Published on February 12, 2018 by Harshwardhan Khandelwal

India’s Finance Minister, Arun Jaitley, had a tough job of presenting the government’s budget for fiscal year 2019 (1 April 2018 to 31 March 2019) on 1 February 2018. On one hand, the government had seen a year full of reform (GST implementation and banking-sector recapitalization), which led many investors to believe it would continue with the reform trajectory and fiscal consolidation process. On the other, this budget is politically important, considering the eight state elections scheduled for 2018 and the general elections for the first half of 2019. These factors may have suggested a populist budget high on subsidies, tax relief and spending focused on rural areas (the vote banks). In hindsight, it is only fair to say that the budget turned out to be neither populist nor prudent.

Key takeaways

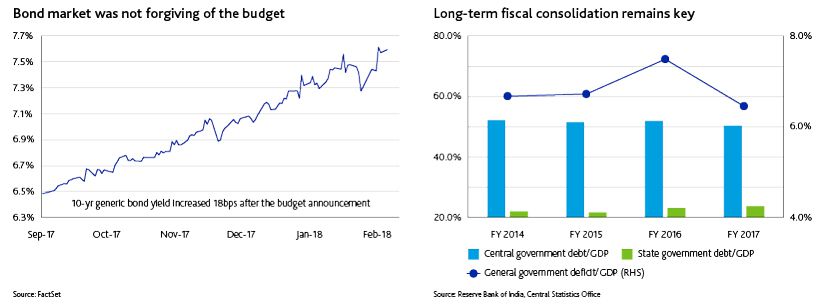

The government now expects fiscal deficits of 3.5% of GDP for FY2018 and 3.3% for FY2019 (vs. targets of 3.2% and 3.0%, respectively).

The Fiscal Responsibility and Budget Management Committee’s recommendations were accepted. The government targets a fiscal deficit of 3% of GDP by FY2021, a central government debt-to-GDP ratio of 40% (50% as of March 2017) and a general government debt-to-GDP ratio of 60% (ca. 67% as of March 2017) by FY2025.

The government expects rural infrastructure spending to constitute 58.6% of total spending in FY2019.

It promised farmers a higher minimum support price (MSP) of 1.5 times the production cost of kharif crops.

It reduced the corporate tax rate to 25% (from 30%) for companies with revenue less than INR2.5bn.

Large companies are now required to finance ca. 25% of their capital needs through bonds.

Impact on key variables

GDP: The government expects the economy to expand 6.5% y/y in FY2018 vs. 7.1% y/y in FY2017 on GST implementation and lingering effects of demonetization. It expects GDP growth of 8% in FY2018. Moody’s Investor Service (MIS) expects GDP growth of 7.5% per annum until FY2020.

Fiscal position: The government estimates a 14.6% y/y increase in total revenue to INR17.3tn in FY2019, underpinned by higher GST and income tax collection (+16.6% y/y). However, it expects expenses to increase 10.1% y/y to INR24.4tn, with a focus on rural, social and infrastructure spending.

Bond issuance: It expects net government borrowing of INR3.9tn and gross government borrowing of INR6.34tn, both less than consensus

Inflation: A higher MSP could increase retail inflation by 20-40bps; higher oil prices are also likely to contribute to a higher rate of inflation.

Deeper corporate bond market: With large companies now required to finance 25% of their capital needs through bonds, the government has requested regulators to make bonds rated ‘A’ and above (vs. ‘AA’ at present) eligible for investment by large corporates. This could increase the number of bond issues over the near to medium term. We expect this move not only to benefit corporates but also to provide foreign investors exposure to local-currency bonds. Refer to a colleague’s write-up on how Acuity Knowledge Partners can support investors and the importance of having an on-the-ground credit team.

Key risks

Oil prices: The government assumes an average oil price of USD57.5 per barrel for its calculations, while oil prices average USD70 per barrel at present. Higher prices for longer could weigh on inflation concerns and warrant a rate hike in the second half of the year

Fiscal profligacy: It is not uncommon to announce populist schemes ahead of state and central government elections (e.g., the farm loan waivers and higher subsidiaries announced ahead of previous elections). We will continue to monitor such developments, as they could be detrimental to government bond yields.

We believe the FY2019 budget is an effort to keep both investors and voters happy. However, it presents inflationary risks to an economy trying to find its feet after a year of reform. It may result in increased pressure on the Monetary Policy Committee (MPC) to raise interest rates; the MPC’s focus on maintaining moderate inflation and on fiscal consolidation is a cornerstone of its policy making.

References

Budget document – http://www.indiabudget.gov.in/

Central Statistics Office – http://www.mospi.gov.in/

FactSet database

Reserve Bank of India – https://rbi.org.in/home.aspx

Tags:

What's your view?

About the Author

Harshwardhan Khandelwal has close to 10 years of work experience in investment research, with a focus on financial institutions, sovereigns and supranational entities. He currently supports a large European buy-side client, providing opinion-based credit research (initiation and maintenance) and issuer rating recommendations by performing fundamental and technical analyses of issuers, and analyzing the capital requirements and structure of banks.

Prior to this, he supported the co-branded bottom-up research alongside onshore fixed income strategists for a major European investment bank’s private banking division. He is also actively involved in training, quality control of deliverables, and client discussions. He holds an MBA and a bachelor’s degree in Mechanical Engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox