Published on January 5, 2024 by Tarun Shah

Introduction

A catastrophe (CAT) bond is a type of insurance-linked security (ILS) that helps insurance companies raise capital for claims in the event of a catastrophe. CAT bonds’ maturities generally do not exceed three years, and these bonds are an alternative to catastrophe reinsurance.

The issuer receives payment from the investor only in the event of a catastrophe, while the investor receives interest payments on time, and the principal is paid upon maturity, provided no catastrophe has occurred.

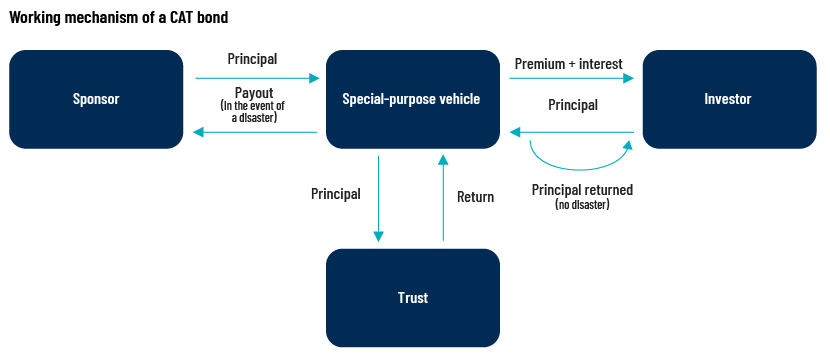

The first step of CAT bond issuance is where the issuer, re/insurer or sponsor establishes a financial entity called a special-purpose vehicle (SPV). The SPV is legally authorised to act as the insurer and shields the parties involved in the transaction from the event of default and issues CAT bonds to the investor after it enters into a re/insurance contract with the sponsor.

The SPV then invests the principal received in high-grade and liquid collateral securities, which are in a trust account that yields a steady stream of variable-interest-rate payments that are transferred to the investor. CAT bonds function as floating-rate notes bearing minimal interest rate risk, also compensating investors for bearing the risk of disaster, with premium payments from the sponsor.

If a catastrophe occurs during the term of the bond, all or part of the principal is transferred to the sponsor, which could lead to a full or partial loss for the investor. If the bond expires without a catastrophe occurring, the principal is returned to the investor.

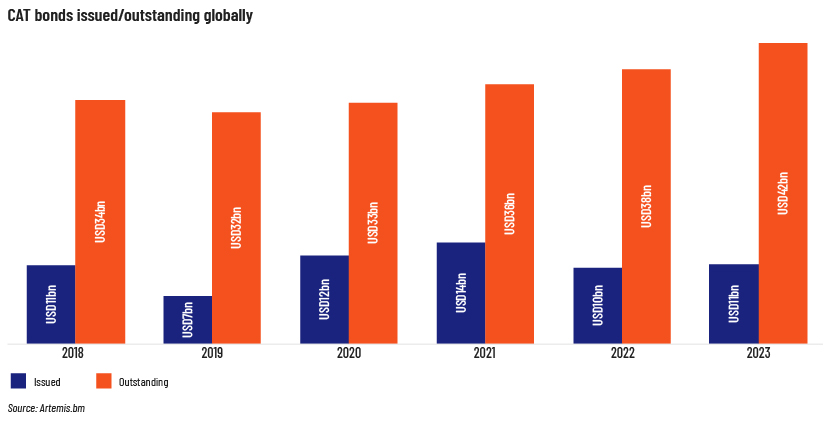

Global CAT bond issuance soared to around USD14bn in 2021 from around USD11bn in 2018, driven by an increase in the number of natural disasters.

However, global issuance fell to USD10bn in 2022, primarily due to a very quiet market in 3Q and 4Q. Issuance slowed further due to Hurricane Ian in 3Q, and bonds that came to market were smaller in size. Thereafter, the average transaction size decreased to USD116m from USD232m as investors’ capacity was curtailed.

The amount of CAT bonds outstanding remained flat in 4Q and January 2023 as investors diverted bonds that matured into new issuances. Deal value grew significantly from 2H22, with transaction sizes YTD 67% larger, on average, than those in 2H22.

Bond issuance remained tepid in the first two months of 2023; activity returned in March, with eight transactions worth c.USD2bn in total. Issuance crossed the USD10bn mark in YTD 2023 (as of 9 October), continuing the trend in March 2023, with the outstanding market at USD42bn at end-3Q23, reflecting growth of c.USD4bn since end-2022.

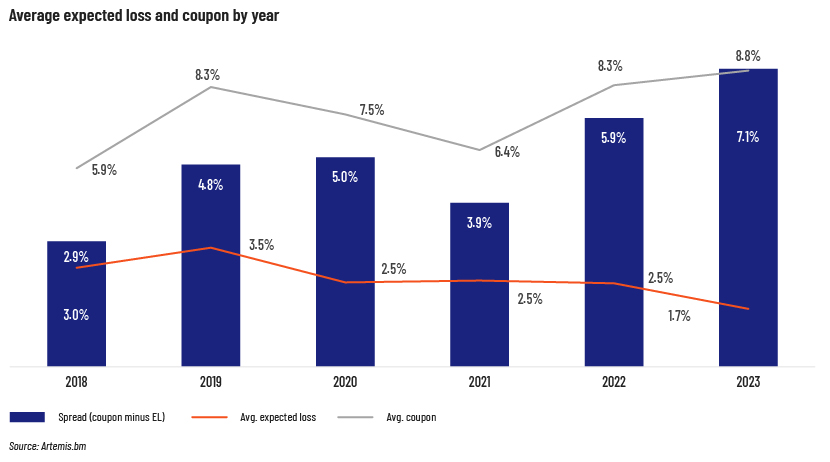

The expected coupon size increased to 8.8% in YTD 2023 (as of 9 October) from 5.9% in 2018 while the expected loss decreased to 1.7% from 2.9% over the period.

The spread increased to 7.1% in YTD 2023 from 3.0% in 2018.

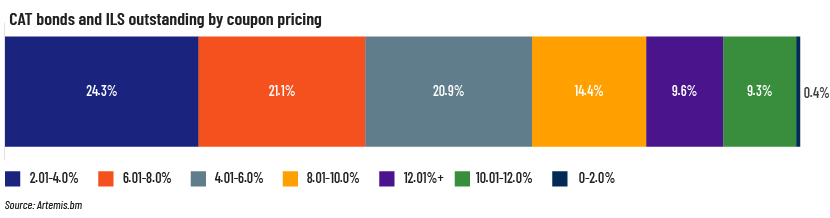

CAT bonds offering coupons of 2.01-4.0% accounted for the largest share, i.e., 24.3% of the outstanding CAT bond market, followed by bonds offering coupons of 6.01-8.0%.

However, bonds offering higher coupons accounted for smaller shares in the outstanding market – i.e., coupons of 8.01-10% for 20.9%, coupons of 12.01% for 14.4% and coupons of 10.01-12.0% for 9.6%.

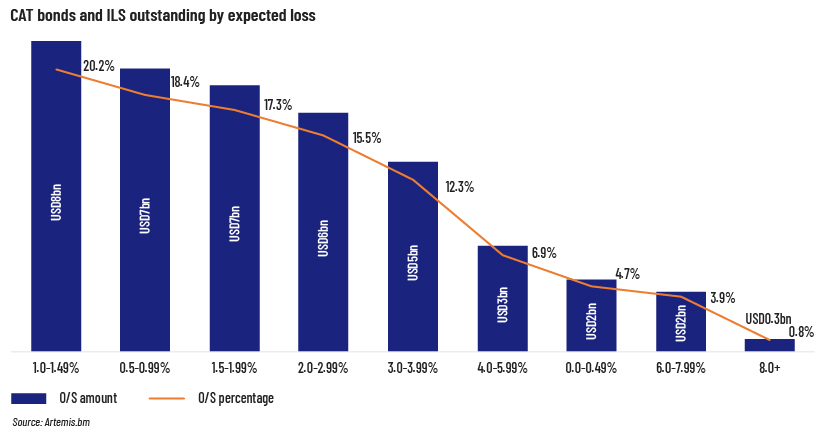

CAT bonds with a lower expected loss, i.e., 1.0-3.99%, accounted for 83.9% of the outstanding amount of CAT bonds and ILS.

However, CAT bonds with a higher expected loss, i.e., 4.0-8.05%, accounted for less (16.3%) of the outstanding amount of CAT bonds and ILS.

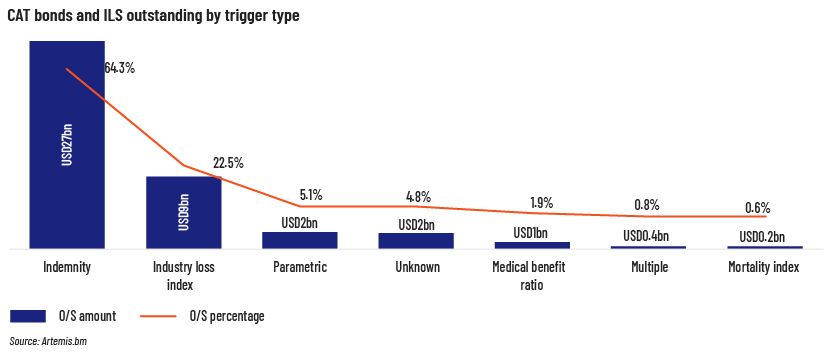

The Indemnity and Industry Loss Index accounted for a large c.76.7% of CAT bonds and ILS outstanding.

Parametric and other unknown sources were the predecessors, accounting for 5.3% and 4.7% of the outstanding amount, respectively.

Conclusion: CAT bonds have an advantage over traditional reinsurance

CAT bonds are 100% collateralised and structured so that counterparty risk is eliminated. This is in contrast to traditional reinsurance, where a reinsurer could fail to pay following a loss event.

Unlike most reinsurance deals that are for a term of one year, CAT bonds also offer multi-year deals, enabling CAT bond sponsors to lock in prices for a longer term.

CAT bonds offer diversification of an issuer’s exposure to catastrophe risk at a lower cost. CAT bond issuers use different sources of capital (e.g., sovereign wealth funds, pension funds and mutual funds) to participate in traditional reinsurance (usually backed by equity capital from reinsurers’ shareholders). CAT bonds use this to reduce reinsurance prices (and price volatility) while increasing the total capital available for the transfer of insurance risk.

CAT bonds differ from other financial-market instruments in terms of yield, as the catastrophe is highly uncorrelated to economic and financial activity. Occurrence of a catastrophes is a natural event and is not dependent on any macro/micro economic factor or geopolitical decision.

The short terms of maturity of CAT bonds (usually one to three years) are attractive to investors, as the possibility of a number of large-scale catastrophes costing millions of dollars to the insurance companies occurring within such a short period of time is limited.

How Acuity Knowledge Partners can help

With a talented pool of experts, we cater to investment banks focusing on the re/insurance and insurtech sectors, supporting them with in-depth research, analysis, investment decision making and strategy amid an ever-changing business environment. Our more than two decades of experience in supporting investment banks and our expertise in the insurance sector position us well to partner such entities and support their teams in daily workflow.

References:

-

https://www.chicagofed.org/publications/chicago-fed-letter/2018/405

-

https://www.aon.com/reinsurance/getmedia/20230512-ils-q1-2023-report.pdf

-

https://www.investmentweek.co.uk/news/4121349/catastrophe-bond-market-doubles-size

-

https://riskcenter.wharton.upenn.edu/wp-content/uploads/2021/07/Cat-Bond-Primer-July-2021.pdf

What's your view?

About the Author

Tarun is an Associate at Knowledge Partners, having more than three years of experience in Investment Banking team. Currently, part of Financial Institutions Group team, with a focus on Insurance sector supporting a Global Investment Bank. He holds a Post Graduate Diploma in Management in Finance and Analytics from JAGSOM Bangalore.

Like the way we think?

Next time we post something new, we'll send it to your inbox