Published on December 1, 2022 by Anamika Deshwal

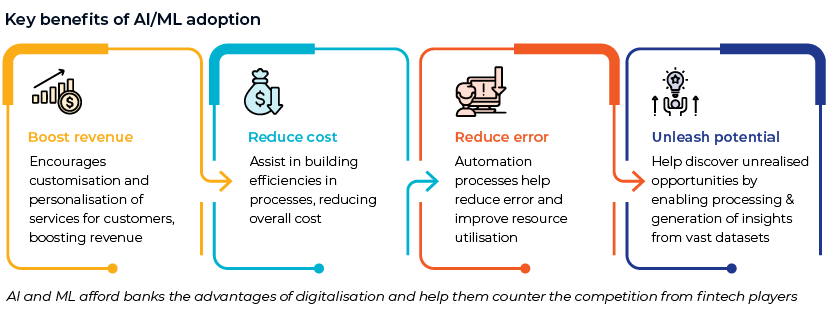

Artificial intelligence (AI) and machine learning (ML) are shaping how banks work and perform their tasks. These technologies are simplifying banking systems. However, the majority of banks and financial institutions using AI are still experimenting with the technology, and only 12% of them use it at an advanced level to gain a strong competitive advantage, according to Accenture. Regardless of the stage of AI or ML adoption, global banks are now understanding the benefits of doing so especially in areas like machine learning in investment banking, where predictive analytics can drive smarter decisions

What are AI and ML?

AI combines computer science and robust datasets to enable problem solving, and ML, a sub-field of AI, enables software applications to make more accurate predictions after analysing large volumes of data, reducing risk considerably for banks and financial institutions. With banks facing increased incidence of loan default, credit card fraud, identity theft and money laundering, the need to deploy AI and ML has increased exponentially.

In terms of market opportunity, AI and ML use among banks and financial institutions continues to increase. According to Autonomous Next research, potential cost savings for banks from AI applications are estimated at USD447bn globally by 2023.

Banks increase spending on AI and ML systems

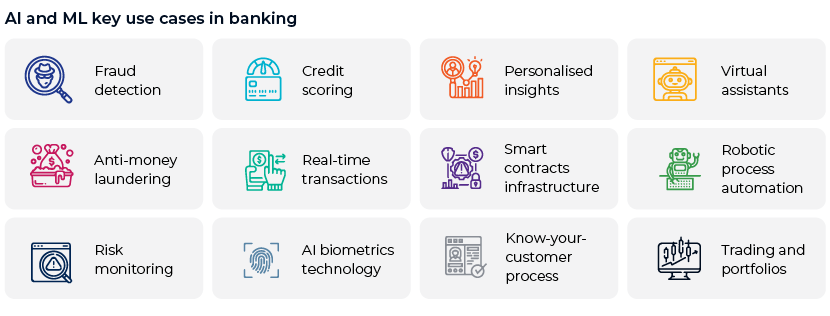

Considering the rate at which new technologies are enabling banks to fast-track customer-services and improve decision making, a large number of banks are planning to invest in AL and ML technologies. Global annual spending on AI by banks and finance firms is predicted to reach USD64.03bn by 2030. They are expected to spend an extra USD31bn on AI embedded in existing systems by 2025, with fraud management the priority, according to a recent IDC report. Banks increase spending on AI and ML systems

AI-/ML-powered systems vs old approaches

AI and ML technologies are far more effective than the obsolete banking systems that are unable to perform most of the modern core business tasks. These innovative technologies improve operational effectiveness and reduce business risks. They are fast, efficient and secure in conducting data analysis, risk management, customer service and credit card fraud detection.

Growth drivers

-

Larger IT spending: Larger investments help banks unlock the benefits of AI, helping them stay ahead of the competition. 75% of financial services professionals at banks with over USD100bn in assets are realising the benefits of AI strategies, compared with 46% at banks with less than USD100bn in assets, according to a UBS Evidence Lab

-

Increased cost saving: The cost saving that AI and ML generate is increasing their use. Use of these technologies in the banking sector is expected to save USD447bn globally by 2023, and up to USD1tn by 2030

-

Favourable policies: Favourable government policies relating to the implementation of AI and ML in banking are leading to increased adoption of the technologies

-

Need to combat financial crime: The need to reduce digital crime, now becoming more sophisticated due to money laundering, is pushing banks to adopt AI- and ML-enabled systems and solutions

-

Enhanced customer experience: Banks are focused on creating novel opportunities for growth and revenue generation by better understanding customer behaviour with the help of AI and ML

We provide details of some of the use cases below:

-

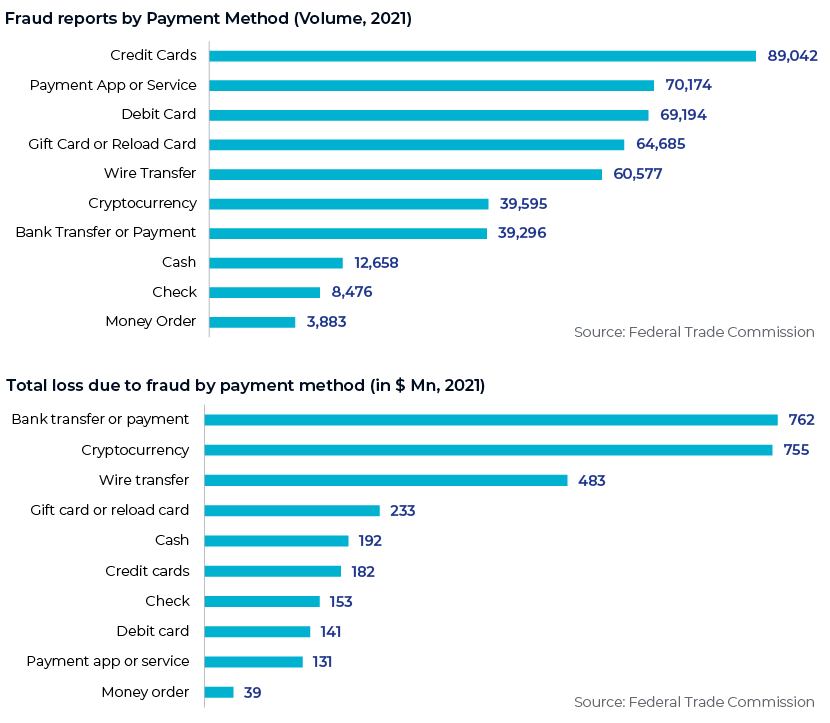

Fraud detection: Fraud in online bank payments and credit card fraud are the most widespread types of financial fraud, and dealing with this should be a core priority for banks and financial institutions. Information on credit cards and online payments gives fraudsters the opportunity to use it illegally for their advantage. Fraud reports in 2021 included more than 2,864,250 cases, with reports of credit card fraud the highest, followed by payment app and debit card fraud, according to statistics from the US Federal Trade Commission.

To manage fraudulent activity, AI and ML programs deduce patterns in the data and apply analytics to constantly improve the ability to differentiate usual behaviour from unusual behaviour. Implementation of AI and ML systems can, therefore, help banks detect fraudulent activity and evolve their systems to mitigate it.

-

Credit scoring and loans issuing: AI and ML technologies are used for credit scoring, which otherwise takes a substantial amount of time due to the large datasets involved, such as of personal information, income, payment history and even credit history from another banks, which can be obtained through financial APIs. T assess the potential profitability or risk of loans, ML-based credit scoring solutions and algorithms analyse the entire set of data on a client, including credit history, transactions, tax payments and salary. The analysis assesses whether the loan will be repaid on time or not, protecting the bank from risky transactions and increasing the likelihood of receiving interest on the loan issued.

-

Personalised customer services and offers: AI and ML help banks and fintech firms detect even the most subtle tendencies in customer behaviour, helping create a more personalised experience and offer better services to customers. Furthermore, having a large amount of information on customers helps banks understand their needs, and their willingness and ability to pay for services, based on which, special offers could be extended to selected customers

-

Chatbots: Bank customers can use chatbots for self-help, reducing the workload for bank support staff. Smart chatbots can perform operations such as locking and unlocking cards, and notifying users if overdraft limits are exceeded

How big banks are using AI and ML in their workflows

-

Bank of America: In January 2022, it launched CashPro Forecasting, a tool that uses AI and ML technology to predict cash positions more accurately across client accounts

-

The solution was developed in collaboration with a fintech that specialises in applying ML to cash forecasting to help solve the key issue of measuring future cash needs for companies without significant manual effort or costly technology investment

-

-

Wells Fargo: It is developing a virtual assistant to help it convert more retail banking customers into digital users. The assistant, named Fargo, would help execute tasks including paying bills, sending money and offering transaction details and budgeting advice. The bank plans to release it in 2022

-

HSBC: In April 2022, the bank leveraged smart analytics to introduce a new Budget feature in the HSBC HK app; this generates personalised insights for customers, enabling them to see spending patterns

-

Citi Group: The bank has developed a solution – Citi Smart Match – that leverages the AI and ML technology of a fintech partner with Citi’s own proprietary assets to create tangible benefits for its customers’ businesses

-

Boosted technology spending by 14% in 2Q 2022 to improve data governance and organisation for better informed capital decision making. Citi is to implement a new banking platform with 37 separate loan processing systems consolidated on a single platform along with risk management capabilities. The transformation is to improve governance, processes, enhance policies and leverage technology, strengthening controls

-

Conclusion

AI and ML will provide banks an extreme level of precision for managing the vast amounts of information and data acquired from customers, transactions and other sources, helping them offer a personalised banking. AI- and ML-based systems and algorithms would also increase protection against fraudulent activity and other risks, reducing operational costs for banks. These technologies are also expected to improve compliance and operational competency.

A number of factors such as increasing investment in AI and ML would lead to banks’ increased adoption of these technologies. This would result in banks reviewing the market, understanding industry best practices and seeking reliable partners. This would eventually provide a niche market for consulting, technology and research firms looking to play a part in the evolving AI and ML landscape.

How Acuity Knowledge Partners can help

We keep abreast of developments and enhancements in the banking and fintech space. We offer a wide range of tailored solutions and capabilities including market assessment, competitive landscape and positioning, competitive benchmarking, competitor tracking, opportunity assessment and market-entry strategy. Our unique approach, combining processes, people and technology, helps deliver faster results and drives excellence for our clients. A number of industry leaders leverage our proprietary suite of business excellence tools and offerings to unlock new levers of business growth and unmatched returns on investment. We currently support the world’s top banking firms and payment providers with our banking and fintech team that offers coverage across geographies.Banking outsourcing services

Sources:

-

Wells Fargo has a new virtual assistant in the works named Fargo (cnbc.com)

-

HSBC leverages smart analytics to develop new tools that enhance the personalised customer

-

More Than 60% of Companies Are Only Experimenting with AI, Creating Significant

-

The Global AI in Banking Market Will Grow to $64.03 Billion by 2030, at a CAGR of 32.6

-

The impact of artificial intelligence in the banking sector & how AI is being used in 2022

-

Citigroup is actively investing to improve automation, says CFO

Tags:

What's your view?

About the Author

Anamika Deshwal is a part of Acuity Knowledge Partners – PE & Consulting team, wherein she has worked on projects for numerous clients across sectors including technology, financial services,and payments.Her functional expertise includes strategic research, company profiling, competitor analysis & benchmarking, besides GTM market studies.Anamika holds a PGDM in Business Analytics from IMT Ghaziabad and BE in Electronics and Communication from Chitkara University, Himachal Pradesh

Like the way we think?

Next time we post something new, we'll send it to your inbox