Published on February 15, 2022 by Mohak Mantri and Arvind Kumar Mahto

In the early 2000s, it was predicted that automation technologies could have a financial impact of c.USD6tn by 2027. This captured the imagination of many organisations, setting off the race to be at the forefront of the transformation landscape, with companies on the lookout to explore use cases and adopt new technologies such as data science or DevOps for innovation.

Organisations were quick to roll out three- to five-year transformation plans, building their competitive strategies around data-driven insights and analytics. While a few companies have met with success, instances of such initiatives proving ineffective are aplenty. So far, only the tip of the iceberg has been conquered, with major success seen only in robotic process automation (RPA) and artificial narrow intelligence (ANI). The financial industry has met with success in the rule-based automation of domain functions in enterprise resource planning, data extraction and analysis and workflow and database management. Intelligent automation generates value for transformation initiatives by learning and adapting as it automates; however, the average accuracy for some automated financial products hovers at less than 30-40%.

In this blog, we look at four major factors that can play a critical role in the journey towards digitalisation and transformation – relationship management, domain expertise, quality of data and leadership culture.

Redefining processes – journey from transaction management to relationship management

Traditional banks are yet to fix gaps that have been at play in operational performance. While automation can help at the task level, a majority of back-end processes continue to be manual in nature. Inefficient processes, interlinked with other critical processes and prone to a high degree of exceptions, do not generate desired outcomes. Organisations have a long way to go in creating synergies, rationalising resources and realising distinctive client experiences.

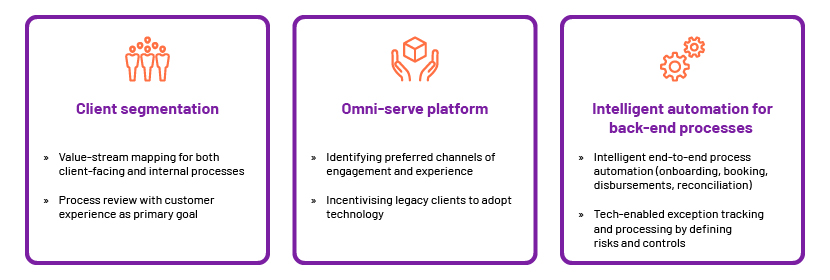

To this end, it is imperative to shift focus from transaction management to relationship management with clients, to ensure that relationship managers engage with clients in more meaningful ways. Successful transformation requires firms to redesign legacy processes and eliminate non-value add activities. Simultaneously, they would also need to apply digital design principles, in the absence of which the result of any transformation could be underwhelming. Three major opportunities on this front are discussed below:

Domain expertise to remain a competitive advantage

Innovation-driven organisations are quick to recognise individuals who are strong in technology, especially in areas of new interest. As organisations try to automate functions with unstructured data, they integrate RPA with other technology solutions to achieve better benefits. However, an algorithm or automation is successful only when it generates the required results, and without domain knowledge in innovation, comprehending a problem at hand would be an arduous exercise.

The key to successful innovation is and always will be an amalgamation of technology and domain expertise. Domain expertise is essential for an organisation to carve a path to growth in innovation and can provide substantial competitive advantage. Without requisite expertise, technology initiatives will likely end up just burning cash.

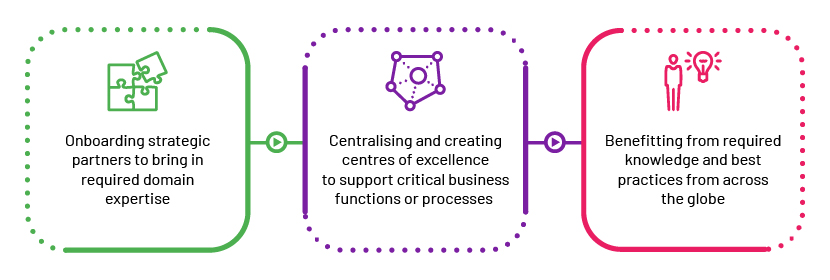

This is where strategic partnerships with third-party vendors can be a meaningful addition to the team. Defining return on investment (ROI) is ambitious at the beginning of a strategic partnership. To be successful in this journey, a holistic ecosystem needs to be created to help synergise technology with domain expertise for meaningful interactions. As enterprises grow to understand how a strategic partner can support with distinctive domain expertise, it becomes easier to scale innovation and digitalisation initiatives to address complex and critical functions.

Creating a centre of excellence

Quality of data

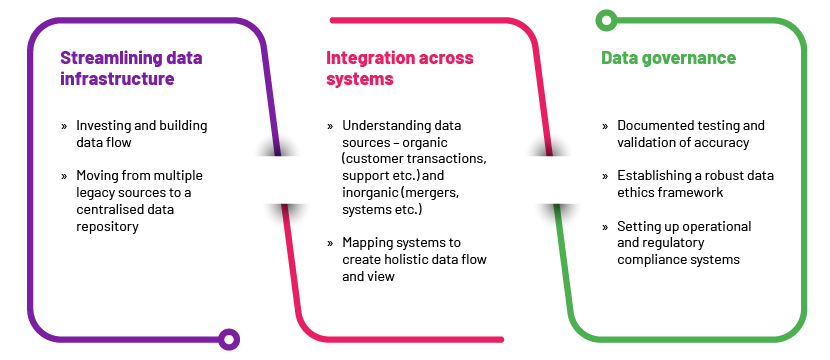

The garbage in, garbage out (GIGO) principle is truer in the digital age than ever before. Data may or may not be the oil of the twenty-first century, but it definitely is the fuel that powers transformation and artificial intelligence (AI). The success of transformation depends on how streamlined current process/data is. Data infrastructure and models have evolved over years of integration of disparate systems (through, for example, M&A) and bridging of data silos. Most of the data-related work involved in the development of products needs to be done prior to the analysis: identifying possible sources of data, processing to transform unstructured information into structured data and integrating multiple sources of data into a common data set. These are seen as primary activities in the quest to mastering data science.

It is no surprise that the majority of organisations that have adopted such programmes are still in the early stages of implementation – doing proof of concepts or data discovery as opposed to full production application. A three-step process, as outlined below, can help with progress:

Culture – the unsung hero

“Culture eats strategy for breakfast”, a quote attributed to Peter Drucker, applies to leadership and management practices. It refers to the willingness of leaders to create a culture that encourages an iterative process and balances critical and creative thinking. This is crucial to eliminating barriers to the implementation of innovative ideas and offerings.

Legacy structures can act as a hindrance instead of providing support. Hence, reorganising to create a product-based structure is more often than not a prerequisite to a successful transformation journey. A transformation may be tagged as successful when it augments human expertise, empowering them to do more with their knowledge. To create a structure that helps build the ability to understand both technology and business, therefore, we require a paradigm shift.

How Acuity Knowledge Partners can help

At Acuity Knowledge Partners, our pursuit to drive digitalisation and innovation in the commercial lending lifecycle has led us to integrate our deep domain expertise with data science. This has allowed us to provide a robust hybrid model to our clients, helping them reduce costs, increase productivity and improve end-client experience across the value chain – from origination, underwriting and closing to servicing and portfolio monitoring. We also help clients streamline existing functions using our flexible engagement model. In addition, our suite of Business Excellence and Automation Tools (BEAT) leverages intelligent automation and artificial intelligence learning for value generation, enabling clients to fast-track their transformation journey.

To know more, please visit Corporate and Commercial Lending Services | Acuity Knowledge Partners (acuitykp.com)

References

-

Competing on Analytics: The New Science of Winning by Thomas H. Davenport, Jeanne G. Harris

-

Big Data @ Work by Thomas H. Davenport

-

Big Data: The Essential Guide to Work, Life and Learning in the Age of Insight by Viktor Mayer-Schonberger and Kenneth Cukier

-

Winning in the Digital Age by Seth Nitin

Tags:

What's your view?

About the Authors

Mohak is part of the Commercial Lending Projects and Transition team at Acuity Knowledge Partners. He has over 13 years of experience in transitioning global projects and leading operations teams for wholesale lending, leasing operations, treasury services and consumer banking functions. Mohak is dual Six Sigma Green Belt certified and has expertise in consulting projects across operations and risk-based control testing and monitoring. He holds an MBA in International Business Strategy from the Indian Institute of Foreign Trade (IIFT) Delhi.

Arvind is a seasoned professional with strong technical and operational experience. He has over 16 years of experience in retail and wholesale banking operations. At Acuity Knowledge Partners (Acuity), he manages treasury, and banking operations . Prior joining to Acuity, he worked with a leading bank as a management consultant, helping set up back-end processes for its different divisions. His expertise spans a broad range of skills including process transition, operational governance, risk control, KPI framing and data analytics.

He holds an MBA in Operations from the Institute of Chartered Financial Analysts of India (ICFAI), Tripura.

Like the way we think?

Next time we post something new, we'll send it to your inbox