Published on February 11, 2019 by Harshwardhan Khandelwal

India’s interim budget for fiscal year 2020 (2019-20) comes on the back of ruling party BJP’s defeat in state elections and ahead of the general elections due in April/May 2019. The full-year budget is scheduled to be presented only in July 2019. The interim budget was, therefore, expected to be populist, with significant benefits provided to farmers and low-income households.

And it did not disappoint. The interim budget promises an annual direct cash benefit transfer (DBT) of INR6,000 (USD85; in three equal installments) to 120m farmers, each with a land holding of less than two hectares. An interest subvention of 2-5% for farmers in distress was also announced. However, much to the relief of the markets, there were no announcements of farm loan relief packages. This would have been taken negatively by the markets and rating agencies. The budget also provides provision of pensions to 100m workers in the unorganized sector.

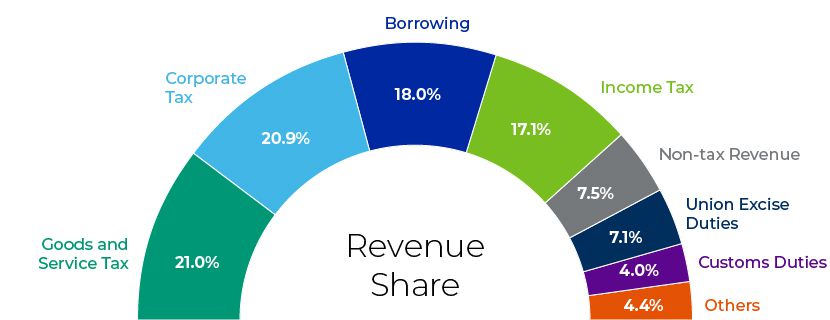

Revenue: The budget expects revenue to increase by 14.3% y/y in FY2020, driven by higher tax collection, increased Goods and Services Tax (GST) revenues (+18.2% y/y), increased divestment receipts (USD12.8bn) and USD11.3bn in dividends from the Reserve Bank of India (RBI) and public-sector undertakings (PSUs). The GST revenue estimates look high, especially after the government acknowledged a INR1tn deficit in its GST collections and the GST rate cuts announced in FY2019. The divestment target also looks aggressive given that the government is yet to achieve its USD11.3bn target for FY2019 (USD5bn achieved until December 2018).

Revenue share

Source: Budget documents

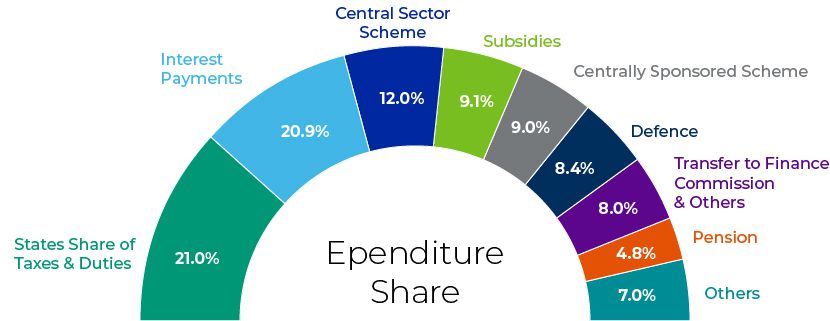

Expenditure: Budgeted spending is expected to increase 13.3% y/y to INR27.8tn (USD390bn; +13.3% y/y). However, we note that the quality of spending is declining, as capital expenditure would now comprise 1.6% of GDP (vs. 1.7% of GDP as per the FY2019 revised estimates), while revenue expenditure is expected to increased 30bps y/y to 11.7% of GDP.

Expenditure share

Source: Budget documents

* Numbers may not add to 100% due to rounding off

Key Takeaways: Prioritizing economic and electoral benefits while maintaining fiscal prudence

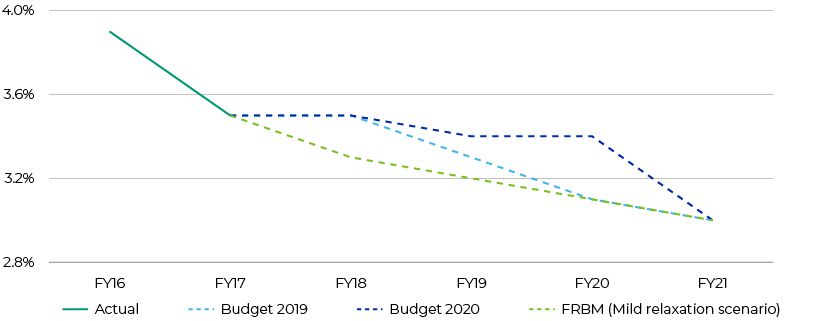

GDP and Fiscal Deficit: The government expects GDP to grow by 7.5% and the fiscal deficit to remain at 3.4% in FY2020. The fiscal deficit for FY2019 was revised to 3.4% from vs. earlier target of 3.3%. This is India’s second consecutive year of deviating from the target.

DBTs and tax breaks: DBTs to farmers will cost the Exchequer USD10.6bn (0.36% of GDP) in FY2020. The first installment would be transferred this quarter, with provisions for DBTs of USD2.8bn in FY2019. Although the sum promised is low, it comes on top of other subsidies such as those under the National Rural Employment Guarantee Act (NREGA) and fertilizer subsidies (ca. USD20bn-USD21bn). We believe this is a bold step by the government and a stepping stone to consolidating other subsidiaries and making a single income transfer to farmers and other economically weaker sections in future. Furthermore, the budget gives tax rebates to middle-class taxpayers with an income not exceeding USD7,000 (vs. a previous tax rate of 5%). These moves are likely to continue to support domestic consumption.

Inflation: The budget looks mildly inflationary given the tax break and incentives for the property sector. Although India’s headline inflation was low at 2.19% in December 2018, we note that core inflation (excluding food and fuel prices) was at 5.7%. Consequently, we do not believe the RBI will cut rates at its meeting scheduled for 7 February 2019. However, we expect the MPC to change its stance to ‘neutral’ from ‘calibrated tightening’ given low headline inflation.

Bond Yields: The budget poses tough challenges for the fiscal situation in FY2020 given its aggressive revenue assumptions. Furthermore, gross borrowings of USD100bn and net borrowings of USD67bn were marginally higher than market expectations. Consequently, yields on India’s 10-year bonds increased by ca. 10bps to 7.38% after the budget was announced. The Indian rupee (INR) has depreciated ca. 2.0% this year, and any rate cut could lead to further depreciation and weaken bond yields, especially after the US Federal Reserve indicated a dovish stance for 2019 at its January 2019 meeting.

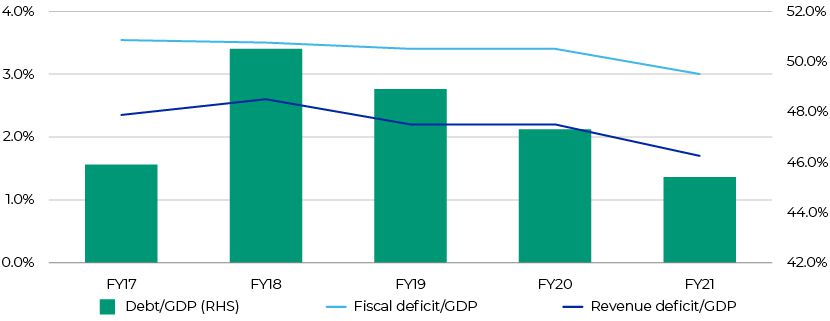

Central Debt/GDP is improving

Marginal deviation from fiscal consolidation

Source: Budget documents, Central statistics office

In conclusion, the interim budget tries to balance populism and fiscal prudence, as economic and electoral priorities have taken precedence, without deviating significantly from the fiscal consolidation path. It also helps that India’s debt is domestically financed. Given the narrative of farm sector distress and general elections in May 2019, a special package for the sector was expected. We think it is positive that the package costs only 0.3% of GDP. Although the revenue targets are a bit aggressive and quality of expenditure has weakened, we note that increased consumption would remain supportive of GDP growth. Regardless, volatility surrounding the elections would remain a drag on fund inflow in the near term.

Disclaimer: These are views of the authors at Acuity Knowledge Partners and should not be construed as a view of Moody’s Investor Services, the rating agency.

What's your view?

About the Author

Harshwardhan Khandelwal has close to 10 years of work experience in investment research, with a focus on financial institutions, sovereigns and supranational entities. He currently supports a large European buy-side client, providing opinion-based credit research (initiation and maintenance) and issuer rating recommendations by performing fundamental and technical analyses of issuers, and analyzing the capital requirements and structure of banks.

Prior to this, he supported the co-branded bottom-up research alongside onshore fixed income strategists for a major European investment bank’s private banking division. He is also actively involved in training, quality control of deliverables, and client discussions. He holds an MBA and a bachelor’s degree in Mechanical Engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox