Published on June 11, 2019 by Harshwardhan Khandelwal and Avinash Kumar

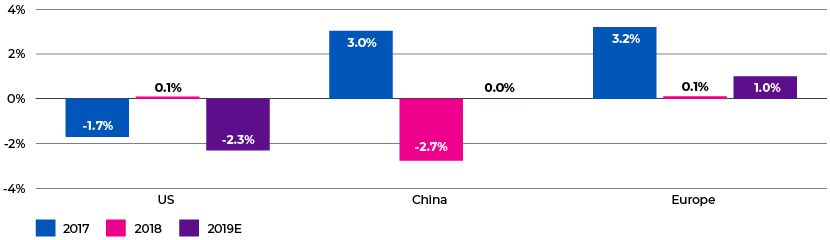

In an ideal world, declining unemployment, increasing wages in line with economic growth and low oil prices would have automobile companies across the word smiling. However, the mood is gloomy in the automobile sector as registrations continue to decline globally. In the first four months of 2019, automobile registrations fell 2.2% in the US.

Trends are similar elsewhere as well. In Europe, automobile sales fell 2.6% and, in China, the world’s largest automobile market, registrations fell c.12% in the first four months of 2019.

Overcapacity and increasing capex remain major issues

Declining sales have led to overcapacity in the sector. Automobile research firm LMC Automotive indicated earlier this year that the US alone has an overcapacity equivalent to 10 plants (or 20,000 jobs) that can turn out about 3 million more vehicles than the demand. During the global financial crisis, overcapacity is precisely what spurred losses in the sector and resulted in the bankruptcy and then bailout of GM and Chrysler.

At present, the largest overcapacity is in the sedan segment as changing customer preferences make these cars less desirable. Companies such as Ford, Honda and Toyota are thus bearing the brunt of overcapacity in the US. Not surprisingly, Ford announced the phasing out of sedans such as Fusion, Fiesta and Focus last year. Later in 2018, GM announced the discontinuation of a slew of sedans, including its popular Chevrolet Cruze.

Although restructuring activities would address some of the overcapacity, but the problem would still remain a drag on the top-line. Additionally, investments by automobile companies to meet emission standards and develop electric vehicles (EVs) would further remain a drag on their already weakening EBITDA margins (which have weakened by c.50bps y/y to c.9.5% in 2018).

More recently, trade war concerns and weakening economic growth outlook have weighed on the automobile sector’s outlook. As such, automobile sales across the two largest markets are expected to decline by over 2% in 2019.

Vehicle sale growth across major geographies

Source: Wards, ACEA and CAAM

Downside risks are rising

Given the macro backdrop, the downside risk to the sector is rising. However, we believe that the pain will not be evenly spread as was seen in the last downturn. For instance, Auto OEM saw a secular decline in vehicle sales during the crisis in 2008-2009, with vehicle sales for Ford, GM and Chrysler falling 20%, 22% and 30%, respectively, in 2008. In contrast, while GM and Ford saw 13% and 9% declines in registrations, respectively, in 2018, volumes of Fiat Chrysler grew 9%. The sharp growth in FCA volumes reflects changing consumer preference toward crossovers, SUVs and trucks, instead of sedans. The luxury segment too saw similar trends in registrations last year, with BMW, Lamborghini and Ferrari registering growth, while JLR saw a sharp decline in registrations. Thus, we believe there would be divergence between the fortunes of major auto OEMs over the near to medium term.

Key trends

-

Mergers and acquisitions: Aston Martin’s CEO, Andy Palmer, recently said “...[automobile companies] are all developing similar technology costing billions and that’s nonsense”, adding that “I think it is inevitable car companies will come together through mergers and acquisitions. The requirements will be too much for many of the firms involved”. Although larger companies can survive, the smaller companies will feel the pinch of the higher R&D spending as competition from the Silicon Valley (for autonomous tech) and EV players intensifies.

-

Cash flows vs cash burns: While large companies, such as Toyota and VW, continue to generate positive cash flow, relatively smaller companies, such as Tesla and JLR, continue to burn cash. Recently, Tesla has been in news because of its weakening liquidity and leverage profile, as it continues to miss its production targets. Despite the capital raising of USD2.7bn in May this year, Tesla continues to face a significant cash crunch owing to high capital requirements (the cost of development of Gigafactory 3 is expected to be at least USD5bn), upcoming debt maturity of USD551m in November 2019 and company’s high cash burn rate. In Q1 2019, Tesla burned around USD200m cash per month and, Elon Musk, has noted that at this rate, the firm will burn all its cash in less than one year.

-

Trade and tariff: The escalating trade war between the US and China and the imposition of tariffs on vehicles and parts by the US would resonate through the global vehicles supply chain. According to the World Trade Organization, the US-China trade war directly affects 3% of global trade; however, the automotive industry is the worst hit, with an adverse impact of around 8%.

Is there a case for distress debt investors in the auto sector?

Companies with a strong balance sheet and an ability to proactively adapt to customer preferences (such as FCA’s switch to focus more on SUVs, trucks and crossovers from sedans in 2016) would emerge as winners. However, companies with a weak balance sheet and an even weaker operating profile could be of interest to distressed debt investors.

We have an upcoming webinar where we will discuss how one can build a proprietary and scalable distressed debt investing process ahead of a cycle.

What's your view?

About the Authors

Harshwardhan Khandelwal has close to 10 years of work experience in investment research, with a focus on financial institutions, sovereigns and supranational entities. He currently supports a large European buy-side client, providing opinion-based credit research (initiation and maintenance) and issuer rating recommendations by performing fundamental and technical analyses of issuers, and analyzing the capital requirements and structure of banks.

Prior to this, he supported the co-branded bottom-up research alongside onshore fixed income strategists for a major European investment bank’s private banking division. He is also actively involved in training, quality control of deliverables, and client discussions. He..Show More

Avinash Kumar has over 7+ years of experience working across different value chain in the Investment Banking domain. Currently, supports Public Finance / Project Finance team, with a focus on Infrastructure Finance / Municipal Finance - Public Private Partnership(P3). He is instrumental in developing automated excel templates for daily, weekly and monthly Infra / Muni market updates, for a U.S. based mid-market Investment Bank, in Bangalore. He holds a Master’s degree in Business Administration in Finance.

Like the way we think?

Next time we post something new, we'll send it to your inbox