Published on December 2, 2021 by Yogesh Mishra and Charan KJ

“Society of Civil Engineers gives US infrastructure 'mediocre' C minus grade”

The US is ranked among the top nations for education, entrepreneurship and quality of life. However, it lags behind in infrastructure, earning a C- on the American Society of Civil Engineers 2021 National Infrastructure Report Card.

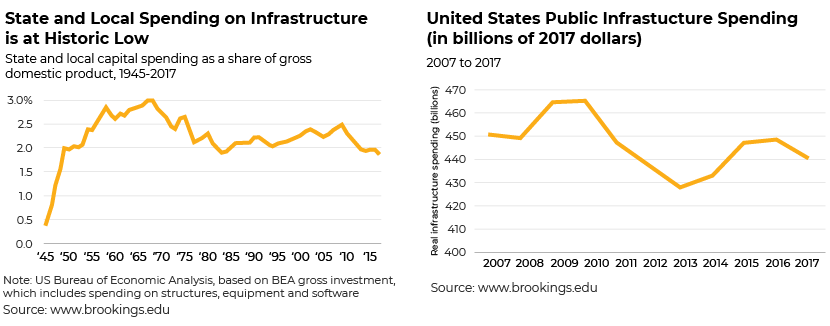

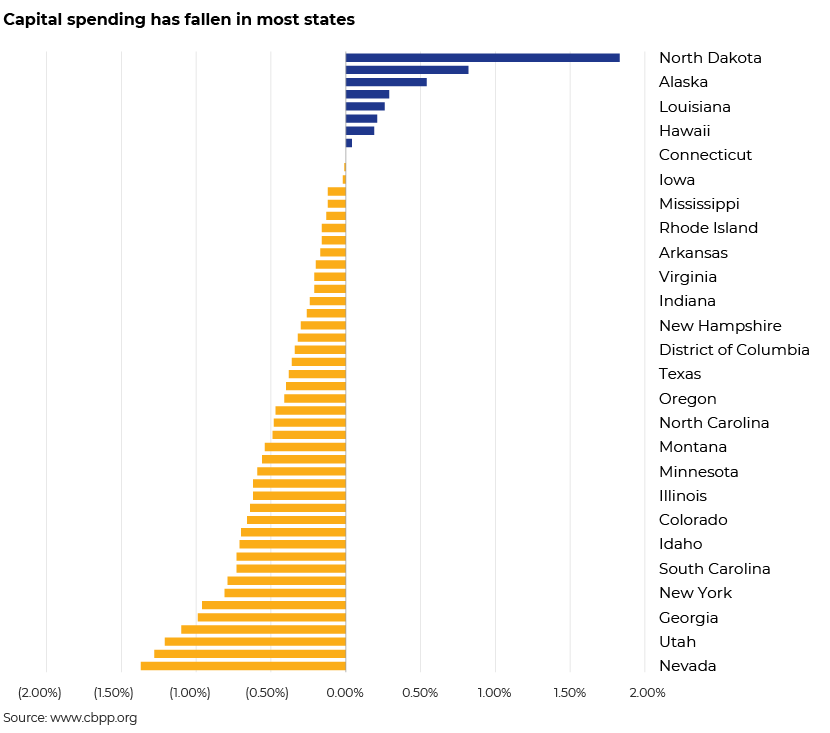

Since the 1960s, public domestic investment as a percentage of GDP has dropped by more than 40%. It is, therefore, high time the US invested in infrastructure and competitiveness. It is now prepared to invest in ways it has not since the construction of interstate highways and its victory in the Space Race.

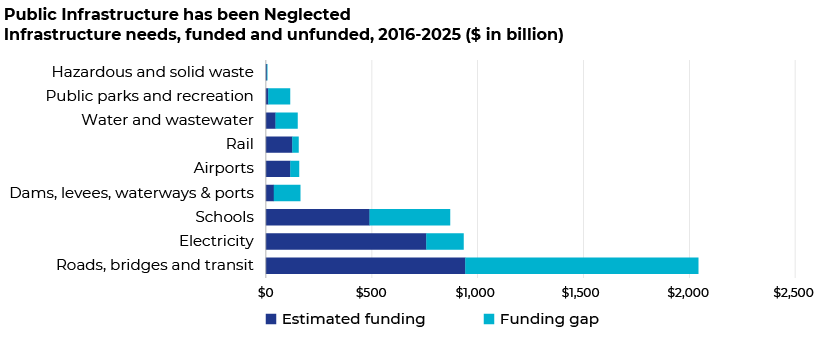

Years of neglect have resulted in roads decaying, bridges in need of repair, insufficient public transportation, antiquated school buildings and other vital infrastructure requirements. We believe it is crucial to take stock of recent expenditure patterns as the country discusses its next big wave of infrastructure investment.

Why the major boost in infra spending?

The following points dive deep into these spending shifts, showing the challenges the US faces both in maintaining and upgrading its infrastructure in a coordinated, long-term manner.

I. Total public infrastructure spending declined by USD9.9bn in real terms from 2007 to 2017

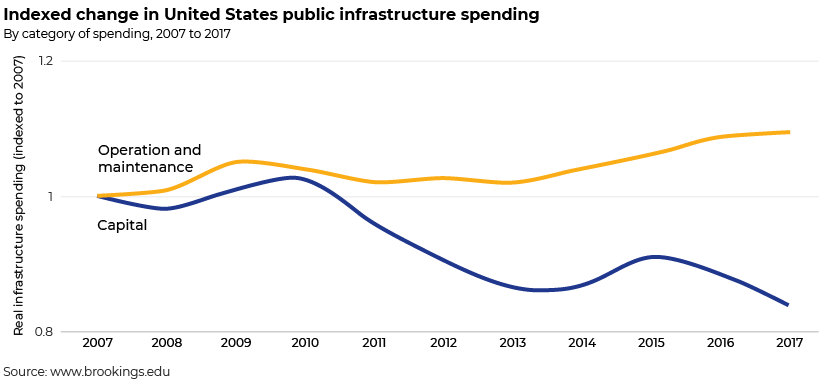

II. Infrastructure operation and maintenance spending has increased by USD23.2bn (9.5%) in the past decade while total government spending has decreased

III. Transportation infrastructure spending has decreased by USD4.2bn (1.4%) since 2007, but has shown signs of recovery in the past five years

Real operation and maintenance costs have increased from USD243.3bn to USD266.5bn since 2007, while real capital project spending has fallen by 16%, from USD207.1bn to USD174.0bn.

As a result, operation and maintenance now account for 60.5% of total public infrastructure spending in the US, up from 54.0% a decade before. On the other hand, capital spending has dropped to 39.5% from 46.0%. While the trends of increasing expenditure on operations and maintenance and reducing investment in capital projects have been gradually gaining momentum since the 1950s, they accelerated in the previous decade.

Biden’s USD2.3tn plan to rebuild infrastructure and reshape the economy

President Biden has introduced a USD2.3tn plan to rebuild and upgrade US infrastructure, calling it a transformational effort that could create the “most resilient, innovative economy in the world”.

“It is not a plan that tinkers around the edges”, Biden said in a speech outside Pittsburgh. “It is a once-in-a-generation investment in America.”

President Biden's proposal to increase infrastructure spending by more than 1% of GDP over the next decade has both short- and long-term benefits.

It has a large “multiplier” – the rise in GDP for every dollar invested in the short term. In an economy with high unemployment and large slack, traditional infrastructure spending has a one-year multiplier of close to 1.5, one of the largest compared to other types of federal government spending and tax policy. With nearly 3m more unemployed permanently as a result of the COVID-19 pandemic, an infrastructure plan that creates new opportunities in communities around the country would be especially beneficial.

Economic studies show that in the long term, public infrastructure contributes significantly to GDP and jobs. It reduces company costs, improving competitiveness and productivity; it lets people to live closer to their workplaces, reducing commuting time, increasing labour participation and cutting carbon emissions.

This is an especially good time to enhance infrastructure spending, because the return on investment is far higher than the government's cost of financing. Thirty-year treasury yields are just over 2%, but the return on practically any public infrastructure investment would almost certainly be significantly higher.

Financing the massive infrastructure spending

To finance the USD2.3tn infrastructure makeover, the federal government is looking to make multiple changes to US tax rules to put the cost of the plan entirely on corporates.

These include raising the corporate tax rate to 28% from the 21% levy set by the Trump administration’s 2017 tax bill, eliminating all fossil fuel industry subsidies and loopholes, and establishing a minimum tax on income companies use to report profits to investors.

The reforms will add 0.5% to US GDP per year in corporate revenue; the White House says this will fully pay for investments within the next 15 years and reduce the government’s deficit after that.

Biden’s tax plan for corporates

|

Tax change |

Goals |

|---|---|

|

Increase the corporate tax rate to 28% |

Reverse President Trump's 2017 corporate tax cut, which now imposes a flat tax of 21% on all corporations. This is expected to generate new revenue of USD1tn over the next 15 years. |

|

Raise the global minimum tax to 21% |

Increase the worldwide minimum tax on firms in the US to 21% from 10.5%. Because the first 10% return on foreign assets is tax-free, and the rest is taxed at half the domestic rate, multinational businesses are currently shifting earnings and jobs offshore. According to Biden, this will generate an additional USD1tn in 15 years. |

|

Prevent US corporates from using tax havens |

Prevent American corporations from claiming tax havens as their residence in order to avoid paying taxes. Currently, US firms can buy or combine with international corporations to claim status as a foreign corporation while managing and operating operations in the US. |

|

Remove expense deductions for offshore jobs and close the intellectual property loophole |

Remove tax expense deductions so that US firms can claim for offshore jobs, and replace them with a tax credit to encourage onshoring. Remove the Trump tax plan's Foreign Derived Intangible Income (FDII), which the White House describes as an intellectual property loophole that permits firms to receive tax incentives for transferring assets abroad. This money will go towards increasing R&D investment incentives |

|

Enforce a minimum tax of 15% on large corporates |

Apply a minimum tax of 15% on the largest corporations' book income. This income is used by corporations to report profits to investors. |

|

Phase out fossil fuel tax breaks |

Remove the fossil fuel industry's current subsidies, loopholes and special international tax credits. Polluters should be required to contribute to a Superfund Trust Fund to cover the expense of cleaning up. |

|

Invest in IRS assets |

Increase the IRS budget to enforce the tax code and deter corporate tax avoidance. According to the White House, practically all significant firms were audited annually 10 years ago. That number has now dropped to fewer than half. |

Biden’s USD2.3tn American jobs plan

|

Budget |

Programme |

Goals |

|---|---|---|

|

USD621bn |

Transportation |

Road and bridge repairs (USD115bn); modernise public transportation (USD85bn); passenger and freight rail service (USD80bn); electric automobiles (USD175bn); ports, canals and airports (USD42bn); improve historical imbalances and develop future infrastructure (USD45bn); and increase the resiliency of infrastructure (USD50bn). |

|

USD400bn |

Elderly and disabled care |

Increase the number of affordable homes or community-based care options available. This involves expanding Medicaid access to long-term care services. Build a foundation for well-paying caregiving jobs. |

|

USD300bn |

Manufacturing |

Strengthen critical product manufacturing supply chains. Create a new agency at the Department of Commerce to track domestic industrial capacity and support production (USD50bn); manufacturing of and research in semiconductors (USD50bn); countermeasures to safeguard against future medical pandemics and employment losses (USD40bn); manufacturing of clean energy (USD46bn); regional innovation clusters and a Community Revitalization Fund (USD20bn); indigenous manufacturers (USD52bn); create a national network of small company incubators and innovation hubs (USD31bn); and create jobs and foster economic growth by partnering with rural and tribal communities (USD5bn). |

|

USD213bn |

Housing |

Over 2m affordable and sustainable houses will be built, preserved and retrofitted. This includes USD20bn in tax incentives to restore or create 500,000 low- and middle-income houses. Infrastructure for the public housing system (USD40bn) and investment in clean energy to improve homes and businesses (USD27bn). |

