Published on September 26, 2024 by Rajshree Sarkar

After an optimistic start to the year, higher interest rates and sticky inflation have dampened investor sentiment, resulting in volatile financing conditions. Consequently, corporate issuers’ profit margins could face headwinds, while their liquidity profiles and credit costs could be stressed given that a large chunk of rated debt falls due in the near term. An even more worrying thought is that most of the rated debt maturing in the near term is held by BBB-rated companies, which lie precariously close to the borderline between “low-risk” investment-grade (IG) and “high-risk” high-yield (HY) status.

Key takeaways

-

Refinancing risk at higher rates, with around USD1tn of BBB debt due through to end-December 2025

-

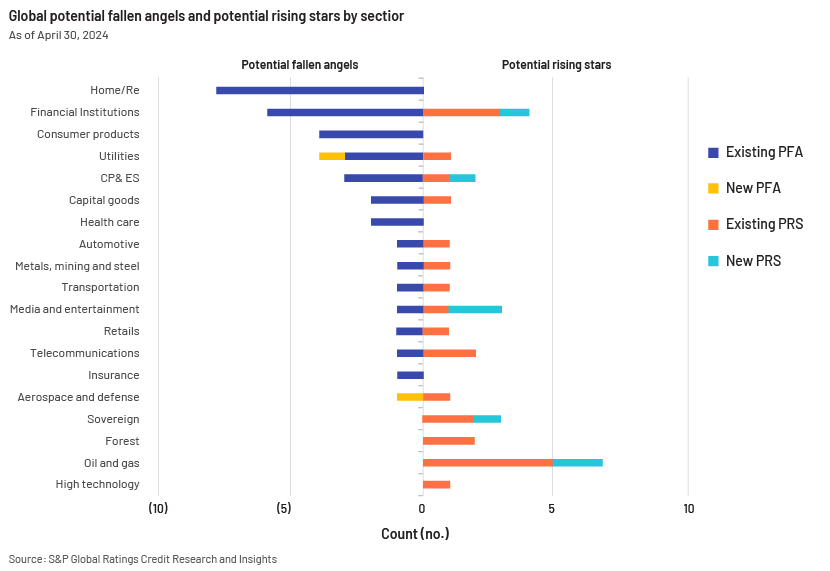

Potential fallen angels (PFAs) continue to outnumber potential rising stars (PRSs). At end-May 2024, S&P had 31 PFAs and 28 PRSs on its radar

-

Sectors at risk: Homebuilders/real estate, office REITs, financial institutions, utilities and chemicals

-

Back to basics: Asset managers would continue to focus on deep-dive credit assessments to identify fundamentally strong/weak BB/BBB issuers that are best positioned to withstand stress scenarios

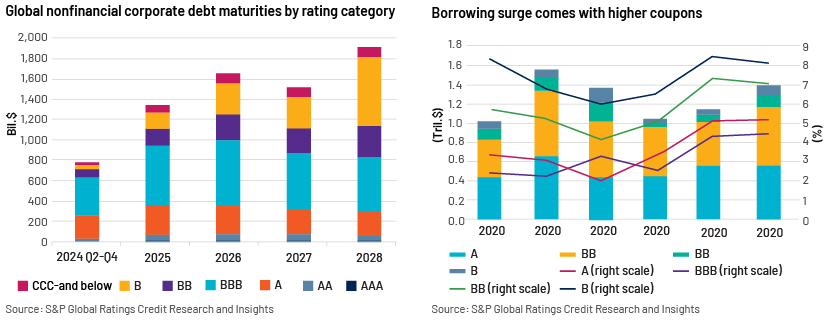

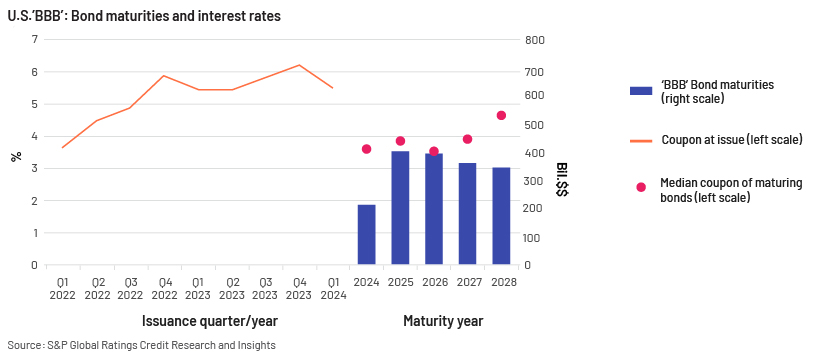

A significant amount of BBB debt falling due in the near term

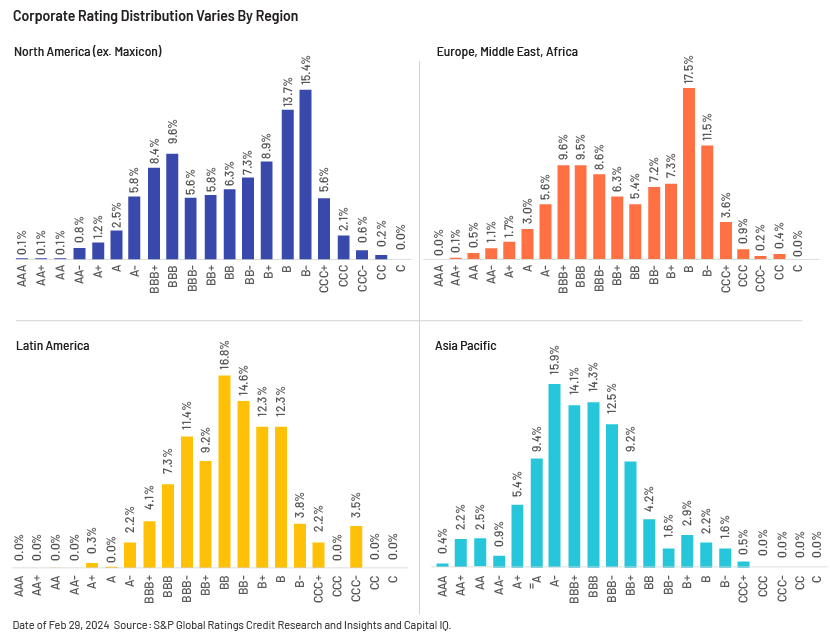

At the beginning of April, global rated debt stood at USD23.7tn, with BBB issuers accounting for the majority share (USD9.1tn or 38.3%). Total rated debt falling due from the start of 2Q24 through to end-December 2025 is USD3.8tn: USD2.1tn of non-financial-sector debt and USD1.7tn of financial-sector debt. Almost USD1tn of the USD2.1tn of non-financial-sector debt falling due through to December 2025 is held by BBB issuers, as illustrated in the chart below. This significant upcoming maturity wall reflects the record issuance and refinancing activity in 2020-21 owing to lower rates, at maturities of five years or more. The large chunk of BBB maturities falling due is a concern. This is because it comes amid a persistently higher interest rate environment, leading to higher borrowing costs, slowing consumer demand and stressed corporate earnings for certain issuers. This is due to a combination of weak post-pandemic credit health and sticky inflationary cost pressures stemming from supply-chain challenges due to escalating geopolitical risk. Although credit spreads are near all-time lows and are contributing to a favourable refinancing environment, current interest rates are notably higher than the lows reached in 2020-21. While refinancing at higher rates, BBB-rated companies could face deteriorating credit metrics in the absence of strong post-pandemic credit health, to the extent of getting downgraded to junk status, which would further increase their borrowing costs or liquidity pressures. BBB bonds in the US maturing later in 2024 could face about a 2pp increase in the cost of funding on the debt that is to be refinanced, while European BBB issuers could face around a 2.3pp increase, according to S&P estimates.

