Published on March 28, 2024 by Arvind Mahto

A precursor to account analysis

Regulation Q, a regulatory measure established by the Federal Reserve Board (FRB), lays down essential guidelines governing minimum capital thresholds and capital-adequacy standards for financial institutions within its purview in the US. Initially instituted in 1933 in conjunction with the Glass-Steagall Act, its principal objective is twofold: to bar banks from offering interest on deposits held in checking accounts, while simultaneously imposing interest rate caps on other types of accounts.

Over time, Regulation Q catalysed the emergence of money-market funds and alternative financial services, providing a workaround to the prohibition on interest payments.

The landmark Dodd-Frank Wall Street Reform and Consumer Protection Act of 2011 heralded the repeal of Regulation Q, affording member banks of the Federal Reserve System (FRS) the liberty to extend interest offerings to demand deposits. This strategic manoeuvre aimed to fortify banks' capital reserves and mitigate credit illiquidity, a pivotal factor exacerbating the 2007-08 financial crisis.

Despite being annulled, demand deposit accounts (DDAs) commonly yield modest interest returns, with certain checking accounts remaining void of interest altogether, occasionally coupled with account-handling fees. With the latest update of Regulation Q in 2013 in the aftermath of the financial turmoil (2007-08), account analysis emerged as a bespoke account classification tailored specifically for commercial, corporate and business clientele within the banking sphere. This innovative framework facilitates the amalgamation of diverse account relationships within the XAA system, leveraging deposit balances to offset banking fees in exchange for accumulating earnings credits.

What is account analysis?

As mentioned earlier, Regulation Q catalysed banks with options such as negotiable order of withdrawal (NOW) accounts, which were checking accounts with a temporary fund-holding period, as well as money-market funds and other specialised banking services. Account analysis, tailored specifically for commercial, corporate and business banking clientele, offers the XAA system, enabling clients to amalgamate different account relationships. This setup enables them to leverage deposit balances of each account to earn credit to offset banking fees and charges.

How does account analysis help clients?

The account analysis system facilitates clients' use of treasury management solutions by leveraging balances and deposit accounts to offset fees for their treasury management services through earnings credits. As clients maintain higher balances, they unlock greater potential to mitigate service fees, fostering a more substantial and mutually beneficial relationship.

Why a client would/should check with their bank for account analysis services:

- High deposit balances have the potential to significantly reduce or entirely cover service fees

-

Clients reap the advantages of cost savings by maintaining substantial deposit holdings

-

Multiple accounts — clients with multiple accounts may consolidate them into a single relationship, streamlining their banking experience

-

It also serves as an additional safeguard against fraud, enhancing security measures within the system

-

Money-market and personal accounts remain out of the purview of this system

How XAA works

XAA offers a comprehensive overview of services and accounts tailored for business clientele. Widely adopted in the banking sector, it serves to assess the profitability of customers and levy charges based on their use of services. While there may be different applications to manage analysis of different types of business accounts within the banking system, the fundamental approach remains consistent:

-

Define and monitor services offered to customers

-

Establish the cost and price of services used for analysis

-

Determine earned credits, based on customer account balances, that could be used to offset fees

-

Invoice or charge customers when their fees surpass their earned credits

Key components of account analysis:

-

Composite account: In an analysis relationship involving multiple accounts, the lead or composite account, typically the primary operational account, consolidates all net service fees.

-

Earnings credit rate (ECR): This rate determines the earnings credit for analysed accounts, functioning as an interest allowance against positive balances in a corporate DDA, often linked to the 91-day US Treasury bill rate.

-

Standard and exception pricing: The pricing framework enables the establishment of standard or temporary exception pricing for a selected range of services, which can then be assigned to customer accounts without necessitating individual service fee overrides.

-

Statement: Account analysis customers receive specialised monthly analysis statements generated by the XAA system, overseen by the treasury management group. These statements detail the customer's analysed accounts, encompassing balances, transaction activity and their use of treasury management services.

How Acuity Knowledge Partners can help

Account analysis, commonly referred to as extended account analysis in the banking sector, entails a multifaceted exploration of activities within interconnected account structures. It involves analysing the transactional events of each account, along with their associated costs and prices, and consolidating them into the lead account as a succinct summary. This empowers customers with valuable financial insights, enabling them to efficiently manage their banking relationships and optimise their cash balances.

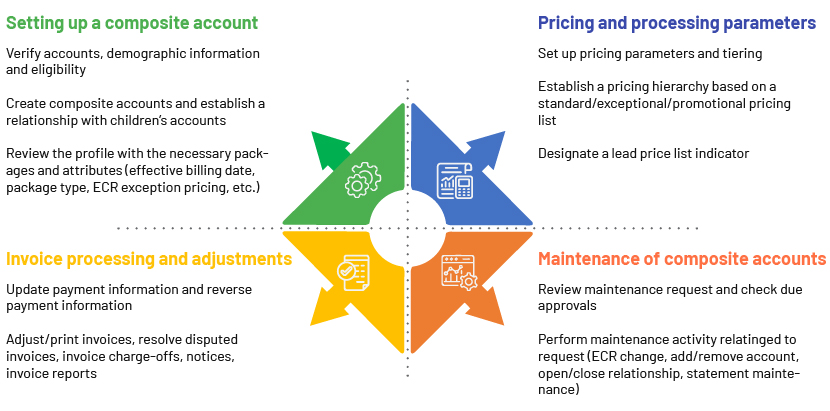

Comprehending the nuanced intricacies inherent in the account analysis process, we focus on four pivotal domains (composite account structure, pricing structure, maintenance and exception resolution) where banks can concentrate their efforts to bolster the entirety of the value chain associated with account analysis. To achieve this objective, it is imperative to establish a robust product control mechanism. This mechanism would not only facilitate the seamless operation of the system, but also harness the system's capabilities for effective exception management and adaptation to any alteration in pricing structure dynamics.

We are a leading service provider with extensive treasury experience, dedicated to empowering businesses with comprehensive financial solutions. With a rich legacy spanning more than 20 years, we have honed our expertise in the treasury domain, becoming a trusted partner to companies seeking robust financial management and strategic planning. Our treasury services encompass a wide range of critical functions, including cash management, liquidity analysis, investment strategies and risk assessment. With a keen eye on market trends and an unwavering commitment to excellence, we tailor our solutions to meet the unique needs of each client, regardless of its sector or size.

Reference:

https://www.federalreserve.gov/

Tags:

What's your view?

About the Author

Arvind is a seasoned professional with strong technical and operational experience. He has over 15 years of experience in retail and wholesale banking operations. At Acuity Knowledge Partners (Acuity), he manages processes ranging from PPP, treasury and collateral booking to MIS practices. Prior joining to Acuity, he worked with a leading bank as a management consultant, helping set up back-end processes for its different divisions. His expertise spans a broad range of skills including process transition, operational governance, risk control, KPI framing and data analytics.

He holds an MBA in Operations from the Institute of Chartered Financial Analysts of..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox