on September 30, 2020 by Jarmanjeet Singh

The midstream sector –critical infrastructure in the oil and gas sector, engaged in the transportation of oil and gas products from oilfields to downstream refiners and retailers– has put on a brave face amid the challenging macro conditions resulting from the COVID-19 pandemic and demonstrated remarkable resilience.

Key takeaways

-

The market has recovered strongly since bottoming out in March, but is still in negative territory

-

EBITDA guidance/revisions show the resilience of the midstream business

-

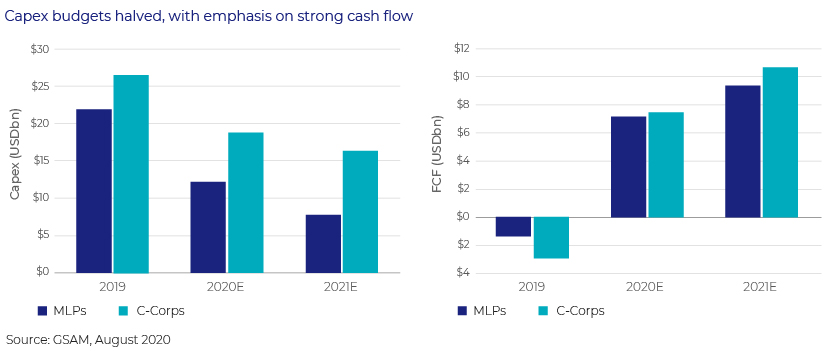

Capex cut is expected to lead to strong cash flow and improved yield

-

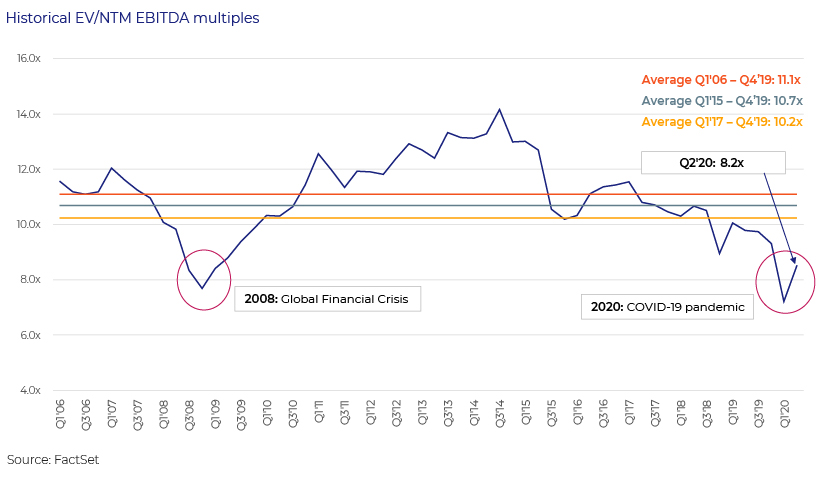

Current valuations are hovering near levels seen during the 2008 global financial crisis

Improvement in demand-supply dynamics has provided the market with a much needed push

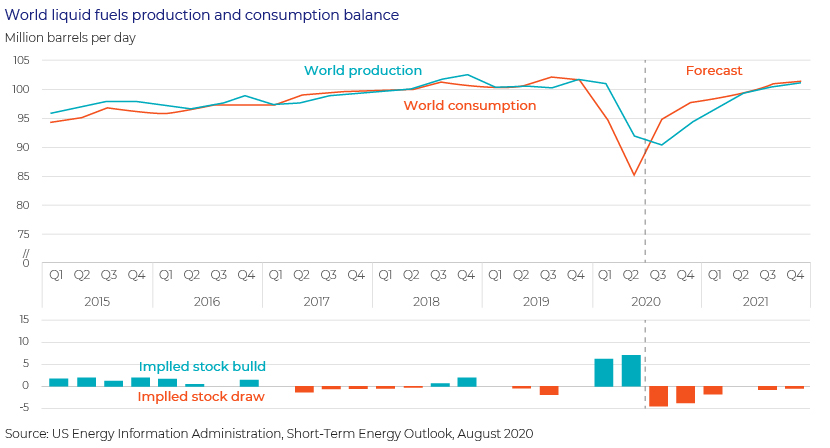

The global lockdown measures in the first half of 2020 triggered the deepest global recession in decades – 2020 global GDP is expected to contract by more than 5%. However, for the energy market, the improvement in demand-supply dynamics following the decline in production by OPEC+ and North America and the gradual opening of economies in Asia, Europeand the US has stopped the free fall of the crude oil price. In fact, the price almost doubled in 2Q – to USD39.27 per barrel at quarter-end from USD20.48 per barrel as of 31 March.

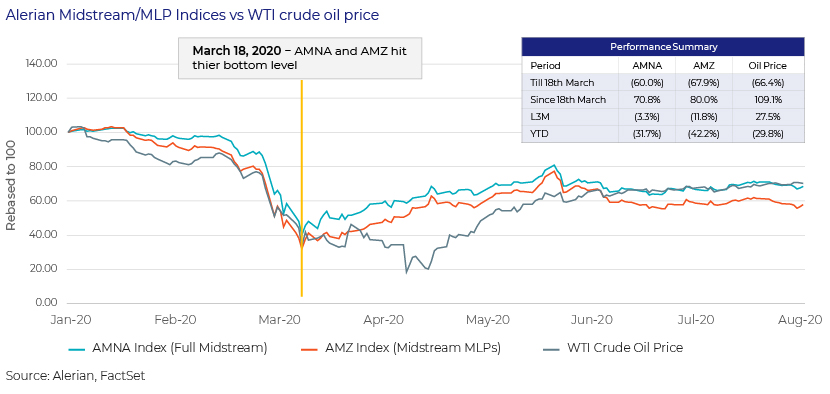

On 18 March 2020, the Alerian Midstream Energy Index (AMNA) and the Alerian MLP Index (AMZ) – the broad-based composites of North American energy infrastructure companies/master limited partnerships (MLPs) – reached their lowest levels as the COVID-19 pandemic and the Saudi Arabia-Russia oil price war proved to be a double whammy for the global energy market. Although the two indices are up by c.70% and 80%, respectively, since 18 March, year-to-date (YTD) performance remains negative at -32% and -42%, respectively

Resilient EBITDA outlook for the midstream business contrasts with the outlook for other energy sectors

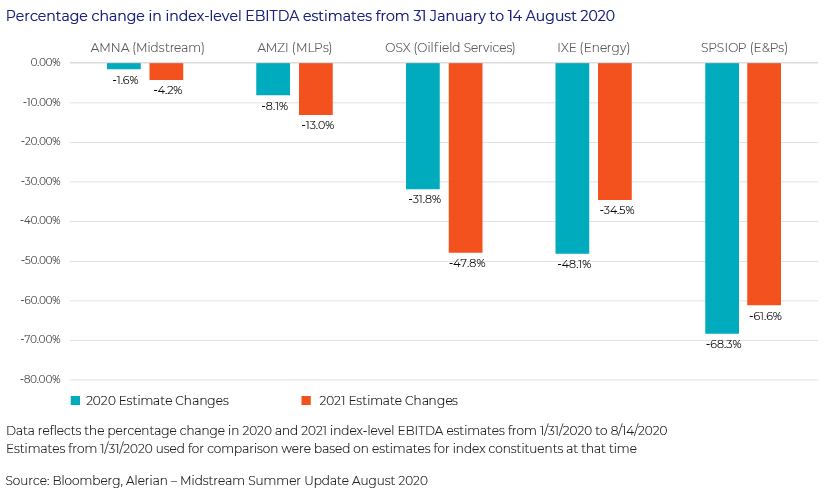

However, stable cash flow due to fee-based business model and contract protections, such as minimum volume commitments accompanied by spending cuts, makes the midstream business more resilient than other energy sectors in these unprecedented times, with demand growing as economic activity restarts across the globe.

Midstream (AMNA) 2020E and 2021E EBITDA estimates had downside revision of ~2% and 4%, respectively between January and mid-August, and the MLPs (AMZ) had downside revision of 8% and 13%. The other energy sectors however saw severe impact on their earnings during these difficult market conditions. This is evident from the latest revision analysis, which implies downside revision of 32% for 2020Eand 48% for 2021E for the Oilfield Service Sector (OSX) Index,downside revision of 48% and 35% for broader energy sector indexIXE, and a downside revision of 68% and 62% for the exploration and production (E&P) companies index SPSIOP

According to Ethan Bellamy, managing director of East Daley Capital Advisors, “the worst is behind us” in the sector (US midstream gas) after gathering and processing-focused companies “performed a lot better than feared” (in 2Q2020). Gabriel Moreen, managing director of Mizuho USA Securities, agreed that “a number of boxes got checked certainly from a volumes standpoint”.

Focus on free cash flow as yields remain elevated with resilient dividend payments

The COVID-19 pandemic has humbled industries across the globe, including the oil and gas sector, and forced a shift in focus to capital discipline from a “growth-at-all-costs” model. As midstream high-grade projects are forced to live within what their cash flow allows, capex will likely continue to decline, and the increased cash flow could be used for de-levering balance sheets and/or for share buybacks.

Despite the headwinds in 2Q2020, payout ratios in 1H2020 were in line with 2018 and 2019 data, indicating the capacity of midstream businesses to afford dividend payments. Dividends for 1Q2020 were announced in April 2020, at a time when the market saw an unmatched collapse in the crude oil price (futures)as the major international oil benchmark – West Texas Intermediate (WTI) –plunged into negative territory. This unprecedented event forced small energy infrastructure companies to hold back their cash to secure their financial flexibility, while large companies that banked on their strong financial positions, diversified asset bases, greater exposure to fee-based activities and contract protections such as minimum volume commitments, managed to weather macro market headwinds.

Attractive valuation: Trading at a discount with high yields and stable cash flow

Although the market has recovered by more than 70-80% since March 2020, when the Alerian Midstream/MLP Indices reached their lowest levels, the YTD change through 28 August 2020 remains in negative territory,not having recovered yet to pre-COVID-19 levels. This has forced the MLP and midstream corporation universe to trade at a discount at an average EV/NTM EBITDA multiple of 8.5x. This is c.17% and 20% lower than the average trading multiples of the past three (2017-2019) and five (2015-2019) years, respectively. Such low valuations were last seen during the 2008 during the global financial crisis.

Even during the last oil price collapse in February 2016, when oil hit a bottom of USD26 per barrel, valuation multiples were 10.0-11.0x – way higher than current trading multiples.

Outlook

While the midstream sector remains attractively valued, we believe the following key factorswill play a pivotal role in pushingmidstream valuation multiples to pre-COVID-19 levels:

Investor appetite: MLP-dedicated products saw net outflow of c.USD3.1bn through August2020, although it had moderated versus that in March and April. Investors are seeking attractive income at a discount.

Strong and stable cash flow: Midstream companies’ average debt is 4.5-5.0x, and their distribution coverage is relatively high at 1.7x. Continued focus on leverage reduction and sustainable payouts.

Stable oil prices: Any further headwinds in the macro energy market would have an adverse impact on the entire energy value chain. Recovery/stability in oil prices is key.

A second wave of COVID-19 infections, bankruptcy of E&P companies and any major shift in public policy, with the US presidential elections due in November, would pose a serious threat to the upside potential of the midstream market.

Acuity Knowledge Partners has years of experience in working with the oil and gas teams of bulge-bracket investment banks and with specialised energy advisors across the globe. Our energy analysts are equipped with the required domain knowledge and in-depth experience to support all aspects of analysis across the energy value chain, i.e., upstream, midstream and downstream, including oilfield services pertaining to M&A, capital markets, restructuring and market research. We have partnered with leading banks, helping them scale up their coverage, while reducing overall costs and timetomarket through access to a large talent pool. For more details on our offerings, visit https://acuitykp.com/solutions/sector-coverage/

Sources:

1. Alerian

2. EIA

3. Bloomberg

4. GSAM US Energy and Infrastructure Monthly Update, August 2020

What's your view?

About the Author

Jarmanjeet Singh has ~15 years of experience supporting various investment banking clients at Acuity Knowledge Partners. In his current role, he is responsible for managing mid-market IB and boutique advisory clients. Jarmanjeet has a keen interest and understanding of Oil & Gas sector and have been regularly working with niche O&G advisors and bankers. He leads teams that work very closely with the senior bankers on live mandates including debt advisory, capital raising and M&A activities. In his prior role at Acuity Knowledge Partners, he worked with a US based bulge bracket investment bank where he led sector teams of EMEA region. Jarmanjeet holds a..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox