Published on February 15, 2021 by Anurag Sharma

Merchants and civilians first adopted a barter system, exchanging precious metals such as gold and silver, cattle and other physical commodities for other goods or services. In 1971, global fiat systems, including the US dollar, espoused floating FX rates, detaching themselves from the archaic gold standard and bringing about a wave of change.

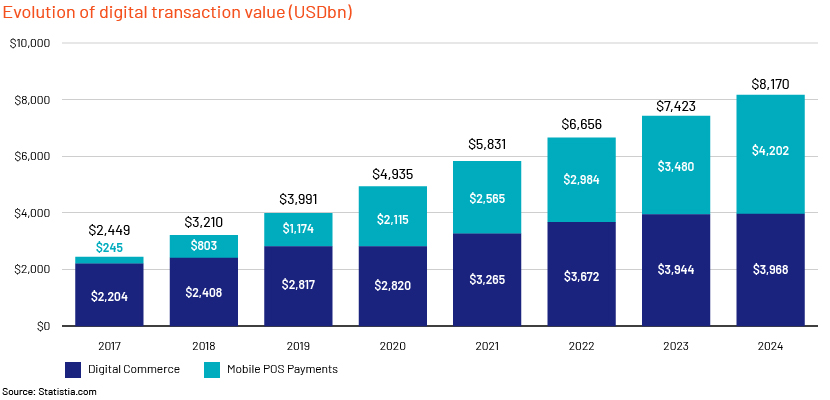

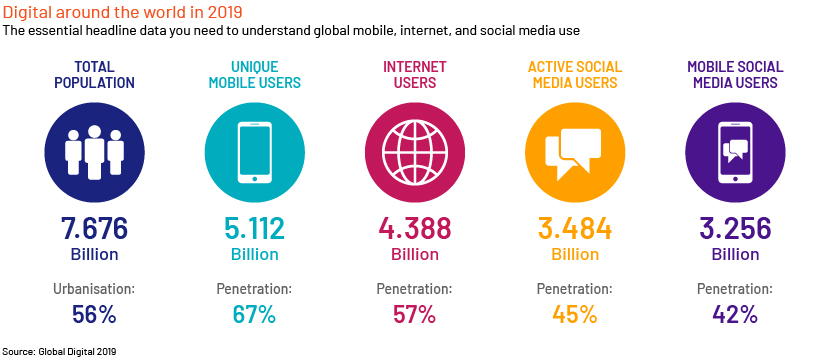

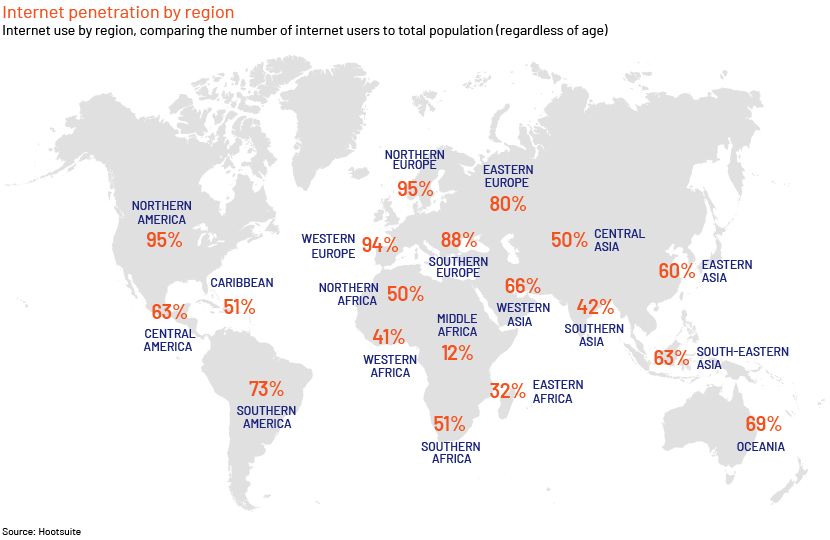

Over the past 50 years, fintech innovations such as cryptocurrencies, distributed ledgers and decentralised protocols have been phasing out traditional payment systems built by financial institutions such as banks. Fintech entrepreneurs are now more aligned with the requirements of a younger, digitally inclined generation that buys goods from around the world through just a tap on their phone screens, with swift delivery guaranteed by e-commerce sites such as Amazon.

