Published on February 6, 2019 by Anupama Sharma

For the past two years, markets and investors have been speculating the onset of the next recessionary phase, with fears fueled by the ever-rising equity markets surpassing all previous levels. These concerns were heightened in the last month of 2018, alerting both investors and the Fed.

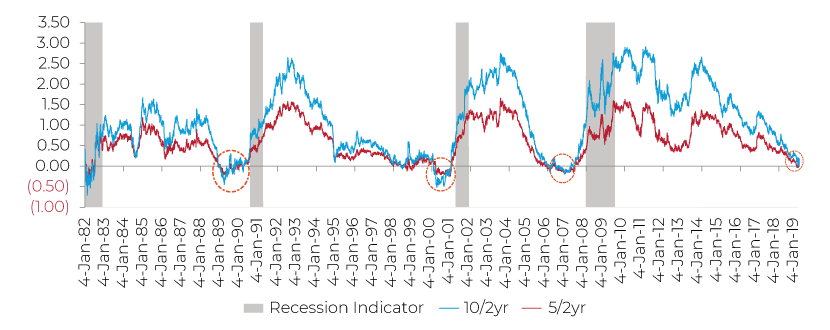

What changed at the end of last year? After a long time, a dreaded event – the inverted yield curve – materialized. In the first week of December 2018, 5-year Treasury bond maturities yielded less than 2-year Treasury bond maturities, with other high-yield curves also starting to flatten; for example, 10-year Treasury bond maturities yielded almost the same as 2-year Treasury bond maturities.

For the uninitiated: normally, short-term yields are lower than long-term yields. Yield curve inversion refers to the phenomenon where astute investors expect economic challenges to arise in the near future and to dampen the returns on short-term bonds and, therefore, gravitate toward long-term bonds. This increased interest in long-term bills pushes their yields lower than yields on short-term bills. At the same time, yields on short-term bills are increased to attract investors.

Such an inversion warns of weakening investor sentiment.

Correlating inverted yield curves to economic downturns

Are inverted yield curves capable of forecasting a recession? Historical observations indicate they are.

As the following chart shows, the Treasury yield curve has inverted before every recent recession – in 1981, 1991, 2001 and before the 2008 Global Financial Crisis (GFC).

The yield curve started to invert most recently in December 2018. Going by the industry experts, if this continues, the economy could face a slowdown.

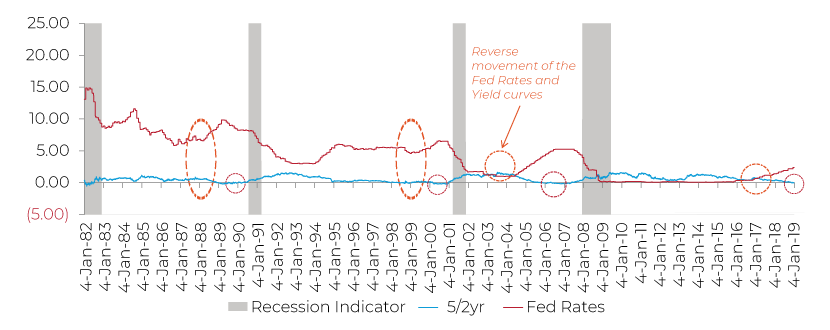

What is causing the current inversion?

The recent loss of confidence in short-term Treasury yields is due to effective Fed rates rising; short-term rates drive short-term bond rates (increasing their yield). However, long-term rates are not rising in tandem. Thus, the hikes in effective Fed rates, which indicate an end to the expansionary phase, are triggering stress in the markets.

What is obscuring long-term economic confidence?

Each recession is triggered by underlying weakness; for example, the 2008 GFC was triggered by unstable peaks of asset prices, including stock and house prices. As money being pumped in reaches its limit, the market is likely to crash.

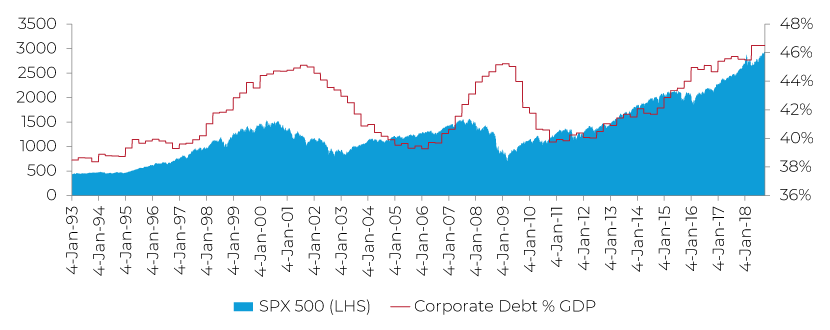

In the current scenario, however, the focus is less on house prices and more on corporate debt. As of 3Q 2018 1 , US corporate debt securities were at an all-time high of USD6.2tn, with total corporate debt reaching USD9.5tn. Corporate debt to GDP was at a high 47%, higher than during the GFC and dot-com bubble.

Higher debt levels, together with rising interest rates, paint a grim picture

According to S&P Global figures of June 2018 2 , the cash-to-debt ratio for speculative-grade borrowers 3 was 12% in 2017, 2% lower than in 2008. This implies that for every dollar of cash held by a company, their debt was USD8. According to key economists, companies are not borrowing against their cash flow or income but against their net worth. This is similar to what households were doing before 2008, when loans were being taken based on the value of collateral rather than on household income and the borrower’s creditworthiness. We are seeing the same happening a decade later in the corporate sector.

Is it a hoax call or a call for caution?

Apart from these observations, The Conference Board’s recent releases of composite economic indicators, such as the Leading Economic Index (LEI) and the Coincident Economic Index (CEI), also show a moderating trend. According to its latest release , “The US LEI declined slightly in December and the recent moderation in the LEI suggests that the US’ economic growth rate may slow down this year. While the effects of the government shutdown are not yet reflected here, the LEI suggests that the economy could decelerate towards 2 percent growth by the end of 2019”.

What the current macros demands from business

These events suggest caution, as the bubble created by the unprecedented debt levels may not last for long. Conditions may fluctuate on policy support, making volatility the new normal.

We interpret the yield curve inversion as indicating the start of a recessionary cycle almost 20 months before the actual onset of a recession, and that vigilance is required at least for the next two years.

In such scenarios, wider business community – including corporates, financial institutions as well as consulting organizations need to keep themselves abreast with evolving developments. This also calls for understanding the structural weakness of past challenges and unearthing best practices to fuel growth in turbulent times.

MA Knowledge Services gained experience of offering related solution during the 2008-09 crisis, and currently offers a range of similar solutions including newsletters, industry insights as well as generate industry and situation specific knowledge by interacting with client teams. Hence, our approach has been very focused and targeted, resulting in high impact solutions

Disclaimer: This is the view of an individual author at Acuity Knowledge Partners and should not be construed as the view of Moody’s Investor Services, the rating agency

Sources

1. Federal Reserve Board Financial Accounts

3. Speculative-grade borrowers have a credit rating of BBB+, BBB, and BBB-. These companies are more prone to default in the event of adverse economic conditions

Tags:

What's your view?

About the Author

Anupama Sharma has over 8 years of experience in research and consulting domain. She has been associated with Acuity Knowledge Partners since 2011 and has been actively assisting investing firms. In her current role, she has been providing analytical and research solutions to Private Equity clients. She has extensive experience across business environment and investment opportunity analysis. She also holds experience in market research and database creation. Anupama is an MBA from Bangalore University.

Like the way we think?

Next time we post something new, we'll send it to your inbox