Published on December 6, 2022 by Siddhartha Gupta

The expansion of services and offerings of financial institutions (FIs) such as banks, insurance companies and asset management companies (AMCs) has locked in a significant amount of customers’ personal data. Advancements in technology and growth of the fintech space have helped these institutions expand their reach and made transactions easier. A number of startups offer short-term loans and trading platforms with minimal brokerage and assist with purchasing financial instruments such as mutual funds, bonds and ETFs, making access to financial services easier, especially for youth.

These abovementioned developments have led to the establishment of financial data aggregators who compile data from different accounts, namely bank accounts, credit card accounts, investment accounts, loans and other financial accounts – through a consent-based mechanism, in a single place. As the volume of transactions increases, data engineering in finance plays a crucial role in managing, processing, and securing the vast amounts of customer data generated by these aggregators.

The concept of financial account aggregation was initiated in the mid-1990s, when banks started rolling out internet banking in the US to help clients with online fund management. They started offering single sign-on (SSO) that enabled clients to monitor all their accounts through a single click, and execute tasks such as fund transfers and opening new accounts. Vertical One was the first account aggregation service provider in the US; this was eventually merged with Yodlee in 1999. “eWise” (September 2000) in Australia, “e-Clips” (June 2001) by Hanvit Bank in Korea and “Moneystation” (September 2001) in Japan were the first account aggregation service providers in their respective countries. Owing to competition and technological developments, banks have now started offering data aggregation apps featuring robot-based advisers. The expansion of the Open Banking API Framework (in the UK and Australia in 2018 and 2019, respectively) has further spurred the growth of financial data aggregation globally.

In India, the concept of financial data aggregators, termed “account aggregators” (AAs), was launched publicly in September 2021. These entities operate with an NBFC-AA licence and are regulated by the Reserve Bank of India (RBI). A number of private- and public-sector banks, namely Axis Bank, ICICI Bank, HDFC Bank, IndusInd Bank, State Bank of India, Kotak Mahindra Bank, IDFC First Bank and Federal Bank, have already joined the AA network. Others that have received in-principle approval from the RBI include Finvu, OneMoney, CAMS Finserv, NADL, PhonePe, Yodlee and Perfios.

What is the problem for in Current Scenario

In general, data relating to a particular client is stored only with the FI providing the service, restricting other FIs, primarily banks and NBFCs that are lenders, from assessing the creditworthiness of clients. This leads to financial and operational issues such as higher transaction costs and processing time, multiple-stage evaluation of documents and applications, evergreening loans and a lack of tailored offerings in terms of interest rates and repayment schedules. Since the data is not available with other FIs, a loan request becomes a fresh application, although the client may have already taken a loan from another bank/NBFC.

To mitigate the problem, we need an entity to act as the link between the financial service provider and the user – a financial data aggregator – to help increase transparency of the process.

What is a financial data aggregator, and how does it work?

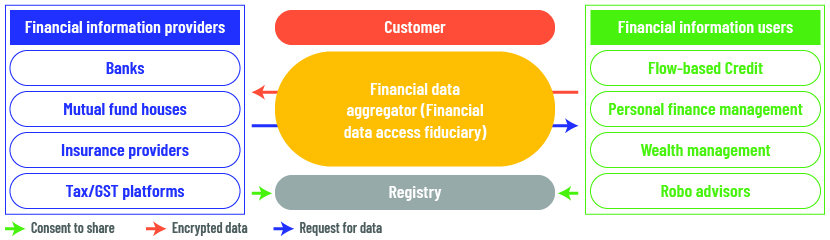

A financial data aggregator is an entity that, under contract with an FI, retrieves or collects financial information of its customers. The network has three participants: the financial information user (FIU), the financial information provider (FIP) and the aggregator. The FIU is the entity that needs the customer’s transaction history to ascertain eligibility. The FIP is the entity that has this data, through the account held with it. The aggregator acts as a bridge between the FIP and the FIU and ensures transparency in the process. The network enables sharing a customer’s financial history safely and securely, based on customer consent granted to other FIUs. An aggregator network helps overcome challenges relating to accessing customised credit and financial services.

For example, if an individual wants a loan to start a medium-scale business, an aggregator collates data relating to the individual from FIs such as banks, NBFCs, insurance providers, AMCs and brokers with whom the individual has accounts and shares this data with the prospective lender.

Such information helps the prospective lender ascertain the applicant’s creditworthiness and repayment history and determine whether to offer credit and related services.

Customer authentication required to initiate process

The process will be initiated solely on customer consent. The entire process is conducted electronically, with no room for manipulating data or forging documents. The data is encrypted, and no FI is allowed to store, process or sell a customer’s data, ensuring data privacy. Financial data extraction methods ensure the data is extracted, shared, and verified securely, with no room for data tampering.

