Published on December 1, 2020 by Sankar Raghukumaran

The sector and the current landscape

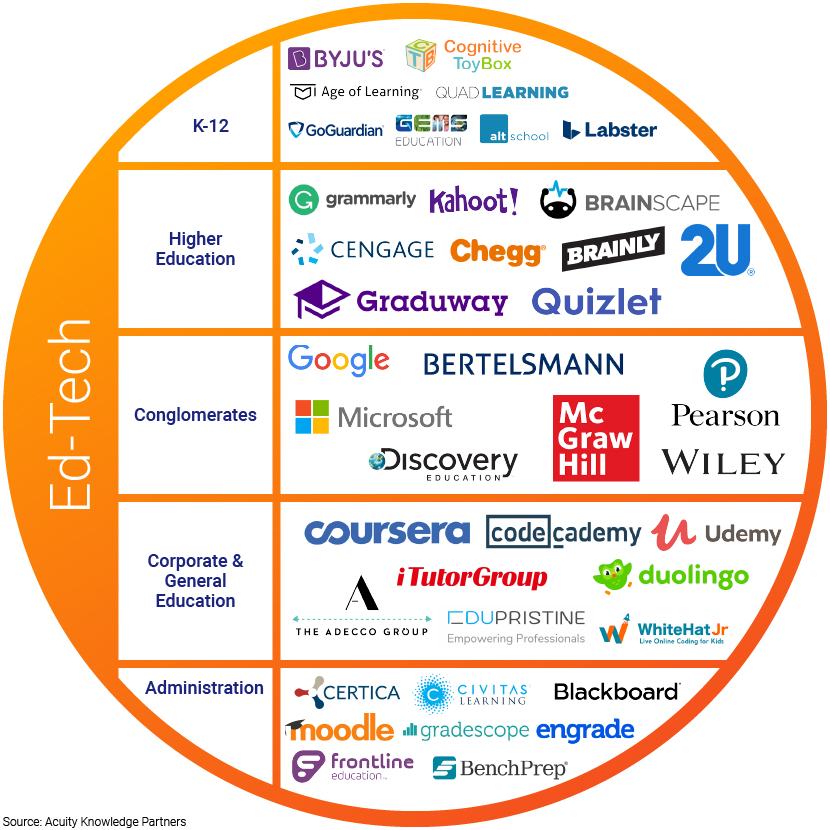

The education technology (ed-tech) sector is a diversely growing one currently experiencing a digital revolution. The age of digitalisation, automation and artificial intelligence has had a significant impact on the revamping of the education sector. Greater access to advanced learning materials and increased data feedback have necessitated changing and upgrading conventional methods of teaching. Technology has played a major role in this revamping process across the three main education categories (PreK-12, post-secondary and corporate training), with each category operating as a sub-segment of the ed-tech market

The current ed-tech landscape and selected participants:

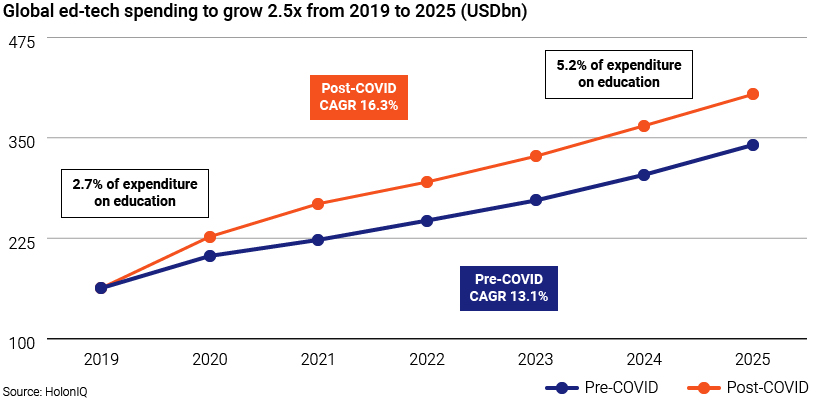

The global ed-tech market seems highly promising, with a market value of USD163bn in2019 expected to grow to USD404bn at a compound annual growth rate (CAGR) of 16.3% from 2020 to 2025, according to education market intelligence company HolonIQ.

The COVID-19 pandemic has impacted the ed-tech sector globally. The sector experienced a hockey-stick effect – sudden activity in sales or EBITDA after comparatively flat periods of operation in the short run. The pre-COVID-19 estimated CAGR for the ed-tech market from 2019 to 2025 was 13.1%; the post-COVID-19 estimate is 16.3% for the period.

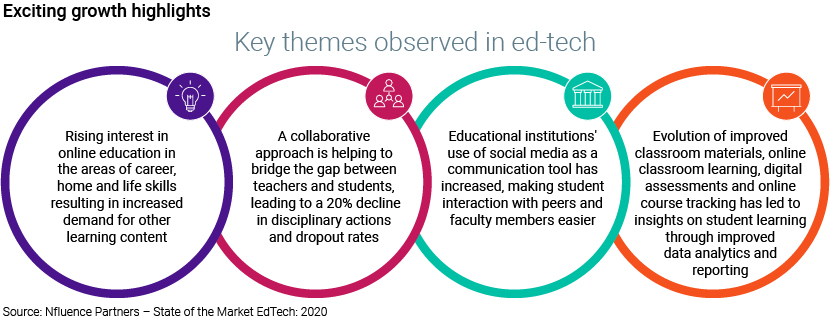

Another study by Grand View Research (GVR) suggests a shift in the education sector from exam-oriented learning (the conventional method) to an interactive and personalised learning approach in recent years. Digitalisation has had a positive impact, with new and creative techniques being invented to deliver education, skills and knowledge. Digital education is expected to benefit a substantial number of individuals across geographies, age groups and socioeconomic status.

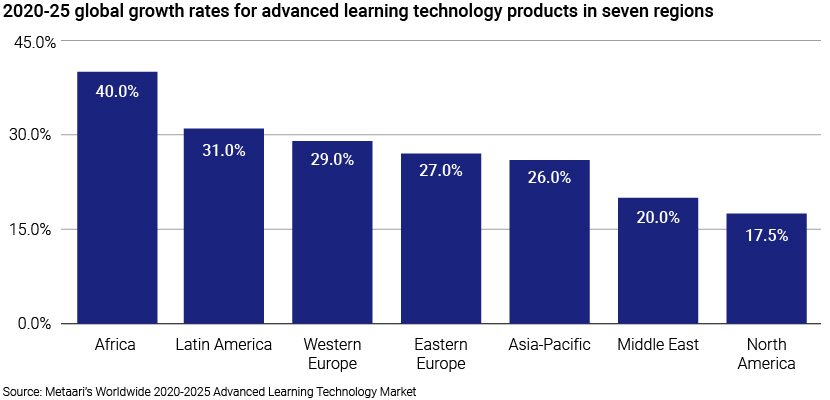

Research firm Metaari has identified seven advanced learning technologies considered to be the key growth areas for the ed-tech sector. These include AI-based learning, mixed reality learning (virtual reality and augmented reality), game-based learning, mobile learning, cognitive learning, location-based learning (location intelligence) and educational bots (physical and virtual combined). Such advanced learning technology companies are expected to grow by 22.8% and their revenue to triple to around USD129.7bn by 2025, the bulk contributed by companies in North America, Asia Pacific and Western Europe. The following chart showcases global growth rates for these advanced learning products by geography.

What do end customers feel?

Findings of a recent Citi GPS survey (“Education: Power to the People”) complement what we have mentioned earlier. The respondents from developed markets were notably less satisfied or convinced that tertiary education results in higher salaries. In contrast, the results from emerging markets showed that tertiary education seems to drive or is perceived to be a positive factor in earning higher salaries. The survey also found that millennials are less satisfied than non-millennials because they have had to pay more than their parents to get the same level of education. Cost/access to funding was a barrier to education for 68% of millennials versus just 50% for non-millennials overall. In the case of developed markets, this split was 66% of millennials versus 38 of non-millennials.

Another interesting fact noted by the Citi GPS survey was that 63% of the respondents felt that the use of educational applications would supplement formal education well, while 22% felt that it could be a good substitute. Only 15% of the respondents felt that educational apps were not useful. It also found that 94% of respondents from emerging markets had a favourable opinion of educational apps (vs 74% in developed markets) and 81% of these respondents would be willing to pay for them (vs 48% in developed markets).

Strategic opportunities for ed-tech firms

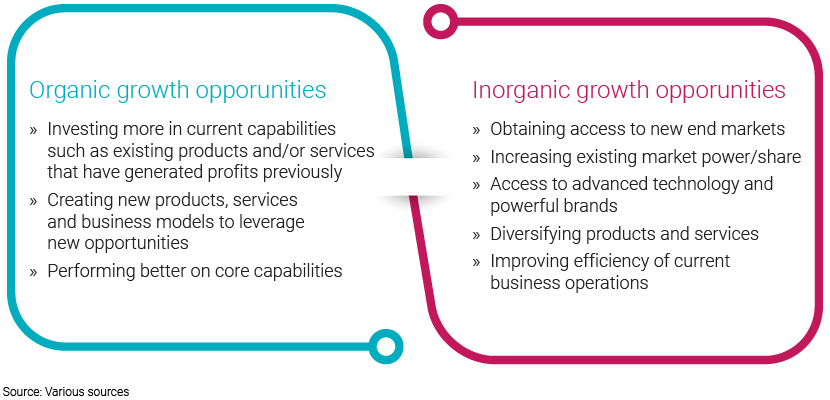

The above mentioned facts illustrate the substantial opportunity for an ed-tech firm to grow, organically or via M&A.

For example, a firm focused on K-12 interactive learning can choose to acquire a provider of advanced learning technology (say, AI-based learning). This provides it the opportunity to integrate its current expertise with future technologies, making it relevant in the long run. The August 2020 acquisition for USD300m of coding startup White Hat Jr. by BYJU’s, which operates in the space of interactive learning, showcases one of these opportunities. BYJU’s acquisition rationale was to create a coding curriculum and expand its offerings for school students.

Another example of growth is via geographic expansion. It would be easier for a firm to migrate and expand its current capabilities used in a specific market to another with a similar system (for example, the US and Canada may have similar styles of curriculum, and a company currently serving only the US could expand to Canada within a shorter timeframe and fewer modifications).

Areas of opportunity for investment banks

The above mentioned points (just some among the exciting growth opportunities in the sector) are making the sector more attractive for investment banks and their clients. Banks are trying to assess opportunities for firms to grow both organically and inorganically. Organic growth requires significant funding for R&D and geographic expansion. Banks are also advising firms on the M&A front, making the sector very attractive.

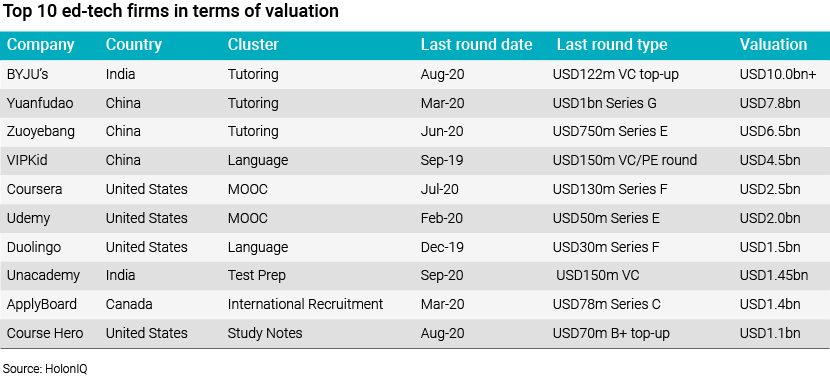

The key growth markets in the area of ed-tech are China, India and Brazil, all developing nations. Of the three, China has the largest number of ed-tech unicorns in the world. Increased government expenditure and cultural prioritisation have boosted its ed-tech ecosystem. India is another promising market, the home of BYJU’s, the ed-tech company with the highest value in the world. The startup landscape is dominated by companies focused on test preparation, K-12 education and online learning. The Indian government updated the education policy recently, intending to have a positive impact on the entire ed-tech sector. Brazil is another exciting market with growth opportunities; the education sector aims to provide a college education to a third of its population.

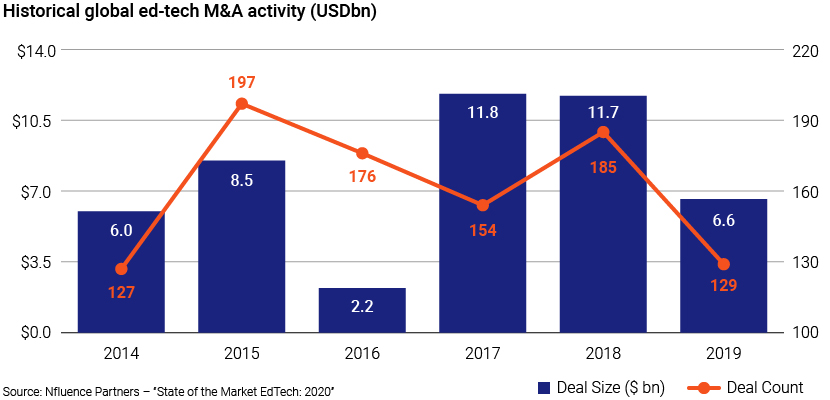

The M&A side

The M&A front has been active since the start of 2020, with many deals including the one in March, where Blackboard, a provider of an SaaS-based, open-source learning management system for online and professional learning, was acquired by Learning Technology Group for USD32.0m.

The COVID-19 pandemic has somewhat impacted the rise in ed-tech, as traditional education systems have been forced to use advanced technologies and teaching methods to ensure continuous learning. Many firms, previously struggling to attract customers (due to reasons such as high pricing and low awareness), have seen robust growth in terms of increased users, traffic, customer engagement and course completion.

The private equity (PE) and venture capital (VC) sides

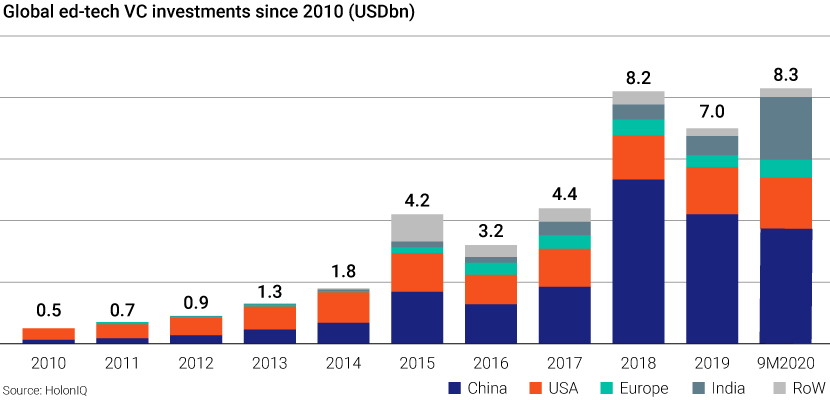

The ed-tech sector continues to attract the attention of both long-time industry veterans and generalist investors. The sector started the last decade with venture capital investments worth USD500m and ended 2019 14x higher at USD7.0bn, according to HolonIQ. Even the pandemic has not been able to stop the influx of cash to the ed-tech sector: the first three quarters of 2020 saw USD8.3bn worth of VC investments. HolonIQ estimates that VC investments will triple over the next decade, with Asia (excluding China), Latin America and Africa seeing higher investments over the next five years.

In 2018, around 75% of ed-tech funding in the US was concentrated on the K-12 and post-secondary sub-segments, while in China, investments were directed towards competence-based education (such as areas related to robotics and coding). In addition to increased VC investment in ed-tech, dozens of PE firms continue to raise funds to invest only in the education sector.

All this shows the significant growth opportunity for the ed-tech sector over the coming years. The world is geared for a revolution in the education sector, and the substantial impact the ed-tech sector can have is encouraging for both consumers and investors. With the clear increase in the number of investment opportunities in the ed-tech sector, investment banks are advising investors on the investing avenues available.

Acuity Knowledge Partners (Acuity) assists investment banks in the different stages of investment and with M&A opportunities. Acuity has a strong team of subject-matter experts supporting a number of bulge-bracket investment banks and boutique investment banking advisory firms across the world. Our Investment Banking team has considerable experience in providing M&A, equity capital market (ECM), debt capital market (DCM) and analytics solutions to our clients.

Sources:

https://ir.citi.com/zwaEqN9YmEuQZ3IxTxz0CB9Cjw5ZT9XEvE6D%2BOgHqO70WrgFdMJNjtS8k0HbjQHOM69MRBTlcJQ%3D

https://www.grandviewresearch.com/industry-analysis/education-technology-market

https://nfluencepartners.com/wp-content/uploads/2020/02/State-of-the-Market_EdTech-2020.pdf

https://www.toptal.com/finance/market-research-analysts/edtech-trends-2020

https://www.holoniq.com/notes/87bn-of-global-edtech-funding-predicted-to-2030/

https://www.holoniq.com/notes/58-global-edtech-mega-vc-rounds-100m/

https://150sec.com/the-edtech-revival-investors-backing-education-again/13299/

https://150sec.com/the-edtech-revival-investors-backing-education-again/13299/

https://www.holoniq.com/edtech-unicorns/

https://www.holoniq.com/edtech-unicorns/

What's your view?

About the Author

Sankar Raghukumaran has about 3 years of experience with the IB team at Acuity Knowledge Partners. Currently he supports one of the mid-market investment banks based out of the U.S. Sankar gained experience in areas of M&A, Equity Capital Markets (ECM) and Debt Capital Markets (DCM). Recently he is supporting the bank on their European operations in prospecting as well as pitching activities for various sectors such as Technology, Industrials and Consumer. Sankar holds a Bachelor’s degree in Commerce (Honours) and a Master’s in Business Administration (focusing in Finance), both from the Sri Sathya Sai Institute of Higher Learning (SSSIHL), India.

Like the way we think?

Next time we post something new, we'll send it to your inbox