Published on November 25, 2020 by Mohit Sachdeva

Introduction

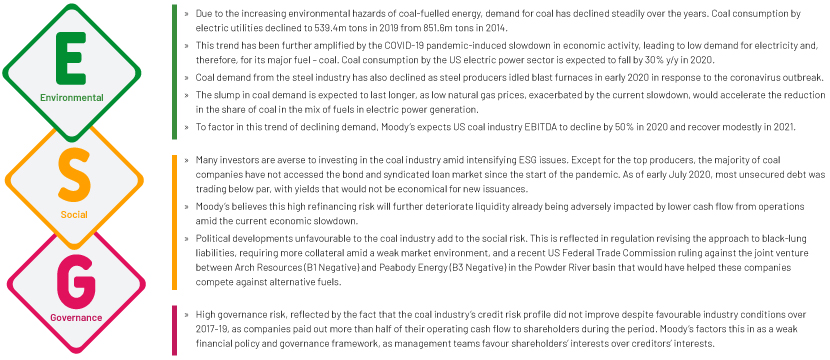

The coal industry, due to its very large carbon footprint, scores high on risks related to environmental and social factors. Governments and investors across the globe are trying to lower their exposure to the coal industry in response to increased awareness of the need for low-carbon economies. This increases the risk of lower demand and higher refinancing risk for the coal industry. The current pandemic-induced slowdown in economic activity, leading to lower energy demand, has amplified demand risk for the coal industry. This article evaluates this risk from the perspective of major credit rating agency Moody’s. The ESG-related risks were a factor that limited its ratings for the US coal industry. Of the five issuers in the US coal industry it rated, the credit rating outlooks for three have been revised to “Negative” and those of the other two have been downgraded since the start of the pandemic.

Moody’s ESG framework

From humble beginnings as a socially responsible investing movement, ESG factors have grown to become a trending theme in global financial markets. While the initial focus was on equity markets, debt capital markets are also becoming increasingly interested in ESG. Assessment of ESG risk in credit analysis has gained traction recently, in efforts to limit downside risk and allocate capital to sustainable projects.

Since 2015, investors have been asking credit rating agencies to systematically incorporate ESG characteristics in their credit ratings. The biggest challenge that credit rating agencies face when trying to integrate ESG in their rating process is the availability of ESG data and the quantification of ESG credit considerations. In a survey of more than 240 market participants conducted at Moody’s annual ESG conference in London in October 2019, 52% of the respondents regarded the availability of data and disclosures as the biggest challenge when integrating ESG issues into credit risk.

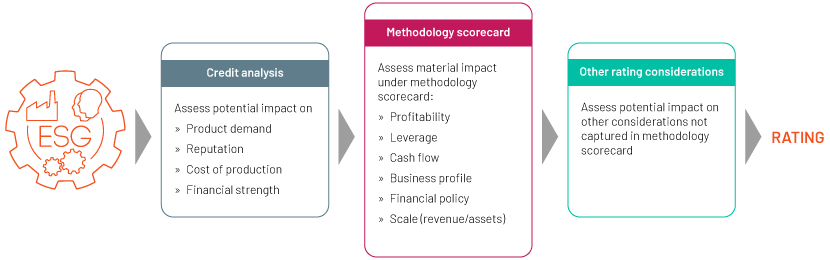

To overcome this challenge, Moody’s has devised a framework for evaluating ESG-related risk and its impact on credit ratings. The framework largely entails recognising an entity’s exposure to the relevant ESG-related risk, analysing the entity’s performance in terms of managing such risk and assessing the potential impact of such risk on the entity’s credit risk profile. The impact of ESG-related risk is generally negative, but it could be positive for issuers willing to mitigate the risk.

Moody’s approach is to measure the impact of ESG considerations on

-

The issuer’s cash flow and value of assets over time

-

The adequacy of cash flow and assets in relation to the issuer’s debt and other financial obligations

-

The issuer’s liquidity and ability to access capital

The ESG risk is factored into both qualitative and quantitative sub-factors of the rating grid, as well as outside the rating grid. In the event of sufficient visibility, ESG risk is incorporated quantitatively in key credit ratios through financial projections and scenario analysis. ESG risks, likely to emerge over a prolonged period or in instances where there is limited information available to quantify such risks, are incorporated into ratings through qualitative factors such as business profile, institutional strength, regulatory environment and financial policy. Some ESG risks can also be factored in outside the rating grid, if not already considered in the sub-factors of the rating grid.

Source: Moody’s criteria dated January 9, 2019 onGeneral Principles for Assessing Environmental, Social and Governance Risks

Negative rating action seen in the US coal industry due to heightened ESG concerns

With ESG factors playing an increasingly vital role in deciding the creditworthiness of a company, the US coal industry seems to be very badly hit by all the three risks, as explained below.

Due to the abovementioned risks, Moody’s has taken negative action on most rated US coal companies in 2020. Credit profiles of coal companies are expected to deteriorate steadily as governments and investors look to lower their exposure to coal-based industries, resulting in lower demand and fewer capital resources for the industry. A revival of the credit profiles of coal companies seems less likely in the near term.

As ESG gains prominence in the credit rating process to meet increased investor demand, Acuity Knowledge Partners is suitably placed to become the preferred partner for rating advisory teams of investment banks and standalone rating advisory firms. We help rating advisors identify sector-specific ESG credit issues and incorporate these factors into their sector-specific indicative rating models and other types of customised analysis, backed by our deep understanding of the sustainable finance and rating advisory markets. For further details on our rating advisory support, please visit our web page:https://acuitykp.com/solutions/ratings-advisory/.

Sources:

Moody’s criteria on ‘General Principles for Assessing Environmental, Social and Governance Risks’

Moody’s Survey the relevance of ESG in global credit markets

https://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_1236866

https://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_1162496

What's your view?

About the Author

Mohit is a delivery lead in the Rating Advisory practice at Acuity Knowledge Partners. He has expertise working with investment banks, providing support on rating for corporates, banks and NBFCs covering indicative rating analysis, debt headroom assessments, market update, ratings pitch, credit positioning and benchmarking. He supports the global rating advisory of a major European investment bank.

Prior to joining Acuity Knowledge Partners, he worked as a Rating Analyst at CRISIL Ratings, where he was involved in conducting rating analysis of mid-size corporates across different industries. He holds Post Graduate Diploma in Management from International Management Institute, New Delhi and Bachelors in Technology (Mechanical) from NIT Jalandhar.

Comments

08-Jan-2021 08:55:15 am

This will surely play a big role in peoples credit score.and businesses credit scores. Although emplyees may signup on a company contract about accepting a certain permission on app or company website which most people dont read due to fine prints and closed intact letters and very long scripts, we should give everyone a fair chance to change. Warn them and encourage them to be a better person. Having an old system that has loop holes in a conpany is not just their fault, it goes a long way with IT (system not that good before) even a company that promotes trust and loyalty , some personnels or security personnels did not do their job before in checking, or could have suggested a better system or aapp before but they didnt. The fact that some employees was able to do it not once but multiple times .because others that suppose to check and watch them are not knowledgeble enough to catch a culprit. (Lack of knowledge) (wrong possitioning in the company) I think its fair to give them a chance, let them be aware about some process or advice them you\'ved installed latest security system or something. (Chance to also fix thier credit score) - emotional stress could effect their families and.childrens and lives. So please give them a fair chance. (Depending on the severity of course)

Like the way we think?

Next time we post something new, we'll send it to your inbox