Published on March 7, 2022 by Rishikesh Kumar

Changing state of the renewable power sector

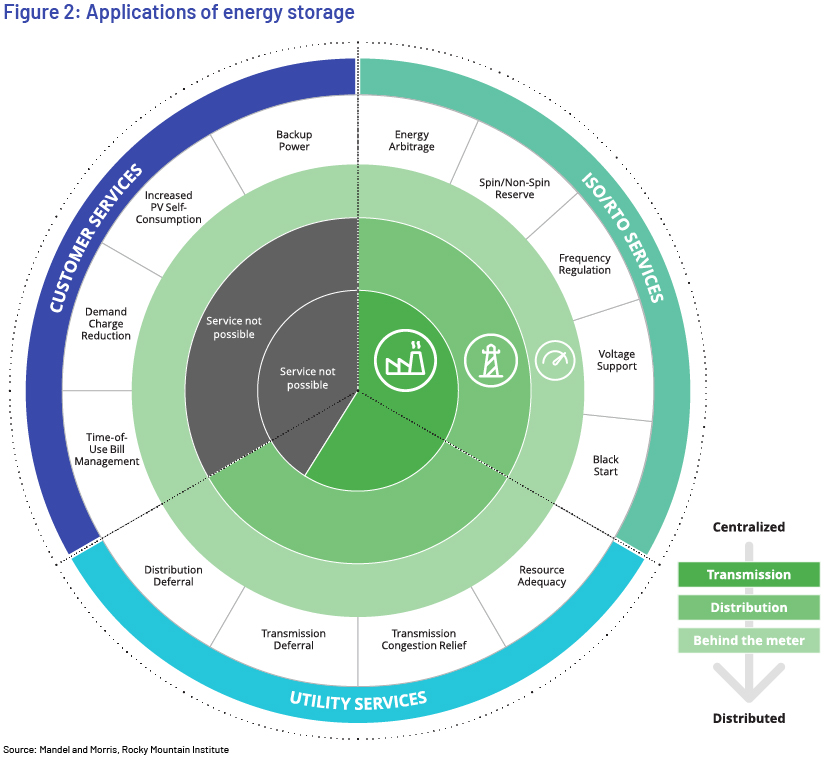

Increasing stocks of renewable energy around the globe are now being integrated with battery storage systems. Energy storage technology helps back up excess energy from solar and wind energy generating resources for use when the sun is not shining or the wind is not blowing, and is also used for a variety of applications – from electric vehicles and residential applications to grid-scale storage.

Grid-scale or utility-scale batteries

They can provide high renewable energy supply to the grid by maintaining excess production capacity and enhancing renewable energy output. These can also provide dependable and low-cost electricity, when complemented by renewable resources, to distant grids and communities not connected to a grid.

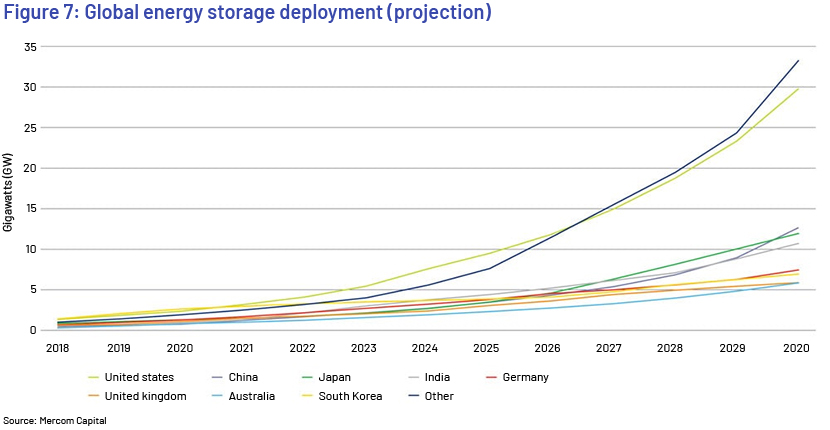

Stationary utility-scale batteries are currently leading the global battery storage market. The market is projected to shift towards small-scale applications by 2030. Large battery systems are at present being deployed for storage purposes in developed economies such as Australia, Japan, Germany, the UK and the US. Many islands and communities not connected to a grid have also shown interest in deploying large-scale battery storage systems to balance the burden on grids and store surplus renewable energy.

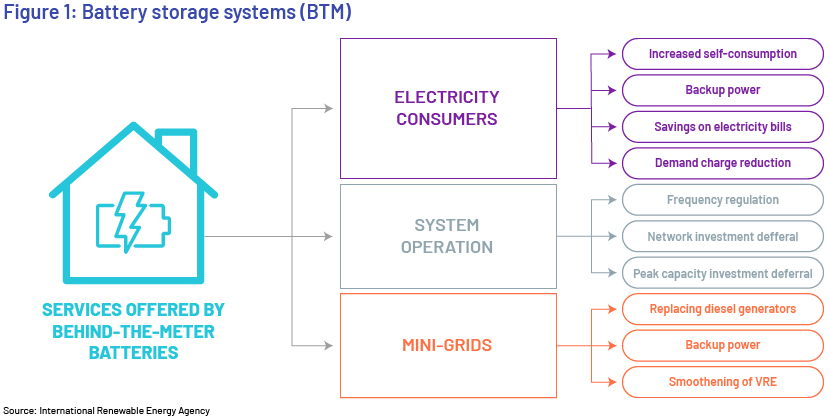

Behind-the-meter (BTM) batteries

BTM batteries are connected to the back of a customer’s meter and are intended primarily to save electricity costs. The use of such batteries is increasing globally due to the low cost of battery storage technology and the growing consumer market. The increase is also attributable to the evolution of electric vehicles, distributed generation through renewables and the development of smart grids.

Global investments and trends in battery storage

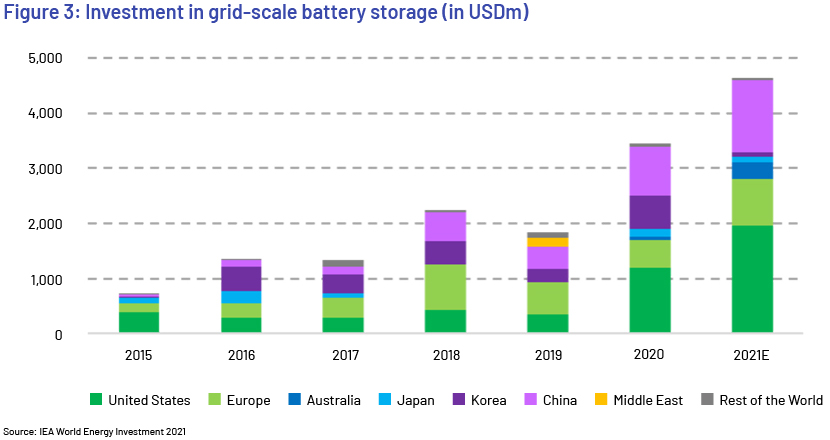

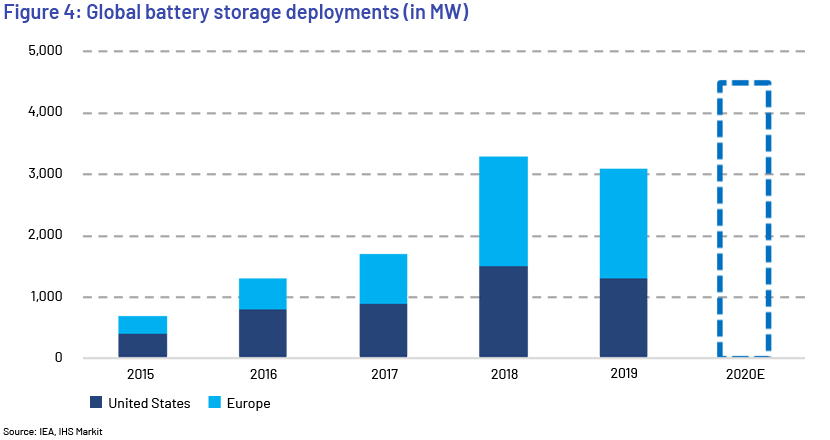

After increasing for almost a decade, annual installation of energy storage systems dropped year on year in 2019. This was largely due to a 20% decline in grid-scale installation. The International Energy Agency (IEA) believes the pandemic, weak support from the policies of key markets and the uncertainty surrounding the safety of batteries threaten growth in installation.

The complex supply chain of battery storage (including cells, modules, packs and installers), which depends heavily on cross-border manufacturing, was disrupted in 2020. However, despite the pandemic, global investment in grid-scale battery storage increased by approximately 40% and reached USD5.5bn in 2020 (c.USD1.5bn in the US). Expenditure on grid-scale batteries has increased by almost 60%, driven by accelerated investment in renewable energy-generating resources.

The cost of installing battery storage systems has also declined sharply, driving investment in grid-scale batteries in the US, China, Korea and Europe. The IEA expects the strong momentum to continue in 2022, based on the large pipeline of projects. It expects more than 10GW of new battery storage to have been installed by end-2021, more than double that in 2020 (estimated at 4.5GW).

Trend in battery storage companies’ funding and M&A

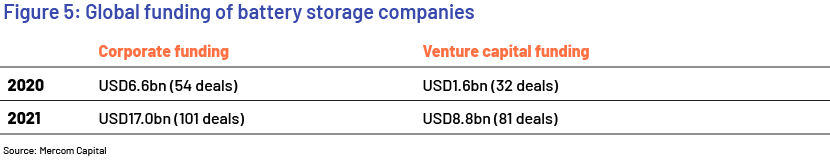

Corporate and early-stage funding in the battery storage sector is increasing. Most of the venture capital funding in 2021 was of lithium-ion-based battery technology companies followed by companies engaged in providing other energy storage systems. Twenty-four M&A deals were concluded in 2021; the number is likely to increase going forward.

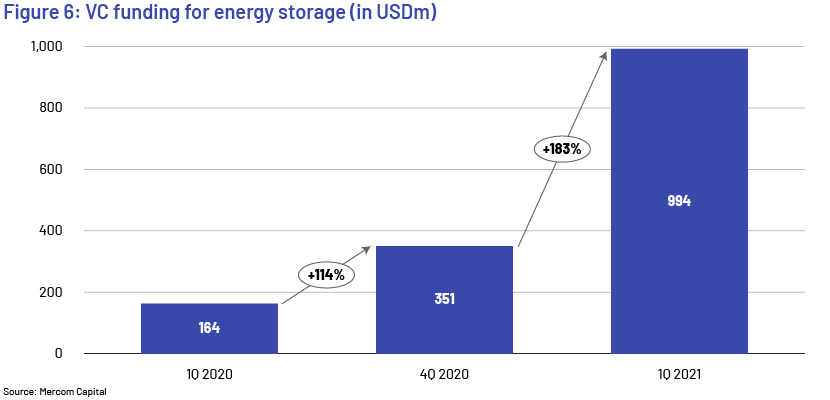

Despite the clean energy initiatives launched amid the pandemic, the market lost momentum in the first half of 2020. Investment in such initiatives recovered in 3Q 2020 and remained strong until 2Q 2021.

Battery storage companies are estimated to have raised almost USD1bn through venture capital funding in 1Q 2021, compared to USD351m in 4Q 2020. Quarterly funding in 1Q 2021 was approximately five times more than the USD164m in 1Q 2020.

Outlook for battery storage

We expect the continued increase in renewable resources and declining battery storage costs to drive the market. More countries are committing to generating over half the power they require from renewable sources by 2030 and changing their regulations to accommodate emerging energy assets. Growing global demand for storage will likely result in battery storage capacity reaching 135GW and annual market revenue of approximately USD16bn by 2030 (growing at a CAGR of 23%), fostering growth of an entirely new ecosystem of battery-powered electricity.

How Acuity Knowledge Partners can help

We help investment banking teams scale up their deal execution and drive value for their clients. By leveraging dedicated teams of experienced analysts in our offshore delivery centres, clients benefit from operational efficiency and cost optimisation. Our team serving the power and utilities sector are well versed in covering renewable project financing and valuation and are vested with state-of-the-art modelling capabilities. Many of our clients working with our specialised power and utilities investment banking teams have benefited from our integrated suite of services along the investment banking advisory value chain.

Sources:

https://www.renewableenergyworld.com/storage/investment-trends-in-grid-scale-battery-storage/#gref

https://www.eesi.org/papers/view/energy-storage-2019

https://www.woodmac.com/press-releases/americas-to-lead-global-energy-storage-market-by-2025/

https://mercomcapital.com/product/2021-q4-annual-funding-ma-report-storage-grid-efficiency/

Tags:

What's your view?

About the Author

Rishikesh Kumar has over 14+ years of experience working across different value chain in the Investment Banking domain. Currently, supports Utilities team, with a focus on Renewable Energy. He has rich experience of working in various KPOs supporting Investment Banking clients. He is well versed in valuation modeling and detailed industry research. He is also responsible for quality check and overall delivery of projects, for a U.S. based mid-market Investment Bank, in Bangalore. Prior to joining Acuity, he was with Evalueserve for close to 3 years. He holds a Master’s degree in Business Administration in Finance.

Like the way we think?

Next time we post something new, we'll send it to your inbox