Streamlined structures such as distributed ledgers are rapid, economical and impenetrable, and overcome hurdles in transnational payments, remittances and data transmissions. This increases economic activity, as it enables consumers to transfer value in a protected and flexible manner.

Entrepreneurs globally are outlining and creating new processes and solutions for the payments industry, enabling banks and consumers to transact without hassle.

Banks have historically invested substantially to build legacy payment systems. This legacy infrastructure is incompatible with modern payment processors, leading to high fees, long delays and frustration when customers seek to send or receive payment. Hence, financial institutions must now not only design processes and systems that incorporate enhanced innovations, but must also meet dynamic customer expectations.

Real-time settlement: A necessity for millennials

Unlike previous generations, millennials and baby boomers appreciate instant service and spontaneity.

Good use cases for RTP

Business payments via cheque: Adoption of real-time payments (RTP) would offer small to midsize businesses (SMBs) that still use paper cheques for payment (mostly for bookkeeping purposes) the ability to link invoices to the relevant transaction, along with quick fund delivery and lower overall cost. This will likely incentivise such businesses to move away from cheques.

Processing regular payroll: Compensation processing and acquiring surplus working capital, if necessary, could be postponed until the last hour. Furthermore, instant fund settlement would grant businesses an additional three to five days of working capital.

Domestic transfers via wire: RTP supports transfer of the same information via business wire, but at a much lower cost. Hence, some businesses could choose the new system over the traditional one. The main challenge with RTP is the payment limit. Wire amounts could be substantial, and RTP may not support such large sums, at least initially.

Security: An important factor for consumers and sellers

Security is a primary element of payment innovation. As KPMG explains, for any new technology to succeed, banks and payment companies must focus on security, in addition to customer convenience. This could be a challenge given the frequent shifts in consumer technology and preferences.

Banks must, therefore, ensure they keep abreast of the latest customer trends, while maintaining the highest levels of security. To develop sustainable strategies, KPMG recommends that banks and payment providers make “a more concerted effort to build security into their products, services and operating models” by subsuming cybersecurity at the initial phases of the programme. All in the organisation and ecosystem should participate in initiatives to enhance cybersecurity. It is, therefore, vital that service providers incorporate a step change in risk models and capabilities to ensure customer satisfaction.

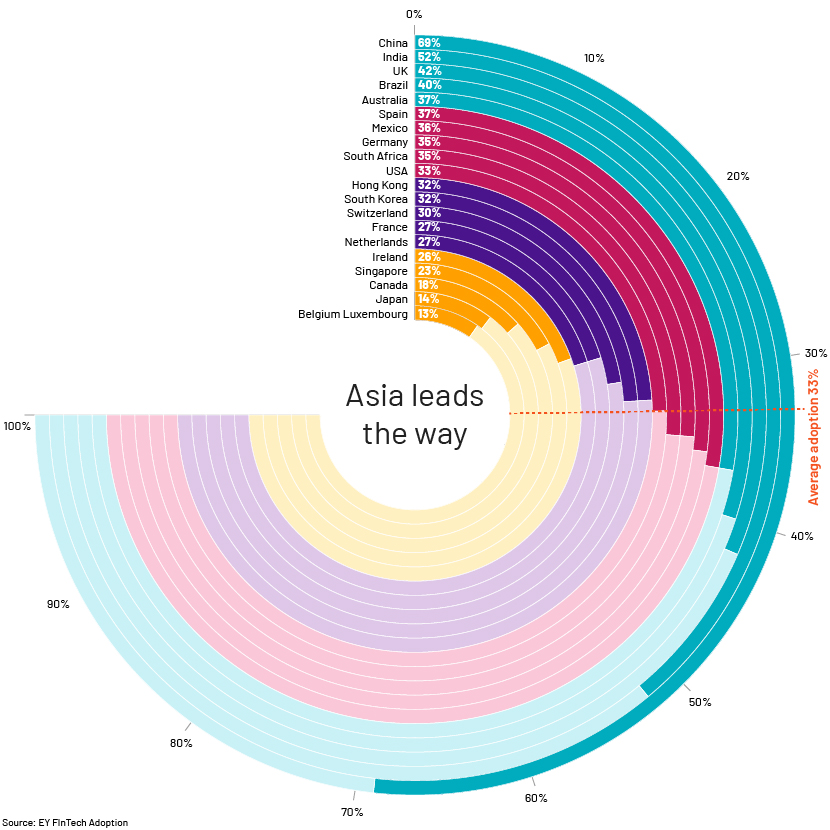

Asia takes the lead in payment innovation. Many Asian countries are upgrading their payment facilities and creating environments supportive of innovation, surpassing the “China effect”. Europe has finally moved up in the league table, mostly because of the new regulatory environment. Since 2008, Asia has been leading the development of most innovative payment solutions and is forecast to continue doing so for another two years. Experts believe that Asia’s leadership position is now more formidable than ever.

