Published on September 25, 2018 by Rahul Kajla

The Key Concern: Unbanked population across the globe

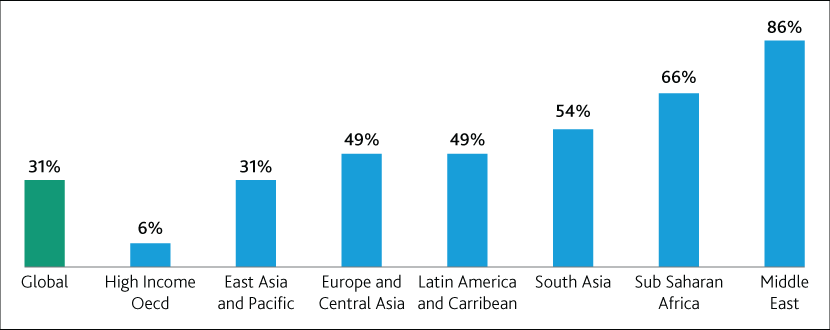

Over 1.7bn adults across the globe do not have a bank account, due to a lack of valid identity proof, absence of credit history/financial records or the inability to afford banking services. Out of these financially excluded adults, ca. 75% reside in the developing and less developed regions.

Percentage of Adults with No Bank Account

Source: International Finance Corporation, World Bank Group

While high costs refrain traditional banks from reaching out to the financially excluded, new-age fintech firms see a huge opportunity in serving this segment.

Globally, there are 7,500+ fintech firms that are making financial services accessible and affordable. Tech players such as MasterCard and Amazon are finding the unbanked to be a profitable segment. While MasterCard has started offering PayPal accounts to the unbanked, Amazon is offering debit cards.

1. Banking Services – Challenger Banks

Over 100 challenger banks across the globe are targeting the unserved, which includes refugees, immigrants, and the homeless. Such banks offer services through mobile apps at lower fees due to their lean set-ups and low cost structures.

UK-based challenger bank Monzo is working on accepting alternative identity documents such as biometric residence permits or letters from homeless shelters for the opening of accounts.

2. Cashless Payments – Mobile Money/Wallet

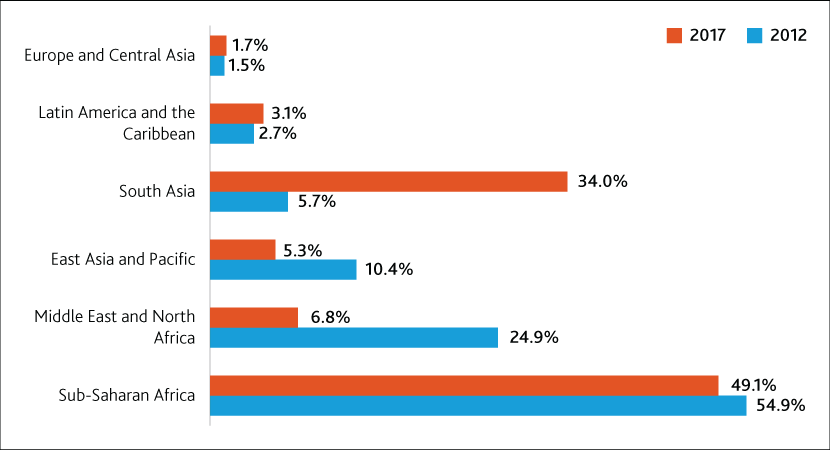

Mobile money facilitates cashless transactions through mobile phones. There are 690m registered mobile money accounts in 90 countries, with Sub-Saharan Africa (SSA) accounting for half of them. Mobile money led to an increase in financial inclusion in SSA to 43% in 2017 from 23% in 2011. Players such as M-Pesa, MTN Mobile Money, and Orange Money allow users to deposit and transfer money via mobile phones.

With the mobile penetration rate in SSA expected to increase to 52% by 2025 from 43% (2017), usage of mobile money is also expected to rise further in the region.

Registered Mobile Money Accounts (%) by Region

Source: GSMA; Registered Mobile Money Accounts: 2012 -– 136m/2017 - 690m

3. Cross-Border Remittances – Blockchain Networks

While the global average remittance cost stands at 7.1%, the average remittance cost to the emerging markets stands at 9.3%. Fintech firms facilitate instant transfers through blockchain at costs that are ca. 250x cheaper than those of the traditional SWIFT network.

Banks and money transfer operators are also partnering with fintech firms such as Ripple and R3 to process cross-border remittances through their platforms and achieve cost efficiency.

4. Loans – Alternative Lending Platforms

Alternative lenders determine the credibility of borrowers who have no credit history through the analysis of unconventional data such as e-commerce purchases, mobile usage, utility/rent payment histories, and social media footprints. This helps in the process of extending loans to the financially excluded segment. They also automate the underwriting process, leading to speedy, efficient, and low-cost credit assessment.

In 2016, funding channeled through alternative lending platforms in the Asia Pacific region increased 136% from 2015 to USD245bn.

Energy Services – Pay-as-you-go Plan

Pay-as-you-go plans facilitate access to services that are out of reach for the economically disadvantaged. In Africa, most of the rural population does not have access to electricity, decentralized energy companies such as M-Kopa and d.Light are providing consumers with affordable solar home systems. Pay-as-you-go plans connect devices to wireless networks, transmit data, and control device functionality remotely. Consumers are required to pay via mobile phones.

Fintech firms are playing a crucial role in reducing poverty and driving inclusive economic growth. With this cost advantage, several traditional banks lenders, etc. are also collaborating with fintech firms to extend low-cost services to customers.

Acuity Knowledge Partners is an experienced research and consulting partner that has been supporting corporates, consulting firms, and private equity firms across the globe in their strategy research assignments and keeps them abreast with the latest trends and developments across various business practices.

Sources:

https://www.cbinsights.com/research/challenger-bank-strategy/

https://www.standard.co.uk/tech/challenger-bank-monzo-banking-unbanked-a3861851.html

What's your view?

About the Author

Rahul Kajla has over 11 years of experience in the research and consulting industry. He currently works in the Strategy Research and Consulting practice at Acuity Knowledge Partners and supports consulting and corporate clients in their research assignments. He is experienced in customized research related to market & competitive intelligence, market assessment, benchmarking, competitive landscape, market entry, partner identification, M&A opportunity in addition to others along with sales support

Like the way we think?

Next time we post something new, we'll send it to your inbox