|

USD180bn |

Tech research and development (R&D) |

Improve scientific infrastructure (USD40bn); collaborate and expand government programmes (USD50bn); encourage USD30bn worth of job creation and innovation in R&D; technology for renewable energy and clean energy jobs (USD35bn); climate-related R&D (USD20bn); HBCUs and other MSIs have invested USD25bn in R&D. |

|

USD111bn |

Water |

Replace lead pipes and utility lines (USD45bn). Upgrade and modernise the nation's drinking water, wastewater, and storm water systems, and combat new contaminants and assist in building rural clean water infrastructure (USD66bn). |

|

USD100bn |

Internet |

Build high-speed internet infrastructure to achieve national coverage of 100%. Encourage internet service providers to be more transparent about their prices and to compete with one another. Reduce the cost of broadband internet by providing widespread service. |

|

USD100bn |

Power |

Build a nationwide electric transmission system that transports inexpensive and clean electricity. Modernise power generating to ensure that clean electricity is delivered. Clean up abandoned mines and plug orphan oil and gas wells (USD16bn); brownfield and superfund sites will be remedied and redeveloped (USD5bn); provide job opportunities in public lands and water conservation (USD10bn). |

|

USD100bn |

Schools |

Upgrade and construct new public schools (USD50bn in direct grants, plus another USD50bn in bonds). Invest in community college infrastructure (USD12bn). Upgrade and construct new child-care facilities (USD25bn). |

|

USD100bn |

Workplaces |

Next-generation training programmes can help workers. Creating a new Dislocated Workers Program and sector-based training (USD40bn) are two examples. Target opportunities for workforce development in marginalised communities (USD17bn). Expand the capacity of existing workforce development and worker protection institutions (USD48bn). |

|

USD28bn |

Veterans Affairs (VA) hospitals and federal buildings |

Modernise VA hospitals and clinics (USD1.8bn). Purchase, construction or renovation of federal buildings (USD10bn). |

Governments have historically accounted for the bulk of infrastructure investment and development, whether funded directly or indirectly via corporatised state-owned enterprises (SOEs). The emergence and development of public-private partnerships and other forms of private participation in infrastructure in recent decades have expanded options for infrastructure development and financing. The infrastructure bill is expected not only to drive economic activity, but also to act as a tailwind for the government, developers, investors, financiers and other stakeholders in the infrastructure arena. Capital-intensive investments would also require investment banks, and conventional public finance, public sector and corporate banking taking an active role in financing and advising.

How Acuity Knowledge Partners can help

We help investment banking teams scale up their project finance practices and drive value for their clients. By leveraging dedicated teams of experienced analysts at our offshore delivery centres, our clients benefit from operational efficiency and cost optimisation. Our team of project finance experts are well versed in covering public finance and project finance and are vested with state-of-the-art modelling capabilities. Many of our clients working with our specialised project finance investment banking teams have benefited from our integrated suite of services along the investment banking advisory value chain.

Sources:

https://smartasset.com/financial-advisor/biden-infrastructure-plan

http://sgp.fas.org/crs/misc/R46826.pdf

http://brookings.edu/research/shifting-into-an-era-of-repair-us-infrastructure-spending-trends/

http://cbpp.org/research/state-budget-and-tax/its-time-for-states-to-invest-in-infrastructure

https://www.theguardian.com/us-news/2021/aug/04/infrastructure-bill-bipartisan-visual-explainer

https://www.economy.com/getlocal?q=C228A0FF-2701-47B2-ADE0-D158B5866251&app=download

Tags:

What's your view?

About the Authors

Yogesh Mishra has 1+ year of experience in Investment Banking domain, with major focus on executing assignments related to Project Finance, Public Finance and Infrastructure – Public Private Partnership (PPP), for a U.S. based mid-market Investment Bank. He holds a Master’s degree in Business Administration in Finance.

Charan KJ has 1+ year of experience in Project and Public Finance domain. Currently supporting the team on various assignments including daily, weekly and monthly Infra and Muni market updates, among others, for a U.S. based mid-market Investment Bank. He holds Master’s degree in Business Administration with specialization in Corporate Finance.

Like the way we think?

Next time we post something new, we'll send it to your inbox