The infographic below shows the flow of information from the FIP to the FIU, based on customer consent.

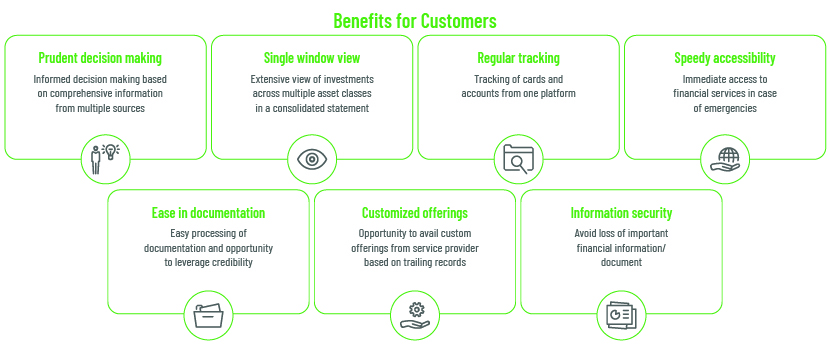

Financial data aggregation has multi-dimensional importance for both the customer and the financial service provider.

Benefits for the customer from Finance data aggregation

Data aggregation platforms will provide consolidated statements related to different classes of financial assets in a single place, aiding in informed decision making and appropriate assessment of an individual’s overall financial status.

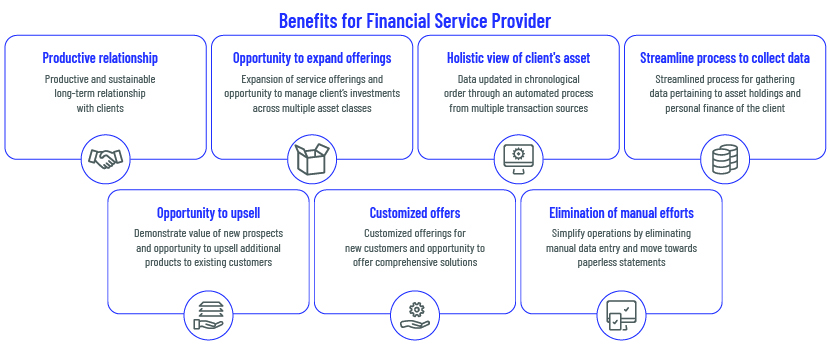

Benefits for the financial service provider:

Financial data aggregation helps bankers and financial advisers take legitimate decisions in the event of loan disbursal and extension of credit limits based on appraisals that rely on a customer’s past and present financial data.

Conclusion

Financial data aggregators will ensure transparency and security of the loan-evaluation and loan-granting process. They also help identify faulty accounts to which multiple loans have been granted. The process would reward those customers who have been disciplined and paid back their loans in line with maturity schedules with lower interest rates and easy terms and conditions but penalise those who have defaulted regularly or have been irregular in paying instalments on due dates.

How Acuity Knowledge Partners can help

We have been providing strategy research and analytics support to financial institutions, global banks and technology firms (including fintechs, tech advisory firms and tech-focused investors) for nearly two decades. We help our clients grow by providing services such as client profiling, sector-specific analysis, customised reports, data management and analytics and insight services, which serve AA ecosystem requirements.

Our unique approach, combining process, people and technology in the fintech domain, helps deliver faster results and drives excellence for our clients. A number of our clients leverage our proprietary suite of business excellence tools and offerings to unlock new levers of business growth and unmatched returns on investment.

Sources:

-

Know all about Account Aggregator Network – a financial data-sharing system

-

Account Aggregators Are Ready To Widen Indian Access To Credit | Mint (livemint.com)

-

Exclusive: RBI issues in-principle licenses to 5 Account Aggregators | MediaNama

-

India launches Account Aggregator to extend financial services to millions | TechCrunch

-

Financial Data Aggregators Are Paving the Future of Financial Services (finicity.com)

Tags:

What's your view?

About the Author

Siddhartha has nearly 5 years of experience and has worked with multinational research and analytics companies in client facing roles and has served clients globally. He holds experience across multiple sectors namely real estate, FMCG and TMT (Technology, Media, and Telecommunications). His areas of expertise include investment banking support and execution of short to medium term consulting projects.

In the current role, Siddhartha is working on a customer engagement program for a Fintech client and reports directly to senior stakeholder in the organization. Day to day work includes assessment of customer feedback for 100+ products across major business verticals; identification of KPIs and drivers pertaining to relationship, product, implementation,..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox