Published on January 17, 2023 by M Amarnath Rao

Introduction

The US categorised cannabis, commonly known as marijuana, as a psychotropic drug and banned the plant in 1937 by introducing the Marihuana Tax Act that was later adopted by other countries. However, the medicinal use of cannabis cannot be ignored; many cultures have been using it to treat illnesses for thousands of years. Cannabis extracts are used to ease the pain of life-threatening diseases such as cancer, HIV, anxiety and nausea. Thirty-five states in the US have now legalised the plant for medicinal purposes, and countries such as Canada have even made it legal for recreational use. Canada’s cannabis industry registered large capital inflow, but the product was not as profitable as imagined, due to a lack of expertise and not conducting due diligence. Institutional investors realise this is a lucrative industry; although it is taking time to get this legalized, the legal side will likely thrive.

Is cannabis legal?

Cannabis is illegal in most countries, but many are starting to permit its use for both recreational and medical purposes.

Each country has laws relating to cannabis. Some permit the use of products that contain only cannabidiol (CBD); others consider use of any kind of cannabis a serious crime.

Cannabis in the United States:

Several states in the US legally permit cannabis for medical and recreational use, although it is still considered illegal under US federal law. It is considered to be a zero-tolerance drug federally, with the Controlled Substance Act (CSA) offering bankruptcy relief to businesses involved in selling it. Schedule I of the Controlled Substances Act (CSA) classifies use of cannabis as a proposed lawful and regulatory change in the law related to cannabis at the federal level. This is the most controlled category for drugs that currently do not have any accepted medical use.

Marijuana is still considered as an unlawful substance under Schedule I of federal law.A total of 27 Columbian states and District decriminalised even smaller amounts of marijuana.

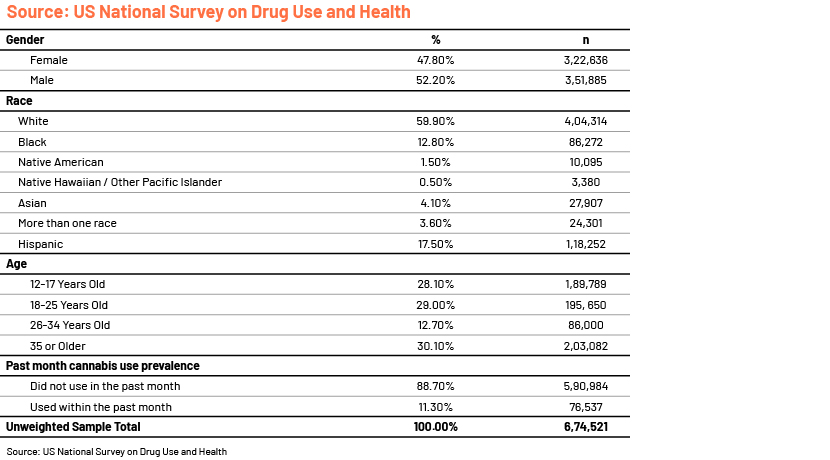

Characteristics of the US population using marijuana

Investment opportunities

Making the use of marijuana legal would lead to substantial benefits for local and national economies. It could also secure investment in a country. Only a few marijuana-related companies are listed and trading on exchanges; while investors have the option of trading on over-the-counter exchanges, Canada and a few other countries have a number of successful businesses in the legal cannabis space.

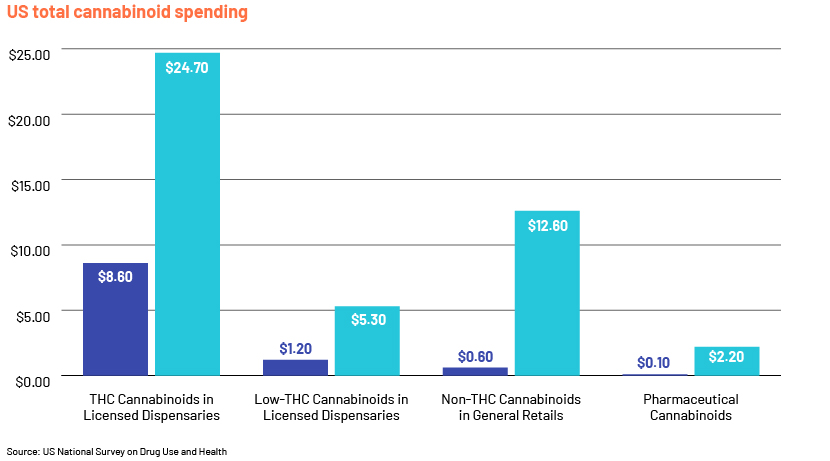

The following chart illustrates estimated exponential growth in the US cannabis sector from 2018 to 2024.

Instruments available for cannabis investment

The cannabis sector is undergoing a transformation. The changes in legislation relating to medical marijuana have encouraged dozens of markets in the US and selected nations in Europe and Latin America.

1. Select an ETF over stocks

Investing in the cannabis sector presents significant financial opportunity. Investing in single-property stocks carries unsystematic risk; this means that even though a sector may grow overall individual companies may be half-baked. Therefore, it would depend on global regulations that change constantly, leading to volatility in share prices. This could be mitigated by diversifying investments across companies along the supply chain, investing in the concept and the sector as a whole.

Hence, an ETF would be safer than buying low and selling high, as it would provide a steady return. Before selecting an ETF, points to check, in order of importance, are liquidity, fund constituents and fees charged.

2. Acquire a commercial cannabis operation

With demand for adequately grown and quality marijuana increasing, another way to invest in cannabis is through medical markets. In Canadian markets, investors speculate on valuations of these growth companies.

3. Invest in a dispensary

In countries that have legalised medical and/or recreational marijuana, this is available only in licensed dispensaries. With marijuana prohibited in certain countries, choosing a dispensary company with branches in multiple geographies would be profitable.

4. Invest in CBD

Cannabidiol, or CBD, is one of the chemical compounds in cannabis that is legal and widely used for holistic treatments. CBD is approved by the FDA³ to treat specific cases of extreme epilepsy in children. Demand for CBD-infused products is on the rise.

Steps taken by governments to drive use of cannabis

A number of countries are promoting the use of cannabis, resulting in growth of the sector and investment in it. One area in which law enforcement is interested is the process for obtaining state licences. For example,

-

To develop products for treating epilepsy and cancers, the Indian Institute of Integrative Medicine (IIIM) has secured a licence to grow cannabis for scientific and medical research purposes. A tripartite agreement was entered into to initiate this process between the Council of Scientific & Industrial Research (CSIR), the Indian Council of Medical Research (ICMR) and the Department of Biotechnology. A cross-border arrangement was formulated in February 2020 by IIIM and CISR with IndusCann, a research company based in Canada.

-

With New York enacting legislation, legalisation of recreational marijuana has evolved significantly recently. This growth has generated substantial revenue opportunities for companies that invested in preparing to participate in line with these new regulatory framework.

The need for compliance

Demand for cannabis is increasing due to its extensive use in medical, recreational, retail, and agricultural applications. To meet market demand, manufactures to stay ahead in terms of conserving resources while innovating and improving facilities to be in line with regulations and third-party compliance.

With significant growth in the sector, the share of cannabis investments in a portfolio could increase. Investment compliance would play a major role here. The need for compliance would help portfolio managers not only to strengthen their presence in the market, but also to effectively manage their portfolios.

Investment compliance could be defined based on the rules governing a sector. In general, compliance within the asset management sector or investment banking refers to adhering to regulatory guidelines on trading in the market and following standards set by internal management and legal or regulatory authorities.

Investment compliance ensures strict adherence to rules and regulations of the respective regulatory authorities, ensuring the safety of investments.

How Acuity Knowledge Partners can help

We tailor-made dynamic functions with a robust, responsive and proficient control framework and process delivery. Our experienced tool-agnostic team provides support in investment compliance, trade surveillance and corporate, forensic and crime compliance. We are experienced in providing unique solutions with the help of our state-of-the-art technology.

Our pool of subject-matter experts help with process delivery, training, projects and automation to mitigate costs. Our established compliance capabilities help clients identify problems and opportunities to navigate a challenging business environment.

Sources:

-

Proposed Approach to the Regulation of Cannabis: Summary of Comments Received During the

-

Cannabis Legalization Could Cost Pharmaceutical Companies Billions of Dollars – Technical420

-

Estimating the effects of legalizing recreational cannabis on newly incident cannabis use | PLOS ONE

Tags:

What's your view?

About the Author

Amarnath carries a total work experience of 14 years and is currently working as an investment compliance specialist in pre-trade & post-trade monitoring. He has worked for various firms including Thomson Reuters & Capgemini. At Acuity Knowledge Partners, he is working as a Delivery Manager supporting both post & pre-trade compliance services. He is a BBM graduate in Finance from Garden City college, Bangalore.

Like the way we think?

Next time we post something new, we'll send it to your inbox