Published on January 19, 2023 by Zhihua Huang

Finding opportunities in the SaaS industry – the top-down approach

Software as a service (SaaS) allows users to connect to and use cloud-based apps via the internet. Customers usually pay a monthly or annual subscription fee to access the software, which is quite different from traditional on-premise software. The SaaS industry has gained significant traction in the past two decades despite the pandemic’s impact and will likely continue to grow with digital transformation and improvements to IT infrastructure.

In this blog, we drill down layer by layer to explore opportunities in the SaaS industry.

US and China SaaS markets

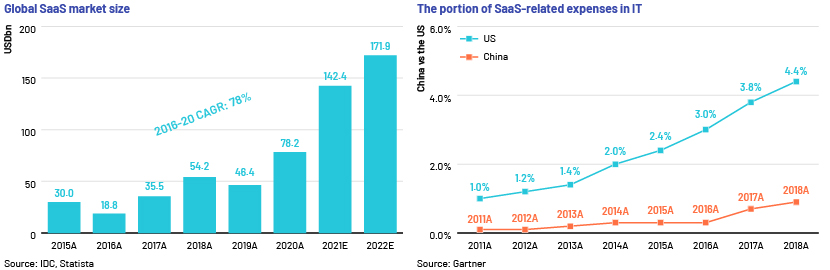

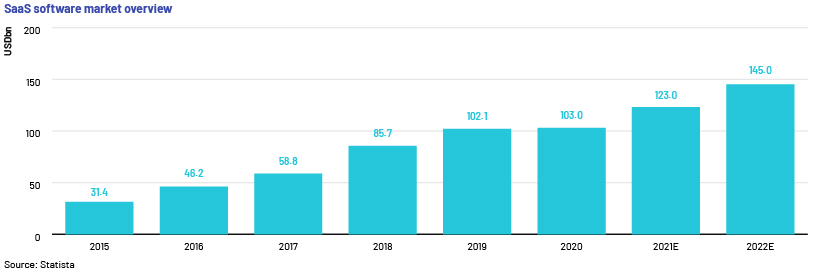

The global market size of SaaS-based technology industries broke records in 2021. The SaaS-based share of the global market is expected to have reached USD142.4bn in 2021, almost double that in 2020. Statista estimates market demand will remain strong at around USD142.4bn in 2022.

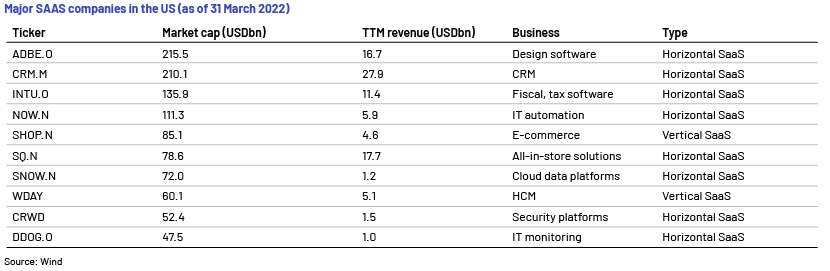

The US is the first country to enter the SaaS stage and the most mature SaaS market, which can be divided roughly into three stages: (1) the creation of SaaS in 1999, when Salesforce launched its customer relationship management (CRM) platform, (2) emergence of the platform-as-a-service (PaaS) form after 2006, leading to a spike in growth in the SaaS market and (3) cloud computing facilitating SaaS companies’ expansion around 2009.

The US SaaS market was valued at approximately USD123bn in 2021, having grown 17.8% from 2020.

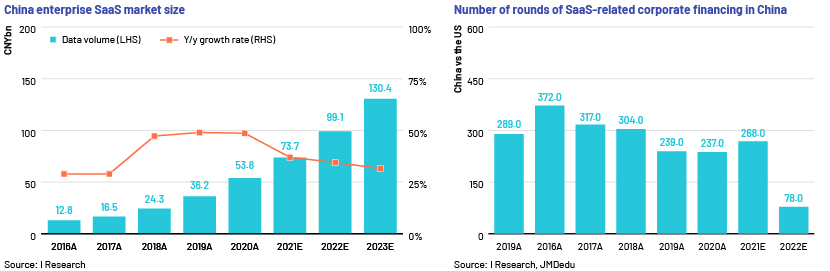

China’s SaaS market lagged that of the US by 10 years, but grew exponentially in 2019. Its growth in the past three years has caught up and almost surpassed growth achieved by the US in those 10 years.

The market value of Salesforce, the US SaaS leader, reached USD290.6bn as of 29 November 2021, and only two of China’s top SaaS companies (Jinshan Office and UF Network) have exceeded CNY100bn. The gap between the two companies’ market values is as much as 14-15 times. China’s SaaS market has grown faster than that in the US, especially since 2018. Overall, China's market has moved into the initial stage of rapid growth, while the US market has reached the mature stage.

According to I Research’s China Enterprise-Level SaaS Industry Development Report, the number of SaaS manufacturers in China was expected to reach 4,500 and the number of SaaS users 9.15m by end-2021. The country’s SaaS market is estimated to reach around CNY100bn in 2022. The popularity of SaaS is also reflected in the capital markets. SaaS-related projects saw 78 rounds of financing, amounting to CNY8.78bn, in the first quarter of 2022.

Although China entered the SaaS industry a little later than the US, some Chinese companies have grown rapidly and become very popular among investors. With funding support and enterprise digital transformation, growth of the country’s SaaS companies is likely to accelerate.

Horizontal or vertical SaaS business model

As the market matures, the SaaS business model continues to change. There are two primary SaaS software formations at present: vertical SaaS and horizontal SaaS.

Horizontal SaaS caters to a wide range of business users by providing a broad service, mainly including CRM, office collaboration, information technology service management (ITSM) and cloud security. It is a mature model that has been adopted for decades. Companies can grow to a very large scale, based on a massive, addressable market While a large market provides considerable growth potential, it requires significant upfront investment due to the complexity of the product.

Vertical SaaS refers to software focused on a specific sector, a recent trend in the SaaS market. The potential market would be narrower than that for horizontal SaaS, as developers are usually expert in a specific sector and have loyal clients when starting a business. Vertical SaaS includes providing professional services for specific sectors such as e-commerce, catering, logistics and education.

Key accounts or small businesses

Key accounts provide a company with a sense of security, as they ensure sustainable and reliable income, but they also entail high delivery costs due to providing customisation. Large enterprises would prefer to develop their own SaaS software when market prices are higher than expected. In addition, the key account market is limited, and companies need to attract small businesses if they are to grow amid strong competition.

Some companies that focus on small businesses usually run a health check at the beginning of an engagement. However, a company would subsequently meet a customer's lower repurchase rate, due to the short lifespan of small businesses. Many US SaaS companies serve both key accounts and small businesses, and China's SaaS companies are likely to do the same, based on the evolution of the demand structure.

Key metrics for measuring SaaS company performance

Investors use the following benchmarks to measure company performance and make informed decisions.

Cash revenue

Cash revenue of a SaaS business refers to customers’ upfront cash payments – an important indicator for investors. This reduces a company’s risk and capital costs and helps run operating activities smoothly. Furthermore, it gives investors a clear picture of revenue generated. Actual revenue converted from booking cash is less important. As SaaS revenue is generated over a longer period of time, there is a potential risk that the company could cancel a service already paid for.

Annual recurring revenue (ARR) and net revenue retention (NRR)

For subscription-based businesses, ARR is a key indicator of the health of a business and helps predict revenue, because these companies often gain from establishing long-term customer relationships. ARR helps gauge projected new revenue from either new sales or business expansion.

NRR indicates the change in recurring revenue over time and facilitates forecasting revenue. A good retention rate means the company does not need to spend much to attract new customers and can benefit from retaining the existing ones. The NRR formula is specified below.

NRR = (MRR* at start of month + Expansion MRR - Churn MRR) ÷ (MRR at start of month) × 100%

*MRR = Monthly recurring revenue

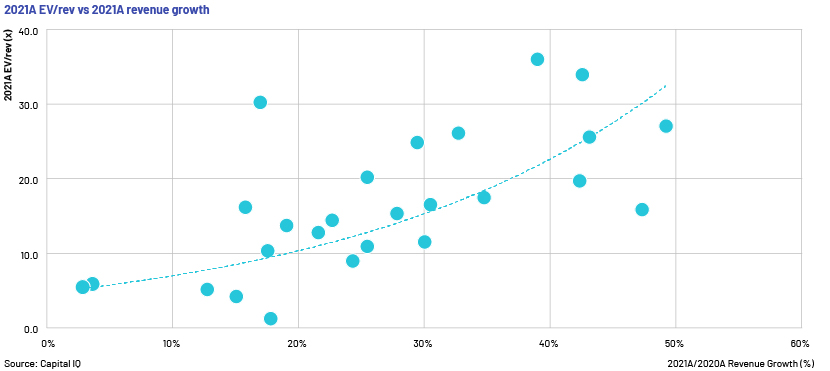

Revenue growth rate

There is clear evidence to show whether a company’s revenue growth rate is in line with its valuation in the SaaS industry. As one company starts to emerge as market leader, there is a cycle of positive reinforcement, as customers prefer to buy from the market leader.

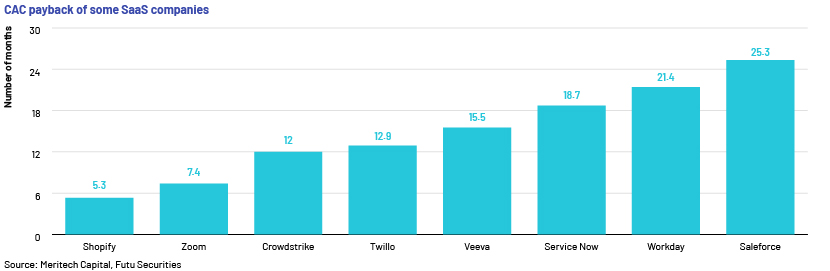

Customer lifetime value/customer acquisition cost

Customer acquisition cost (CAC) is the cost of acquiring a potential customer. The customer lifetime value (CLV):CAC ratio monitors the relationship between sale expenses and new customer revenue – how much revenue from a customer is required to recover the cost of acquiring that customer. The CLV:CAC ratio is one of the best ways to measure profitability of a company. A higher CLV:CAC value means the higher engagement of a company’s products, the more difficult they are to replace, and that the company is truly creating value for customers. In general, the CLV:CAC indicators of excellent SaaS companies are greater than three times.