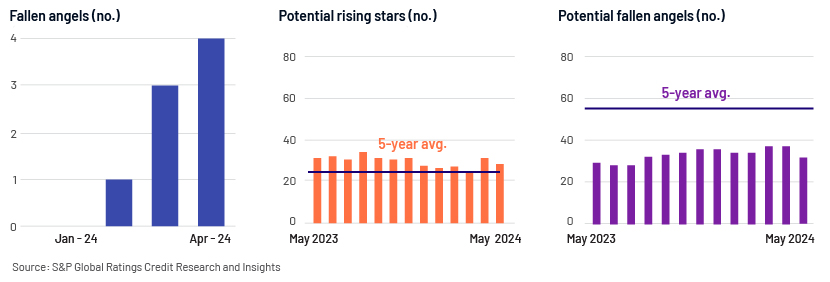

PFAs continue to outnumber PRSs

After a strong start to the year, when the first quarter alone had 10 new rising stars (RSs; defined as issuers upgraded to IG from HY status), there were no new RSs in April and four new RSs in May, taking the YTD total to 14. Fallen angels (FAs: defined as issuers downgraded to HY from IG status) gained momentum, with four new FAs added in April (with a combined total of USD9bn in rated debt affected); this number equalled the total number of FAs in all of 1Q; one new FA was added in May, taking the YTD total to nine. Although actual RSs outnumbered FAs in YTD May 2024, PFAs (defined as BBB- issuers with either negative outlooks or on CreditWatch negative) continued to outnumber PRSs (defined as BB+ issuers with either positive outlooks or on CreditWatch positive). At end-May 2024, S&P had 31 PFAs and 28 PRSs on its radar. The Boeing Company (USD46bn) was added to S&P’s PFAs list in April owing to quality issues and is now the largest PFA in the list.

Most of the FAs downgraded to HY status in YTD May 2024 were large companies with large borrowings and anaemic corporate earnings; these included Paramount Global (USD18bn debt), Braskem S.A. (USD6.2bn) and CPI Property Group S.A. (USD6.3bn). Downward triggers (debt to EBITDA) were also tightened on Charter Communication (USD45bn) in May amid intense competition.

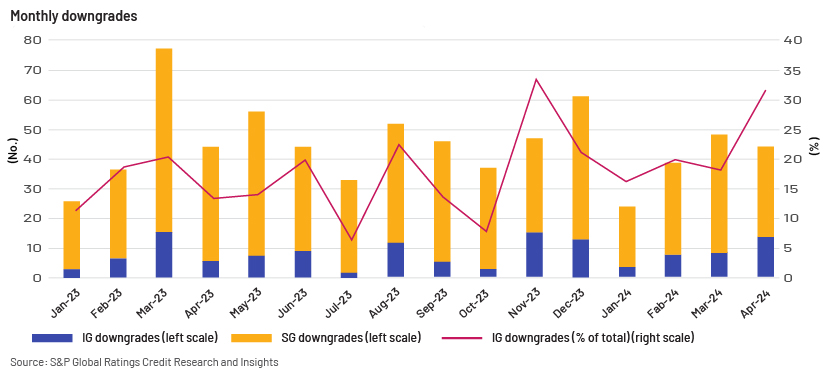

M/m CPI readings in May saw an improvement, indicative of a slowdown in US inflation. The European Central Bank (ECB) took the lead in announcing its first rate cut in five years on 6 June. However, S&P expects the US to make its first rate cut only in December. The pace of global rate cuts is also expected to be much slower than that of rate hikes, keeping borrowing costs elevated in the near term. As inflationary challenges ease, rates reduce and economic growth resumes, the number of PFAs could reduce given that IG issuers have generally exhibited resilience through economic cycles. Nevertheless, higher-for-longer rates and escalating geopolitical tensions could continue to weigh them down for longer, as also evidenced by the number of IG downgrades as a percentage of total downgrades spiking in April.

Sectors and regions most at risk

FAs in April mostly included homebuilder/real estate issuers exposed to China’s property sector. Weak property sales in China dented property developers' liquidity and the balance sheets of local governments, crippling their ability to support local government financing vehicles (LGFVs).

Commercial real estate (CRE), especially office REITs, are facing declining office demand with lower tenant utilisation and retention rates. This is also creating a challenge for smaller banks with sizeable CRE exposure, especially in the US, and a few European banks as well. As a result, US regional banks led with the most 1Q additions to the PFAs list. In Europe, property valuations are declining due to higher rates. As of the week ended 7 June 2024, S&P Global Ratings had seven homebuilding/CRE firms on its PFA radar in the US (2), France (2), Germany (1), Finland (1) and Sweden (1).

