Published on January 19, 2024 by Tarun Shah

Introduction

Insurtech refers to technologies that increase the efficiency of insurance practices, aiming to boost growth, distribution and customer experiences in the insurance sector. Technology adoption in areas of traditional insurance is helping companies provide solutions and settle claims faster. Digital transformation, led by the adoption of cloud computing, digital applications and artificial intelligence, in the insurance sector is playing a key role in reshaping the global insurance business. The global insurtech market was valued at c.USD5.5bn in 2022 and is expected to be worth c.USD146.4bn by 2030, growing at a CAGR of c.50.8%.

Innovations in the space

-

Predictive analytics and AI: Predictive analytics and AI have had a positive impact on the insurance sector, helping over two-thirds of all insurers reduce claims and underwriting costs. 60% of the insurers urveyed claim that the data collected helped boost sales.

-

Machine learning: Machine learning has improved claims processing by leveraging automation to forecast rates and expenses for policies, with numerous AI and big data analytics algorithms powering end-to-end insurance processes.

-

Digital documentation: The use of optical character recognition (OCR) to recognise hand-written and digital text and swiftly add data to the digital client profile from ID photos and forms has ended the traditional paper trail. Documents can now be electronically checked and declined when they are digitised, analysed and stored on the cloud. Developers are striving to enhance the precision of core machine-learning algorithms for OCR.

-

Automated processing: Automation and access to digital resources enable buyers to explore and buy insurance online, providing convenience, efficiency and personalisation.

-

Field management systems: Field management systems, integrated with insurance companies’ customer relationship management (CRM) systems, help managers track the progress of field teams simultaneously and automatically assign leads based on proximity, availability and the representative’s skill set. Mobile CRM applications help them update their progress on the go, enhancing visibility on the representative’s daily activities.

-

AI for automobile insurance: Insurtech companies are currently developing software to integrate the automobile insurance sector with technology. Quotations are made based on the driver’s driving patterns and behaviour,

-

Drones for home insurance claims: Insurers are deploying drones to ensure a better customer experience, as drones are ideal for property risk assessment, inspection and analysis. Insurance companies are integrating machine learning and AI with drone technology to conduct inspections and rooftop checks.

-

Embedded insurance: Embedded Insurance is a process where insurance policies are bundled in real time and sold at the point of sale of a product or service. The right amount of insurance coverage that a customer should buy and the actual amount of insurance coverage a customer buys differs by USD1.3tn. Embedded insurance would help a customer explore new markets for insurance policies.

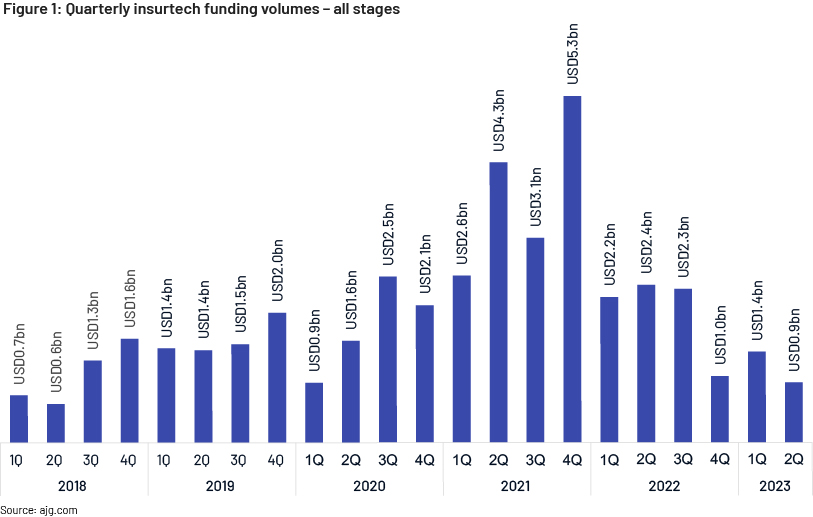

Global insurtech funding stood at USD15.3bn in 2021, with 4Q21 witnessing the highest funding volume since 1Q18. 2022 funding volume decreased by 48.0% y/y to USD8bn. 1Q23 funding increased by 40.0% compared to 4Q22 volume.

Following an increase in funding in 1Q23, global insurtech funding fell by 36.0% q/q in 2Q23 to USD0.9bn. Quarterly insurtech funding slipped below USD1.0b in 2Q23 for the first time since 2Q18. Life and health (L&H) and property and casualty (P&C) insurtech witnessed a drop in funding volume in 2Q23, with L&H insurtech reaching its lowest funding level since 1Q20.

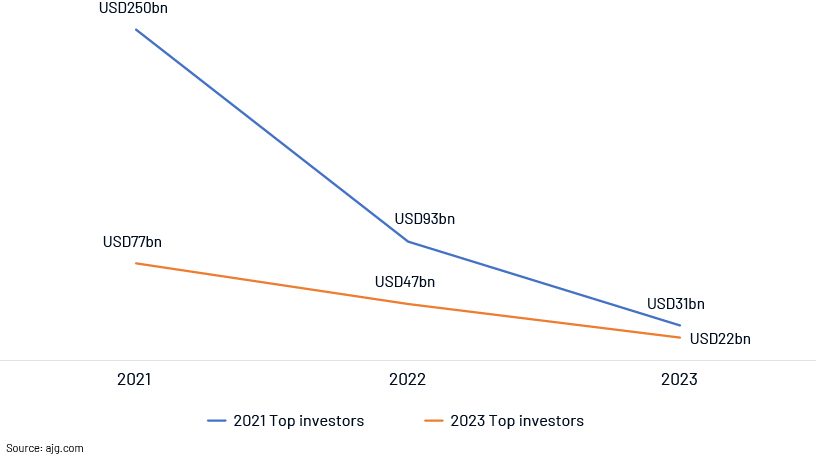

Comparison of the top 40 most tech-active investors (including insurtech) in 2021 and the top 40 tech investors in 2023 (YTD

Total investment by the top 40 investors in the tech sector (not just in insurtech) in 2021 stood at c.USD250bn across 1,628 deals. In 2022, the total investment volume was USD93bn across 1,179 deals; it is USD31bn across 251 deals so far in 2023.

he total insurtech investment volume by the top 40 investors in 2023 stood at USD77bn across 884 deals in 2021, USD47bn across 884 deals in 2022 and USD22bn across 229 deals in 2023.

The most active investors in 2021 have reduced their investments by 12.0% in 2023, while the most active investors in 2022 have reduced their investments by 29.0% in 2023.

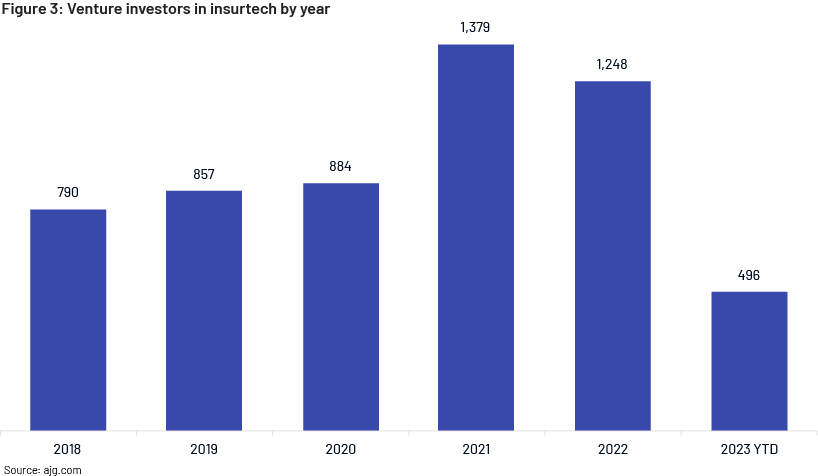

In 2021, when insurtech investment was at its peak, c.1,379 venture capitalists (VCs) invested in insurtech companies. VC investment participation decreased by 9.0%, to only 1,248 VCs investing in the insurtech space in 2022.

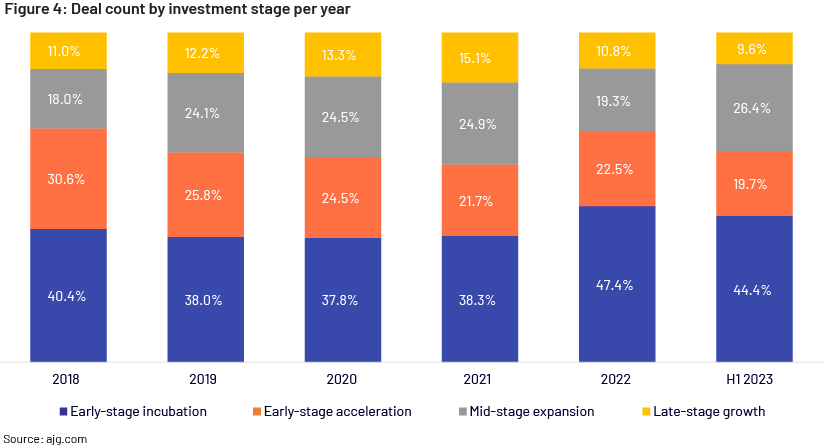

The contribution from early-stage acceleration fell below 20% for the first time since FY18 in 1H23. Early-stage incubation has been the largest contributor to volume since FY18, with late-stage growth the smallest contributor, ranging from 9-15%.

Most active nations in early-stage acceleration insurtech funding (2022 and 2023 YTD)

| Company | Total amount invested (USDm) | Deal flow volume |

| United States | 810.2 | 62 |

| United Kingdom | 358.5 | 12 |

| India | 158.1 | 12 |

| France | 108.1 | 7 |

| Canada | 21.0 | 5 |

| Israel | 36.5 | 5 |

| Netherlands | 50.6 | 4 |

| China | - | 4 |

| Sweden | 31.6 | 3 |

| Germany | 34.5 | 3 |

Source: ajg.com

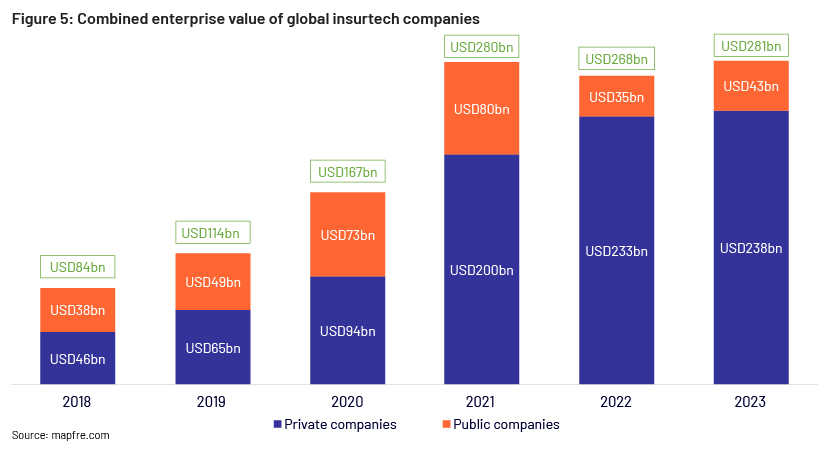

The value of insurtech firms globally stood at USD281bn as of 6 June 2023, with private companies holding an 85% share. The value of private companies grew by 19% from 2021 to 2022 but slowed in 1Q23, .

Pros and cons of implementing insurtech

-

Pros and cons for buyers: By leveraging technology, customers can be provided with easy access to policy information and insurers, and personalised policies. Smooth digital interactions would result in higher customer satisfaction. However, insurtech is still in early stages of development compared to the traditional sources of insurance; geographical coverage and market penetration could, therefore, be challenges for end customers.

-

Pros and cons for agents: Integration of technology with traditional sources of insurance could free up insurers’ time, resulting in increased efficiency and cost benefits. However, to fully leverage the solutions that insurtech can provide, agents would need to be trained. Moreover, most insurtech solutions currently available cater only to end customers, leaving agents with very limited options to leverage.

-

Pros and cons for reinsurers: Collaborating with insurtech companies to leverage cloud-based platforms would benefit reinsurers in the long run. Insurtech companies offer services such as drone-based surveillance that reinsurers could leverage to enhance their capabilities. However, such collaboration could require a significant time commitment due the differences in operating methodologies. Moreover, the privacy and protection services that insurtech companies currently provide are not very reliable – a number of them use blockchain technology to gather credit scores that are shared over several platforms and websites.

Conclusion

Integration of insurtech with traditional insurance depends on the customer’s choice – whether they prefer physical interaction or digital convenience. Traditional insurers could benefit significantly by integrating with insurtech companies, as it would increase their efficiency in several ways such as by enhancing customer relationships and expanding business operations with limited investment. Before such integration, however, insurers would first need to combine company and customer data on a single platform.

How Acuity Knowledge Partners can help

With a talented pool of experts, we serve investment banks focusing on the reinsurance and insurtech sectors, supporting them with in-depth research, analysis, investment decision making and strategy. Our more than two decades of experience in supporting investment banks and expertise in the insurance sector position us well to partner and support their teams in day-to-day workflow.

References:

-

https://www.mapfre.com/media/2023_Insurtech_report_Mundi_MAPFRE_NN-Group_Dealroom.pdf

-

https://www.leadsquared.com/industries/insurance/insurtech-insurance-technology/

-

https://dealroom.co/reports/the-state-of-global-insurtech-2023

Tags:

What's your view?

About the Author

Tarun is an Associate at Knowledge Partners, having more than three years of experience in Investment Banking team. Currently, part of Financial Institutions Group team, with a focus on Insurance sector supporting a Global Investment Bank. He holds a Post Graduate Diploma in Management in Finance and Analytics from JAGSOM Bangalore.

Like the way we think?

Next time we post something new, we'll send it to your inbox