CAC payback = Total sales and marketing costs during the period/(Net new MRR acquired during the period * Gross margin)

Similarly, the CAC payback ratio tells investors how long it takes to earn back initial customer acquisition costs. The general benchmark for payback periods of startups is 12 months or less.

Exit options

The exit is the last critical step of the private equity (PE) investment process, as it affects realised returns for investors significantly. In this section, we discuss three main exit strategies PE investors can choose from: IPO, trade sale and buyback.

IPO is one of the most popular exit options for PE investors, although it involves time and high costs, mainly due to legal restrictions and market supervisors’ rules. Exits via listing mainly refer to direct listings and special-purpose acquisition companies (SPACs) with more flexibility. IPOs are suitable for companies with large portfolios or for high-performing companies.

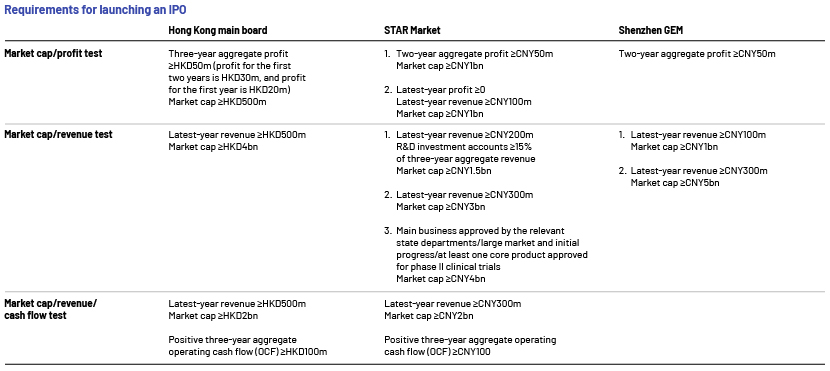

Loss-making SaaS companies in China preferred to list on the Nasdaq before the recent geopolitical tensions, as its rules on company profit were relaxed. As foreign listing has become more difficult in recent years, they have preferred to list in Hong Kong or mainland China. China launched a new stock market, STAR Market, and pushed reform of the Shenzhen Stock Exchange’s Growth Enterprise Market (GEM) board, while launching a pilot registration system for listing candidates. These measures are aimed at lowering barriers and helping channel fundraising for home-grown innovative companies. Hangzhou Raycloud Technology Co. Ltd, an e-commerce software and service company, was the 100th firm and the 1st software firm listed on the STAR board as of 29 April 2020. Taimei Technology, a digital operation platform for the life sciences sector, had submitted an IPO application to the STAR board as of 29 December 2021, seeking to raise CNY2bn.

Trade sale refers to selling the business to a strategic buyer or another PE house, generally a preferred exit option for PE investors. This is often associated with a higher sale price and faster transaction process, as it is not subject to the regulatory restrictions applicable to public transactions. The strategic acquirer expects to improve its market position in its respective sector and will hold the acquisition over the long term. In addition, the investor may sell ownership to another PE investor via a follow-on investment when it thinks the company is overvalued.

A buyback generally occurs when a company does not perform well or fails to launch an IPO. This is often the last resort and could involve a lawsuit as the entrepreneur buys the shares back from the PE investor.

Conclusion

It has been difficult for investors to enter the SaaS industry since 2021 due to higher valuations in the primary market. With a correction, however, investors are likely to have more access to truly valuable companies.

How Acuity Knowledge Partners can help

We have in-depth knowledge of China’s SaaS industry. Our team is well versed in Chinese Accounting Standards (CAS), International Financial Reporting Standards (IFRS) and Hong Kong Financial Reporting Standards (HKFRS) and keeps abreast of changes to accounting standards, industry policies and listing guidelines, helping our clients better understand the real performance of investee companies.

References:

-

CITIC: Global SaaS Cloud Computing Industry Series report

-

CMB: China Software & IT Services

-

X Partner: SaaS company valuation

-

Morgan Stanley: SaaS X-ray revisit

-

GGV: How to evaluate an SaaS company

What's your view?

About the Author

Zhihua Huang has 2 years of experience in private equity investment analysis with a focus on China market. At Acuity Knowledge Partners Beijing office, Zhihua supports both pre-investment research and post-investment management for a large Asia private equity fund, covering a wide spectrum of industries such as SaaS sector. Zhihua holds a master degree in Financial Risk Management from University of Reading.

Like the way we think?

Next time we post something new, we'll send it to your inbox