Published on February 2, 2023 by Ankit Agrawal

-

The latest budget continues to prioritise growth and fiscal consolidation, with higher allocation towards capital expenditure. Capital spending is expected to grow 37% y/y in FY24 to INR10tn (ca USD122bn), underpinning economic growth and job creation – a structurally positive theme for India

-

Higher capex (22.2% of total spending in FY24 vs 17.4% in FY23 RE) is funded in part by rationalising subsidies (8.3% vs 12.5%)

-

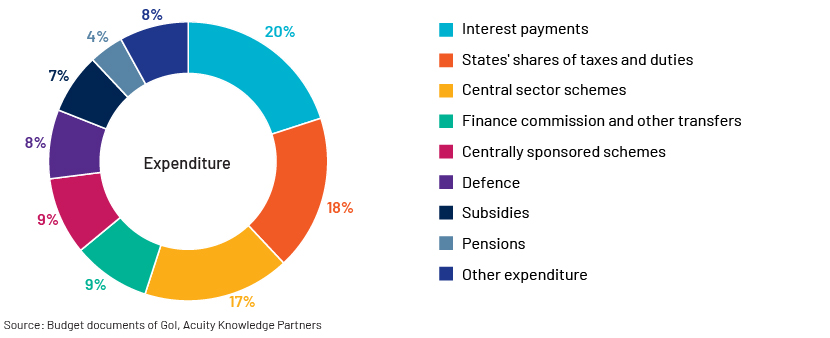

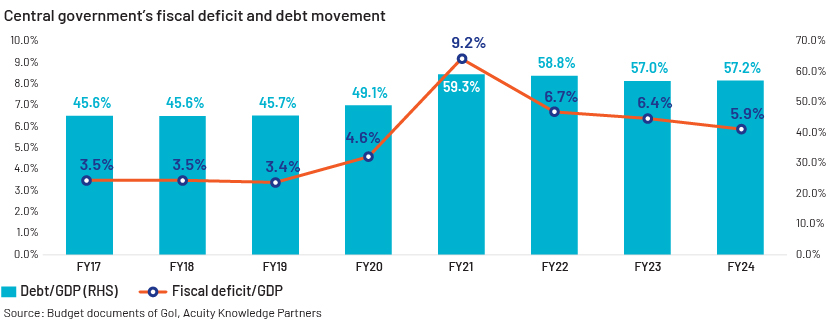

The fiscal consolidation target remains intact, with fiscal deficit to GDP expected to improve 50bps y/y to 5.9% in FY24

The FY24 budget sees one of the biggest increases in capital investment in recent years to support economic growth and job creation, while the government continues on its previously announced path to fiscal consolidation. This will be funded in part by rationalising subsidies (10.7% of revenue expenditure in FY24 vs 15.1% in FY23 RE). The government estimates a fiscal deficit of 5.9% of GDP in FY24, an improvement from 6.4% of GDP in FY23, underpinned by faster growth in revenue receipts (+12.1% y/y) vs expenditure (+7.5% y/y) and healthy nominal GDP growth of 10.5% y/y in FY24.

Other major highlights:

-

The fiscal deficit limit for states is set at 3.5% of GSDP from FY24, including 0.5% of GSDP related to power-sector reform

-

Incentivising local governments to improve their creditworthiness for issuing municipal bonds

-

Tax bonanza worth INR370bn announced for the middle class under the new tax scheme – no meaningful impact on fiscal math, as this will cost a meagre 0.1% of GDP

-

The government is implementing a number of green programmes (energy, mobility, buildings, etc.) with budgetary allocation of at least INR854bn to reduce carbon emissions in its effort to achieve carbon neutrality by 2070

-

Custom duty relief on imports of certain products to boost green mobility and electronics manufacturing in the country, in line with the Make in India initiative

The government continues on the path to fiscal consolidation

The government announced continuation of its fiscal glide path, targeting a fiscal deficit of 5.9% of GDP for FY24 and reaching below 4.5% of GDP by FY26. Fiscal consolidation is supported by faster growth in total revenue receipts of 12.1% y/y compared to expenditure growth of 7.5% y/y. Gross tax revenue growth of 10.4% y/y is largely in line with nominal GDP growth of 10.5% in FY24. Non-tax revenue growth of 15.2% y/y is supported by higher dividend income (+8.4% y/y) from the Reserve Bank of India (RBI) and public-sector enterprises (PSEs). Disinvestment proceeds are expected at INR610bn (ca USD7bn), up 1.7% y/y. However, non-tax and divestment receipts appear to be slightly aggressive.

