Published on April 19, 2023 by Abhishek Singh

Investors typically track indices such as the S&P 500 and the Nasdaq-100, but it is not possible to invest directly in these indices. Therefore, investors have to invest in index funds or ETFs tracking these indices; this is known as passive investing. The main advantages of passive investing are that the cost is low, it does not depend on fund managers’ ability (as passive investing is rule-based) and turnover is generally lower than that of an active fund.

Passive investing has gained popularity in recent years: passive funds were holding more US stocks than active funds in June 2022. Investors in these funds expect the same returns, or returns as close as possible to returns from the index that the funds are tracking. However, tracking error generally results in lower returns from these funds than from the index being tracked.

Hedge funds and traders, too, try to predict index reconstitution or rebalancing, i.e., additions and deletions of constituents from popular indices, and take positions accordingly. Tracking error demonstrates the effectiveness of their trading strategies. A positive tracking error shows that the constituent prediction algorithm is accurate and the trading strategy is optimal; negative values for tracking error, on the other hand, point to a possible issue with the prediction algorithm or inefficient trading strategy. Based on these evaluations, the hedge fund or trader would make amendments and improve the overall performance.

In simple terms, tracking error is defined as the standard deviation of the difference between portfolio returns and benchmark returns. It is a statistical measure that indicates portfolio performance and the risk involved. Tracking error is an important criterion for measuring and comparing performance of index funds, ETFs, hedge funds and traders. These insights could be used to identify better-performing portfolio managers and areas for improvement. Tracking error could be positive or negative, indicating whether a portfolio is performing better or worse than the benchmark.

Tracking error is an important indicator of performance, but the overall performance of a portfolio should be evaluated based on other performance indicators, keeping in mind the overall objective of the portfolio/fund.

Causes of tracking error

It is easy to see how tracking error could be generated in the case of a price-weighted index, an equal-weighted index or any other index other than a market cap-weighted index. The value of the index and the value of the portfolio will not move to the same extent, as the weights will be different, depending on the movement of price.

In an ideal scenario, in the case of a market cap-weighted index, the weights would need to be aligned with the index once, and the portfolio would then perfectly track the index, as the weight change would be the same.

However, several other factors affect tracking:

-

The weight does not remain exactly same because units would be redeemed or new units created; this would happen at slightly different prices (based on the price fluctuations every second). For example, if we sell one share and buy it back after a minute, the price may not be the same, whereas the index will be calculated without assumption of trading (except for rebalancing).

-

There are trading costs involved in an actual portfolio. There may be liquidity issues with some of the securities, and there may be a higher impact cost for larger funds.

-

Funds with holdings in foreign currencies would have hedging costs.

-

In the case of a commodity or forex market, ETF/index funds have to hold futures; this results in additional cost due to rollover of contracts to the next period. Similarly, leveraged ETF/index funds have additional costs of maintaining leverage.

-

The market price of securities being added to or deleted from the index fluctuates significantly around the announcement and execution dates when large volumes are involved. Thus, prices are artificially high when securities are added.

-

Portfolios incur management fees and expenses, reducing returns.

-

If the portfolio is not similar to the benchmark index, this would result in a difference in performance. There may also be legal restrictions preventing the portfolio from having the same exposure as an index; for example, the diversification rule in the US does not allow more than 25% exposure to a single security; this could be an issue for thematic funds.

-

The amount of cash a fund carries would also result in different returns than from the index. Funds maintain cash for paying dividends or to manage redemption or creation of units.

How to minimise tracking error

Minimising tracking error helps investors get the maximum expected return and helps fund houses show stronger performance than the competition.

-

Netting: Fund houses that track multiple indices do not actually buy and sell in the market but would see if buy/sell requirements could be adjusted internally among schemes, saving on trading costs. This is an advantage for bigger fund houses.

-

Risk management: Fund managers have to decide when to trade the stocks being added to or deleted from the indices. This is based on data analysis of past events.

-

Stock lending: Fund houses lend stocks to short sellers and earn extra return for investors, without taking on additional risk.

-

Foresee index changes: Fund houses predict index changes prior to their actual reconstitution or rebalancing based on upcoming corporate action and position their trades accordingly.

-

Different benchmark: Fund houses also choose a benchmark very similar to popular indices but with different rebalancing dates so there is no crowding during their rebalancing period.

What does the data suggest?

Tracking error is a main consideration when selecting funds. Managing tracking error results in better returns, not just for investors, but also for the fund house, as funds with lower tracking error have lower risk, attract more investors and, thus, enable the fund house to charge higher fees.

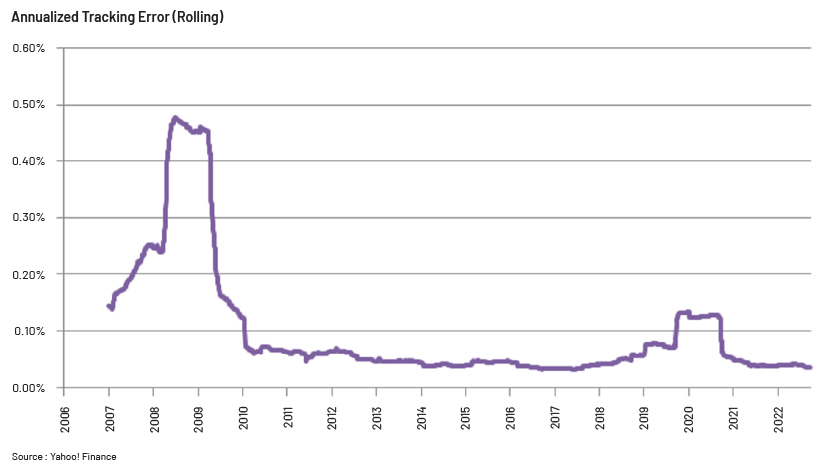

Tracking error has been reducing over the years and currently stands at a minimal level. The annual tracking error of the SPY ETF, benchmarked against the S&P 500 (Total Return), reduced to less than 0.05% by 2022 from 0.15% in 2007, with a few spikes in between.

How Acuity Knowledge Partners can help

We have more than a decade of experience in working with large benchmark index providers. We have a clear understanding of index methodologies and are engaged in periodic index reviews and reconstitution. We also work closely with trading and hedge funds to predict index rebalances and track corporate action. Our expertise spans support across the index solutions lifecycle – from a domain perspective and from a technology perspective We have partnered with several leading index providers, ETF players and other sell-side and buy-side providers, providing support on index research, back-testing, index operations, corporate action and benchmark data management.

Sources:

-

https://www.investopedia.com/articles/exchangetradedfunds/09/tracking-error-etf-funds.asp

-

https://www.investopedia.com/terms/t/trackingerror.asp#:~:text=Given%20a%20sequence

-

https://www.ft.com/content/27b5e047-5080-4ebb-b02a-0bf4a3b9bc08

What's your view?

About the Author

Abhishek is part of Index Quants team at Acuity Knowledge Partners. He leads the team responsible for publication of strategy indices and contributes to projects related to index quants. He has over nine years of experience in Index operations, Risk Management, Equity Research and Investment Banking with more than 6 years of experience in Index operations. Abhishek holds an MBA in finance and B.Tech in Computer Science.

Like the way we think?

Next time we post something new, we'll send it to your inbox