Cambodia, Malaysia, India and Thailand are experimenting with quick response (QR) scan codes to improve remittances between them. QR codes that are compatible with EMVCo specifications could be used to send and receive payments in local currencies.

Europe takes second place, and Africa, North America and Latin America the third, fourth and fifth places, respectively. This is a significant improvement for Europe, which has been at the bottom of the innovation potential table since 2008. Africa is ranked above the US; this is exemplary given the funding issues facing fintech and payment companies in Africa. Capital invested and press coverage of innovation in the US should be equal to that in Asia, but the US still lags way behind, limited by its very basic infrastructure.

Conclusion

Future of payments

-

Fintech entrepreneurs eliminating barriers to payment is increasing economic activity and enabling fresh wealth creation

-

Digitally savvy consumers expect novel technologies such as cryptocurrencies, blockchain technology, tokenisation and peer-to-peer networks, forcing a change in a vast and well-established ecosystem

-

The system currently in place to send and receive money will likely change completely by 2030

-

Making a payment would be just a tap away and made easier (just one gateway) via a mobile phone or watch. Payments would also be highly secured, without the need for a PIN/passcode, and available across the globe

New startups

-

The capital markets landscape has changed due to the number of new technologies, and hundreds of startups are leveraging these enhanced technologies to overcome the inefficiencies in the investment banking system

-

The biggest banks are investing in rather than ignoring these changes

-

Since 2012, the top 10 US banks (by assets) have participated in 72 rounds of funding, investing USD3.6bn in 56 fintech companies

-

In Europe, Banco Santander has provided a maximum of unique investments to fintech startups, making 13 investments in 12 startups. Its largest investment was USD135m in 3Q 2015 in Kabbage, a small business lender. The funding round included the participation of the ING Group

-

Effect on investment banking

-

Investment banks are likely to become more flexible and reduce costs by consolidating processes

-

AI and analytics would support resources and intellectual property in the front office, so as to serve clients better

-

A highly automated and largely externalised blockchain-enabled back office will likely support best-in-class trading platforms

-

Investment banking channels will likely incorporate B2B platforms and marketplaces as these evolve in the real economy. Collaboration will play a pivotal role, even between competitors, as the white labelling of services becomes more common, with the industry eliminating the duplication of costs in favour of a smarter approach

-

Today’s investment banks are unlikely to shift to this model instantly. However, it is beneficial that they do so soon, as their ROE could otherwise decline in the coming years

How Acuity Knowledge Partners can help

Acuity Knowledge Partners (Acuity) is a leading provider of bespoke research, analytics, staffing and technology solutions to the financial services sector. Acuity has nearly two decades of transformation experience in servicing over 300 clients with a specialist workforce of more than 2,500 analysts and delivery experts across its global delivery network. Our services are supported by our proprietary suite of solutions – Business Excellence and Automation Tools (BEAT) – that combine technology automation and subject-matter experts. Members of our tech team continue to enhance their automation capabilities with machine learning and NLG. The investment banking solution suite enables banks to achieve faster turnaround without compromising on accuracy. It helps them enhance client service and drive revenue while reducing costs and retaining talent.

Sources:

Global Digital 2019

EY FInTech Adoption

Hootsuite

What's your view?

About the Author

Anurag Sharma has a 6+ years of experience working across various roles in the Investment Banking team at and Acuity Knowledge Partners and Verity Knowledge Solutions. Currently, he supports the Financial Institutions Group team of a bulge bracket investment bank based out of the U.S., in deal originations and executions. He currently leads the FIG team at Acuity and is responsible for client delivery and management. He holds a B.Tech. from National Institute of Warangal.

Like the way we think?

Next time we post something new, we'll send it to your inbox