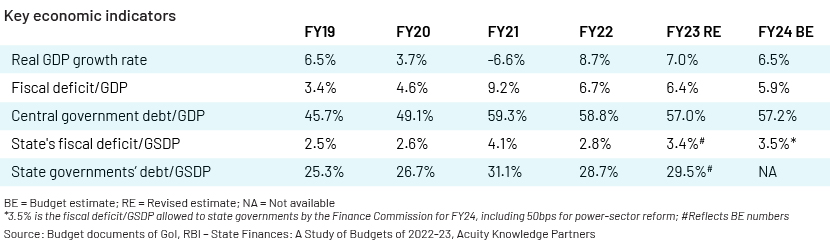

Revenue

Central government revenue estimates are on the conservative side given gross tax revenue growth is in line with nominal GDP growth of 10.5% for FY24. Revenue receipt estimates (+12.1% y/y) are supported by goods and services tax (+12% y/y), personal income tax (+10.5% y/y), corporate income tax (+10.5% y/y) and non-tax (+15.2% y/y) revenue.

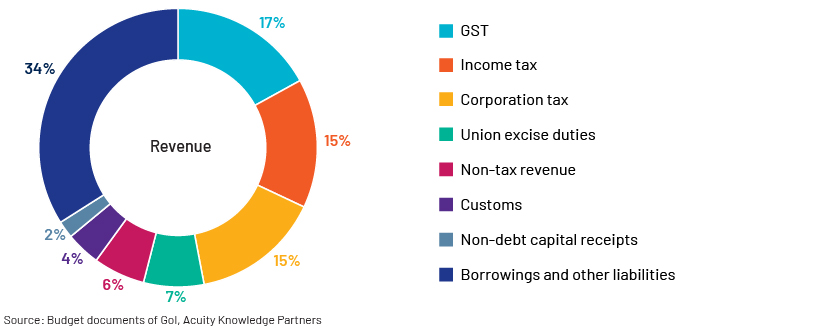

Expenditure

India’s expenditure has traditionally been focused towards driving consumption, with a high allocation towards subsidies, interest expenses and defence. However, this year, the government is focused more on investments than on boosting consumption. This is underscored by high allocation towards capex (ca USD122bn; 22.2% of total spending vs 17.4% in FY23 RE). This is a key positive given the medium-to long-term multiplier effect capex has on the economy. Additionally, subsidies are projected to decline (-28.2% y/y) on lower food (-31.3% y/y) and fertilizer (-22.3% y/y) outlay. However, large interest payments of ca 41% of revenue receipts highlight weak debt affordability for the government.

Deficit funding

For FY24, the government projects a fiscal deficit of 5.9% of GDP, which will be funded through net debt assumption of INR18tn (ca USD220bn), including gross market borrowings of INR15.4tn (ca USD190bn). Debt/GDP is expected at 57.2% in FY24 (vs 57% in FY23 and 58.8% in FY22).

Rising interest expenditure can be a risk

The rising interest rate poses marginal challenges to the government’s budgetary plans, as interest expenses account for 31% of revenue expenditure in FY24 (vs 22% in FY21). Rising rates and sustained borrowings would continue to exert pressure on the government’s borrowing cost and could marginally dilute spending plans.

Having said that, we do not see this as a large risk, given most of India’s borrowing is in local currency and held by domestic investors. Local investors owned 98.6% of total outstanding dated securities as of 30 September 2022.

The budget had a positive impact across asset classes

The financial markets had an optimistic view on the budget with the bond, currency and equity markets reacting positively to the fiscal consolidation and high capex announcement. The 10-year bond yield was down 10bps just after the fiscal target and net borrowings announcement, and it continued to decline for the rest of the trading session, closing at 7.28%, compared to the previous day’s close of 7.34%.

The equity market was volatile as the benchmark Sensex and Nifty 50 Indices gained ca 2% on large capital outlay estimates, but the indices closed on a mixed note as Adani Group stocks dragged the Nifty 50 into negative territory, while the Sensex ended with marginal gains.

The INR strengthened to 81.68 per USD from the previous day’s close of 81.93 per USD following the budget announcement, but the currency pared all the day’s gains, closing at 81.94 per USD on a declining stock market.

Sources:

-

Union Budget document

-

Economic Survey of India

-

Ministry of Statistics and Programme Implementation

-

Controller General of Accounts

-

Reserve Bank of India

Tags:

What's your view?

About the Author

Ankit has close to 12 years of experience in fixed income credit research, focusing on bank, sovereign and corporate credit reviews. He has worked with three of the largest buy-side asset managers, based in Europe and the US, assisting with investment decisions. He is actively involved in discussing themes and issuer updates and is adept at writing detailed credit reviews and building in-depth financial models to present his investment case. Ankit holds a Master of Business Administration (Finance) from Symbiosis International University.

Like the way we think?

Next time we post something new, we'll send it to your inbox