Other sectors featuring prominently in the PFAs list are the consumer goods sector in the US and Latin America owing to supply-chain challenges as a result of the conflict in the Middle East; utilities in North America and Europe facing competition; and chemical companies. APAC accounted for the largest share of BBB debt.

A trade-off between risk and return

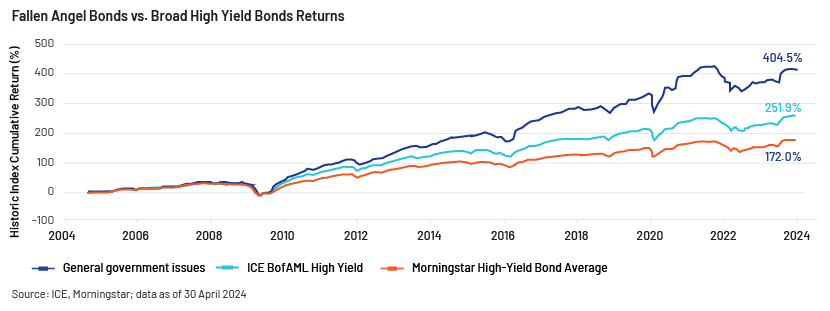

Some central banks have started cutting rates, and others are set to start later this year. Given the higher-for-longer interest rates, investors in FAs and PFAs could opt to “stay put for longer”, going long on maturity and locking in at current higher yields. FAs have historically outperformed compared to the broad HY universe, declining in price prior to being downgraded to HY status and recovering following the downgrade. Systematically investing in these undervalued bonds has generally provided good returns to FA investors.

However, given certain investors’ lower tolerance of risk and that certain funds cannot hold anything below IG, any downgrade of BBB debt investments to junk status could suddenly make investors perceive them as high-risk investments, no longer serving their purpose of minimising risk/diversifying a bond fund. This could call for a compulsive sell-off of FAs at a loss. For this reason, in times of economic uncertainty, we note that lower IG holdings/investments such as BBBs need to be monitored with more caution, despite them having IG characteristics.

How Acuity Knowledge Partners can help

The BBB universe continues to represent the largest rating category of total rated debt globally. Although much of the BBB segment has weathered inflation and higher interest rates over the past two years, there are many BBB companies that entered the post-pandemic era in a weaker position or having suffered significant balance sheet damage as a result of the pandemic. Such companies remain vulnerable to economic uncertainty. A deep-dive bottoms-up approach and detailed credit assessment are imperative for identifying the fundamentally strong BBB investments that are best positioned to withstand the ongoing challenges.

We have two decades of experience in partnering with leading market players across market cycles. Our experience and expertise across fixed income asset classes help us partner with buy- and sell-side institutions and support their research teams to identify and take advantage of dynamic situations.

Sources:

-

Credit Trends: Q2 2024 Global Refinancing Update: Window Of Opportunity May Be Closing

-

Credit Trends: Global Refinancing--Rated Corporate Debt Due Through 2024 Nears $11 Trillion

-

This Week In Credit: Positive Outlooks Spiked | June 3, 2024 (spglobal.com)

-

How Changing Interest Rates Affect Bonds | U.S. Bank (usbank.com)

-

Global Credit Conditions Q2 2024: Between Economic Resilience And Market Exuberance (spglobal.com)

-

How Changing Interest Rates Affect Bonds | U.S. Bank (usbank.com)

-

Investment-Grade Credit Check Q2 2024 | Pressure Points (spglobal.com)

What's your view?

About the Author

Rajshree Sarkar has nine years of work experience in providing fixed income research to buy-side clients. She currently supports an American private equity firm in initiating models and reporting on a multi-sector portfolio. Prior to this, she worked with a special situations investment firm based in New York that invested in distressed debt. She is also actively involved in training and quality control of deliverables. She holds an MSc in Finance.

Like the way we think?

Next time we post something new, we'll send it to your inbox